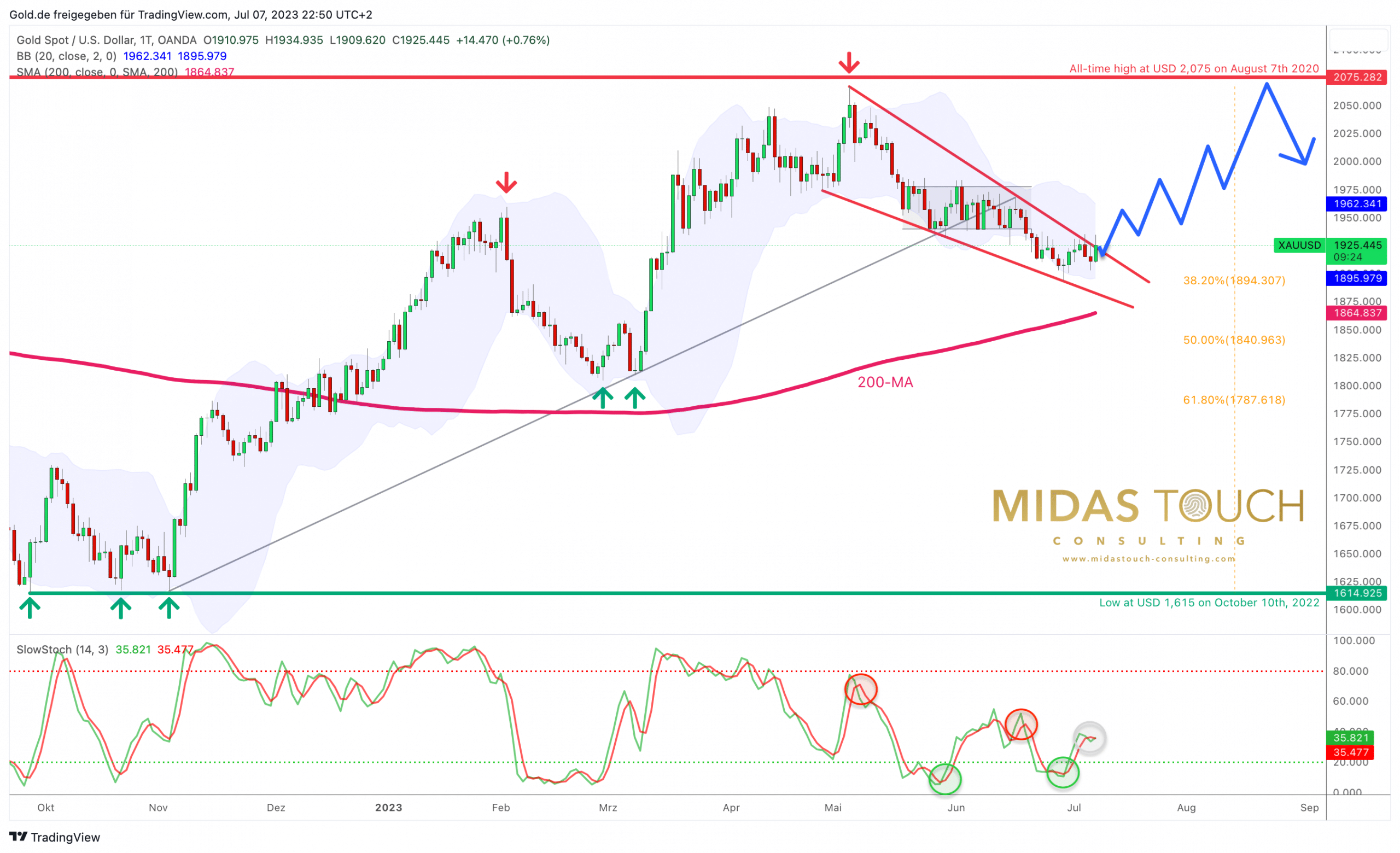

Over nine weeks have passed since the last peak in gold. During this time, gold prices have fallen by 8.4%, from USD 2,067 down to USD 1,893. While the initial wave of this correction was fairly decisive, market participants have been increasingly deceived by a trend-less back-and-forth since the interim low on May 30th at USD 1,932. Since then, bears made only slow and steady progress. Gold – Turning point within reach.

Correction has reached exactly the 38.2% retracement

Nevertheless, they managed to push gold prices down to the 38.2% retracement of the previous rally at USD 1,893 10 days ago. Hence, the first “classical” target of the correction has been reached. On the same day, the gold bulls returned to the market, resulting in a potential reversal pattern with a closing price at USD1,908. Consequently, gold bulls made efforts to stage bounce during the last trading week.

However, this bounce has been rather feeble and uncertain so far. Thursday’s US labor market data triggered a sharp sell-off down to USD 1,902 as nearly half a million new jobs were created in the US private sector in June. This robust employment situation, combined with rising wages, could reignite inflation and prompt the US Federal Reserve to raise interest rates further.

Job numbers below estimates but wages ran a bit hot

The US labor market data released on Friday, on the other hand, disappointed and caused a spike higher in the gold market. This resulted in the breaking of the downtrend-line of the past nine weeks. Overall, gold managed to close the week slightly higher at USD 1,925.

Although the final bottom in the gold market cannot be declared yet due to the volatile back-and-forth, the turning point seems to be within reach. Maybe we have seen the final low of this correction already on Thursday, June 29th, at USD 1,893. In the worst case, there is still a remaining downside risk of approximately USD 50. However, there is a potential reward of around USD 600 on the upside once gold can clear the resistance around USD 2,075, too. The crucial question in the gold market remains the timing of this breakout as it is expected to unleash tremendous energy and quickly propel gold price to around USD 2,525.

Gold in US-Dollar – Bears are making little progress.

Gold in US-Dollar, daily chart as of July 9th, 2023. Source: Midas Touch Consulting

As predicted, gold prices have corrected into the zone between USD 1,900 and USD 1,920. Although there was a brief dip to USD 1,893, overall, the bears are increasingly getting stuck in the targeted zone. With Thursday’s low at USD 1,902, the bulls have also managed to establish a higher low, while the downtrend-line that has been capping the price for over nine weeks is losing its strength. Although a clear new buying signal from the Stochastic oscillator is still missing on the daily chart, the situation is improving on a daily basis. A swift recovery towards the upper Bollinger Band (USD 1,962) would not be a surprise to us!

If the final low in the gold market did indeed occur either on Thursday, June 29th or will come in the next one to three weeks, a rapid return towards the psychological level of USD 2,000 can be expected thereafter. However, the breakout above the all-time high at USD 2,075 is likely to take until late summer or early autumn.

Gold in Euro – Both buying limits have been executed.

Gold in Euro, daily chart as of July 9th, 2023. Source: Midas Touch Consulting

In euro terms, gold prices have been correcting since March 20th, 2023. After reaching a new all-time high at EUR 1,885, gold has retraced by 7.7% to down EUR 1,740 over the past three and a half months. As we suspected, there has been a prolonged reunion with the rising 200-day moving average (EUR 1,756) over the past two weeks.

Fortunately, our two buying limits at EUR 1,800 and EUR 1,775 have been gradually activated in the last three weeks. With prices around EUR 1,760, gold is still within our buying zone, while seasonality is now sending a buy signal too. We eagerly take advantage of these favorable gold prices!

Conclusion: Gold – Turning point within reach

It’s time to buy! As expected, gold has undergone a significant and necessary pullback since early May and now appears to be figuring out its typical bottom in early summer around USD 1,900. In the worst case, it may go a step further down to the range between USD 1,850 and USD 1,875. However, the low point at USD 1,893 would already be sufficient. The longer gold can now stay above USD 1,900, the greater the chance that the final low has indeed been seen at USD 1,893.

Looking ahead, the prospects are promising, as gold is entering the best seasonal phase of the year. Along with the anticipated breakout above USD 2,075, a significant opportunity is brewing in the gold market. We are firmly back in the bull camp and executing all our precious metal purchases now or very soon.

Kitco News Interview with Michelle Makori

Gold has been in some form of consolidation since 2011, says Florian Grummes, Managing Director at Midas Touch Consulting. Speaking with Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News, Grummes explains that gold is gearing up for a “phenomenal” breakout. But it needs to tackle this technical level first. Grummes also discusses a pivot by the Federal Reserve, the U.S. dollar, and gives his picks for which mining stocks he thinks have significant upside.

—-

Analysis initially published on July 7th, 2023, by www.gold.de. Translated into English and partially updated on July 9th, 2023.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies, subscribe to our free newsletter!

Disclosure: This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts, and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.

**********