2024’s second quadrimestre is now complete. So let’s start with our title’s second phrase “GDP Defies Belief”. For Q2’s annualized GDP growth rate was just raised from an improbable first estimate of +2.8% to now an impossible second estimate of +3.0%.

“Questioning the Bureau of Economic Analysis, mmb?”

Just doing the math, Squire. Here’s the Economic Barometer from one year ago-to-date. The puke-green portion of the Baro’s line is the May/June/July reporting period for Q2 data, (which for you WestPalmBeachers down there covers economic activity for April/May/June). Does anyone actually believe this even approximates +3.0% GDP growth?

To be sure, the Econ Baro takes in some 50 metrics per month, whereas the StateSide Gross Domestic Product calculation is far more blunt, (true to the modern art form of throwing a few buckets of paint up against the barn wall and then seeing what happens). Creativity aside, the GDP’s simplest form is merely the sum of both Private and Public Spending as offset by the Trade Deficit. That’s it.

Thus given (as you regular readers know) the Baro provably has led (for some 26 years) the lagging conventional wisdom assessment of the economy, we’ve been ever so dubious over this reported Q2 GDP +3.0% growth pace. And electioneering notwithstanding as regards Washington’s bureaucratic Bureau of Economic Analysis, ’tis purportedly an apolitical agency. But quite obviously the numbers don’t add up. “Got Gold?”

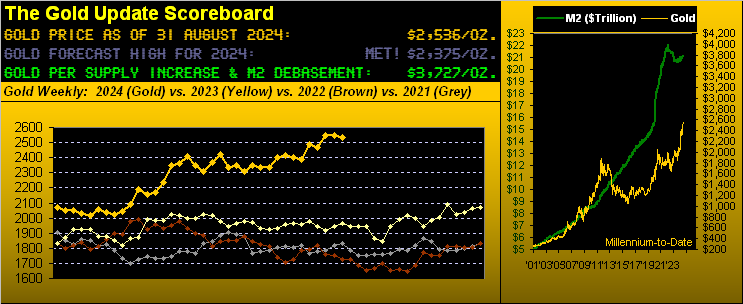

Which brings us to the first phrase of this week’s title “Gold’s 2nd-Narrowest Week”, specific to the year thus far. Indeed for 2024’s 35 trading weeks now in the books, the past five trading days missed being the narrowest weekly range by the tiniest of margins, (second only to that ending 23 February). Measured by percentage distance between Gold’s high and low, last week’s range was 1.48%: the average through the first 34 weeks was 3.31% … slow old Gold! In settling yesterday at 2536, Gold’s net loss for the week was a scant -13 points. In turn, this means we’ve yet to see a pullback of at least -100 points following price’s recent (albeit marginal) set of All-Time Highs. Such -100-point pullbacks otherwise have been Gold’s wont on all prior All-Time High occasions earlier this year as we herein documented two missives ago.

“Well, mmb, that’s ’cause now we know the Fed is about to cut interest rates…”

Which they shall so do (but see our wrap’s Barron’s boo-boo) per the Federal Open Market Committee’s Policy Statement on 18 September. And ’twill be by just one pip (from the present target range of 5.25%-5.50% to 5.00%-5.25%). Oh to be sure, there are those parroting pundits looking for a two-pip dip. But: as noted a week ago ‘twould be poor optics for the Fed to so do, and — of course — we now know the U.S. economy is healthily growing at a groovy +3.0% annual pace. Life is Goldilocks Great!

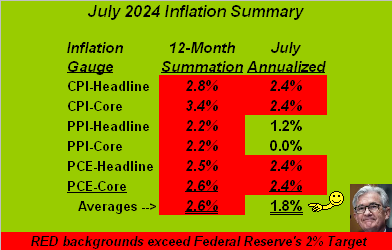

Further, (courtesy in part from the same Bureau of Economic Analysis along with the Bureau of Labor Statistics), the Fed has successfully tamed inflation. (You can tell, right?) Gathering inflation data reported for July, here’s our updated table comprised of retail inflation (Consumer Price Index), wholesale inflation (Producer Price Index) and “Fed-favoured” Personal Consumption Expenditures. Note the lower rightmost July annualized average: a joyous below-target +1.8% for the Fed and The Nation!  “Celllll-a-Bration…”

“Celllll-a-Bration…” –[Kool and the Gang, ’80]:

–[Kool and the Gang, ’80]:

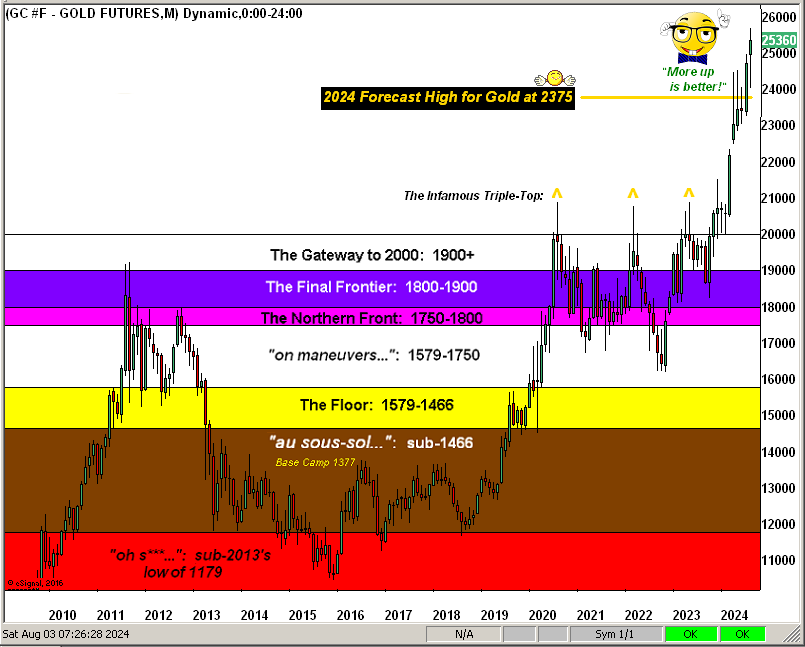

As for Gold itself, we sense already well-priced in is a one-pip Fed dip. So to Gold’s weekly bars we below go, their charted from one year ago-to-date. Note the five rightmost closing pips all are above the present slope of the trendline and that the newest parabolic blue dot is nearly spot-on our forecast high for this year. Indeed that 2375 level we view (as herein cited a week ago) to be mid-structural support. Too, for you seat-of-the-pants traders, Gold’s six-hour Parabolics top the yellow metal’s segment on our Market Rhythms page: nine of that study’s past ten Parabolic flips have followed through by at least 12 full points, the average moreover being 43 points … just in case you’re scoring at home. ‘Course, in this business, cash management = account survival. For as the “Triple-Negative Dept.” reminds us: nobody (human nor algorithm) is never wrong. Here are the weeklies:

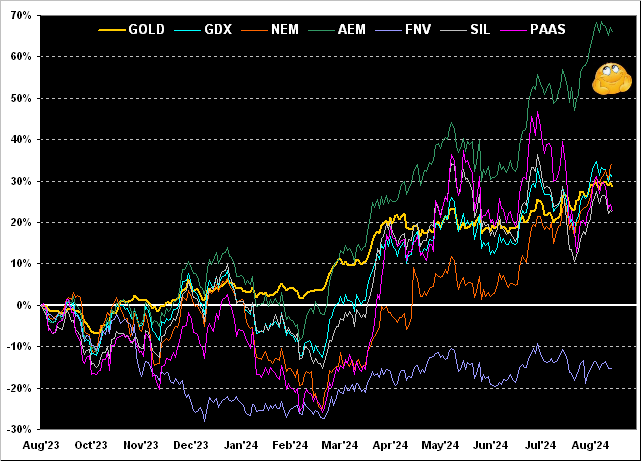

Now let’s add in our set of key precious metals equities, again from a year ago-to-date. And how ’bout that Agnico Eagle Mines (AEM): +66%! (‘Tis nice when your earnings improve +65% from the like quarter a year ago). Then in descending order of improvement we’ve Newmont (NEM) +34%, the VanEck Vectors Gold Miners exchange-traded fund (GDX) +31%, Gold itself +29%, Pan American Silver (PAAS) +23%, the Global X Silver Miners exchange-traded fund (SIL) +22%, but still Franco-Nevada (FNV) -15%. “Yet, ya luv it when the metal equities’ upside leverage kicks in!”

Speaking of love, everyone loves being Number One, which is exactly Gold’s year-to-date placement per our BEGOS Markets Standings by percentage change with eight months of 2024 now recorded. ‘Tis a beautiful thing:

Let’s, too, go ’round the horn for all eight BEGOS Markets across their past 21 trading days (one month) in tandem with their baby blue dots of each grey trendline’s consistency. A rather “Dollar-weaker” picture all told, and notably so for the metals, with Silver and Copper nearly identical by both price pattern and their respective “Baby Blues”:

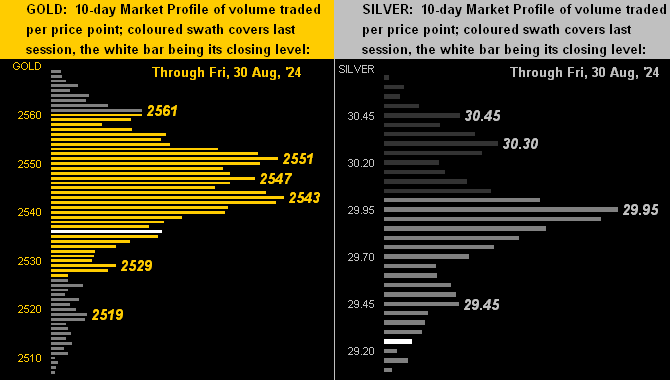

From which we move to the precious metals’ 10-day Market Profiles for Gold on the left and Silver on the right. The length of each horizontal bar equates to the contract volume traded for that price. Thus for Gold, (presently 2536), the 2543-2551 area appears resistive. As for Sister Silver (presently 29.25), her overhead line-in-the-sand is 29.95:

Toward this week’s wrap, with August behind us, here is our monthly view of the stratified Gold Structure from some 16 years ago-to-date. And “more up” is always great:

And so we wrap we these three notes:

Note One: ‘Twouldn’t be The Gold Update without a statement on stocks. Our bailiwick for such is, naturally, the S&P 500, which month-after-month, indeed year-after-year, refuses to cave to an insanely high price/earnings ratio, our “live” reading at this writing 40.3x. That is +59% higher than its inception in 2013 at 25.4x, (i.e. the earnings aren’t there). Too, as we’ve been recently “X’ing”(@deMeadvillePro), the MoneyFlow relative to the S&P’s recent rally is weak. Add to that, the S&P is now 12 days “textbook overbought”, bang-on-time for the start of September which — by conventional wisdom — is the stock market’s worst month of the year. Shall you vacate the throng before it all goes wrong?

Note Two: Nvidia (NVDA). ‘Tis exceedingly rare that we get specific to a stock, simply because equities’ risk is too much for us to bear, (our preferring to rest easy in the sanctity, safety and serenity of the commodity futures markets). But that said, ’twas impossible to hide from the hype ahead of Nvidia’s earnings report, even knowing in advance ’twas to be but a fraction of that earned a year earlier. To wit: whilst waiting for the bus (oh yes) a few days ago, a wanna-be athletically-clad gentleman walked passed us, excitedly going on his phone about Nvidia’s then still upcoming earnings report. Elsewhere pre-report we heard as well “I just bought more Nvidia!” Then came that report and the 70x earnings stock got its comeuppance (or in this case, comedownpance … yikes). Then followed this opening to an opinion spanking courtesy of Dow Jones Newswires: “The Dumb Money Poured into Nvidia Ahead of Its Results … Retail investors — known pejoratively as the ‘dumb money’ on WallStreet – loaded up on Nvidia ahead of the microchip maker’s poorly received results.” Let’s face it folks: paying $70 for something that earns $1 is pretty dumb.

Note Three: Speaking of DJNw, did you catch yesterday’s Barron’s boo-boo? In recent years we’ve on occasion referred to the “children’s writing pool” at the once highly-regarded publication. But this piece was so off-the-mark that we think it was instead composed by “AI” (“Assembled Inaccuracy”). Using our trusty tablet, we screen-captured the moment. Here — unaltered — ’tis:

So don’t you boo-boo, lest get booed … ensure you’ve Got Gold in your brood!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

********