Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

In the crazy world of hydrogen for transportation plays, some endeavors stand out. Ballard’s $1.3 billion in losses, $55 million a year since 2000, with no profits ever is one. The $1.2 billion that California received as a hydrogen hub which is going to go down the drain because it’s being spent on transportation instead of fertilizer is another.

And then there’s Hype, Europe’s hydrogen-only taxi app company. It’s managed to secure €55 million in European grants, on a claimed fund raising of €105 million (or maybe €145 as there is some debt financing in there too). Yes, Europe is throwing more money at this hydrogen-powered Uber competitor than private investors are.

It’s understandable that private investors in France would have ponied up some euros back in 2015 when it was launched during COP21. Ride-hailing apps were all the rage in Silicon Valley and elsewhere. Uber and Lyft were going toe to toe. There was — and is — a lot of room for people to pick off slices of the ride-share pie in different markets. Uber remains the giant, with a full 25% of the global market, trailed by Lyft with 8% and lots and lots of smaller, mostly regional solutions like DiDi Rider, Gojek, and Ola. And in 2015, hydrogen — despite a 15-year history of failed hydrogen fleet pilots — was considered a go-to decarbonization solution.

France is a country that really likes to have its own flavors of things. When it comes to wine and cheese, it’s hard to argue with their taste. While I was looking at the European aviation funding ecosystem a couple of years ago, it was clear that they also had a strong focus on funding local aviation firms, ones whose founders spoke fluent French, regardless of the quality of the technology or business models they were pitching.

And so, a French ride-hailing app firm. But the Hy in Hype is the foie gras on the baguette, elevating it above other, more sensible French ride-sharing offerings like LeCab, G7 Taxi, Chauffeur Prive, and yes, Uber. And when I say elevating, I mean elevated costs. With the cost of making hydrogen, distributing hydrogen, pumping hydrogen, and maintaining flakey hydrogen fleets, you might as well be running them on champagne.

The original investor money and grants has been used to put hundreds of Toyota Mirais and 50 hydrogen wheelchair vans on the streets of Paris, and keep the rates it charges passengers competitive with firms that are putting cheap electrons into Teslas or gasoline into Renaults. A new investment of €15 million from VINCI Concessions is going to flow back to VINCI to build hydrogen electrolysis and refueling stations, so it seems a bit circular in an odd, questionable accounting kind of way.

There’s another fun parallel to Ballard. That company started out in lithium-ion batteries before pivoting to fuel cells, picking the losing side. So did Hype. Originally, it was STEP, Société du Taxi Électrique Parisien, founded in 2009, and the Électrique is a clue. Yes, it was an electric taxi firm that wasn’t doing very well, so rebranded to Hype and pivoted to riding the European hydrogen hype wave. Presumably that’s because the founder, Mathieu Gardies, realized that grants for hydrogen were much bigger than for battery-electric because the costs were so much higher, and so he could have bigger numbers in corporate bank accounts and seem more successful.

But that was 2015. Why in April of 2023 was it given another €18 million to expand to seven other European cities — Le Mans, Bordeaux, Brussels, Madrid, Barcelona, Lisbon, and Porto? As with California, bureaucracies and programs which give away money have sprung up and when they have money in their bank accounts for hydrogen transportation, they have to give it to someone. Hype is one of several firms at the front of the line offering to help with that odd problem.

As I noted a month ago, the EU has spent about €1.2 billion on grants to hydrogen for transportation schemes since 2008 and has virtually nothing to show for it. Hype Taxi is clearly well aware that the hydrogen funding system in the EU doesn’t require results that make any sense and in fact is looking for any good news at all. By the standards of the space, Hype actually has cars on the roads of Paris delivering passengers at a heavily subsidized, hence artificially competitive, cost.

When I say nothing to show for the money, I really do mean that. They had very low-ball quantitative targets for average distance driven between failures — much lower than internal combustion vehicles — and failed to achieve them, averaging only 785 kilometers for one set of fleets before requiring fixing, while battery-electric fleets are much lower maintenance than diesel vehicles. They had a target of €5 per kilogram hydrogen, and it’s running €15 and up in the EU. They had a target of incredibly short 20-month warranties for hydrogen fuel cell buses, and only some fleets managed to get that from manufacturers, while 5- and 8-year full warranties with all repairs are common on the battery-electric side. They had a target of lower than an incredibly expensive €850,000 per bus and some fleets managed to achieve that, while battery-electric buses are under €500,000. Fuel cell durability results out of the IMMORTAL program managed to achieve a quarter of the target.

Then there are the targets where there’s just no quantification after well over many years of programs. A hydrogen refueling station with an uptime of 99% — incredibly unlikely given California’s published results where stations are being fixed 20% more hours than they are pumping hydrogen — has zero reported data. Sixteen freight trucks and four refueling stations for €32 million, when €12 million would buy equivalent trucks and megawatt chargers. Freight truck mean distances between failure of a paltry 2,500 km, perhaps three days driving, again with no reported results. One key program, H2ME, where the results and analysis page is populated with web placeholder standard, LOREM IPSUM DOLOR SIT AMET. The JIVE bus program delivering zero quantitative results despite being in operation for 7 years.

Etc, etc, etc.

In this context of abject failure and zero results, European hydrogen bureaucrats must love Hype, regardless of whether the fundamentals make any sense at all. After all, it has Hype emblazoned on hundreds of vehicles in tourist-magnet Paris. Most of the other cities on the expansion list are also high tourism and hence high visibility cities. And then there’s Brussels, home of Europe’s bureaucrats, where hydrogen taxis will pay with institutional credibility during funding cycles. No surprise it’s on the list for a money-wasting expansion.

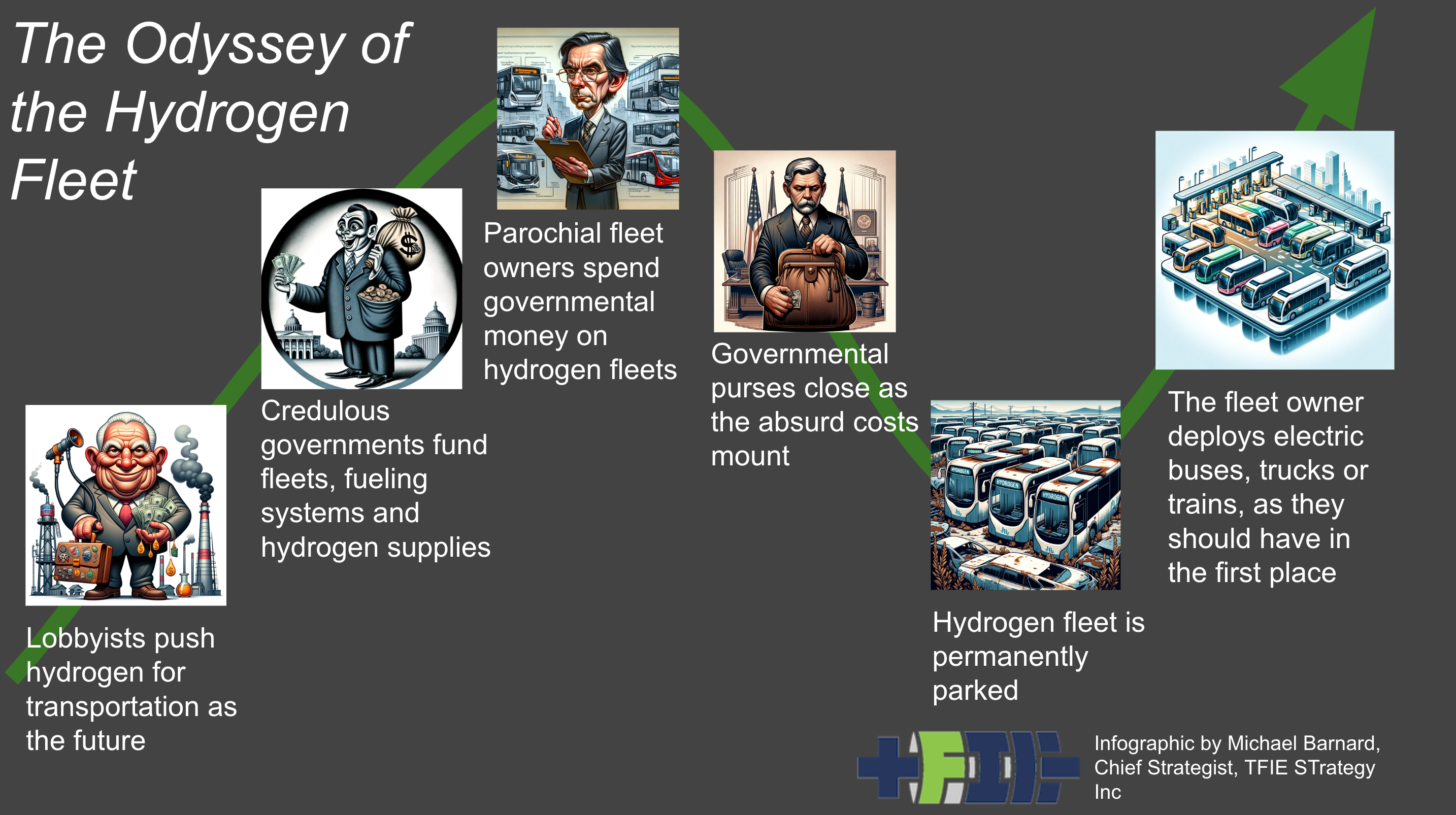

So, they’ve received €18 million for the expansion, taking new stagings of the Odyssey of the Hydrogen Fleet to several more European cities. What’s that supposed to buy? 18 refueling stations and 3 electrolyzers in these new regions. Presumably a lot of dirt cheap Toyota Mirais as well.

Dirt cheap? Yes, currently Toyota is discounting the €63,900 manufacturer suggested retail price including value added tax by around €38,000. Yes, a 63% discount because no one wants the things. Great for a fleet committed to them, I guess, if it weren’t for the very high cost of everything else. Oh, wait, that’s what taxpayers’ money is for.

Let’s consider a magical alternative world where the Tesla Model 3 base model actually existed, was available in Europe, and had 513 km of range. In this magical world, the Tesla Model 3 costs €42,990 per vehicle. This fantasy alternative Europe has Tesla Superchargers and high-speed charging from multiple other vendors available everywhere, about 82,000 of them. And high-speed depot charging for fleets is also part of this moon dust fantasy scape, and it’s cheap.

European taxis average about 200 kilometers a day, and this fictitious Model 3 could pick up 320 kilometers of range in 15 minutes of charging at a Supercharger. Oh, in this alternative world’s scenario, Superchargers and equivalents from other companies cost 10% of what hydrogen refueling stations cost, and just sit there and work, unlike hydrogen stations where the compressors fail constantly and expensively.

I know, it’s utopian, but how many Tesla Model 3 taxis could be running much more cheaply with €18 million? Probably 400 of them including fast chargers at depots. If only that were possible.

In the ‘real’ world of Hype and Europe’s hydrogen funding bureaucrats, the flushing sound as they commit more to hydrogen is one way, from taxpayers’ wallets into Hype’s bank accounts. And when the flush cycle inevitably ends, Hype will disappear. I’m pretty sure that Mathieu Gardies’ bank accounts won’t disappear with it.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.