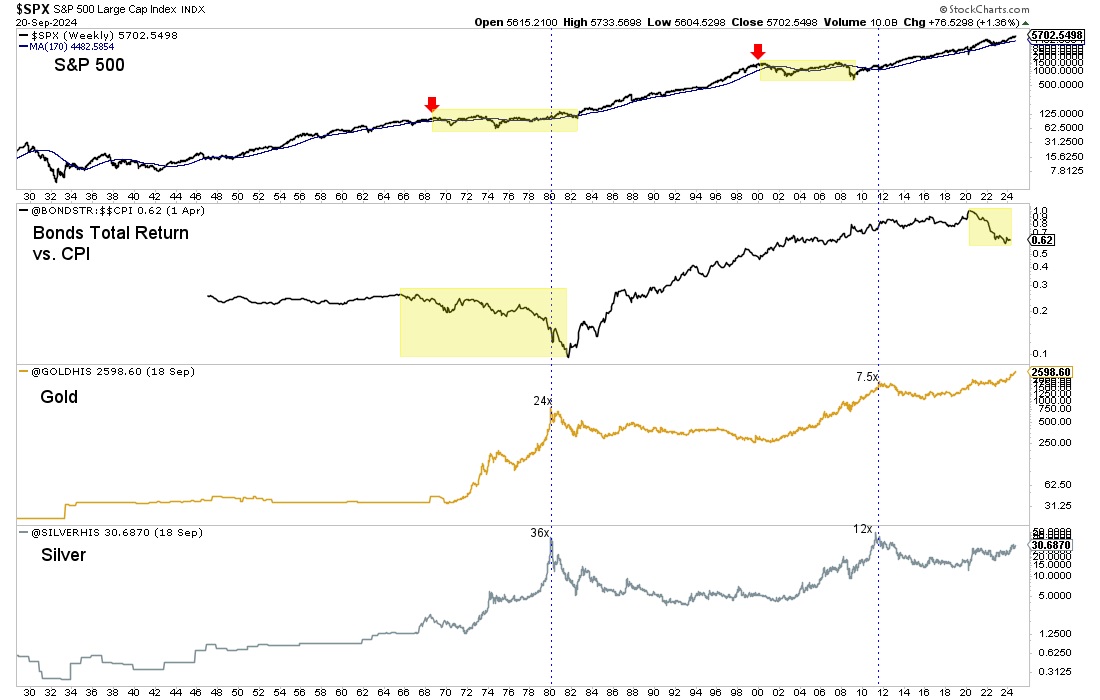

Under the global fiat currency regime, there have been two secular bull markets in precious metals: 1970 to 1980 and 2001 to 2011.

The gains in the 1970s were far more dramatic than in the 2000s.

Using daily closing prices, Gold surged 2300% in the 1970s against only 648% in the 2000s, and Silver surged 3540% in the 1970s against only 1106% in the 2000s.

The 1970s were an inflationary decade, but the gains in real terms still dwarfed those in the 2000s.

The first reason the gains were so much larger in the 1970s was that Stocks and Bonds (competing asset classes to Gold) were in a secular bear market. In the 2000s, only Stocks were in a secular bear, while Bonds remained in a secular bull.

Bonds fell into a secular bear market in 1965, which preceded Stocks’ beginning of a secular bear market in late 1968. At present, only Bonds are in a secular bear market.

The second reason the gains were so much larger in the 1970s was the propensity for new all-time highs in both Gold and Silver.

During the 2000s, Silver never made a new all-time high, while Gold spent most of the secular bull market regaining ground lost in the 1980 to 2000 secular bear market.

However, in the previous secular bull market, Silver first made a new all-time high in 1967 and later in 1973, while Gold made its first new all-time high in 1972.

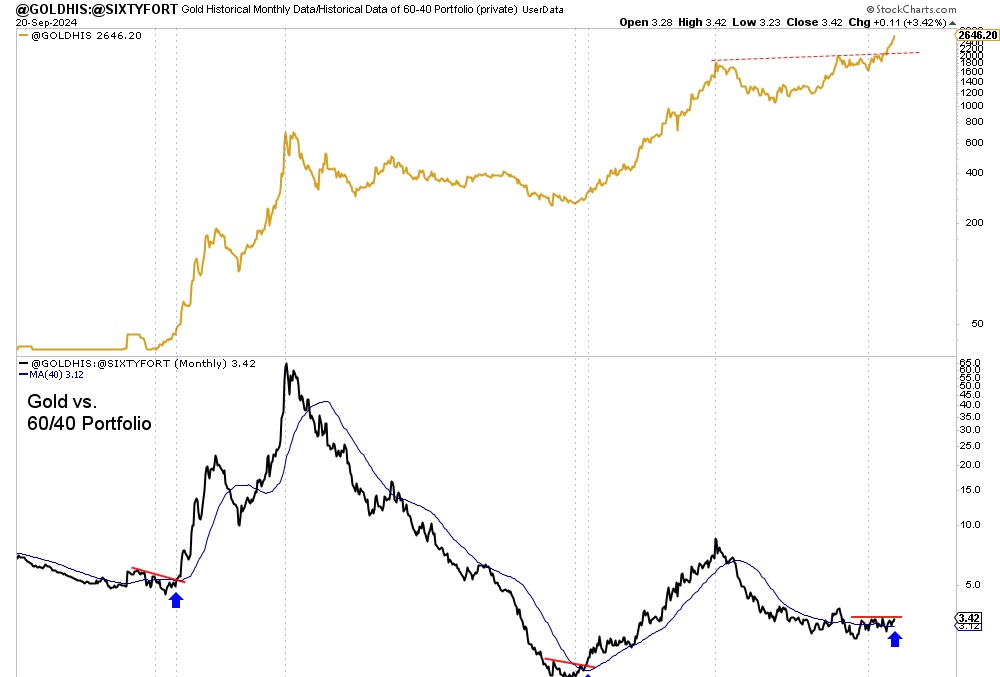

The most explosive bull markets occur when the market breaks to a new all-time high not long after its secular bear market ends. I have argued that precious metals were in a secular bear market from 2011 through 2023.

The secular bull market in precious metals is not confirmed until Gold breaks out and consistently outperforms the total return of the conventional 60/40 investment portfolio.

The previous secular bull markets lasted another eight years and nine years after that signal, which has yet to occur.

Once Gold breaks out against the 60/40 portfolio and Silver makes a new all-time high, the current secular bull market will be fully aligned with the one in the 1970s.

The setup is for spectacular gains in precious metals over three to four years. The potential gains should surpass those seen in the 2000s from periods like 2005 to 2007 and 2008 to 2011.

I invest in the quality companies that offer the most upside potential. There is still time to buy these companies before they become too expensive, so investors must act soon.

*********