One of the most common questions we get from clients is whether they should buy either gold OR silver. Anyone researching an investment in bullion can find good arguments for owning either metal.

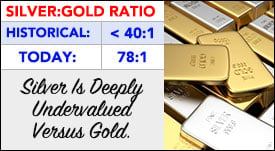

One of the best ways to evaluate the prospects of one metal versus the other is by looking at the gold/silver ratio.

Gold and silver prices tend to move in the same direction on any given day, with silver being the more price-volatile of the two. Over time, though, they can diverge.

This ratio has generally moved higher since May 2011. At that time, silver had reached nearly $50/oz and the ratio bottomed at just under 40:1. The ratio topped out in 2020 at almost 120. Today it stands at about 78.

This ratio has generally moved higher since May 2011. At that time, silver had reached nearly $50/oz and the ratio bottomed at just under 40:1. The ratio topped out in 2020 at almost 120. Today it stands at about 78.

While the ratio has fallen, it remains well above some historical benchmarks. The average over the past three decades is about 60, but over the last 80 years, it’s under 40.

The “natural ratio” for silver is estimated at 10. That’s the proportion of silver in the Earth’s crust relative to gold.

Going as far back as the 12th century, gold sold for 15-16 times the price of silver by convention in many societies. This is often referred to as the “classic ratio.”

By just about any historical measure, silver looks cheap relative to gold. Odds are silver will do some catching up in the years ahead.

History, however, does not have to repeat. Some advisors believe gold will outperform silver. One of the primary arguments is that gold, as a monetary metal held by central banks around the world, will shine brightest in a monetary crisis.

Another argument is that silver is more of an industrial metal, and prices could suffer during an economic contraction.

Some view gold as having an advantage because it is culturally embraced, especially with respect to jewelry, in burgeoning regions of the world such as the Indian subcontinent. Citizens there hold more total gold wealth than anywhere else in the world.

Our view is that silver also deserves plenty of attention as a “monetary metal.” This has been reinforced in recent years as confidence in the dollar has declined. Investment demand for both gold and silver surged in response.

Silver has been used as money more often than gold throughout history and populations around the world still think of the metal as a good hedge against inflation. Silver is also the metal favored by preppers worried about a total economic breakdown.

We also consider silver’s broad (and growing) industrial uses as bullish for the metal.

New applications in solar, high tech, and healthcare are being developed. These applications in manufacturing provide a baseline for growing demand, in addition to investment demand.

It’s also worth noting that most of this industrial silver is consumed, not recycled; whereas with gold, it’s almost never consumed out of existence, practically speaking. As gold is dug out of the ground, the total above-ground supply continues to build.

Our suggestion to longer-term investors who just want a recommendation as to which metal will outperform is to overweight silver.

But it’s important to understand that silver is more volatile. If volatility is too uncomfortable, gold might be a better fit for such folks.

Gold also has some practical advantages over silver in terms of being able to store more value while taking up less space – and being easier to transport.

But both metals can be expected to perform well vis a vis the Federal Reserve note in this age of inflation and uncertainty.

*********