Fake employment reports, endless wars, a soup kitchen called the Fed, free speech in a garbage can, and a soaring US stock market that supposedly proves that all this madness is sanity…

Does anyone really need another reason to focus on getting more gold?

The Chinese stock market crashed overnight, after the government didn’t promise any more free printed money to “fix” the economy.

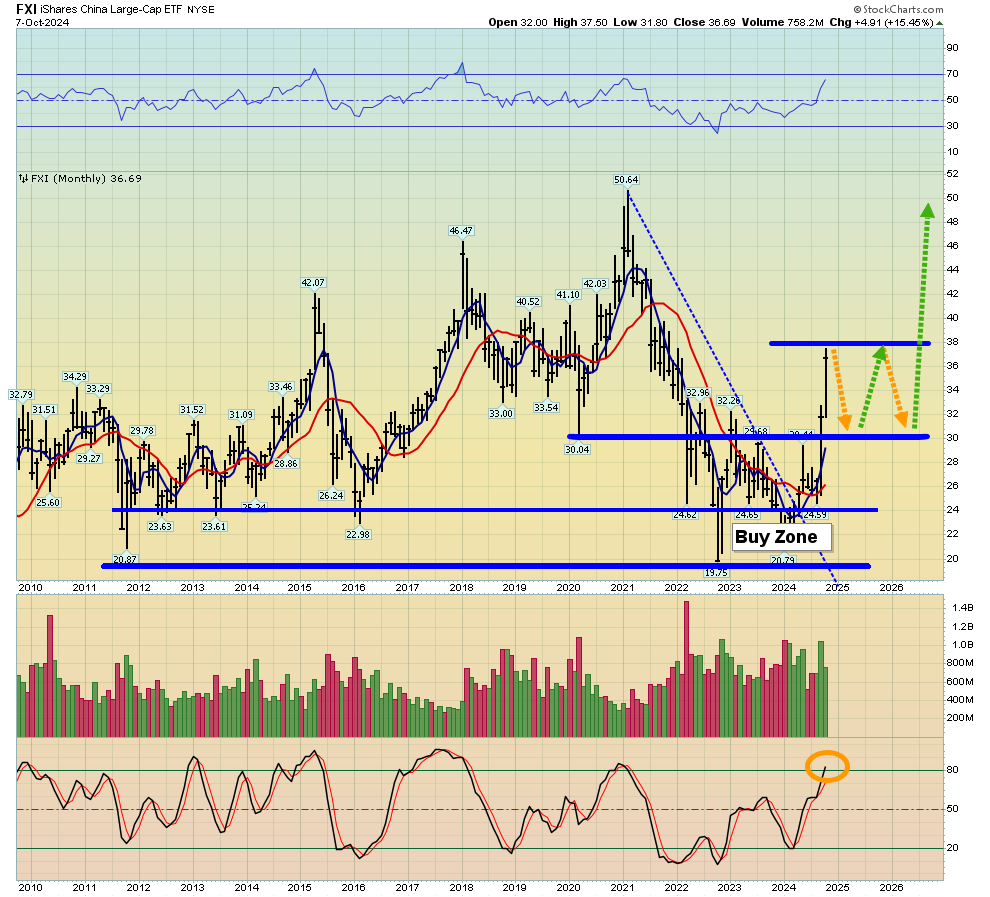

The FXI has soared about 75% from my buy zone for investors…

But the more exciting news is that the overnight crash could create a tidal wave of fresh demand for gold.

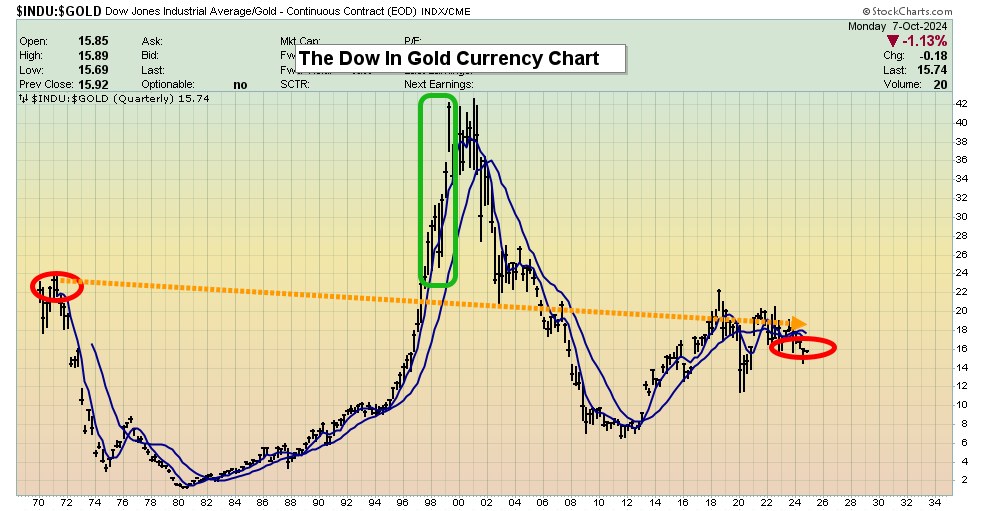

After 54 years (more than half a century!) the mighty Dow Jones Industrial Average has failed to produce any sustained gains when measured in supreme currency gold… and the gains that it did make only lasted for two short years (1998-2000) before they began melting away.

If America’s 30 mightiest companies can’t build any sustained gold money wealth after 54 years, can the average investor expect to fare better?

The obvious answer is no.

The dollar is a failed currency (because it’s fiat), yet most investors are obsessed with getting more dollars rather than more supreme currency gold.

The 2021-2025 war cycle has once again put the spotlight on oil. In a nutshell, the mid-East is always a powder keg, and the fuse is once again lit.

Interestingly, oil has been moving in the opposite direction to gold since the 2022 surge faded, and especially since last October, when US rates hit my 5% sell zone at my $1810 buy zone for gold.

Now, gold is drifting sideways while oil is aggressively rallying from my $65 buy zone. Will this action continue?

Well, for some technical insight into the matter:

This is the short-term US rates chart. The most likely scenario is that the dollar, rates, and oil all rally together until rates get to the neckline zone on this chart.

From there, a big decline in rates is likely, and it “should” be accompanied with a surge to $3000-$3300 for gold.

This long-term chart suggests that a short-term fade in US inflation and growth will produce a dip in rates…

But then both inflation and rates will begin to rise like they did in the 1970s (and more), creating what is best described as nirvana for mining stock investors.

Note the RSI and Stochastics action on this daily chart; gold is simply working off another short-term overbought situation.

It could take a few weeks until US rates arrive at their H&S top neckline and gold’s oscillators become oversold, but there’s no reason for investor concern…

Provided they are focused on getting more gold!

Western debt and key buy zones are just part of the big markets picture I cover 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, and I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

The hourly chart H&S top pattern for GDX is in sync with the H&S top for RSI on the daily gold chart.

Short-term top patterns on the miners are expected to form (and typically do) as gold becomes overbought… especially if gold stocks are arriving at previous highs of significance, which is currently the case with GDX.

It’s clear that GDX is recoiling after rising towards the area of the hugely significant previous high of $43.

For another look at this intriguing chart:

Inverse H&S patterns can morph into cup and handles, and that appears to be what’s happening here. The golden news is that both patterns are outrageously bullish, and both have a $60 target for GDX!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********