It is different this time. It must be, because the major economies led by America cannot continue to spiral on their downward path. The reality is lost on hope. Hope that markets will continue higher, hope that interest rates will go down and hope that Trump won’t be that bad, once in office. And we are at war, the market doesn’t recognize it. Yet the markets are hopelessly naïve, particularly against a backdrop of political turmoil.

Faith in America’s capitalism has been undermined by profligate government spending, layers of subsidies, the greening of America and lately, protectionism. Tax cuts, subsidies and the monetization of debt have become part of America’s high spending ways. The main effect of the spending is that inflation remains stubbornly high, boosted by the endless wars in Ukraine and Gaza which eliminated the peace dividend exposing the vulnerability of western militaries.

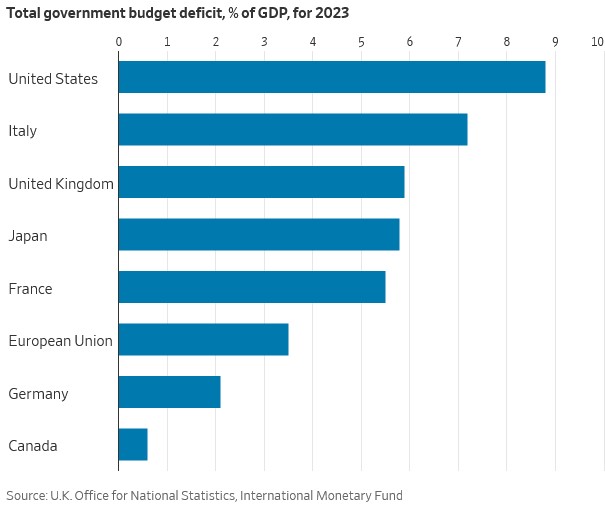

America’s fiscal house is no longer in order following Obamacare, bank bailouts and Trump’s tax cuts, which resulted in the government’s largest role in American society. Government spending alone makes up a whopping 36% of GDP and today the Congressional Budget Office (CBO) estimates the budget deficit at nearly $2 trillion, 8% of GDP or four times the 2% average over the past three decades. Debt levels continue to climb.

That spending and subsequent monetary explosion is the feedstock for stocks at all-time highs, and the inflation shock. And it does not appear to be ending. This would be understandable if the economy was weak, but the economy is booming, and funding that spending with borrowings is unsustainable since the cost of servicing that debt has become a critical issue. As such, public debt is now 130% of GDP, higher than Greece which required an IMF bailout in 2010 which shook world financial markets and almost destroyed the euro. The problem is that America’s ability to pay off its debts is dependent on the debt market, especially now that the Federal Reserve has stopped purchasing Treasuries as part of its quantitative tightening program. History shows that when public spending wags the monetary dog, the end result is high inflation, higher rates and eventually, hyperinflation. Ancient Rome, Weimar Germany, Argentina and recently Venezuela all had common roots of reckless fiscal and monetary policies and, enormous budget deficits that ended in hyperinflation. Hyperinflation is out-of-control inflation which is the inevitable result of a central bank issuing too much money as the government spends too much on debt.

New Cold War

More recently nationalism is threatening the world order. Incumbent leaders are falling everywhere. Trust in UK politics has shrunk to all-time lows as it turned to the left. That is the exception because from the United States to France to Italy, a swing to the hard right promises policies once thought extreme, now considered mainstream. Similarly the left too is polarized and this populism has caused economic chaos, particularly with the era of US-led globalization drawing to a close.

We have re-entered an era of great power confrontation where the Darwinism 19th century “might was right” governed the legitimacy of international action. In order to protect its security interests, America has twisted the laws of commerce in order to justify terminating deals that put the rules-based international order to the test. The endless proxy wars in Ukraine and Gaza are examples of the protection of interests which could easily spiral into destructive global wars. Similarly with the prospect of a return of Trump’s America First, what would happen if the US-led security order NATO, the bedrock of Europe’s security was shredded? Nationalism is also reflected in trade with globalism replaced by protectionism, made worse by the Biden administration’s “de-risking” from China (code for trade barriers), as a cover for his country’s failings. This turnaround is ominous as it is increasingly hard to ignore the striking similarities to the depression-era Thirties.

For nearly half a century, American policy was shaped by commerce and the monolithic US hegemonic economic system allowed Europe, India, Latin America and China to prosper, lifting a good part of the world’s population out of poverty. Decades long prosperity even kept a lid on US consumer prices as free trade promoted growth. But old rules, institutions and free market capitalism are being replaced with China, a potential adversary, ironically going the other way, initiating talks in the first ever trilateral free trade agreement (FTA) with South Korea and Japan, partly to counter sweeping US export controls. China has filled the void left by the trade fragmentation, protectionism, and the breakdown of globalization with super growth propelled by the creation of special economic zones like Shenzhen and Hainan Island, and trade expansion via the “Belt and Road” Initiative. Investment support came from recently established institutions like the Asian Infrastructure Investment Bank (AIIB) and New Development Bank. An inadvertent consequence of this fragmentation was the establishment of an alternate payment system competing with the US financial SWIFT payment settlement system. Such moves have strengthened regional supply chains against the protectionist moves and is a microcosm of a world with strong alternative options. Simply others are setting the rules.

As a result tensions between China and the United States are at their lowest since the Seventies, and panda diplomacy has given way to a widening gulf between war and peace, with rising protectionism, artificial intelligence, climate change and critical minerals the battlegrounds. As America weaponizes its economic hegemony, allies are forced to pick sides as direct confrontation replaces the diplomatic niceties of the past, yet no one has a solution.

Battleground: Economic

In international politics, actions are more important than words. Words no longer mean what we think they do. Politics has changed their meaning. While talking “rapprochement” with China, Mr. Biden regards Chinese made EVs as potential national security threats and quadrupled 100% tariffs on EVs, despite less than 2% are Chinese built. While decoupling this relationship, Biden’s politicization of climate change and demonization of everything Chinese, speaks to the hypocrisy, undermining moves and cold economic logic. The US appears to be consuming its principles, eroding its credibility and trust on the global stage, viewing China as an adversary, not a competitor in a test of each other’s red lines. It’s a dysfunctional mess.

Take those EVs which have become pawns. The United States exports $200 billion to China and imports about $500 trillion worth of goods from China. China, which accounts for 35% of industrial production and 15% of global exports, has several significant advantages in the middle of global supply chains. The West has profited from cheap imports from China, which has reduced inflation. China exported goods worth about $3.4 trillion, of which $500 billion went to the US and $500 billion to Europe. Therefore, the consumers in each country will be harmed more by the tit-for-tat taxes. Moreover, China’s dominant position in climate change from EVs, to solar panels, to the processing and production of the necessary critical minerals, including the latest cutting-edge technologies such as intelligent chips, advanced radar or even advanced batteries, has helped them bring down the cost, making them affordable. What is wrong with that? The new western levies aren’t likely to change that as China becomes a research and development powerhouse giving it a technological advantage aided in part to the largest car market in the world. Simply America can no longer compete, with their EVs left in the dust or car lots. Besides, the goal of tariffs was not to level the playing field but to protect the domestic automakers who can’t make affordable EVs but now risk losing access to the world’s largest EV market.

While China is the world’s biggest producer of EVs, the competition for green tech has become prohibitively expensive and even today Western industrial strategy is largely focused on early generation cars, semi-conductors or solar panels. Falling behind, the Biden administration is spending hundreds of billions of dollars in subsidies and tariffs to counteract China’s dominance of key industries and technological lead. Protectionism will not win this race so both the climate and consumers are left to suffer. The escalating tariffs has prompted China’s leading players to focus on markets elsewhere leading to Chinese dominance across important markets like energy, where they are investing in both production and even in the processing of raw materials.

Despite US controls, there is much leakage with NVIDIA selling $12 billion of AI chips in China this year. Then there is US giant Berkshire Hathaway, owned by Warren Buffet, a shareholder of BYD, one of the biggest electric vehicle manufacturers in China and a rival to Tesla. Then there is Huawei, the telecom giant, which has grown since the United States blacklisted the behemoth ten years ago. Alternatively, there is food. Approximately 94.4 million tonnes of fish were farmed in 2022, primarily in Asia, according to a UN Food and Agriculture Organization estimate. For the first time ever, that was greater than the wild catch. Climate change is reducing crop yields and driving up prices. Not only does agriculture provide food for the world, but it may also be the site of the next conflict due to the possibility of tariffs, climate change or even a food war. China has begun an anti-dumping investigation into EU pork products in retaliation for European electric vehicle tariffs. Beef and poultry might be next. America is vulnerable in a “tit-for-tat” food war.

While politics is a factor, the above paradox highlights a comparable period when bank rescues, tit-for-tat protectionism, threats of world wars, authoritarian governments and roaring stock markets was a prelude to the 1929 financial crash. Is it different this time? Not really.

Weapons: The Art of Tariffs

A few years ago, Donald Trump used tariffs as a blunt tool to reduce the trade deficit with China. He said, “trade wars are good, and easy to win.” Instead of helping, the deficit widened. If Trump, the self-described “Tariff Man,” is re-elected, he is likely to double down on his “America First” policies and already promises a second-round 60% tariff, including 10% on everybody else which is unlikely to make America great again. In fact, Trump says tariffs will raise billions of revenues to pay for his tax cuts. In 2023, $80 billion was raised on duties or 2% on almost $4 trillion of imported goods. Raising duties by 10% would net $400 billion while the tax cuts and spending are in trillions. Trump’s math just doesn’t add up. Last time the national debt rose and since tariffs were paid by consumers, inflation roared. Trump’s proposal will not only enlarge the deficit, but also hurt allies like Canada, Mexico and EU. Moreover, history shows that other countries will retaliate, and a war of tit-for-tat tariffs could trigger a recession risking another 1930s style depression.

Protectionism is not a Trump exclusive with Joe Biden’s opposition to the acquisition of US Steel by Nippon Steel. Both candidates for president want to wield tariffs as a geopolitical tool as part of deglobalization. Besides tariffs are taxes paid by the consumers in a transfer of wealth from consumers to the government coffers. The question is, which one is Smoot or Hawley?

Not only are wars expensive, but they also boost inflation. Because the outcome was unknown, wars were financed by gold with the loser transferring gold bars to the winners. The mountains of debt became too cumbersome, so governments printed currency, levied taxes and credit was sometimes granted. Today wars are paid by a computer click and buried in government expenditures, financed by debt which helped cause the Great Inflation. Today there are concerns that an old fashion subsidy and trade war raises the risk of a currency war which could send the world back to the dark ages of “beggar-thy-neighbour” protectionism. It is not China that the West should fear, it is Putin’s Russia. It has happened before.

Pork Barrel Politics

When Americans go to the polls, neither presidential candidate has focused on fiscal integrity nor offered a credible plan to make America great again. Mr. Biden promises to spend hundreds of billions of dollars on large subsidies and tax credits under his Inflation Reduction Act to green the economy. Donald Trump’s 2017 tax cuts are set to expire next year and if elected, he will extend a second round of tax cuts, estimated to cost the Treasury $4.6 trillion. Both will add trillions to the deficit already at 8% of GDP which would weaken the dollar and boost inflation further, making America’s debt balancing even trickier, particularly since after America’s $5 trillion Covid pandemic spending surge, Washington continued to rack up $2 trillion deficits, incurring more debt, just to pay debt.

Nowhere is the pain clearer than the banking system which faces a $2 trillion wall of commercial real estate debt due in the next three years, which must be refinanced at much higher rates. Simultaneously, the FDIC announced that unrealized losses in the banking system climbed by 8% to $517 billion in the first quarter, marking the ninth consecutive quarter of such losses. The bank bailouts have only just begun. We believe this accumulation of debt has masked the deterioration of the US economy and the price of everything has gone up all at once. Inflation is a monetary phenomenon and as a result, inflation will be higher for longer.

Weapons: Currency Debasement

Recently the Mexico peso plunged following the election of leftist Claudia Sheinbaum. The yen too has fallen to 1986 lows. China’s renminbi also weakened, sparking PBOC intervention over concern of a flight of capital. In 1997, volatile currencies sparked the Asian crisis and central bank intervention. Of concern, as ever higher tariffs and sanctions take hold, the distortion of money flows will cause the big hedge funds to capitalize on this weakness, exacerbating the falling currencies. And, in another sign of the shifting economic landscape, the world’s major central banks have diverged with the European Central Bank (EU), Sweden and Canada reducing rates while American rates stay higher for longer.

The problem is that with America’s national finances in disarray and to tackle its ballooning debt, the age-old devaluation option is an option. With every major currency falling against the dollar, the sinking currencies could spark a round of competitive devaluations since every country around the world led by the United States continues to print more money. Whether it’s the 1930s or today, the prospect of tit-for-tat tariffs and a currency war to improve a nation’s trade competitiveness is eerily similar to the last century’s currency war which was part of the Great Depression.

Sanctions, tariffs and dollar hegemony have simply become weapons of war. China’s increasingly large role in the global economy is encouraging use of its currency. For example, the Cold War has resulted in China and Brazil trading in their respective currencies with BRICS+ nations pursuing more independent foreign policies, even settling trade in their respective currencies. Türkiye, a member of NATO is considering joining BRICS to lessen dependence on the dollar. The G7 is now the G20+. This fragmentation or balkanization of the global monetary system has resulted in multi-polar trading blocs such as an Asian basket, Euro basket, BRICS basket, and dollar basket with these currency blocs supplanting the dollar-based system. The BRICS group represents 45% of the world’s population now includes traditional American allies, Saudi Arabia and the UAE, who use other currencies than the dollar for oil trade, weakening the dollar’s dominance. There are reports that BRICS is to back their new currency with gold and not the dollar. Without trust and an international infrastructure system for co-operation, American power is limited.

Is Gold the Next Battlefield?

At the end of World War II, the US accounted for half of the world’s activity and the US dollar underpinned the global financial system. But then President Nixon was forced to default and give up the dollar’s convertibility to gold in 1971 due to a 38% decline in gold reserves as a result of debts from the Vietnam War and Lyndon Johnson’s “guns and butter” spending. Since then the dollar was backed by the faith and credit of the United States. Yet today, the US only accounts for 25% of global output and somehow must finance Mr. Biden’s “guns and butter” spending. Biden can’t do both. We believe the succession of geopolitical and economic blunders has undermined the institutional pillars on which the post-war global economic and political order has rested. Free trade is no longer free. While America’s plans for world order grow increasingly ambitious, it turns inward while its public finances and security underpinnings have become increasingly weak, making it difficult for the rest of the world to view America great again.

We also believe using this prism, the geopolitical framework of a declining America and polarized politics has eroded democratic freedoms, and the compound threat of currency wars is a reason for the need for gold. The decline of globalization, the endless wars, protectionist politics, and a divided state of America has contributed to an increasingly isolated America. Foreigners hold dollars because they believe they are secure. However, the dollar’s safehaven status has been eroded with the dollar accounting for about 58% of global reserves, down from 70% according to the IMF. In the aftermath of the financial crisis of 2008, the kings of debt increased federal debt to a whopping 130% of US gross domestic product with trillion-dollar deficits as far as the eye can see. The Treasury market alone has grown from $5 trillion in 2008 to $27 trillion today because the US enjoys the exorbitant privilege to issue debt on its own terms. Making matters worse is that interest payments exceeds defense spending topping 4% next year, the highest since World War II. As the burden of debt grows, the odds of a budget crisis increases raising the question, why put all your eggs in the dollar basket? It is different this time. Dollars are not forever.

Central Banks Buy Gold

For the past two years, central banks have accumulated almost one third of the world’s annual gold production, purchasing 1,082 tonnes in 2022 and 1,037 tonnes in 2023 as some avoid the risks of sanctions, following seizure of Russian reserves. The World Gold Council reported that central banks bought 290 tonnes of gold in the first quarter, with China being the largest buyer (18 months in a row) with 2,264 tonnes held as they exchange US debt for gold. We believe central banks have been the primary driver as gold reached an all-time high at $2,440/oz as part of a secular trend with Eastern countries buying gold from western nations. China is expected to be a continual buyer since they hold only 5% of their reserves in gold. Others have repatriated their gold such as India moving 100 tonnes from the UK back to India whose holdings stand at 822 tonnes. We believe that the purchases signifies a major shift in the financial system since many are reluctant to have all their eggs in the dollar basket. Gold is an alternative currency.

The presidential cycle has begun. Historically, there has been a pattern with gold gaining the most in September/October of an election year and declining (sell on news) in the December/January period of the presidential year. Today both candidates proved to be the biggest spenders in America’s history. Then there are the multiple wars: a tariff war, the endless wars in Gaza and Ukraine, cold war with China and soon an AI war – all must be paid for and all are inflationary. The conventional wisdom is that it is different this time and we are nowhere near the conditions of the Great Depression that we write about. This view is wrong. The world is now so much more interconnected and unfunded debts are much bigger than before, fueling the largest asset price bubble in the history of the world. At the same time, we have an erosion of confidence in our institutions, laws and governments. Yet no one is concerned. That too is a mistake. Come November, with the prospects of another four years of Trumpian fireworks, gold will be a good thing to have.

All Time Risk at All Time Highs

Today we get more news in one minute than in a year. It started with the town crier, newspapers, radio and then television. In our lifetime, the computer created the internet, smartphones and social media. TikTok is shaping a generation’s financial literature, let alone moves by its endless videos but at its worst, expediting the spread of disinformation. In France a far-right 28-year-old wonderkid, lacking political experience was vaulted to become prime minister due to his chart topping Tik Tok feed that triggered a risky snap election and European turmoil. Ironically with 1 billion global users (170 million US), the platform faces a US ban next year unless reversed by US courts on free speech grounds. It isn’t the first time that a government has tried to muzzle the media.

Even so, with half of the world voting for new leaders, none is more important than the United States where the Jan 6 attack on the US Capital and Donald Trump’s guilty verdict reinforces the nation’s rule of law and legal system. However, with a polarized population, the prospects of an election of a former president with new found immunity, who ignored the laws to reverse an election and is now a convicted felon, could also ignore the laws that govern society and commerce. In a past world, where the bond of a handshake meant a deal, enforceable laws is all that protects business transactions. In November, those laws could easily be corrupted, posing a substantial business risk since those laws might be decided by a convicted felon who cannot distinguish fact from fiction. On top of this the divided states of America will vote in November and already a legal war has begun with the criminal conviction of Donald Trump raising the prospect that the November election results will be fought in the courts, further undermining American credibility on the world stage.

It is not about checks and balances. The problem is that too few American citizens understand America’s founding principles or ideals. What then? Of concern is that a polarized grudge match influenced by social media platforms in place of the traditional media will be directed by those who can speak the loudest or possess the largest number of followers. The upcoming election will test these new ecosystems, but at stake in this divided states of America is the legitimacy of the system and democracy.

In Gold We Trust

Even in Canada, government has frozen bank accounts, suspended freedoms including freedom of speech and last year called in the army to maintain order. When reviewed subsequently by an independent commission, those extraordinary measures were deemed unnecessary, and the government simply ignored its own commission. To pay for out-of-control expenditures the government recently increased capital gain taxes, without parliamentary approval. That makes complacency a danger, undermining trust. Recently freedom of assembly was suspended in the universities. Freedom of information too was suspended when the government introduced a law that forbids the big social media platforms to link to traditional news unless they paid up in a gangsteristic shakedown. Nowadays, Canada remains the laggard of all NATO nations in pledges to spending 2% of GDP on defense, yet the government can send troops to break up domestic issues such as the Ottawa protests or earlier when Trudeau’s father sent troops into Montreal during the FLQ days. And like elsewhere the politics of division for partisan gain has become the norm. Democracy is at risk. Like COVID, it spreads.

Is it different this time? America is richer today. Yet, the basic mechanisms of how the economy might fall into a severe recession looks quite similar to those that caused the Great Depression. Back then, an inexperienced Herbert Hoover a Republican, was elected on a populist platform of reforming government, reducing its regulatory system and increasing trade. At the start of the Thirties, the Roaring Twenties gave an illusion of prosperity. Then a rolling series of bank panics began. To kickstart the economy and help local industries, Hoover signed the Smoot-Hawley Tariff Act, the largest tax increase on trade, that triggered the familiar tit-for-tat retaliation resulting in a sharp slowdown of the US economy that precipitated the Great Depression. US exports fell 50%.

Subsequently to make up for loss revenues, both state and federal governments introduced tax increases, exacerbating the collapse. In 1933, to stop a run in the dollar, which was then backed by gold, the government made it illegal to own gold and the confiscated gold was taken to Fort Knox. The US dollar collapsed as global trade came to a halt. The dollar devaluation, with the New Deal stimulus caused inflation and eventually growth. In both cases, a credit crisis, tariffs and complacency were at the centre of the story.

Déjà vu. We are facing a major crisis today, but no one is heeding its call. To do nothing is what was done during the Great Depression of the Thirties. A looming presidential election and a divided inward-looking state of America is likely to create investor certainty, and by ignoring the lessons of history and succumbing to the false solutions of money printing, democracy itself is threatened. In the interim, gold will be a good thing to hold, because it is different this time.

Recommendations

Although gold has more than a 6,000 year history, gold is rare. Gold has a proven store of value better than any fiat currency backed by some politicians’ promises. Gold is a finite commodity. The World Gold Council estimates that some 190,000 tonnes have been found and only 54,000 or so tonnes are still underground. Every year, the industry produces about 3,000 tonnes a year but for years there has been more demand than supply and the gold industry reached “peak gold” in 2019 with reserves declining every year. India, Thailand and China are big consumers of gold. We continue to believe gold will top $3,000/oz within the coming 18 months.

Consequently M&A mining activity has picked up laying bare the need for investment. Reserves are declining and industry has not replaced a rapidly depleting resources. Declining reserves, flat exploration budgets and slow growth have forced the mining industry to look for reserves in geographically risky places, with the problem that some jurisdictions have a habit of confiscating assets. Yet the demand for gold continues, particularly from the central banks. Finding and developing deposits has also become time-consuming and costly. For the past decade, shareholders have focused on the seniors who have repaired balance sheets, paid attractive dividends and resorted to buybacks to boost share prices. Nonetheless investors have largely avoided the mining sector, despite gold recording almost daily new highs and up 13 percent last year, outpacing most other investments. Mining executives are also guilty of not telling the story of the importance of mining. For example, mining provides the minerals needed for our daily lives and to build green industries (there’s 100X more gold in an iPhone than one tonne of gold ore). The role of mining fuels economic growth, provides jobs and is a crucial part of everyday life. Yet governments continue to be hostile to mining with draconian taxes and arduous red tape.

There is no doubt that investment is needed, and investors need greater confidence that mining will not be impaired by politics or the changing of rules. The mining industry is the salami in the sandwich between China and the West with both needing each other to source the important critical minerals for the betterment of both societies. Some Canadian miners are leaving Canada after the government killed the Solaris deal which blocked Chinese investment as an important financing source for cash strapped juniors. Maybe they should make love, not war. Much needed investment is also required as well as certainty of rules, particularly in lesser developed countries. Planning and construction skills are important and capital requires certainty. Mexico is a rich jurisdiction but now potentially could be hostile to future investment with the election of leftist leader Claudia Sheinbaum. Guyana on the other hand is developing into an attractive mining district with new mining laws, attracting takeovers by majors in a modern-day gold rush. Argentina too is attractive with the senate recently passing a mining friendly bill. Canadian politicians should take note. Tariffs won’t do it.

We believe that the developers will become targets for the larger miners in the quest to add depleting reserves, because it is cheaper to buy ounces on Bay Street than to explore. A new mine could take up to 10 years to bring a mine into production due to permitting delays and financial uncertainties. We like McEwen Mining and Eldorado because both are bringing mines into production in the current cycle. With expanded gross margins and abundant free cash flows the majors have excess capital to deploy. The problem is that in this game of musical chairs, there are few empty chairs. Our top senior picks are Agnico Eagle, Barrick and B2Gold. We also like high grade Lundin Gold and Endeavour as potential actors in an active M&A market.

Agnico-Eagle Mines Ltd.

Large cap producer Agnico Eagle released the long-awaited technical life of mine (LOM) on Detour Lake. The PEA increased production by 300,000 ounces of gold per year and extended the life of the mine. The Detour underground will require minimal surface infrastructure and the mining methods would be comparable to Agnico’s Odyssey which is on schedule. Agnico has been successful in bringing on big projects with few problems. Agnico is the largest producer in Canada with mines also in Finland, Mexico and Australia. The company’s guidance will produce about 3.4 million ounces this year with most of the production from flagship Canadian Malartic and Detour. After guiding the company over three decades continuing the legacy of Paul Penna, Sean Boyd will become chairman. Agnico has a strong pipeline of brownfield and greenfield projects. We like Agnico Eagle here.

Barrick Gold Corp.

The world’s second largest gold producer, Barrick has 50% of its mines in North America, 37% in Africa and 13% in South America. Barrick also has the largest number of Tier 1 mines and a significant exposure to copper with Reko Diq expected to be in production in 2028. Importantly, the company has an experienced executive management team that has emphasized growth and balance sheet integrity. Although operating in some geopolitical sensitive countries, Barrick has partnered with respective governments and brought in partners to spread risk. Guidance is unchanged at 4,100,000 ounces this year but the company has a growth pipeline with Porgera the newest and Reko Diq down the road. We like the shares here.

B2Gold Corp.

B2Gold produced 225,000 ounces in the first quarter which was in line with expectations. The company has an aggressive exploration budget of $73 million and the Columbian Gramalote PEA study has the potential to produce about 200,000 ounces a year from an open pit with a 21% IRR at $2,000 gold. Meantime B2Gold is completing the big Goose Mine in Nunavut which will be in production next year with $400 million left to spend. B2Gold has a strong balance sheet of $568 million in cash and a revolver of about $700 million. In addition, the Otjikoto Mine’s facilities in Namibia will process the nearby Antelope satellite deposit which could contribute as early as 2026. Antelope could add another 200,000 ounces using Otjikoto’s existing facilities. We like B2Gold for its rising production profile.

Centerra Gold Inc.

Centerra produced about 111,000 ounces in the first quarter which was in line with guidance. Company continues to optimize flagship Mount Milligan. Öksüt performed as expected. Centerra also released a PFS on the restart of Thompson Creek and Langeloth processing moly facility. Centerra has the Goldfield project in Esmeralda Nevada which is an early exploration project. Consequently Centerra has a flat production profile but a great balance sheet with $648 million a cash and no debt. We prefer B2Gold here.

Centamin PLC

Centamin PLC, the largest miner in Egypt had a flat quarter but reaffirmed guidance for the year at 480,000 ounces this year with AISC at $1,350 an ounce. The company spent $46 million in the quarter and has a solid balance sheet of $167 million of cash and liquid assets and $100 million revolver. The 36mw Sukari solar plant was commissioned last year, producing major savings. Centamin has an active exploration programme near Nugrus as part of the company’s huge 3,000 km2 tenement within Egypt’s Nubian Shield. We like the shares here as a potential tasteful tidbit for one of the majors. Buy.

IAMGOLD Corp.

IAMGOLD completed a $300 million financing to purchase an additional 10 percent stake in Côté Gold project from partner Sumitomo, boosting its stake to a 70 percent interest with Sumitomo holding the balance. IAMGOLD has a much improved balance sheet and Côté is expected to pour its first gold bar in the third quarter this year. Meantime security remains a problem at Essakane in Burkina Faso. Westwood had a mixed quarter. We continue to be skeptical of the overbudget Côté, believing that there is substantial downside risk with IAMGOLD. Not only do we expect teething problems but the company’s billion-dollar bet could be a company destroyer. We prefer to stay on the sidelines.

Kinross Gold Corp.

Kinross had a strong quarter and released some drill results from the huge Great Bear project where the company has been extensively drilling underground as part of its PEA expected shortly. Until the PEA is released, it is too early to give much for a project that has a long runway to production. The PEA is expected to include both an open pit and underground mine with a smaller 10,000 tpd mill, rather than 15,000 tpd. Nonetheless, we believe that Great Bear’s PEA is long overdue, particularly given the price they spent with development only to start next year. With so much money with so little results, Kinross is left with mature assets and a flat production profile. We prefer B2Gold here.

Lundin Gold Inc.

Lundin Gold had a solid quarter and now debt free. Lundin produced 111,000 ounces in the first quarter at a low cash cost of $735/oz from Fruta del Norte (FDN) in Ecuador and is on track to produce 490,000 ounces this year at an AISC of $890 per ounce. The company is a cash flow machine, which allowed it to quickly retire its debt allowing Lundin Gold to buy out a stream from Newmont for $330 million. Also, the company has an aggressive exploration project and has already identified FDN East which is an epithermal comparable to the Fruta del Norte main deposit. FDN East’s results are promising and the company now has 10 rigs, seven surface rigs and three rigs underground which will add to rising reserve profile. Lundin is an attractive dividend payer and we expect Lundin to be a player in the upcoming M&A games. We like the shares here.

McEwen Mining Inc.

McEwen had a solid quarter and raised an additional $70 million dollars for its subsidiary 48% owned McEwen Copper’s huge Los Azule’s copper project in Argentina (Stellantis and Rio Tinto Nuton are the other partners). McEwen also had a good quarter with the turnaround at Gold Bar and 49% owned San Jose. McEwen has a rising production profile and produced 137,000 ounces last year. At Fox Complex in Timmins, the company has delineated three deposits (East, Main, West) with initial production planned from East at Stock which will replace Froome material. We like the shares here.

John R. Ing

Please refer to the Legal Section of our website (maisonplacements.com) for our Research Disclosures for an explanation of our rating structure at https://maisonplacements.com/research-reports/

********