I have been writing about this for years, but it bears repeating because many gold bugs deny or gloss over its reality.

Although Gold is hovering around all-time highs, the precious metals sector will remain in a secular bear market until the stock market and the economy crack.

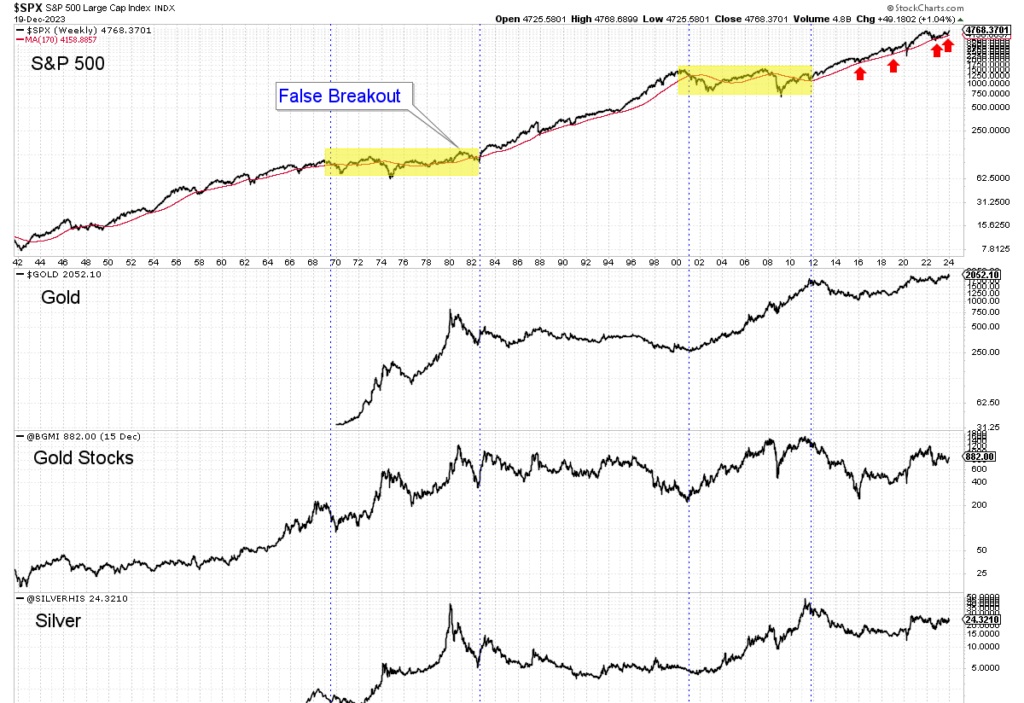

Let’s review the historical picture.

The biggest moves in precious metals were during secular bear markets in stocks. See the yellow.

There is an overlap with the 1960s as gold stocks, a proxy for Gold, exploded higher after 1964. They strongly outperformed the stock market even though the secular bear in stocks did not begin until the end of 1968.

There are some similarities between today and the mid-1960s, but I digress.

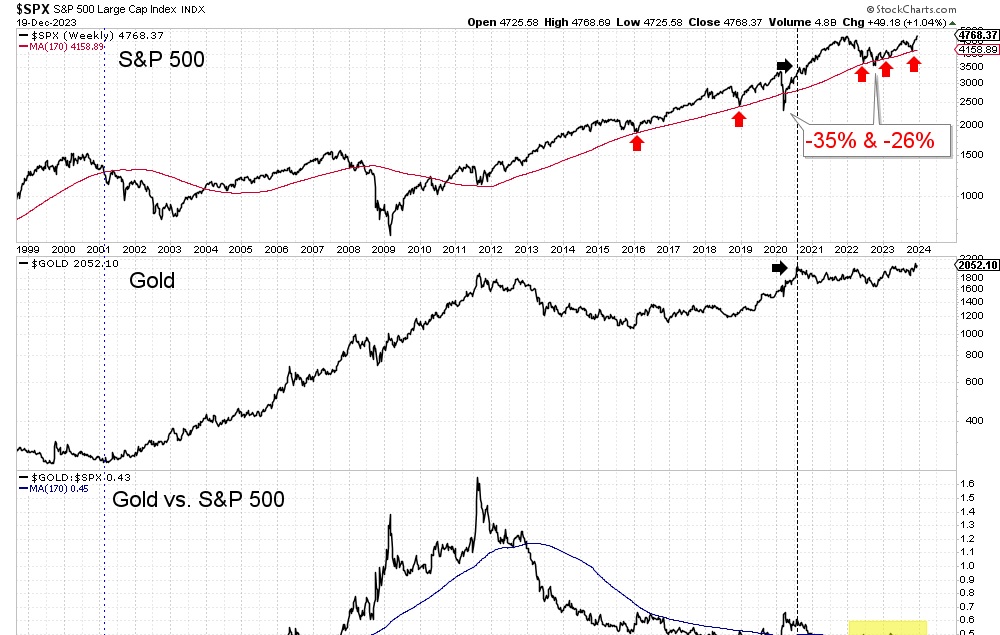

Let’s focus on Gold and the stock market in recent years and the present.

Gold peaked in August 2020, exactly when the S&P 500 surpassed its pre-Covid crash high. The S&P continued to make higher highs for another 16 months while Gold corrected.

The S&P 500 lost 26% to its bottom in October 2022. Surprisingly, that was not enough to push Gold to a breakout.

The stock market managed to hold the equivalent to the 40-month moving average (my secular trend indicator noted by the red arrows) and now is on the cusp of making another higher high.

The stock market should outperform Gold into the first quarter of 2024. Breadth indicators are strong, the market has momentum, and Fed policy is now supportive. The setup exists for a strong move and a potential major top on the other end (if there will be a recession in 2024).

Here are the things to watch for a stock market peak and the next rebound in the Gold to S&P 500 ratio, which is quite weak.

A decline in the 2-year yield, when accelerating, signals a rate cut and usually leads to a steepening in the yield curve, which is the recession signal. The stock market is setting up to peak around the time the Fed cuts rates.

That scenario could be a few months away. Capital is moving back into stocks and bonds. The big money is not buying Gold yet.

If Gold and precious metals were to rally with the stock market (because there is excess capital and few sellers left in the sector), it could transpire similarly to the stock market in 1980-1981. Gold could rally to $2300 and correct one last time before the new bull market begins.

I continue to focus on finding high-quality gold and silver juniors with 500% to 1000% upside potential over the next few years. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

********