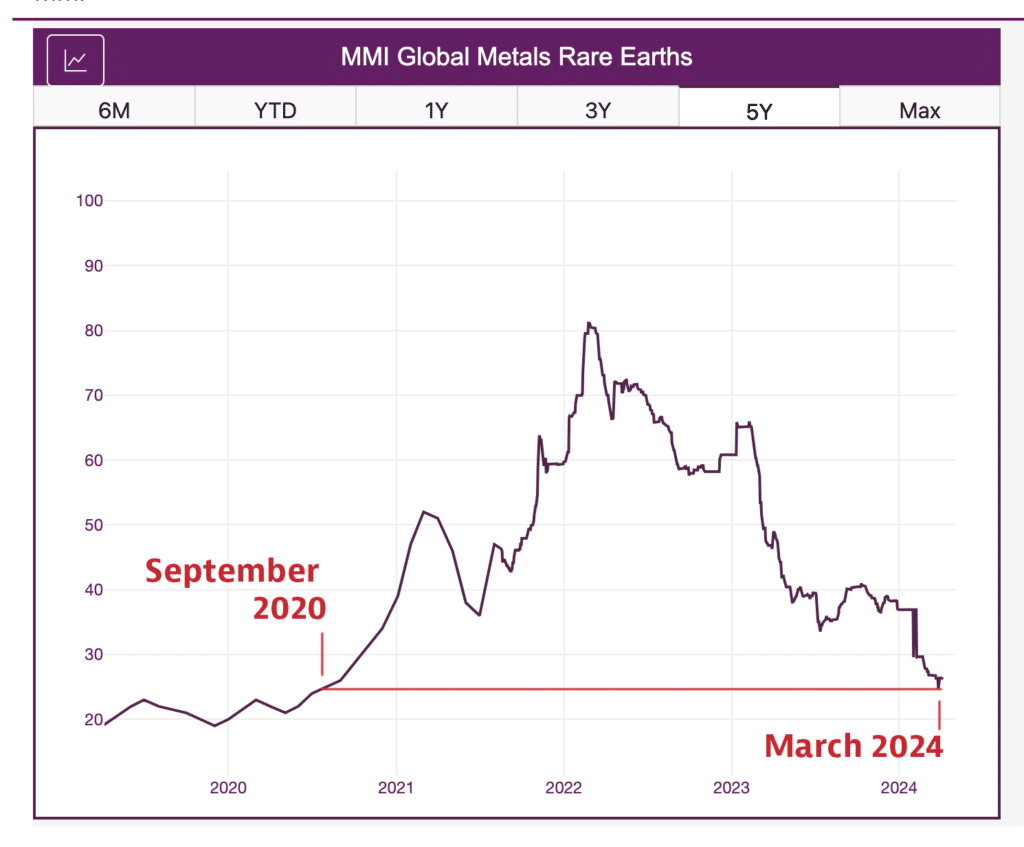

Month over month, rare earth metals witnessed new price lows not seen since September 2020. While neodymium oxide and praseodymium oxide witnessed the sharpest drop out of all of the components of the Rare Earths MMI (Monthly Metals Index), the index fell by 5.08% overall. But with price points nearing pre-pandemic lows, the index may have finally found a bottom following six straight months of declines.

Rare Earth Metals Nearing Pre-Pandemic Price Lows

A recent S&P Global article shed some light on the year-over-year decline in rare earth metals prices. According to the Australian company Lynas Rare Earths, a large rare earths producer, the average selling price for neodymium-praseodymium dropped 32% year over year to AUS $35.50 per kilogram for the July–December 2023 period.

Another article on oilprice.com noted that in March 2024, terbium oxide and neodymium oxide reached their lowest levels since late 2020. Meanwhile, MetalMiner’s own MMI index showed similar data: the cost of commercial rare earth elements is nearing pre-pandemic price lows, and similarly hit their lowest price point since September 26 2023.

According to UBS analysts, some cost support continues to develop at present price levels given the history of protracted periods of low prices. However, developing conviction around a durable price recovery is still difficult. Furthermore, Lynas Rare Earths recently announced a major decline in sales and earnings in its Q1 2024 results.

Experts anticipate that rare earth prices will need to grow substantially to support the development of new rare earth projects, which usually require higher prices to be economically feasible, the recent hurdles notwithstanding.

Challenges to Rare Earth Metal Prices and Market Recovery

An abundance of rare earth metals is one of the main causes of price drops. According to a U.S. Geological Survey study, 2023 saw the output of rare earth metals rise by 10% worldwide, surpassing the growth in demand. Because of the severe downward pressure on prices caused by this excess, producers are finding it more difficult to remain profitable.

Furthermore, the demand for several items that depend on rare earth elements, such as industrial machinery, continues to decrease due to the global economic downturn.

Trade Disputes and Technological Advancements

A small number of nations contain a disproportionate amount of rare earth elements, with China producing the majority of rare earth metals worldwide. Due to supply chain weaknesses and trade conflicts brought on by this geopolitical concentration, rare earths continue to witness disproportionate market dynamics.

Furthermore, the two biggest economies in the world recently intensified their competition, resulting in trade obstacles and taxes affecting the worldwide market for rare earths. This may bring challenges for producers and consumers who need to make long-term plans due to the unpredictability and volatility that these geopolitical tensions might bring about.

Meanwhile, the European Commission reported that the potential to replace rare earth elements with alternative materials and the advancement of new technologies may present obstacles to the recovery of rare earth metal prices. This could result in less demand and more price pressure if scientists and producers actively look for methods to use less rare earth elements or find viable substitutes.

Rare Earth MMI: Noteworthy Price Shifts

Looking for more lucrative rare earth sourcing tactics? Click here to learn the 5 biggest cost saving sourcing tactics.

- Neodymium oxide fell the most out of all of the components of the index, dropping by 6.48% to $49,962.23 per metric ton.

- Praseodymium oxide also dropped by 5.25% to $53,458.88 per metric ton.

- Terbium oxide dropped by 4.93%, which left prices at $759.46 per kilogram.

- Finally, cerium oxide rose by 7.28%, which brought the overall price value to $1,036.05 per metric ton.