LME aluminum prices edged sideways throughout August, with a modest 1.69% month-over-month rise. Meanwhile, prices show little bullish or bearish momentum as they continue to trade within a tight range.

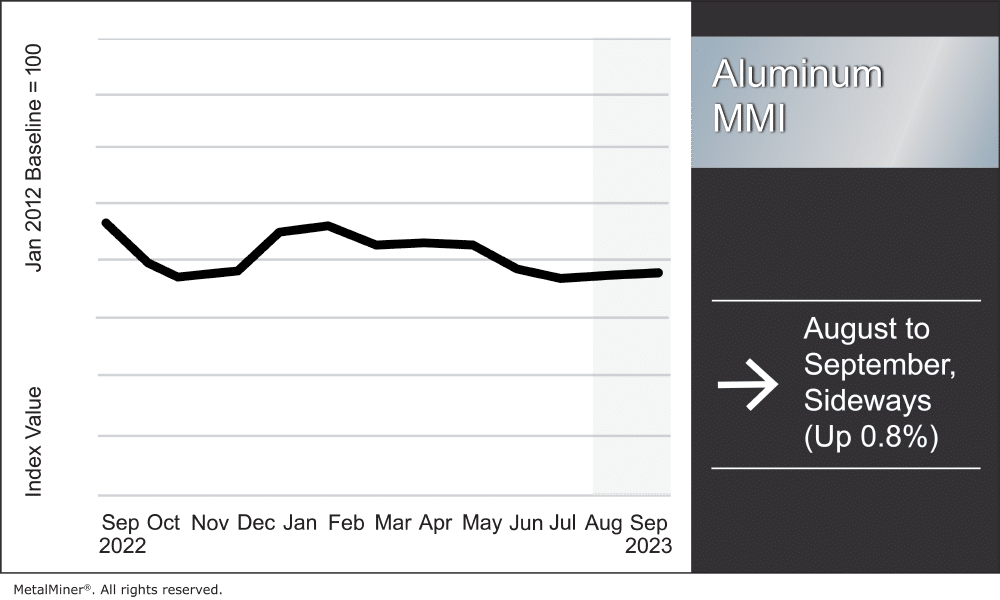

Overall, the Aluminum Monthly Metals Index (MMI) continued to move sideways as well, rising a modest 0.79% from August to September.

Get valuable market trends, price alerts, and commodity news, preparing your business in case sideways aluminum markets shift rapisly. Register for MetalMiner’s free weekly newsletter.

Hydro Bets Big on Lower Carbon Aluminum – Will the Market Reward the Company’s Strategy?

Hydro Extrusions North America recently placed a large bet on lower-carbon aluminum. Indeed, the company, which manufactures custom extrusion products, aims to lead the North American market on green aluminum. The big question remains whether U.S. consumers are willing to pay for it.

Investments by Hydro Extrusion’s North American entity factor into the company’s 2030 global strategy to expand both extrusions and recycling. Recent investments made by Hydro will increase the amount of scrap in its melt mix, thus offering customers a lower-carbon option.

Hydro’s investment in North America remains underpinned by strong growth. Indeed, this has pushed the company past where it stood before the Great Recession. For instance, during the second half of last year, the company ran at full capacity, with roughly 20% of its products going to service centers. That said, the market has seen a notable shift of late. Except for trucks and trailers, which continue to show a strong build rate this year, demand from almost all other sectors dropped.

During the Great Recession there was a truck/trailer build rate of an estimated 80,000 units. According to a recent interview with Charlie Straface, Business Unit President for Hydro Extrusions North America, this year, that volume rose to 300,000 units amid strong performance of that sector. Straface told MetalMiner that Hydro forecasts a slight fall in overall truck and trailer production, down to 280,000 units in 2024.

Hydro specializes in complex, high-strength extrusions in the 6000 series alloy family. The company has a specific advantage in 6061 and 6082 alloys, which utilize larger presses (10, 12, and 14 inches).

Avoid making tactical aluminum procurement choices with the precision and insight offered by MetalMiner Insights’ price forecasting and should-cost models. Click here.

The Upside and Downside of Hydro’s Lower-Carbon Aluminum

On the one hand, Hydro’s strategy boasts rigorous third-party testing. The company collects scrap from a number of dealers, much of which comes from the construction industry. There are two primary methods to determine the carbon footprint of scrap. The first designates all scrap with a zero carbon footprint. The second, which Hydro favors, only designates post-consumer scrap as having a zero carbon footprint.

Hydro’s strategy will play into the growing market for eco-friendly options, especially amid the ongoing push toward renewable energy in the U.S. Straface noted that Europe has largely embraced the shift toward recycled material as part of its climate ambitions. He now hopes the North American market will follow suit.

While experts anticipate scrap demand to grow in the coming years, Hydro noted no problems with its availability. The growth of the EV market, which uses more aluminum than sheet steel compared to the traditional auto market, will add to the domestic scrap supply. Recycled aluminum will also help improve the efficiency of the company. Finally, scrap aluminum prices have been to Hydro’s advantage because of the current slowdown in demand.

Are Consumers Ready to Pay the Higher Aluminum Prices?

Lower-carbon aluminum also comes with a few drawbacks, mainly the price. Lower-carbon extrusions will carry a premium over their counterparts, which could result in limited interest from North American consumers. That said, larger-scale operations may have more interest in such products. This mainly hinges on whether or not they represent a small part of a much larger budget and can be used to boost their eco-credentials.

Tesla, which may benefit from the ongoing UAW stroke at the Big Three automakers, is one of the largest consumers of aluminum in the North American auto industry. Tesla also boasts a wider profit margin, which may leave room for higher-priced extrusions. However, the average consumer currently pressured by inflation may feel less inclined to purchase such products at a premium.

Scrap sorting also poses a challenge for companies like Hydro, which continues to develop technologies for this purpose. The invention of a more economical way to sort scrap would likely help improve the current challenge of a pricing premium for lower-carbon aluminum products.

Upcoming negotiation on your aluminum contracts? Don’t go into any contract negotiation session without knowing 2024 aluminum price projects. Get access to MetalMiner’s 2024 Annual Metals Outlook. See a sample copy and subscribe.

Aluminum Market Outlook Remains Bearish for Both Prices and Premiums

As Hydro goes green, the overall aluminum market remains bearish. According to a recent Bloomberg report, six separate buyers, producers, and traders claim they struggled to book deals at Fastmarkets’ recent aluminum conference.

After aluminum prices found a peak in mid-January, they proceeded to drop over 17% throughout the year. The Midwest Premium shows an even sharper fall throughout 2023, mainly due to lackluster demand from the U.S. market. Indeed, Midwest Premium futures fell more than 31% from January. And while LME aluminum prices started to move sideways in recent months, Midwest premium futures have yet to find a bottom and continue plunging toward their October 2022 low.

According to data from the International Aluminum Institute, North American primary aluminum production averaged almost 2% higher during the first seven months of 2023 compared to the same period of 2022. Rising supply appears to be a global issue, which continues to offer little support to prices.

Biggest Moves for Aluminum Prices

- Chinese primary cash prices saw the largest increase of the overall index, rising 3.15% to $2,685 per metric ton as of September 1.

- Chinese aluminum billet prices saw a modest 2.85% increase to $2,732 per metric ton.

- Meanwhile, Korean commercial 1050 sheet prices fell 4.7% to $3.88 per kilogram.

- The Korean 3003 coil premium over 1050 sheet also dropped 4.7% to $3.92 per kilogram.

- The Korean 5052 coil premium over 1050 sheet saw the largest decline, dropping 4.71% to $4.03 per kilogram.