Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

A new report unveiled this month finds that the US insurance sector held $536 billion in fossil fuel-related assets in 2019, despite some insurers citing climate-related risk and natural disasters as factors in raising premiums and/or dropping coverage within certain high risk regions.

The report, Changing Climate for the Insurance Sector, conducted by Ceres, ERM, and Persefoni, reveals that the top 16 US insurers alone held more than 50% of the half trillion dollars in fossil fuel-related assets owned by the sector. The quantitative analysis was undertaken using US Insurers’ 2019 assets compiled by the California Department of Insurance, the most complete and recent dataset currently available. Here is the introduction to that report.

As the climate crisis intensifies, the insurance industry finds itself uniquely exposed. Its investment patterns create financial and reputational climate related risk, while its underwriting helps greenhouse gas-intensive industries continue operations contributing to global warming.

In their roles as underwriters, insurers are moving to curtail their exposure to climate related risk, with a growing number ceasing to offer certain policies in some locations. However, there is less evidence that insurers are making their investment portfolios equally as climate resilient as their underwriting portfolios.

Ceres, ERM, and Persefoni conducted research into the relationship between the fossil fuel industry and the United States insurance industry, focusing on analysis of the insurance sector’s investments in fossil fuel-related assets.

Quantitative analysis of a large dataset of U.S. insurers’ 2019 assets, compiled by the California Department of Insurance, yields a number of insights into fossil fuel-related investment patterns in the insurance industry, including the specific types of fossil fuel related assets (tar sands, coal, oil & gas, and corporate utilities) held. The report also builds on insights from interviews and focus groups with insurance company investment teams, regulators, and senior subject matter experts. The report reveals:

-

- The top 16 U.S. insurers held approximately 50 percent of the over $500 billion dollars in fossil fuel-related assets owned by the sector.

- The financial decisions of the two largest property & casualty insurance companies have a far greater impact on overall fossil fuel-related asset ownership than that of any other companies in the dataset analyzed.

- Investment policies that focus only on one type of fossil fuel, or only on one type of investment, may result in asset portfolios that still include large fossil fuel holdings.

Insurance & Climate Risks

Some insurers are currently moving to curtail climate-related risk, with a growing number ceasing to offer certain policies in some locations. This includes State Farm’s May 2023 decision to stop offering new home insurance policies in California due to wildfire risk, Farmers’ July 2023 announcement that it will stop renewing almost a third of the policies the company has written in Florida, and close to 20 home insurers in hurricane-prone Louisiana either pulling out of the state or declaring insolvency.

Tom Reichert, Group CEO of ERM, said: “As the climate crisis intensifies, the insurance industry is finding itself uniquely exposed to climate related challenges. Now is the time for insurers to take action to address these risks and opportunities related to their investments and underwriting. This will help to ensure their business models remain resilient and that they can continue to serve their customers effectively, while ultimately accelerating the transition to a low-carbon economy.”

Kentaro Kawamori, CEO and Co-founder of Persefoni, said: “This research once again emphasizes that climate risk is financial risk. Insurance companies must continue to evaluate their financed emissions and measure the impact they have through their fossil fuel-related assets. The technology to do this exists and will help the transition to a global decarbonized economy without penalizing businesses and consumers.”

Mindy Lubber, CEO and president of the sustainability nonprofit Ceres said: “Insurance companies are facing increasing climate change risks as the frequency and severity of extreme weather events, such as hurricanes, floods, and wildfires escalate. This report reveals the urgent need for insurers to address the financial risks of climate change posed by their fossil fuel holdings and take advantage of opportunities to accelerate the transition of their investment portfolios to a clean energy future.”

Insurance Giants Heavily Invested In Fossil Fuels

The report also revealed that the top two US property and casualty companies, Berkshire Hathaway and State Farm Insurance, hold 44% of total fossil fuel related assets owned by the entire sector. Asset ownership among life insurance companies was more broadly distributed, with the top two life insurance companies, TIAA Family Group and New York Life, owning 14% of assets owned by companies in that sector.

Insurers are often large asset owners and therefore have an important presence within the institutional investor sector. However, US insurers often lack an accessible, systematic approach to incorporating climate-related factors into investment decision making. The report aims to provide useful insight into insurers’ patterns of investments in fossil fuel related assets and to prompt the industry to harmonize its approach to climate change across its underwriting, risk, and investing functions.

Well, isn’t that interesting. These insurance giants are running away from climate-related risk while at the same time propping up the very industries that are primarily responsible for creating that risk in the first place. Is there a name for such behavior? Here’s a few that come to mind — hypocritical, two-faced, deceptive, ignorant, and stupid. Take your pick.

Senators Take Notice

The issue has come to the attention of some members of Congress. In June, Senators Whitehouse, Wyden, and Sanders launched an investigation into how the U.S. insurance industry evaluates climate-related risks, decides to invest in or underwrite fossil fuel expansion projects that drive such risks, and prices policies that insure such projects.

In letters sent to AIG, Berkshire Hathaway, Chubb, Liberty Mutual, Starr, State Farm, and Travelers, the senators pressed the companies to disclose why and how they are still supporting the underwriting of and investment in new and expanded fossil fuel projects. The letters asked what plans the companies have made to follow the example of global insurance counterparts, many of which have begun restricting their underwriting of fossil fuel projects; what plans they have to divest their fossil fuel-related investments; and what methodology they use to evaluate future impact on climate of their investment and underwriting decisions, among other questions.

The senators also requested information about how the insurance companies evaluate their responsibilities with respect to the principle of Free, Prior, and Informed Consent, which ensures Indigenous Peoples can give or withhold consent for any action that would affect their lands, territories, or rights and is protected by international human rights standards.

Senator Whitehouse said, “Any new fossil fuel expansion is incompatible with our climate goals and economic stability. By underwriting and investing in new and expanded fossil fuel projects, U.S. insurers are helping Big Oil bring us closer to the worst runaway climate scenarios, which threaten lives, livelihoods, and the federal budget.

“That is why I am launching an investigation to obtain key information and internal documents showing how these companies weigh risks to the climate when considering their underwriting and investment decisions. This information is especially relevant as some of these companies begin to pull out of certain markets because they see the coming catastrophic climate risks — despite continuing to provide services to the fossil fuel industry.”

The investigation follows a series of hearings held by the Senate Budget Committee that have examined the economic risks associated with climate change. Central bankers, economists, insurance industry executives, financial experts, and others have testified before the Committee that climate change poses multiple “systemic risks” to the economy — risks with the potential to cascade beyond immediately affected sectors to cause economy-wide harm similar to the 2008 financial crisis.

In their letters, the senators wrote, “Witnesses have warned that sea level rise and wetter, more intense storms could eventually make more than $1 trillion in coastal real estate uninsurable, and therefore unmortgageable, leading to a coastal property values crash; that more frequent and intense wildfires could result in a similar death spiral for western property in the wildland-urban interface; that climate-related losses are making it harder for the insurance industry to price risk, already resulting in insolvencies among regional insurers; and that, as demand for oil and gas declines, hundreds of billions of dollars in fossil fuel assets may be stranded.”

Non-US Insurance Companies Lead

The senators noted that many global insurance companies are beginning to limit the scope of coverage they will provide — or pull out of markets entirely — due to their assessments of impending “catastrophic risk” caused by climate change. At the same time, and despite evidence that new and expanded oil, coal, and gas development is incompatible with global climate goals and long term economic stability, the US insurance industry is continuing to support fossil fuel expansion. US insurers currently have approximately $582 billion invested in fossil fuels, including nearly $90 billion in coal alone.

“[I]n the United States, the insurance industry continues to support existing and expanded fossil fuel projects with few restrictions in place limiting—or excluding—either. U.S. insurers continue to underwrite polluting projects while making investments in an industry whose continued expansion poses multiple serious dangers to overall economic stability and to insurance services in particular,” the Senators wrote. They maintain that the continued expansion of the fossil fuel industry poses serious dangers to the economic stability of the United States and to insurance services in particular.

Changes Coming

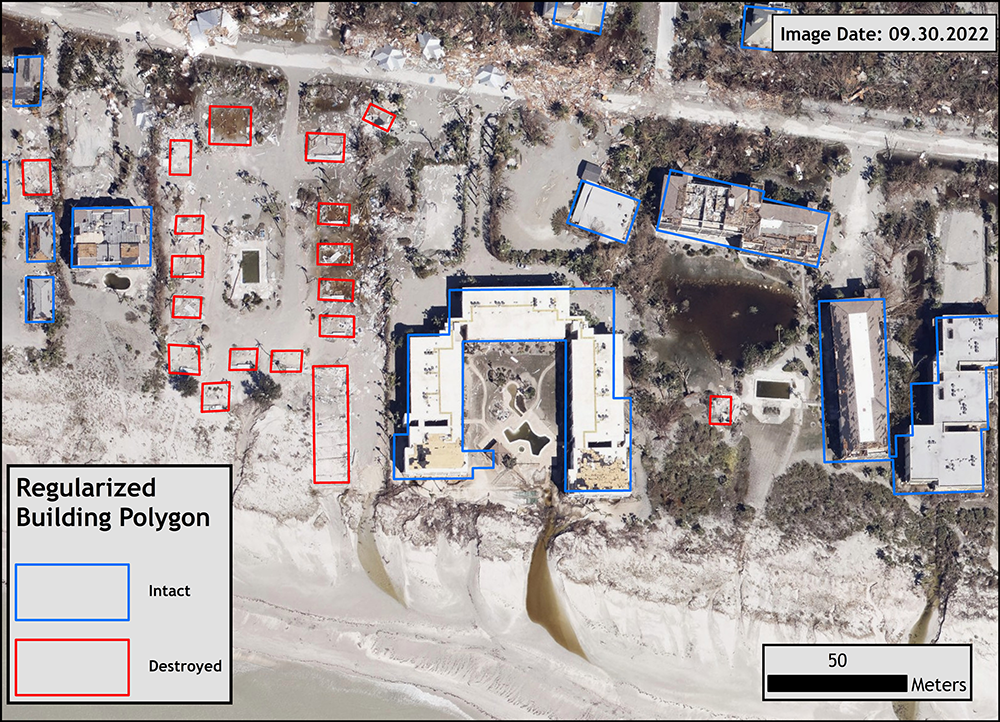

This image shows structures that were destroyed in Lee County, during Hurricane Ian. Credit: ORNL, U.S. Dept. of Energy

Reuters contacted some of the companies and was told they are beginning to make changes, but investment decisions have a long timeline and it might take years for the changes to become apparent.

Some companies said they had made “huge changes,” and the researchers said there was evidence the sector had made a “significant effort” to respond to global expectations about how they loan to and invest in emitting companies, but that it would take several years for this to show. “We started excluding coal in 2015, but some of our coal bonds run for 20 years,” one executive from a Europe-headquartered insurance group said. All those who spoke with Reuters requested anonymity.

The upshot is, the insurance companies want to limit their risk today, but wait 20 years or more to do anything substantive to ameliorate that risk. This is a game called “Heads we win; tails you lose.” Bonds can be sold. There is no requirement they be held to maturity. Buying and selling bonds happens every day in financial markets worldwide.

In the meantime, these companies continue to insure fossil fuel operations even while they refuse to insure homes in California, Louisiana, and Florida. Is that two-faced or what?

The Takeaway

My old Irish grandfather liked to say there are two businesses that have a government license to steal — banks and insurance companies. He suggested the business model for insurance companies is to sell coverage and deny liability.

Ultimately, insurance companies will decide where we live. As sea levels rise and storms become more severe, more parts of America will become uninsurable. When that happens, people looking to buy homes in those areas won’t be able to get mortgages. Cities and towns will see their tax revenue slashed as property values plummet. People who own property in those areas will become self insurers out of necessity and will be unable to sell their homes at any price.

It is already happening. Insurance companies are fleeing Florida partly because the damages for storms is growing exponentially. The other part of the story is that Florida has the most corrupt governor and legislature in the country. (Yes, even more than Texas, if that is possible.)

More than three-quarters of all insurance litigation in America takes place in Florida. The governor took large campaign contributions from the insurance industry in the last campaign. The legislature is packed with the same lawyers who are suing the insurance companies and raking in millions in legal fees by doing so. It’s a circus where everybody wins except the people. Rabid Ron is too busy trying to bring fascism to Florida instead of doing what he was elected to do — govern.

The insurance business is really quite simple. The companies are betting they will take in more in premiums than they pay out. Policy holders hope for just the opposite result. Lately the insurance companies have been hemorrhaging money as a result of wildfires and floods. Their data analysis tells them an overheating planet will lead to spiraling losses this year and in the near future, so they are packing their bags, putting up the “Closed” sign on the front door, and skedaddling away from danger just as quickly as they can.

That makes perfect business sense. No company can lose gigatons of money and stay in business. What does not make perfect sense, however, is why these same companies are investing in the fossil fuel companies responsible for the spate of wildfires and more powerful storms. That seems like a contradiction at best; morally reprehensible conduct at worst.

We don’t have time for those insurance investments to mature. The climate emergency is here and growing by the hour. Business as usual is a death sentence for us all. By dragging their feet, these companies are begging for government intervention, and when that happens all the right wing crazies will scream about government overreach. But that’s what governments are for — to protect the citizenry from rapacious behavior by kn individuals and corporations.

Nobody much cares about insurance — until they can’t get it. The US insurance companies are sowing the seeds of their own destruction and will have no one to blame but themselves when the chickens come home to roost.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.