A tangle of factors pushed prices for renewable energy certificates serving the PJM Interconnection to historic highs in Q2 of 2023, and there is little potential of easing in sight, sources said.

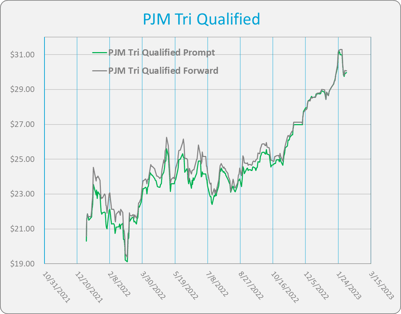

The OPIS month-to-date mean assessment for prompt-year PJM Tri-Qualified, a benchmark REC that can be retired in Pennsylvania, Maryland or New Jersey, was up 47% year-over-year at $35.414/MWh on June 21, 2023. Just under half of that jump in nominal value has occurred in Q2 alone. The forward-year PJM Tri-Qualified assessment has surged even higher, from a month-to-date average of $24.751/MWh on June 22, 2022, to $37.238/MWh on June 21, 2023, a 50% year-over-year gain.

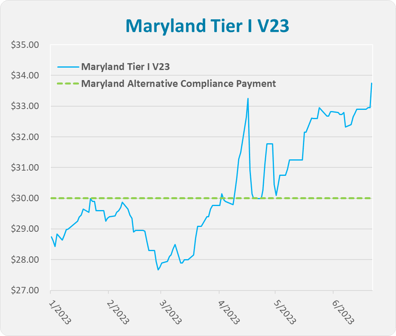

Alongside the price spike, some atypical market conditions have emerged. For example, Maryland Tier I RECs have begun to trade above the state’s alternative compliance payment level, which is intended to serve as a price cap if the RECs market gets too tight.

“Honestly, in my career, this is the first time I’ve ever really seen RECs trade materially over cap,” AES Clean Energy Vice President of Environmental Products Erin Eckenrod said. “It’s nonsensical.”

There appears to be no single culprit to blame; the drivers behind the price jump and some seemingly unprecedented market conditions can instead be found in an interlocking series of renewable energy purchasing patterns, federal and state policy decisions and ballooning electric demand in regions such as Northern Virginia’s “Data Center Alley.”

How Renewable Portfolio Standards and Rising Electric Loads Create a Double Driver of REC Retirement Mandates

One of the key factors when considering pricing dynamics is an understanding of the underlying Renewable Portfolio Standards that stoke much of the demand for RECs.

One REC represents the environmental attributes of one megawatt-hour (MWh) of electricity produced by a renewable source. States require power suppliers to purchase and retire RECs to cover a set percentage of the electricity they deliver to comply with the RPS. These state laws incentivize the development of renewable power sources as a means of reducing emissions and enhancing energy security.

State RPSs are designed to gradually increase renewable capacity — and the amount of RECs suppliers must purchase — over time. Because they operate as a percentage of delivered power, suppliers must also purchase more and more RECs as their customer demand increases.

An update to Virginia’s RPS significantly tightened REC supply in the PJM service region, sources said. Beginning in 2021, it transitioned its law from a voluntary incentive program to a mandatory one and required all RECs to derive from sources within Virginia or the PJM region. The new provisions have led to a more tangible supply crunch.

An update to Virginia’s RPS significantly tightened REC supply in the PJM service region, sources said. Beginning in 2021, it transitioned its law from a voluntary incentive program to a mandatory one and required all RECs to derive from sources within Virginia or the PJM region. The new provisions have led to a more tangible supply crunch.

Virginia and many other regions of the PJM Interconnection, furthermore, have seen electricity demand increase significantly in recent years.

Virginia total retail electricity sales reached 107.8 TWh in 2012, according to the Energy Information Administration. By 2021, the latest data available, they had climbed to 125.2 TWh. PJM forecasts total energy in its service area to hit 788.05 TWh of power in 2023 and increase to 909.6 TWh in 2033.

Voluntary Drivers in Demand

Much of that growth in electricity demand has been driven by tech companies that operate or contract with a growing system of data centers in the region, according to PJM. Furthermore, many of those tech companies have committed themselves to ambitious net zero emissions goals.

Several of the country’s largest tech companies both operate significant data infrastructure in the PJM service area and have voluntarily committed to aggressive decarbonization strategies. Each of these companies have begun to pursue plans that go beyond the market-based accounting method for voluntary Scope 2 emissions — those produced by heat, cooling, electricity or steam — as laid out in the widely followed Greenhouse Gas Protocol. In addition to offsetting their emissions with REC acquisitions on a yearly basis, each business has sought to do more to bring additional renewable capacity online on grids from which they draw large amounts of power.

This marks a shift from the 2010s, when many businesses that funded new renewable generation through power purchase agreements would receive the RECs and execute swap deals, exchanging them for lower-cost RECs from regions like Texas and the Midwest and pocketing the difference.

“It isn’t until the last five or six years that the voluntary buyers in these regions would actually take the higher-priced RECs and retire them,” Eckenrod said.

“With the data load growth, the importance of actually making a meaningful contribution to the grid is even more important for these entities,” Eckenrod continued. “So now that supply is not in the market for the mandatory buyers, and it’s millions and millions of RECs a year.”

Slow Permitting and Interconnection Queues Have Throttled Development

There’s an additional complicating factor at work. The time it takes to build new renewable generation sources has grown longer in recent years. Project developers must obtain permitting and progress through their regional transmission organization’s new service request queue process before they can begin construction.

Between 2000 and 2007 it took, on average, less than two years for a project to progress through an interconnection queue, get built and become operational, according to data from the Lawrence Berkeley National Laboratory. In the period between 2018 to 2022, that timeline roughly doubled.

The total capacity of projects waiting in PJM’s queue nearly quadrupled to 288 GW between 2017 to 2021, according to the U.S. Department of Energy. With the tax incentives for the development of new renewable generators provided by the Inflation Reduction Act passed in August 2022, queues have swollen even further, and timelines have stretched longer.

The PJM queue grew to over 2,700 projects by the end of 2022. In November, the organization obtained approval to freeze new interconnection requests and implement reform measures as it worked through the backlog.

Many REC purchasers, however, have signed PPAs with projects that were projected to come online recently or in the near future, but remain stuck in the queue. Therefore, project delays have funneled both voluntary and compliance REC purchasers that need to hit RPS deadlines or net zero pledges into the secondary market.

“If the queue was running more effectively, we would probably see enough supply coming through to cover all this increasing demand,” EDF Renewables Transaction Manager Gabe Messercola said.

Other sources believe that project delays may explain the current dynamics playing out in the Maryland REC market. Most states, including Maryland, set an alternative compliance payment in their RPS that allows electricity suppliers to pay a fee in lieu of acquiring and retiring RECs if that process becomes too expensive or difficult.

Many states set their ACP far above the market rate of RECs. But Maryland diverges from other states in that it has set its ACP at $30/MWh for the current compliance period and has designed it to decrease over the next several years.

Market analysts expected Maryland’s ACP to act as a pressure-release valve for the PJM market and keep REC prices near or below that $30/MWh level. That has not come to pass. Maryland Tier I RECs have routinely traded above the ACP level in secondary markets through the second quarter. Maryland Tier I V23 was assessed at $32.95/MWh on June 21, 2023.

Market analysts expected Maryland’s ACP to act as a pressure-release valve for the PJM market and keep REC prices near or below that $30/MWh level. That has not come to pass. Maryland Tier I RECs have routinely traded above the ACP level in secondary markets through the second quarter. Maryland Tier I V23 was assessed at $32.95/MWh on June 21, 2023.

PPAs signed by voluntary purchasers can involve language that guarantees the delivery of RECs during certain periods, regardless of whether or not they derive from the renewable generation source in question. Some PPAs for Maryland developments, therefore, might have committed the seller to the delivery of Maryland Tier I RECs. If the project was then delayed, the seller would be required to source Maryland Tier I RECs from whatever source necessary, such as the secondary market, and the $30/MWh ACP would have no bearing on the situation.

PJM has gained approval from the Federal Energy Reliability Council to update its interconnection queue process. But it doesn’t expect to clear the existing backlog until 2026. In the meantime, RPS requirements and electric demand will likely continue to increase. Until new renewable capacity comes online, sources expect the supply-demand imbalance for RECs to grow more and more lopsided.

—Editing by Kylee West, kwest@opisnet.com

OPIS Carbon Market Report assesses the largest compliance carbon markets in the world with reliable and transparent trade-day data. Easily track and manage your carbon compliance costs with daily pricing and breaking news.