A quarter of the world’s copper mining projects are at increasing risk from the impacts of climate change, with extreme rainfall expected to affect production of the metal crucial for the global clean energy transition by 2050, new research shows.

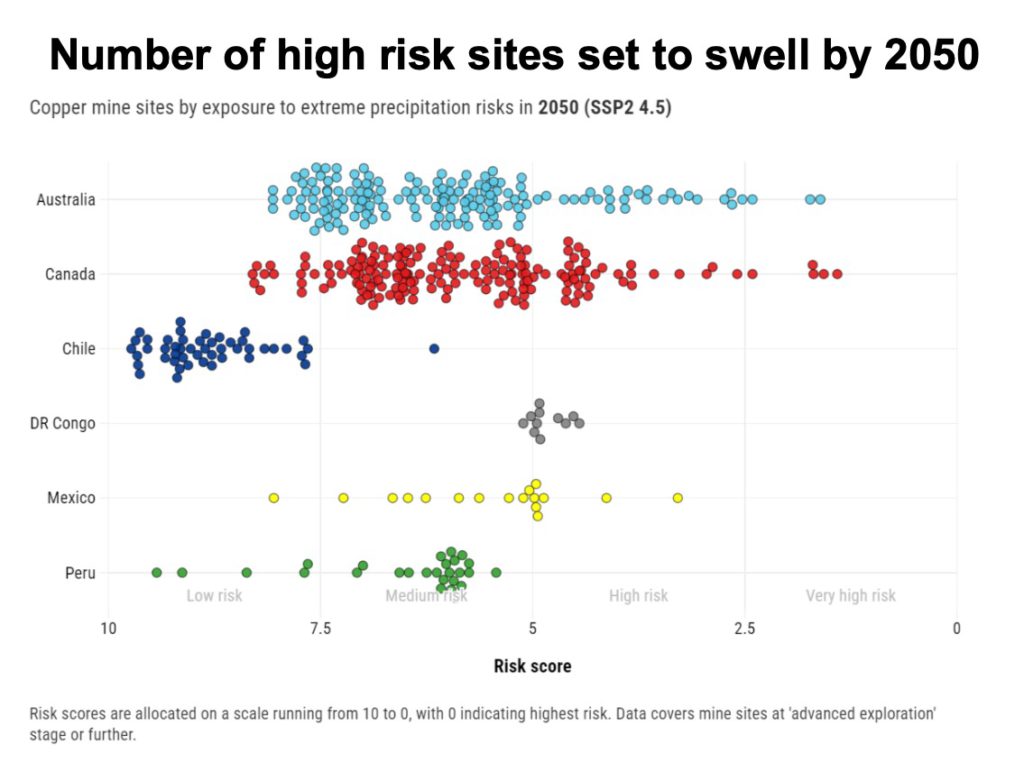

According to a study by risk intelligence firm Verisk Maplecroft, around 25% of global copper projects are projected to face “high” or “very high” risk of extreme precipitation by mid-century. Major copper-producing countries, including Canada, Australia, and the Democratic Republic of Congo (DRC), are expected to be the most vulnerable to climate-related disruptions.

Verisk Maplecroft’s Extreme Precipitation Index, which measures the frequency and intensity of heavy rains across seven different time horizons and three emissions scenarios, shows that 19% of copper mines already face significant risk from extreme weather events. This number is expected to rise as global temperatures increase, leading to both more severe rainfall and drought.

“Health and safety risks to workers, damaged access roads and electrical and structural damage at site facilities can all have an impact on production,” says Jimena Blanco, chief analyst at Verisk Maplecroft. She notes these impacts will likely extend beyond the mine site, affecting local communities and supply chains.

Canada and Australia account for just under half (47%) of the 718 copper projects benchmarked within the consultancy’s analysis, which focuses on mine sites tagged at “advanced exploration” stage or further based on data from Costmine Intelligence.

The number of Canadian copper sites facing high or very high risks from extreme precipitation is set to more than double, from 16 projects currently to 42 by mid-century (under an intermediate emissions scenario).

Australia, which hosts the second highest number of potential sites, is set to see a marginal increase, from 27 sites currently to 28 in 2050 – leaving 17% of the country’s copper projects at risk.

Countries like Mexico and the DRC, with fewer potential copper mines, are also projected to face heightened risks. In Mexico, the number of high-risk sites is expected to increase from two today to seven by mid-century. In the DRC, the projects exposed to extreme rainfall could triple from three to nine by 2050.

Multi-million losses

Over the past decade, severe rainfall has led to forced suspensions of operations in copper mines across Chile, Peru, and Australia, resulting in billions of dollars in losses.

Reconstruction efforts following such events are often costly and time-consuming, with damaged equipment and unsafe buildings requiring extensive repairs, Verisk Maplecroft says.

Preparing for both current and future climate risks is essential to bolstering emergency response plans and ensuring the resilience of mining operations, the consultancy notes.

A similar study published in April by PricewaterhouseCoopers (PwC), found that even if the current level of carbon emissions are reduced rapidly, more than 70% of cobalt and lithium production, and around 60% of the world’s bauxite and iron production will be at risk by 2050 due to climate-related reasons.

PwC reports centred on the effects of extreme high temperatures and shifting weather patterns would have on extending drought periods. Even in an optimistic low emission scenario for 2050, more than 50% of the world’s copper mines will be in areas exposed to drought risk that’s deemed significant, high or extreme, the study showed. For two other energy transition metals — lithium and cobalt — drought exposure is even higher at 74%, it concluded.