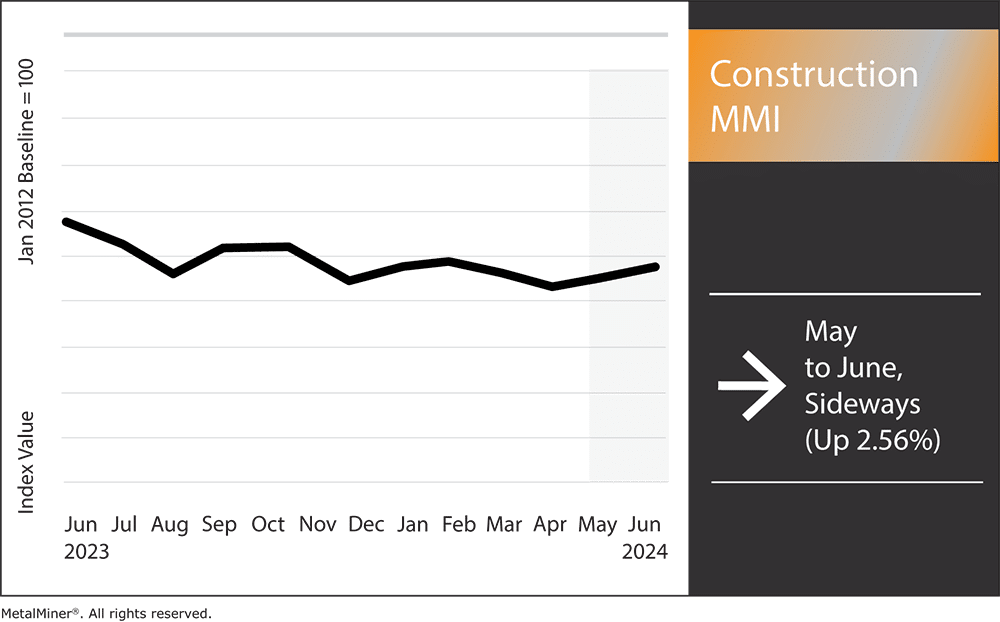

The Construction MMI (Monthly Metals Index) continued to hold sideways month-over-month, without significant bullish or bearish pressure on industrial metals. Overall, the index saw a slight 2.56% uptick in price action. However, it failed to break out of its 10-month-long sideways price range. Weekly Midwest bar fuel surcharges dropped significantly, which pulled the index down. However, Chinese steel rebar witnessed a price increase, pulling the index up.

Once again, there was significant pressure in both directions. Despite China’s slight rebound from sluggish demand, orders still remain somewhat weak for industrial metals, which continues to impact global construction industries.

Learn the impact of granular price intelligence and how suppliers want to keep this information from you to prevent you from saving money. Join us on July 10th for our workshop “The MetalMiner Way”.

China’s Economy Sends Shockwaves Through Global Industrial Metals Markets

China’s metal demand is still slow, which is having a big impact on the world’s industrial metal markets. According to multiple sources, there are several reasons behind the drop in demand.

First, China’s slower economic development significantly impacted industrial activity. Indeed, the real estate sector, a key user of steel and other metals, continues to face decreased investment and slower building activity. There will be less demand for steel and other industrial metals as a direct result of this downturn.

Meanwhile, geopolitical tensions and rising interest rates have made matters worse. This is because global demand for metals falls when high interest rates and economic concerns curtail investment and industrial output.

Grappling with Staggering Demand

Chinese manufacturers continue to turn to overseas markets to make up for local shortages, resulting in a rise in the export of semi-finished and completed steel due to the country’s sluggish demand. However, this change also adds to the worldwide glut, which drives down costs. For example, aluminum prices continue to fall despite a general upswing in industrial metals, mainly because China is not a strong buyer.

Make informed metal purchasing decisions. Access MetalMiner’s free Monthly Metals Index report to understand economic metal price drivers through metal price charts and expert analysis.

Optimism for Growth in the U.S. Construction Industry

Regarding the rise of the construction industry in the remainder of 2024, contractors remain confident. This optimism results from several factors. First, the market anticipates a surge in initiatives pertaining to sustainable energy, transportation infrastructure, and industry. There will likely be more investments and growth in these areas, which will increase demand for construction services and industrial metals.

The sector is also well-positioned to gain from government financing and assistance. Contractors anticipate a steady stream of business with a focus on renewable energy and infrastructure upgrades. This expected wave of projects will probably lead to job growth, with some estimates saying the sector will require roughly 340,000 additional workers by the end of 2024 to keep up with demand.

Reasons for Skepticism

However, there are still some reasons for skepticism about growth in the construction industry. The persistent labor shortage is one of the main issues. Many companies report that it’s getting harder and harder to find younger people with the right abilities, which might make it more difficult for the sector to fulfill project objectives.

Furthermore, the overall mixed image of the market points to potential volatility. Contractors continue to prepare for possible changes in demand, which might result in slower growth and activity periods. Serious worries also exist due to certain economic uncertainties, such as fluctuations in material pricing and supply chain disruptions as a result of geopolitical conflicts.

Construction MMI: Noteworthy Price Shifts

Don’t get blindsided by price volatility. Secure your metal buying strategy with expert insights from MetalMiner’s weekly newsletter.

- Chinese steel rebar prices trended upward by 2.06%, bringing prices to $555.81.

- Chinese h-beam steel moved sideways, increasing by 0.46%. This left prices at $483.49 per metric ton.

- Weekly Midwest bar fuel surcharges witnessed a drop of 10.85%, which brought prices to 0.48% per mile.

- Finally, aluminum bar prices traded flat, remaining at $2962.63 per metric ton.