Gold peaked one trading day after we issued our Blow-Off Top Warning.

Gold peaked one trading day after we issued our Blow-Off Top Warning.

A repeat of the 2006 pattern suggests a potential decline toward $3,500 in November.

Silver, platinum, and mining stocks are expected to follow gold lower, with each potentially collapsing to their 200-day moving averages over the next several weeks.

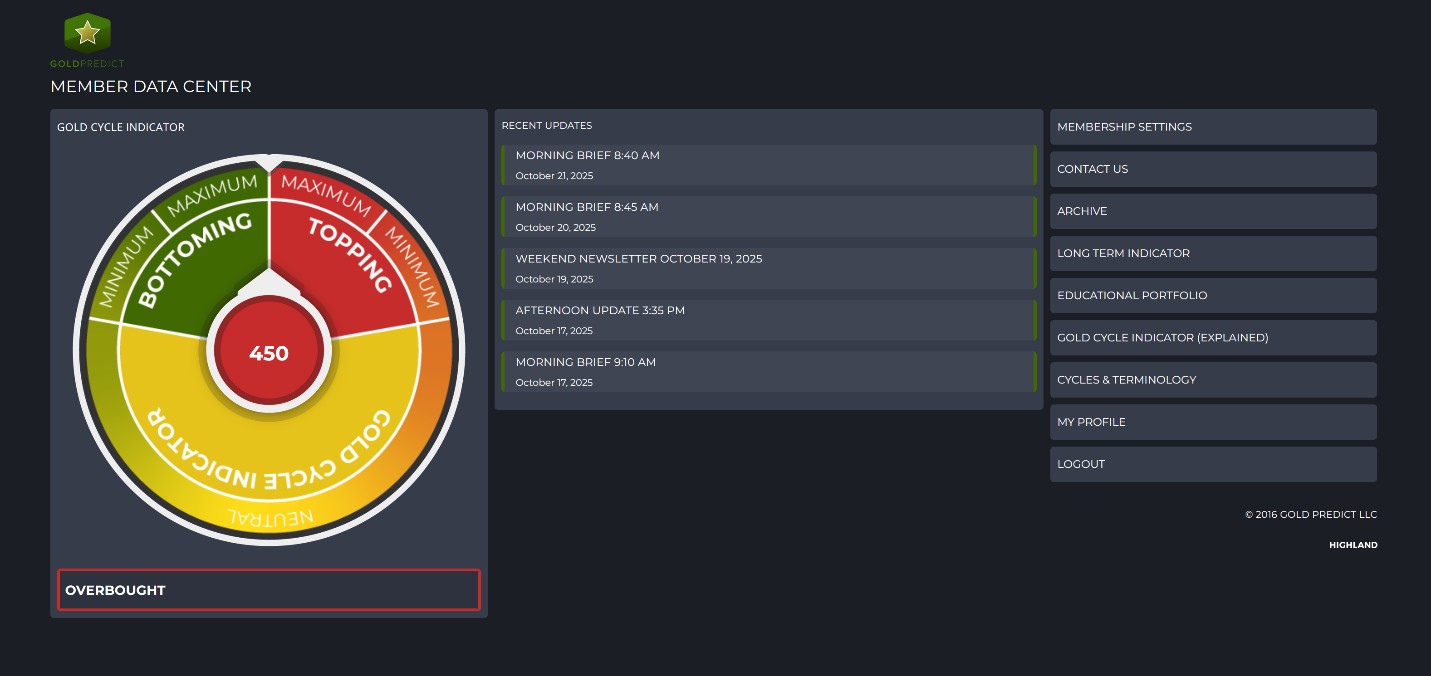

The Gold Cycle Indicator remains maxed out at 450, noting extreme overbought conditions. In this report, I present the worst-case scenario with targets for metals and miners, assuming they follow the 2006 playbook.

2006 Blow Off Top: During the 2006 blow-off top, gold prices jumped 36% in two months, only to retrace almost all of those gains in just over a month. If a similar pattern unfolds now, gold could correct back toward $3,500 by late November. Note how prices precisely tagged the 200-day MA.

GOLD: Gold surged 32% in just two months, and if the 2006 pattern repeats, we could be on the verge of a sharp pullback toward the 200-day moving average by around this time next month (November 21st). The price gap near $3,450 could serve as a potential target if gold revisits the 200-day MA.

SILVER: Silver collapsed back below $50.00, supporting at least a local high. If gold slips back to its 200-day MA in November, then silver could certainly fill the price gap near $40.00.

PLATINUM: Platinum is testing its 50-day EMA, and consecutive closes below this level would confirm an intermediate breakdown. If confirmed, support is likely to emerge near the 200-day moving average.

GDX: Miners collapsed, and the odds favor a significant pullback that could send prices back to support near $55.00 and the 200-day MA as soon as November.

GDXJ: If gold corrects back towards $3,500, then junior miners could revisit support near $71.50 and the 200-day MA before Thanksgiving.

SILJ: If we see a 2006-style correction that is swift and violent, we may see a drop back to support near $16.00.

AEM: A preliminary support level for Agnico Eagle would be around $126.00 in November.

NEM: If we get a 2006-style correction in Newmont, prices could revisit the $61.50 gap by this time next month.

BARRICK: I’d look for support surrounding $23.00, which should correspond with the 200-day MA next month.

BITCOIN: Bitcoin rebounded into resistance at the 50-day EMA. To support the potential for further upside, prices would need to close firmly above the October 13th pivot at $116,000. Otherwise, there’s about a 60% chance the 4-year cycle peaked at $126,300 and that we’re entering a 12-month bear phase.

Tuesday’s breakdown across metals and miners supports the view that a top may be in place, potentially signaling the start of a significant, long-overdue correction. The above targets are preliminary and will be adjusted as these trends develop.

AG Thorson is a registered CMT and an expert in technical analysis. For more price predictions and daily market commentary, consider subscribing at www.GoldPredict.com.

*******