Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Public vehicle fleets, which include everything from city buses and school buses to garbage trucks and law enforcement vehicles, make up a significant share of traffic on U.S. roads. There are 645,000 vehicles in the federal fleet, 500,000 in state fleets across the country, more than 3 million municipal and county vehicles and approximately 500,000 school buses — a total of nearly 5 million vehicles, before even accounting for public transit and other fleet types.

As the United States works to cut greenhouse gas emissions in half by 2030 and reach net-zero by 2050, shifting public fleets from fossil fuel vehicles to EVs will be a critical step. And that’s not the only reason to do it: Electrification can also cut costs for fuel and maintenance while reducing the air pollution and negative health impacts that stem from auto emissions — particularly in low-income and communities of color, which are often disproportionately impacted by pollution from transportation.

While some public fleet operators have made significant strides toward electrification—one transit agency in Anaheim, Calif., for example, is close to reaching 90% electrification of its buses — progress is uneven across the country. Here’s a look at the current state of U.S. fleet electrification and how fleet operators can start planning for a fully electrified future:

What’s the Current State of Public Fleet Electrification in the U.S.?

The United States’ transition to electric vehicles (EVs) is accelerating faster than ever before. The share of all U.S. car sales that were EVs increased from just 3.4% in January 2021 to nearly 10% in June 2023, spurred by cost decreases, expanded charging infrastructure and new federal tax credits as well as rising consumer interest. This growth has been driven largely by light-duty (passenger) vehicle sales to date. But meeting local and national climate goals will require electrifying all vehicle types on the road — including commercial and government-owned fleets as well as passenger cars.

Federal Tax Incentives for Public Fleet Electrification

The “direct pay” provision of the Inflation Reduction Act made it easier for public entities to access EV tax credits that can support their electrification goals. For example, through direct pay, a city seeking to purchase an electric garbage truck could use the Commercial Clean Vehicle Credit to get up to 30% of its cost or $40,000 back, whichever is lower. Learn more about federal funding and tax credits for electric vehicles at WRI’s U.S. Climate Policy Resource Center.

Governments, transit agencies and other public entities are well positioned to lead on this transition thanks to expanded federal funding and, in many cases, ambitious climate targets which require them to work toward electrification in the near term. At the national level, a 2021 executive order from President Biden committed the federal government to purchase 100% zero-emission light-duty vehicles by 2027 and 100% zero-emission vehicles for all fleets by 2035. State and local governments and transit agencies have followed suit, with many committing to light-duty electrification requirements over the next decade. Others have instituted requirements for agencies to purchase an EV unless they can demonstrate a need for another kind of vehicle.

Some local governments have made significant progress toward their goals. For example, New York City has over 4,000 EVs in its fleet, comprising nearly 14% of all public vehicles, with a recent order of EVs set to put the city past 18% in its mission to full electrification. Other public entities are working to electrify, too — such as Williamsfield Schools in rural Central Illinois, which will have 8 electric buses this fall, maintaining only one diesel bus for longer school trips.

Federal agencies, on the other hand, had just 2,705 plug-in vehicles (including battery electric vehicles and gasoline plug-in hybrids) at the end of fiscal year 2022, comprising less than 1% of the federal fleet. The federal government has set targets to acquire almost 9,500 light-duty EVs and install 8,500 charging ports in fiscal year 2023. However, agencies have encountered limitations in the numbers and types of vehicles available as well as challenges related to charging infrastructure, including electrical capacity limitations, costs and leased sites at which they cannot unilaterally install chargers. Many local fleet operators will face similar challenges as they work to meet their own electrification commitments.

Learning from a Leader: One Transit Agency’s Journey to 90% Electric Buses

As governments and public entities navigate the transition to EVs, they can look to others who are further along in the electrification journey for guidance. One leader, the Anaheim Transportation Network (ATN), is seeking to become the first transit agency in California to have an all-electric bus fleet. Starting in 2002, ATN took advantage of state funding for electrification to purchase lead-acid battery electric buses. Today, about 65% of its fleet is electrified, with an upcoming order of electric buses set to put it past the 90% threshold.

ATN has navigated its fair share of challenges as an early and ambitious mover in fleet electrification. Over the last twenty years, the agency has seen firsthand how important it is to manage risk as the industry develops: With new EV technologies constantly emerging, existing vehicles and charging infrastructure can become “stranded assets,” meaning they are not useful for their full intended life. ATN hedged against this concern by working directly with the municipal utility to establish a power purchase agreement with a consistent rate structure for the next 20 years. This certainty in electricity costs allows the agency to proactively budget for new vehicle purchases and updated infrastructure installation.

BYD ART electric bus in Anaheim, California. Image Kyle Field, CleanTechnica.

Siting infrastructure has also proved difficult. EV charging infrastructure takes up significant space, and as a tourism hub, Anaheim doesn’t have a lot of land at its disposal. In attempting to build a new charging depot — which will be critical to supporting a fully electrified bus fleet — ATN faced constraints in land availability as well as community opposition to one proposed site. After about a year of searching, the agency was recently able to secure the land it needed — thanks in part to its strong relationship with the city, which provided financial support for the purchase.

ATN’s success also hinged on successfully leveraging state and federal funding opportunities, including the California Traffic Congestion Relief Program, the Volkswagen settlement and the Low- or No-Emission Grant Program. While not all states have policy environments that are as supportive as California’s, new federal funding from the Bipartisan Infrastructure Law and Inflation Reduction Act can support other fleets’ electrification efforts in the same way state support has for ATN.

5 Best Practices for Full Fleet Electrification

While electrification is a rising priority for fleet managers and many are beginning to make the shift, governments and public agencies often have limited time, capacity and technical expertise to plan for full fleet electrification over the long term. Electrification also poses many novel challenges, such as siting EV charging stations, engaging with utilities on grid capacity constraints, and financing and maintaining an ever-changing suite of new technology.

To better understand public fleet managers’ needs and roadblocks to full electrification — as well as potential solutions — WRI’s U.S. Energy team interviewed 17 fleet consultants, fleet managers, transit agencies, local governments and vehicle electrification experts. The team also reviewed transition plans developed for public purpose fleets and broader fleet electrification research to understand how long-term, full fleet electrification differs from early-stage considerations.

The following emerged as key steps that fleet managers can take in the near term to maximize efficiencies, reduce costs and reach their long-term electrification and sustainability goals.

1) Identify workforce and organizational needs at the outset.

Electric vehicles, particularly in a fleet context, involve a number of technical considerations that are not part of current workers’ responsibilities, such as charge management and vehicle and charging equipment repair. As much as possible, public purpose fleets should seek to hire or re-train staff in key electrification roles. For example, Washington, D.C. is spending over $1 million to increase the number of certified electricians in the District and is educating electricians and repair shops more broadly on EV technology. But contracting out for turnkey fleet solutions is another option to consider when public purpose fleets lack the expertise and capacity to manage fleet operations.

Interagency coordination is also key to a successful EV transition. Communication between different departments at a local government, which might each have their own EV procurement plans, can help ensure that investments in vehicles and charging infrastructure are as cost-effective as possible.

Public institutions, such as large cities, school districts and statewide agencies, can consider reconfiguring roles for fleet services or creating a new agency focused on cross-department collaboration with respect to vehicle electrification. For example, New York City established the Department of Citywide Administrative Services to coordinate fleet electrification across city agencies. This kind of reconfiguration can create centralized expertise and help address potential stumbling blocks earlier in the process.

2) Engage with utilities early and often.

Utilities are key partners in ensuring long-term vehicle electrification plans go smoothly; as energy distributors and suppliers, they have a direct interest in making sure their infrastructure can service current and future needs. By engaging utilities early in the process, public fleet managers can integrate their electrification plans into their utility’s infrastructure planning and potentially avoid being charged duplicative upgrade costs.

Like many other utilities, the Port of Oakland (which serves as the utility for the City of Oakland’s airport and seaport), asks its customers to keep it informed of planned and potential electrification. This allows the port to identify where electrical upgrades needed to support EV deployment can occur simultaneously with other planned infrastructure maintenance and upgrades. Without this coordination, there’s a risk that newly electrified fleets could exceed electrical constraints when they plug in and cause electricity infrastructure to malfunction — in which case the port would have to make electrical upgrades and the costs would fall on the customer.

3) Be creative with siting electric vehicle depots and infrastructure.

Siting charging infrastructure can be one of the most challenging aspects of transitioning to EVs, depending on where vehicles are parked and the location of depots.

In some cases, siting is relatively straightforward — such as a local government’s parking enforcement fleet that is parked at an existing, municipally owned depot where charging equipment can be installed on-site. But siting is often more complicated. Many school districts, for instance, use “park-outs” for school buses when they are not in use; these can be anything from a bus driver’s driveway to a contracted retail parking spot. Figuring out how to install charging infrastructure for these park-outs is extremely complex, requiring careful coordination with partners and individuals and different financing considerations.

Electric school buses can function as giant rolling batteries to support the power grid through the use of vehicle-to-grid (V2G) technologies. Image: Nuvve’s V2G AC chargers and platform connected to Lion Electric school buses on Con Edison’s grid in White Plains NY. Image courtesy of Nuvve Corporation.

School districts and other vehicle fleets in similar positions should prioritize electrification and installation of charging infrastructure where it is most feasible in the near term (for instance, at large depots that have sufficient electric capacity and space for vehicles and chargers), while also planning for a more systemic approach in the future. Potential solutions could include changing, decentralizing or centralizing depots, sharing a site with a regional partner, or creating a park-and-ride depot that is linked to public transit where electric capacity is abundant.

Electric buses in California’s Twin Rivers School District fleet are plugged in to charge. For large public vehicle fleets, determining where to install EV chargers can be one of the biggest hurdles to electrification. Photo by LION

The right approach will vary by location and fleet. The Washington Metropolitan Area Transit Authority, for example, is rebuilding its three garages to accommodate its goal of a zero-emissions bus fleet by 2042, with the first rebuilt garage scheduled to open in 2027. By contrast, New York City spreads its fleet vehicles over about 400 unique locations throughout the five boroughs. As the city expands its EV infrastructure, it can prioritize electrification at certain sites based on the attractiveness of real estate, the ease of upgrades and whether they are accessible to multiple city agencies. Where possible, strategic siting of EV charging infrastructure can reduce grid build-out costs and even help cost-effectively scale up renewable generation.

Maintenance of chargers is an important issue to address upfront when implementing electrification. According to a recent study, 20% of EV drivers who recently used public charging stations experienced charging failures or equipment malfunctions, leaving them unable to charge. As their charging networks grow to keep up with EV demand, public purpose fleets may find that they have trouble keeping their infrastructure up to date and adequately maintained.

Public purpose fleets should consider re-training or hiring staff to manage charging equipment or contracting out to an external company that has expertise in these areas. In addition, having preemptive discussions with potential contractors about adding equipment can help accommodate further EV transitions in the future. This could include laying extra conduit, adding additional stub-ups for future chargers, or buying panels or switchgear in anticipation of future loads. Finally, fleet operators can consider using different ownership or contracting mechanisms such as service-level agreements to ensure charger reliability and uptime.

5) Incorporate new technologies throughout the electrification journey.

EV technologies are constantly changing and evolving. To lower the risk of vehicles and charging infrastructure becoming obsolete as the space develops, fleet managers should consider piloting new technologies and diversifying their vendors throughout the electrification journey.

Using a variety of vendors that distribute different types of vehicles and charging infrastructure can limit stranded asset risk by ensuring that fleets will still be able to continue making electrification progress if one vendor goes bankrupt or faces supply chain challenges. Meanwhile, implementing innovative technologies can provide long-term benefits. For example, vehicle-to-grid buses can provide electricity to the grid in times of grid stress, typically creating an additional revenue source for the fleet. Microgrids — self-sufficient energy systems that can operate both as a part of the larger electricity grid and in “islanded” mode — can improve resilience and ensure that fleet vehicles still are able to operate during outages. Such technologies can sometimes be partially financed using government grants or incentives, such as the Low- and No-Emission Vehicle Program and the Renew America’s Schools.

Montgomery County in Maryland, for example, partnered with AlphaStruxure and the Carlyle Group to build a 6.5-megawatt microgrid and electric bus depot at no upfront cost to the county. Fourteen buses were purchased through federal funding while solar, storage and additional buses were financed through a long-term contract between the county and the two private groups. Montgomery County’s project, which will serve roughly 140 buses and 5 surrounding buildings, is an excellent example of how to approach incorporating new technologies such as microgrids and vehicle-to-grid (V2G) using available funding and strategic partnerships.

While these technologies can help support long-term electrification goals and will likely be an important part of a clean energy future, they are not requirements for fleet electrification and should not distract from investments in EVs and charging infrastructure for organizations with limited finances.

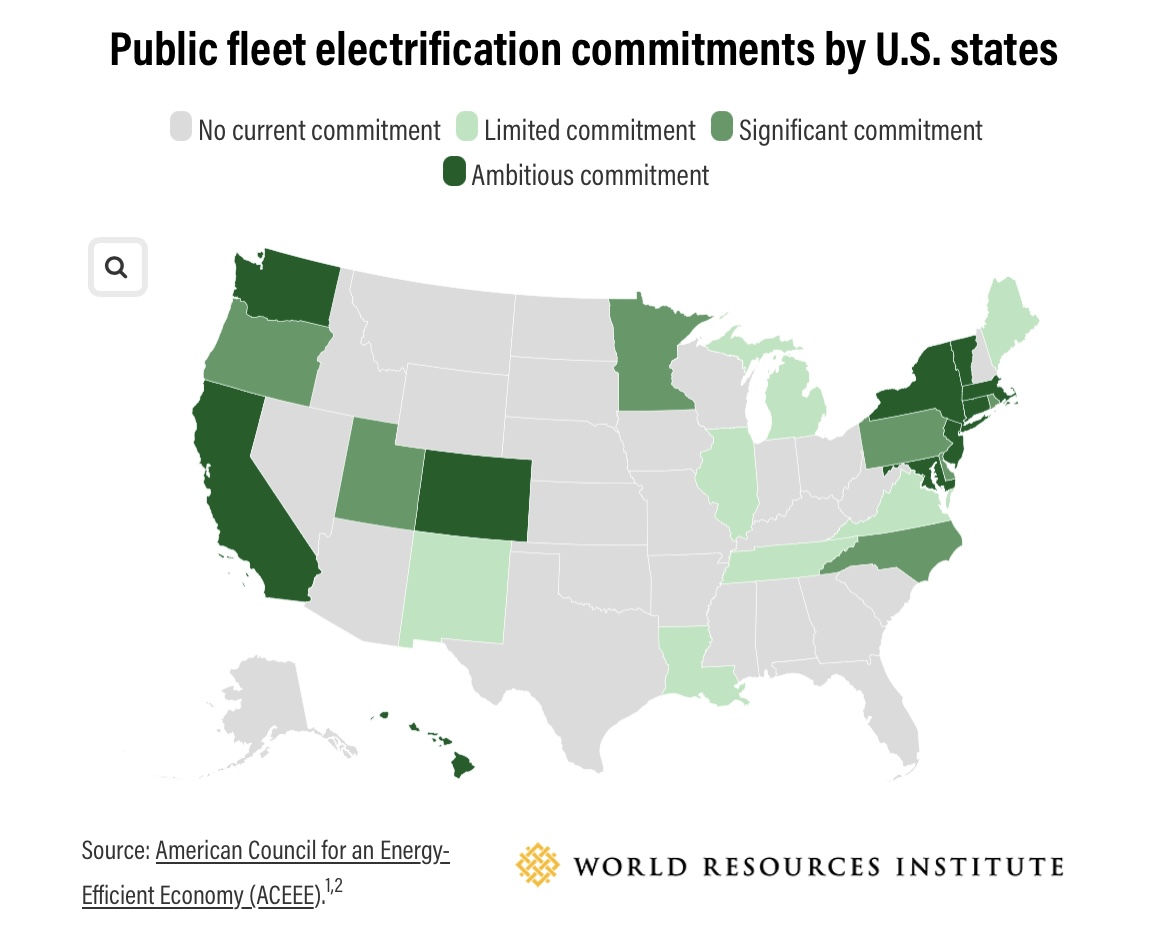

1) States including Alabama, Florida, Mississippi, Missouri, New Hampshire, Ohio, South Carolina, Texas and Wisconsin do not have electrification commitments for state fleets but do have policies to encourage fuel efficiency or require agencies to consider purchasing an alternative vehicle.

2) California, Colorado, Connecticut, Washington, D.C., Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island, Virginia, Vermont and Washington have adopted California’s zero-emission vehicle standards requiring manufacturers to sell 100% zero-emission light-duty vehicles by 2035. In addition, California, Colorado, Connecticut, Washington, D.C., Hawaii, Maine, Maryland, Massachusetts, New Jersey, New York, North Carolina, Oregon, Pennsylvania, Rhode Island, Vermont and Washington have committed to ZEV sales targets for medium- and heavy-duty vehicles of 30% by 2030 and 100% by 2050. These commitments are not reflected in the graphic above which aims to capture specific state fleet commitments.

Courtesy of WRI. By Joseph Womble and Lori Bird

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.