Our title’s Roman “III” is indicative of having used “Gold in 60 Seconds” now for the third time across these esteemed Saturday missives’ 15 years (previously on both 16 April ’16 and 08 March ’14). Again, this time ’tis so apropos. For as herein previewed a week ago…

Greetings from a remote, undisclosed, rural location in easternmost England, an area sufficiently primitive that in lieu of digital internet connectivity we are reliant upon the dear old analog telegraph to produce this week’s piece. And with time to write this week at an extreme premium, let’s get salient straightaway with just the key graphics (to the extent they can visually be reproduced via the telegraph).

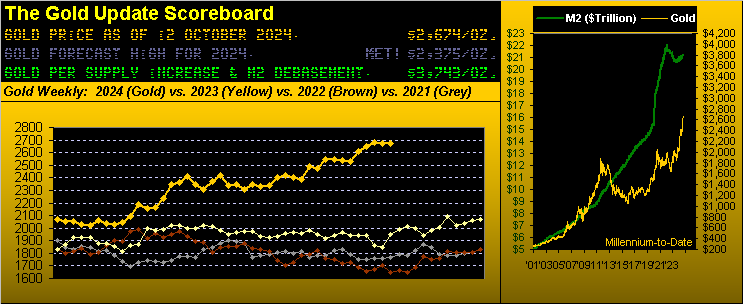

For all the hype over the past StateSide “Inflation Week” — which at the retail level (CPI) was more robust than consensus anticipation, yet at the wholesale level (PPI) relatively benign — Gold netted a gain for the week of (deep breath … ready?) exactly one point in settling yesterday (Friday) at precisely 2674.2 vs. the prior Friday’s 2673.2. Here are Gold’s weekly bars from one year ago-to-date, the blue-dotted parabolic Long trend now 13 weeks in duration, even as price has made a “lower high” now twice in succession:

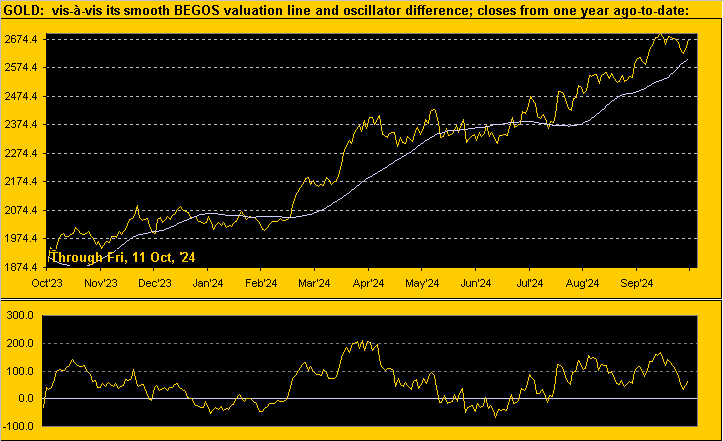

Per recent editions of The Gold Update — as well of late in the daily Prescient Commentary — we’ve been alluding to Gold’s being “high” relative to its smooth valuation line to which price inevitably reverts as we next see from this time a year ago to now. The smooth line reflects a near-term valuation for Gold based on its movement relative to those of the five primary BEGOS Markets (Bond / Euro / Gold / Oil / S&P 500). The graphic’s lower panel oscillator (price less valuation) tells the tale that with price recently stalling, ’tis becoming more in line with valuation, the good news there being (as herein highlighted a week ago) the BEGOS valuation for Gold is rising:

Again, that’s merely a near-term view, for long-term by the opening Gold Scoreboard (which may appear graphically-challenged per said analog telegraph transmission), the yellow metal today at 2674 is undervalued by some -1069 points per its 3743 Dollar debasement value. Dip Gold may near-term do, but long-term do not Gold eschew.

Meanwhile, the relentless S&P 500 made record highs both this past Wednesday and Friday, en route to settling the week at 5815. ‘Course, its “live” P/E ratio remains staggeringly high at 43.6x, some +72% above its inception a dozen years ago. But we reprise: the S&P’s saving grace is earnings no longer having a role in “valuing” stocks. “Les jeux sont fait; rien ne va plus.” And as to near-term technicals: through 197 trading days this year-to-date, the S&P 500 has been “textbook overbought” for 122 of them, including now. (A word to the wise is sufficient).

In concert with the the one-way stock market is the Economic Barometer, albeit hardly are they in tune with one another as shown here year-over-year. One cannot beat the modern day reality of a weakening economy being of benefit to the S&P 500. As ’tis said “If it’s so easy, then everybody would do it.” And indeed, they are. But be it the “Look Ma, No Earnings!” crash — or worse — the “Look Ma, No Money!” crash, at some point, such unsustainability shall revert to the mean, as relative to earnings the S&P 500 has historically done since its creation 67 years ago in March of 1957.

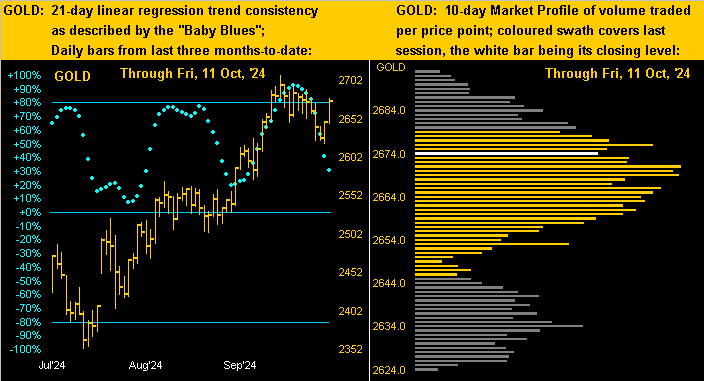

Of this week’s total 60-seconds read, we’ve but 10 seconds left to offer. Thus swiftly let’s bring up the two-panel display of Gold’s daily bars from three months ago-to-date on the left and 10-day Market Profile on the right: Therein, most key are the falling “Baby Blues” of trend consistency. As penned in last Tuesday’s Prescient Commentary: “…we’d look for lower precious metals prices near-term, perhaps for Silver right ’round 31 and for Gold 2620-2570…”:

So there briefly ’tis for this week as we simply must scoot. 14 incoming metrics are due next week for the Econ Baro, plus Q3 Earnings Season starts to become more voluminous; (but be they better or worse, as noted, earnings today are simply passé).

Thus from the undisclosed wilds of easternmost England, we bid you “Good Day!”, and that many-a-good Gold trade come your way!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

*********