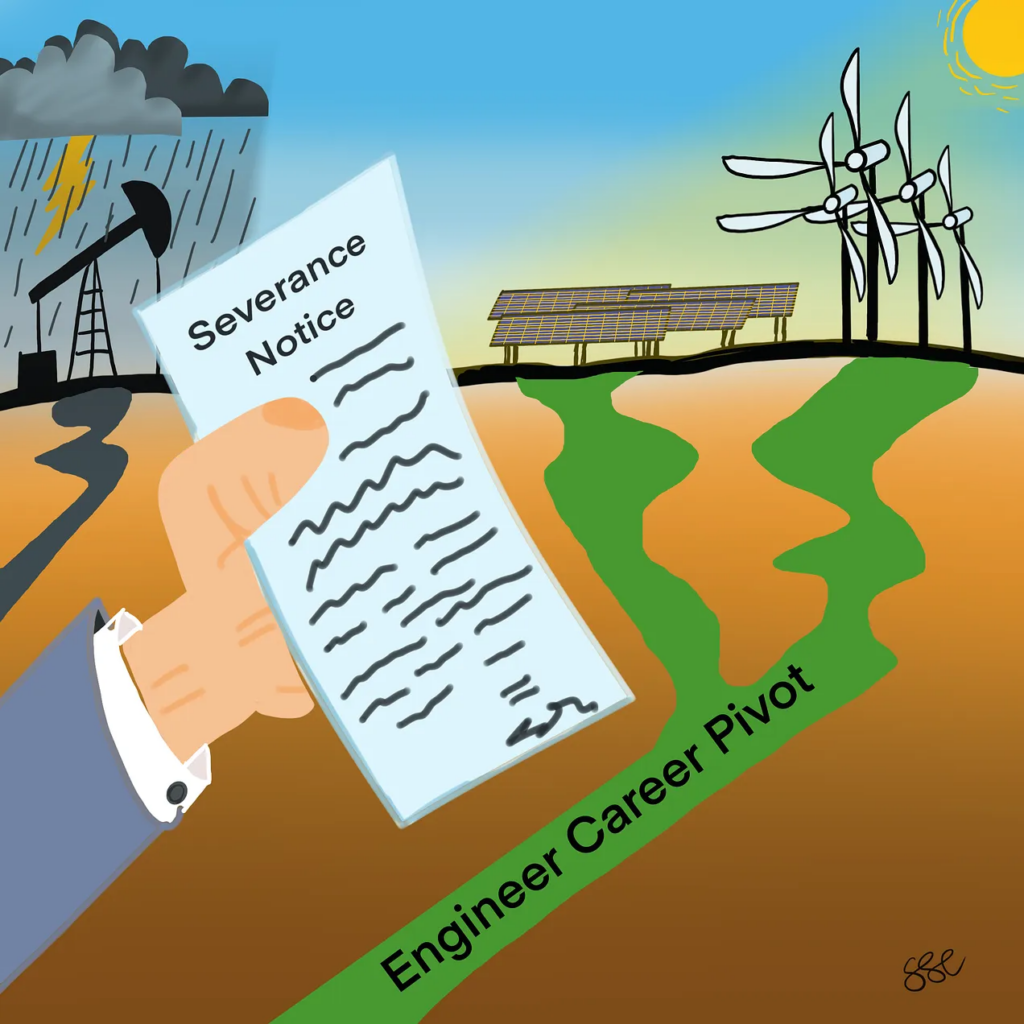

Go from survive to thrive in a few easy steps.

By Geoffrey Cann

If you’re working on a digital innovation when your oil and gas company has been acquired, you’re at risk, and you need a plan.

Why The Industry Is In Turmoil

Let’s be frank.

The oil and gas industry is the poster child for a fast turning commodity cycle. It’s really hard, even in a quasi-competitive market like global energy, to get supply and demand precisely and continuously in balance. As a result, prices are much more volatile than other long stride commodities such as iron and copper.

Americans now find themselves the unwilling global swing producer, a role that was long occupied by Saudi Arabia, until American producers sorted out unconventional reservoirs with techniques like horizontal drilling and multi-stage hydraulic fracturing.

Now wells can be drilled and completed at will, even inventoried (by delaying completion). Yields and recoveries improve year by year.

Throw in a little interest rate escalation, perhaps a wave of debt repayment, and, just as it is with homeowners, it’s likely some debt covenants are under stress. Companies need to sell to get relief. Cashed up, but prospect poor producers can then acquire production that can bolster their reserves position.

And that’s exactly what’s happening right now. The US oil and gas industry is experiencing a wave of consolidation that looks well poised to continue for some time.

ExxonMobil has acquired Pioneer Resources. Chevron scooped up Hess. APA Corp (Apache) has picked up Callon Petroleum Chesapeake Energy and Southwestern Energy have announced a merger, to create a newly branded company. Occidental has swallowed CrownRock Minerals.

Do you think it stops here? Unlikely.

What’s In It For Me?

Gauging your career prospects if you’re in one of the acquired companies is tricky. The closer you are to the front line, actually running an asset or supervising production, particularly one with strong production, the more likely you will be retained. But the further away you are from the front line, the greater the risk that you’ll be packaged out.

Handsomely packaged out, but packaged out.

As an oil and gas engineer, you made the call a few years ago to work on some digital innovation project that was intended to help your company succeed. Your work is novel and showing clear results. You’ll be safe, right?

Maybe. Maybe not.

All around Houston, you can bet that the big consulting firms have been retained to help figure out the merger game-plans. Outside help is always hired because the employees in both the buyer and the seller are too busy running their existing companies, producing their products, paying the bills, to drop what they’re doing and focus on this big change.

How do I know? I was the lead consulting partner for one of the Big 4 consulting firms when my client bought out a competitor to become the largest oil company in the country.

Consultants are paid to be fast, objective, and dispassionate. There’s little time to get into the specifics and the nuances of every individual project. The merchant bankers and lawyers will have already justified the deal to the investment community because of the ‘synergies’ to be captured, and the costs to be taken out, almost all of which are short term and immediate (within weeks of the merger being finalized). The consultants will have incentives to achieve these targets.

They’ll apply a simple rule to guide their choices, because speed is essential.

Any project or investment, including digitally enabled changes, that is not going to deliver a guaranteed bottom line impact within the next 12 months, gets shut down. Project budgets not spent are declared as carrion for the bankers.

There are exceptions. Large multi-year inflight capital projects, or projects for regulatory compliance, or safety, may be spared.

Deployed and highly successful digital innovations that are duplicative of something that the acquirer already has, will be dropped. The acquirer will simply move your company onto their footprint so as to capture a synergy. That includes AI, analytics, machine learning, specialized apps, cloud services, automation… everything.

Even if you’re working on something that is incredibly unique, ground-breaking, and disruptive to the industry is no guarantee. You’re going to lose all your internal champions who were supporting you, and you’ll need to convince a new group of people with whom you have no relationship to believe in you, at a time when their mind space is elsewhere.

I’ll be blunt. The outlook is not good. You need a plan.

Preserving Your Career

Your digital work is going to be valuable somewhere, just not in the acquiring company. Here’s how you preserve the value that you’ve acquired.

Go the Entrepreneurial Route

First, find out if what you’re working on is something the seller has flagged as part of the value proposition to the buyer. Usually the value proposition in an oil and gas deal is based on reserves and production, captured synergies from consolidation, and some asset sales. Rarely does it hinge on specific technology innovations or techniques. There’s a very good chance that your innovation is something the seller will simply tell you to take with you as you leave.

I’ve seen this time and again. Sellers know precisely the amazing innovations that they have nurtured, but they know equally that the innovation will not receive growth capital. Rather than let the innovation go to waste, they just let it go.

Good for you. You’re now an entrepreneur.

Map Out Your Life Goals

Second, you should ask yourself whether you should even stay in oil and gas. This wave of consolidation, set against a backdrop of climate change, decarbonization, electrification, a trillion dollars in US federal government incentives in clean energy, points to rising demand for people with your skills. With a bit of career repositioning you might be qualified for one of the estimated 5 million job openings that are forecasted for new energy businesses in the next decade.

Take the time to revisit your goals in life to confirm that your hard-earned career in this industry will sustain you to retirement and beyond.

Assess Your Prospects

If you want to stay in the industry, there’s a possibility that your digital chops are going to find a home somewhere, but where?

The larger producers already have digital groups that are trying to bring capabilities such as AI, machine learning, automation, digital twin, analytics and digital reality to the fore.

Focus instead on the mid-sized firms hoping to grow and differentiate. Pay particular attention to those firms that are valued at the market average. They’re likely looking for, and can afford, innovations that can set them apart and help them break out from the pack. Those trading below the average are acquisition candidates.

Put your digital story front and center. Hiding it as a by-line isn’t going to make you stand out. Remember, there’s lots of oil and gas engineers hitting the market right now. Your differentiation needs to be made exceptionally clear.

Seek Greener Pastures

If you conclude that oil and gas is no longer your jam, you need to sort out where to next. There’s never been a better time as a professional energy engineer, what with all the money flowing into clean energy, renewables, geothermal, hydrogen, and carbon capture, to look for greener pastures.

Do some research into where the money is flowing into these new energy fields in your home town. There’s growth everywhere, and you’ll need to make some choices.

- Hydrogen? Great if you’re mostly a plant engineer, as it’s going to be a manufacturing business.

- Geothermal or carbon capture? Great if you’re into reservoirs and drilling.

- Renewables? Looks like a place for project engineers.

Sort Out Your Fit

Having settled on a new, but related field, you need to consider how you message your fit given your oil and gas background. This doesn’t come naturally to engineers. We’re trained to be precise, clear, perfect, and accurate. No puffery or exaggeration.

Highlight the skills that you have that are common to the industry you target and the industry you’re leaving. Energy is energy, after all. Compliance with relevant standards and regulation, creative problem solving, teamwork and collaboration.

And above all, put your digital story first. Unlike oil companies, new energy businesses have no baggage, and cannot succeed without being digital to the core. Can you even imagine a new energy business that simply bans the use of mobile devices, rather than designing the business around mobility? I can’t. But oil companies can, and do.

Practice Your Message

If there’s one thing that most people suck at, it’s telling compelling stories about themselves and their work. And that’s a shame, because our stories are fascinating, at least to us. And as engineers, we like to focus on the science, the math, the physics. We avoid the emotional angle. We gloss over the economics. We don’t punch the story home with a solid ‘so what’.

Pick out a few key stories about you and your work. Your origin story. Your hero story. Your passion story. Write them down. Say them out loud and rehearse them so that they are second nature. Make them short and tight. Ditch the unnecessary technical aspects unless they are absolutely key. People love a good story, but most don’t have the patience to take in a long and rambling yarn that seemingly goes nowhere, and worse, ends with a whimper.

Start Your Career Pivot

And with the hard decision making behind you, you can start the easy part — getting your name and profile out there as the ideal candidate for a fantastic new role in energy.

For more on how you might go about your career pivot, take a look at ‘Engineering Your Career Pivot’, a new training course I’ve co-developed with Philip Black to help oil and gas engineers thrive in tough times.

Artwork is by Geoffrey Cann, and cranked out on an iPad using Procreate.

Share This:

Next Article