With inflation fading, FOMC preps its “decision” on the Fed Funds Rate

With inflation fading as yesteryear’s news, Goldilocks continues to hold sway. It’s been a year now that this website and its resident market service have been managing the coming end of the hysterical inflation situation. You can click the graphic to read the article about decelerating inflation…

…which is the source of the stock market’s good cheer in the short-term. Here is ES (S&P 500 futures) making its move further above what was our primary target at the August high.

Now it gets interesting because:

- Inflation built this economic upturn, and that same inflation fading, combined with decelerating manufacturing, real estate, and other aspects of the economy indicate an oncoming recession.

- “But fading inflation!” will tout the touts.

- SPX/ES is getting overbought now on the daily time frame.

- Market sentiment and significant FOMO driven MOMO are in play…

- …as a much anticipated “decision” by central monetary planning authorities comes tomorrow.

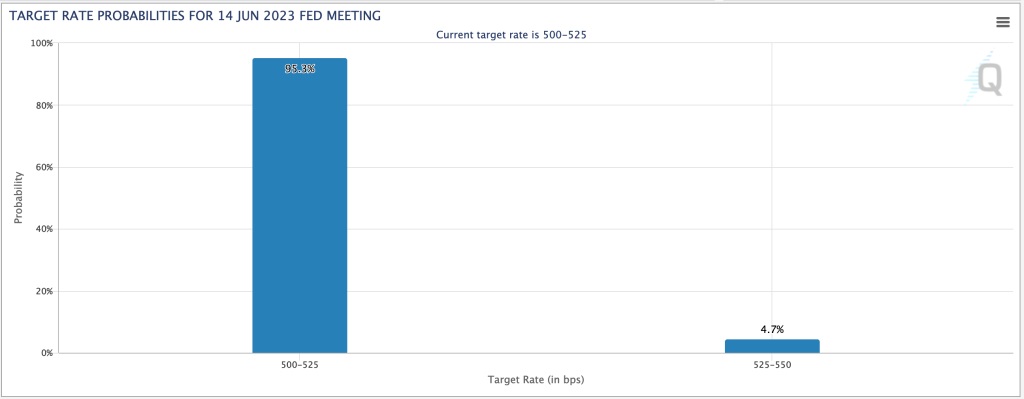

- If the goons back off the rate hikes in June – as anticipated by CME Group – there could be FOMO fueled energy in this overbought, over-loved market to drive SPX to what I had considered our next and less probable upside target (not publicly broadcast now that it is realistic, but it was noted here many months ago).

- Let’s for a moment ignore the fact that for some reason CME favor a rate hike in July before the rate hike cycle ends. Okay, let’s not ignore it in that it might fit well with a theme of an overbought market, with massively over-bullish sentiment and MOMO, driving all the way to upside targets in a real sentiment-based, ‘suck ’em all back in’ blow off. That is how sentiment events often end. Might the Fed use that tool, the threat of a July hike, if there is a combination of such unrealistic stock market euphoria and maybe even the slightest mid-summer tick upward in inflation signaling?

- The stock market bull from 2020 was, after all, a product of the Fed’s well curated inflationary operations back then. Doctor Frankenstein, meet your monster.

- Of course, this could all be a bull trap, sell the news situation in the short-term as well. But this morning’s view into the futures is thus far going the other way.

Okay, getting a little too wordy now. Post will end here. But think about it.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.

********