Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

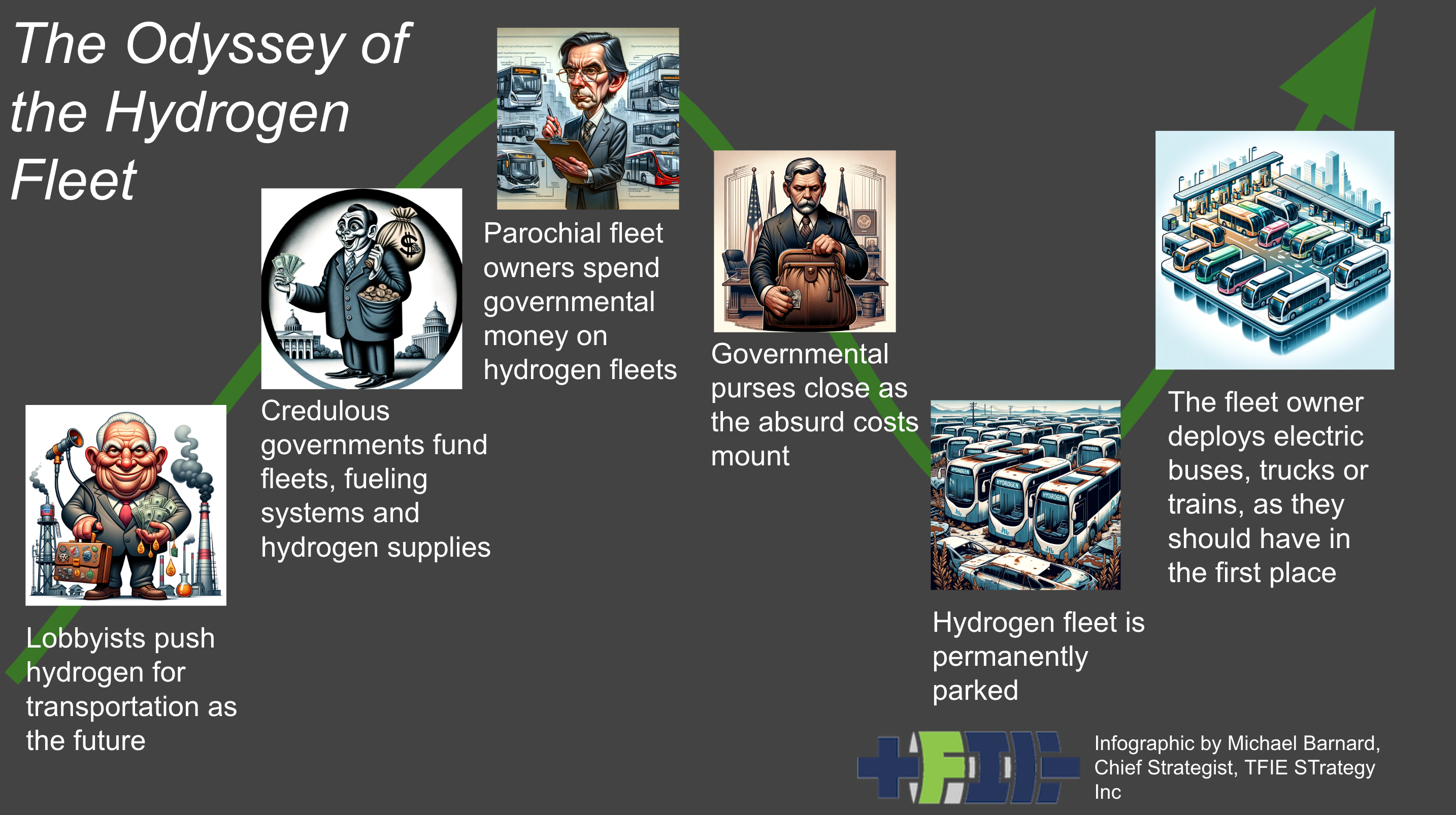

As the years pass and more re-enactments of the Odyssey of the Hydrogen Fleet are played out, they get staged in multiple settings, much like Shakespeare’s Tempest being staged in a waterpark in Germany in 2019. In recent months, I’ve curated a couple of lists of hydrogen bus and train trials and related judgments, almost entirely against hydrogen. Now it’s time for water.

Let’s start with Norway, the frozen fjordtress, known for the thick slurry of green electric cars over its vast fossil fuel wealth. Unsurprisingly, it has a subset of thermodynamically and economically unenlightened types who think hydrogen is the answer to most questions. The question in this case is, “If we have a 12 kilometer total ferry crossing of a fjord a few times a day in a rural area 315 kilometers from Oslo, how can we make it as expensive, high emissions and failure prone as possible?” Enter the Hjelmeland–Nesvik–Skipavik route in Norway where the MF Hydra was converted to hydrogen. The ferry primarily operates on a short, fixed route as part of the local transportation network, and has been in service since 2023.

Hydrogen fans love to point to this example, as if it is a harbinger of doom for electric ferries. What they don’t both to look up and ignore if forced to confront it, is that there are about 80 battery electric ferries in the country, happily and much less expensively and reliably crossing the waters between towering cliffs. While it hasn’t failed and been abandoned yet, in addition to fuel cells from perpetual money loser Ballard — $1.3 billion since 2000 with zero profitable years ever — it also features liquid hydrogen, adding another 33% energy loss to the tremendous inefficiencies of the hydrogen drive train.

The costs of all of this aren’t shared, but given that the hydrogen capacity is vastly overbaked for the requirements, with a single refueling of liquid hydrogen being sufficient for 12 days of sailing or 1,850 kilometers, far beyond the service requirements, they are undoubtedly high. The amount of liquid hydrogen requires about four diesel powered tanker trucks to drive 1,275 kilometers from the Linde plant in Leuna, Germany full and return to Leuna empty afterward. That’s 10,000 kilometers of truck diesel every couple of weeks to allow a ferry to travel between three cities that can see one another a few times a day. That’s about 9 tons of CO2e every 12 days, or about 275 tons annually.

Of course, as I noted recently regarding the hydrogen supply chain, every point in it leaks because hydrogen is one of the smallest molecules in the universe, and the high pressures and multiple movement points all end up emitting a bit. Peer-reviewed studies out of Europe and California suggest 10% isn’t an unreasonable assumption for long supply chain total leakage, for example a lot of 1,300 kilometer road trips from an electrolyzer to compression tanks to a liquifier to liquid hydrogen storage tanks to tanker trucks to boil off on the two full days of driving per truck to transfer to ferry tanks to turning into a gas to compressing to the right amount for fuel cells to feeding into the fuel cell.

That four tons of liquid hydrogen, in other words, is going to be leaking in the range of 0.4 tons of hydrogen every couple of weeks, another efficiency loss. And liquid hydrogen has a high global warming potential, 13 to 37 times as bad as CO2 depending on whether you look at 100 or 20 years, due to it preventing methane from breaking down in the atmosphere. Every 0.4 tons of hydrogen that leaks, in other words, is like an additional five to fifteen tons of CO2e, for another 150 to 450 tons of CO2e per year, adding up to 430 to 730 tons of CO2e annually.

This, of course, ignores the manufacturing and liquification of the hydrogen in Leuna. Linda does buy certified renewable electricity for its electrolyzer, but it didn’t build new wind and solar plants, so doesn’t meet the additionality requirement. It takes the electricity from the grid at convenient times for electrolyzer operation, not when the sun is shining and the wind is blowing, so it doesn’t meet the temporality requirement. The certified wind and solar plants are in the same grid region, so it does meet the criteria for locality.

The four tons of liquid hydrogen would require about 260 MWh to manufacture and liquify and giving the Leuna facility the benefit of the doubt given the lack of additionality and temporality, even at 50% of Germany’s grid intensity, that’s another 45 tons of CO2e every couple of weeks, or about 1,400 tons per year.

We’re now up to 1,800 to 2100 tons of CO2e per year to make and deliver the hydrogen. Obviously, they are doing this for carbon benefits, so the MF Hydra must have been a really high emitting ferry previously. Well, no. For ferries of MF Hydra’s size and duty cycle, about 900 tons a year of emissions is more likely. As far as I can tell from this emissions work up, they’ve radically increased the greenhouse gas emissions from the ferry as opposed to reduce them even a tiny bit.

By contrast, delivering electricity to the 80 or so electric ferries doesn’t require any diesel trucks driving four days back and forth, doesn’t leak any green house gases and doesn’t lose 80% of the energy that’s put into it to electrolyzer efficiency, liquification energy requirements, boil off and leakage. They plug in at the docks using Norway’s 30 grams CO2e per kWh electricity, 10% of the carbon intensity of German’s because of all the hydropower. Those 80 ferries are vastly reducing the greenhouse gas emissions of the ferries, and at much lower expense and complexity. An MF Hydra size ferry powered by batteries charged with Norway’s green electricity would likely emit about 50 tons of CO2e per year dam-to-wake, a huge improvement over diesel and a massive improvement over hydrogen.

This is on top of the very significant energy cost differences of making hydrogen at Germany’s higher electricity rates, throwing away most of it between electrolyzer, compression, liquification and fuel cell inefficiencies, compounded by so much of it leaking. Industrial electricity rates are roughly double in Germany and about five times as much is required per kilometer of ferry movement, so energy costs are about ten times for the hydrogen ferry as for comparable battery electric ferries.

These really weird energy costs, waste and distances are par for the course for hydrogen fleet trials by the way. When Canada trialed hydrogen buses at the Whistler Blackcomb ski resort starting with the 2010 Winter Olympics, green hydrogen was trucked in from Quebec, 4,500 kilometers away, requiring about the same amount of diesel burnt just to deliver the hydrogen for the distances the buses traveled.

It’s hard to say how the MF Hydra got through business casing, but one assumes it wasn’t a rational and clear decision, and inevitably the ferry will be converted to much cheaper battery electric like the rest of Norway’s fjord-crossing fleet.

The MF Hydra example is a good one because this article was triggered by the bankruptcy of Norwegian company TECO, with its hydrogen fuel cell technology for maritime applications. The filings were driven by financial strain, including a bankruptcy petition from the Norwegian Tax Authority and difficulties securing capital. The company cited delays in Norway’s zero-emission regulations for cruise ships as a factor that hindered market opportunities. I assume that zero-emission regulations were looking at the reality of hydrogen value chain emissions and that was a problem for the firm. After all, in the best possible case scenario, a ship running on green hydrogen made with Norway’s electricity would cost three to four times as much to fuel and have three to four times the emissions per kilometer traveled. That’s before leakage, which makes things worse.

The redundantly named H2 Barge 2, formerly known as FPS Waal, began operating on the Rhine between Rotterdam and Duisburg in 2023. The retrofitted, 200-unit, 140-kilometer route, container cargo vessel features six 200kW fuel cells from Ballard Power Systems. The project faces challenges, including high operating costs, limited hydrogen refueling infrastructure, and delays in regulatory frameworks supporting hydrogen adoption. As a reminder, there are two 700-unit container ships powered entirely by batteries covering 1,000 kilometers on the Yangtze with swappable, containerized batteries sprinkled up and down the river at ports.

The project received significant funding from multiple European and national initiatives. The Clean Hydrogen Partnership contributed through the Flagships H2020 Project, while the Interreg North Sea Region Programme supported it via the ZEM Ports NS initiative. Additionally, the Netherlands Enterprise Agency (RVO) provided financial backing. Though exact figures haven’t been disclosed, this combined support enabled the retrofit and launch of the zero-emission hydrogen-powered vessel. Financial sustainability remains a concern, with stakeholders seeking additional funding to maintain operations. As is common with hydrogen fleets and trials, when the governmental money dries up, the trial ends.

In neighboring Belgium the Hydrotug 1, the world’s first — and hopefully last — hydrogen-powered tugboat, commenced operations at the Port of Antwerp-Bruges in late 2023. Developed by CMB.TECH, the vessel features dual-fuel engines capable of burning both hydrogen and diesel, reducing emissions by up to a claimed 80%, although the MF Hydra case study should cast serious doubts on that. As a thermodynamic reminder, internal combustion engines are even less efficient than fuel cells at turning hydrogen into forward motion, so while the engine is cheaper, the fuel costs are roughly double. As a mechanical reminder, electric motors are very high torque from zero RPM compared to internal combustion engines, so this solution fails on that front as well. The project was funded through a mix of private investment and public support, including contributions from the European Green Deal initiative and the Flemish government, with total costs estimated at €12 million. Of course, there are well over a dozen battery electric tugboats plying waters around the world and a lot more on order.

The Elektra, heralded as the world’s first emission-free hydrogen-fueled push boat — a boat that pushes barges as opposed to tows them —, was christened in Berlin’s Westhafen in May 2022. The vessel, developed by BEHALA, integrates battery-electric propulsion with hydrogen fuel cell technology. The project incurred total costs of approximately €14.6 million, with the German Federal Ministry for Digital and Transport contributing €9.1 million. Additional support came from Project Management Jülich and the National Organization for Hydrogen and Fuel Cell Technology. The Elektra is currently operational, transporting goods in the Berlin-Brandenburg region and on routes extending to Hamburg.

Germany being an epicenter of hydrogen folly, they couldn’t stop with just one hydrogen boat trial. Freudenberg e-Power Systems has been pushing fuel cells for the maritime industry for a while, with its hydrogen fuel cell technology deployed on cruise ships like the Silver Nova (54,700 gross tons) and the AIDAnova (183,900 gross tons). The Silver Nova, launched in mid-2023 by Meyer Werft and Royal Caribbean Group, uses Freudenberg’s fuel cells to power its hotel load while in port. Similarly, under the Pa-X-ell2 project, the AIDAnova integrates Freudenberg’s systems. The fuel cells are designed to not only run on inefficient hydrogen directly, but on methanol or ammonia of any provenance, likely at even higher cost and emissions as the process involves stripping the hydrogen out of those before putting it into the fuel cell.

Project 821, a 118.8-meter fuel-cell superyacht built by Feadship, has successfully completed sea trials. The project, reportedly costing over €500 million, benefited from private funding alongside technical collaboration with hydrogen technology firms to ensure efficiency and safety. While the yacht is operational, questions remain about the scalability of such innovations in broader commercial shipping sectors. That is, after all, at the upper end of the cost scale for yachts of that size, and it’s questionable how many of the world’s billionaires that can afford to blow that much on a floating hotel they occasionally use, along with the likely €100 million annual operating costs accounting for finding fuel for the thing wherever it happens to be, will bother. It’s certainly not much of an advance in sustainability for a rich person to be leaking hydrogen globally, as the MF Hydra case study above makes clear.

Crossing the Atlantic, the Sea Change, a 70-foot, 75-passenger hydrogen-powered ferry, was launched by SWITCH Maritime in 2021 as a purportedly zero-emission vessel operating in the California Bay Area. Funded by public-private partnerships, including support from the California Air Resources Board (CARB) and Maritime Administration (MARAD), the project received more than $3 million in grants. Additional financial support came from Chevron New Energies, United Airlines, and the Golden Gate Bridge, Highway, and Transportation District. The ferry sources its hydrogen fuel from local suppliers which make it from natural gas, with plans to transition to green hydrogen produced using renewable energy as availability increases. Infrastructure limitations have posed challenges for consistent refueling. Financial sustainability remains uncertain, as high operating costs and limited hydrogen availability have strained SWITCH Maritime’s resources.

California has proven itself to be immune to reality about hydrogen, being one of the epicenters of hydrogen folly globally. That’s an unfortunate side effect of trying to do the right thing early. Back around 2000, it was clear that hydrogen was expensive, no one knew about its greenhouse gas status and batteries just weren’t obviously viable, so leaders of various types decided the world would eat the high costs for low-carbon transportation. Time has passed, reality has shown it’s dead in the water, but bureaucracies, lobbying groups, research organizations and granting agents continue to flog it, hoping that just a few hundred million more will somehow magically change the laws of physics and the basics of economics.

In another epicenter of hydrogen folly, Japan, the HANARIA, the country’s first hybrid passenger ship utilizing hydrogen and biodiesel fuels, began service in Kitakyushu in April 2024. The vessel employs a combination of hydrogen fuel cells, lithium-ion batteries, and diesel generators, achieving a claimed greenhouse gas reduction rate of 53% to 100% compared to conventional fossil-fueled ships. The hydrogen fuel cell system, delivering up to 240 kW of power, was developed and supplied by Yanmar Power Technology Co. While specific funding amounts for the HANARIA project have not been publicly disclosed, it involved collaboration between MOTENA-Sea, Ltd., the ship’s operator, and investors including Mitsui O.S.K. Lines, Ltd. Yanmar can afford it, one assumes, as it’s a $7 billion USD annual revenue company, so as long as it doesn’t waste too much more money on hydrogen and fuel cells, it can absorb the inevitable losses.

Of course, part of Japan’s folly has been the belief that they would be importing hydrogen and so the Suiso Frontier, the world’s first liquid hydrogen tanker, exists. Built by Kawasaki Heavy Industries for approximately $500 million, the vessel is 116 meters long and can transport up to 1,250 cubic meters of liquid hydrogen cooled to -253°C. By contrast, a very large crude carrier costs about $130 million and carries around 300,000 cubic meters of oil. The 1,250 cubic meters of liquid hydrogen contains only ~0.093% of the energy carried by a fully loaded crude carrier. The hydrogen tanker completed its maiden voyage in early 2022, delivering hydrogen from Australia to Japan as part of the Hydrogen Energy Supply Chain (HESC) pilot project. Naturally, the hydrogen was made from coal, a very high emissions process. Recent news suggests Japan has finally pulled out spreadsheets to cost this nonsense, or at least that senior enough people have started looking at them that rational energy thinking is starting to emerge.

In tiny island nation Singapore, which has a very strong refining and chemical industry along with no local energy and hence an attraction to the illusory promises of hydrogen, hosts Sydrogen Energy, which has a 250kW hydrogen fuel cell power module, developed in collaboration with Shanghai Hydrogen Propulsion Technology Co., Ltd. The system is targeting smaller boats and auxiliary systems on larger ships, but isn’t deployed on any yet apparently. Initial funding for Sydrogen’s maritime projects has been bolstered by private equity investments and government-backed innovation grants from Singapore’s Green Energy Initiative. The firm is also in dead end grid storage and EV charging backup markets, proving that they are bereft of economic and thermodynamic rational thinking and the use of spreadsheets in multiple target markets.

I’m sure I’ve missed one or two attempts to make hydrogen an energy source on the water, so readers please share. Just as hydrogen is like square wheels on ground vehicles, it’s like using a colander as a hull on the water.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy