The attempted murder of Trump has been followed with significant attempts to unite US politicians and citizens.

Sadly, most of this unification involves continued worship of barbaric relics like fiat and debt.

Gold’s latest rally began from one of my key buy zones for investors.

For another look at the price action:

On this weekly close chart for gold, it’s clear that a breakout to the upside could occur at any time…

And if there’s weakness instead, the bull flag pattern remains intact!

The Fed is clearly supporting the gold bulls, and that support is set to intensify in the coming months.

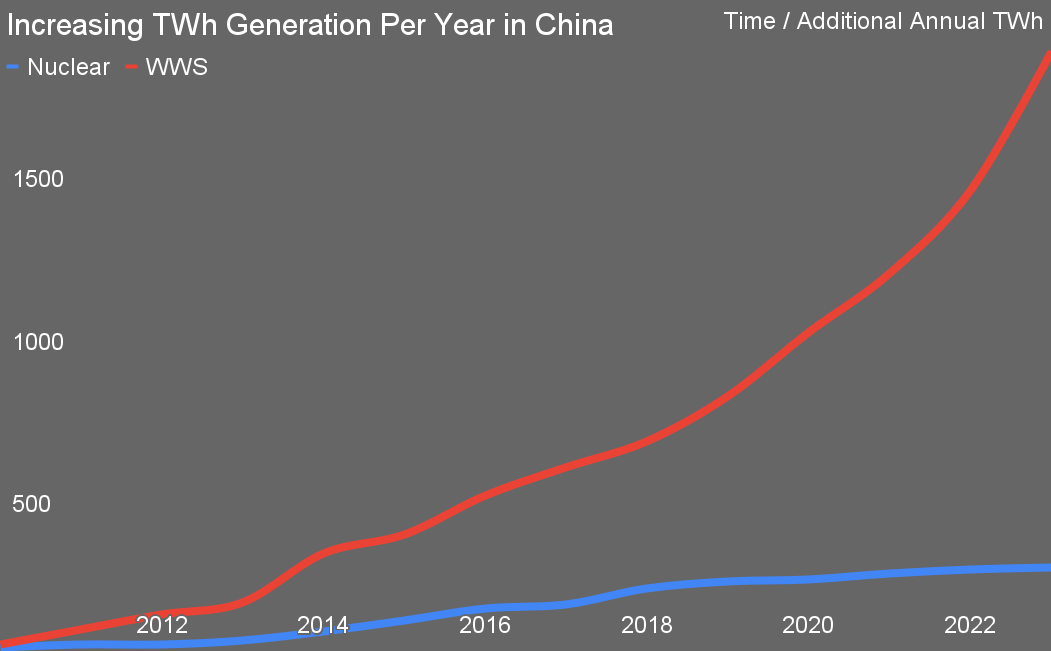

The East? China’s latest GDP growth numbers were disappointing and that means investors there are going to continue to focus on gold rather than the stock and housing markets.

There’s a decent chance that the citizens of India get a needed tax break in next week’s budget but…

What about the direct taxes on gold?

Indian jewellers always call for a duty cut ahead of the annual government budget… and odds appear to be a bit higher that it might finally happen this year.

Given the price action and fundamentals in play, it’s clearly a time for gold bugs to feel jubilant.

Investor fear is best reserved for the collapse of fiat against gold… a collapse that is relentless.

The stock market?

This is the Dow and gold chart. There’s a lot of synergy between them… and it should continue if the Fed goes into an easing cycle.

For more insight on that cycle:

Technically, the 5% zone is huge resistance and recoil action is now in play.

Rates could remain soft for a year or two, especially if Trump wins the election (which is becoming more likely).

A Trump administration is likely to fade the war worship that has been so common under Biden… and focus on tariff taxes against China.

Trump has also said he won’t reappoint rate hawk Jay and may try to transfer some interest rate policy setting from the Fed to the Treasury.

War is inflationary, and a fade in it would put more downward pressure on rates. Tariff taxes are inflationary, but it would take time for Trump’s next round of them to help create a new (and bigger) wave of inflation… probably 1-2 years.

A daily focus on the big picture (fundamental, cyclical, and technical) is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

A major 40year inflation cycle began in 2020, and its launch was mainly related to Corona crisis money printing, Trump’s tariff taxes, and Biden’s wars. There are still 36 years to go in the cycle, but most of what lies ahead is not likely related to events in America.

The gargantuan population of gold-obsessed India will peak around 2060, when the inflation cycle is also technically set to peak.

That country could be producing 30%-50% of the world’s wealth by then. The intensity of Indian citizen demand for gold that will result from that wealth production is almost unimaginable.

The bottom line: There will be bumps in the gold bull era road, but gold bugs in the West likely have 36years of very happy times ahead.

What about the miners?

This is the exciting GDX daily chart. Senior and intermediate producers are breaking out to fresh 2024 highs… and pointing the way there for gold!

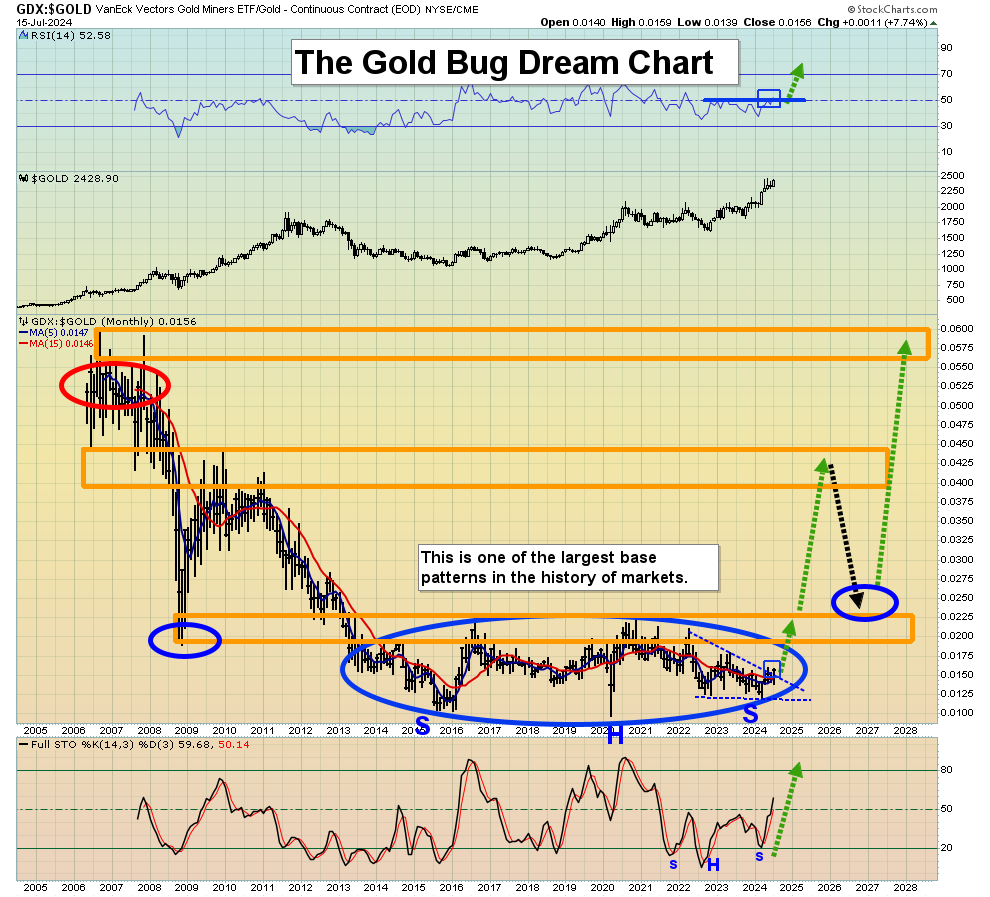

This is a mindboggling long-term GDX versus gold chart. Should gold stock bears retire? This chart suggests they should. Note the fabulous push by RSI over the momentum line of 50, and the stunning inverse H&S pattern on Stochastics.

There could be a monthly close over the dotted blue line, a close that may be ushering in one of the longest and most powerful bull moves in the history of markets. The bottom line: A five-year 2021-2025 war cycle is fading, and a 40year inflation cycle is here. Enjoy!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********