Through recent missives we’ve been near-term negative on Gold, indeed looking for a move down to test the 2247-2171 structural support zone. Such read remains in concert with price’s weekly MACD (moving average convergence divergence) still adversely positioned.

But gritty Gold refuses to fold, price settling yesterday (Friday) at 2400, all told! And when the yellow metal trumps that which is technical, we’re reminded that Gold’s ultimate value is fundamental, that it “sees” what is about to economically unfold! Thus a Federal Reserve rate cut to behold? Or does the Fed not (yet) “see” the economy getting rolled?

In other words: will the Fed be behind the descending curve as ’tis usually? FedSpeak of late, whilst not necessarily hawkish, has been nonetheless cautious toward an otherwise imminent rate cut come the Open Market Committee’s Statement on 31 July. And if previously you’ve therein read this phrase once, you’ve read it a bazillion times: “…the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks…”

Well folks, with respect to Gold’s reality being fundamental, here as a heads-up to the not-ahead Fed is the incoming data, its evolving outlook, and hence a bleak balance of risks via the Economic Barometer. And as you long-time readers know, the Baro is borne of some 50 incoming metrics per month across 26 years as a tried-and-true leading indicator, at which (‘twould so seem) the FedFolks don’t look. But as we herein mused a week ago: come 25 July, might the first read of Q2 annualized Gross Domestic Product actually be negative? Cue Murray Head’s ballad from back in ’75  ““Say It Ain’t So, Joe” ”

““Say It Ain’t So, Joe” ” and have your own look:

and have your own look:

‘Course when rates plop, Gold oft gets a pop. Moreover, a bevy of Gold positives are coming to the fore. However, first let’s update the stance of Gold’s weekly bars from a year ago-to-date, wherein we see a second week of parabolic Short trend now complete. But as was the case with the prior two red-dotted Short trends, shall this one also be “short-lived”? Either way — as has now been the case for some 13 weeks — price basically is ebbing and flowing ’round our year’s forecast high of 2375:

True, we just mentioned there are Gold positives for “The Now”, inclusive of the opening Gold Scoreboard’s currency debasement valuation already up at 3712 (i.e. 55% higher than the present price of 2400). Here are a few more immediate Gold positives upon which to chew:

- Monetarily: inflation “magically” vanished in May; ’tis over, and thus the Fed ought cut; Gold Positive;

- Fundamentally: the StateSide economy is tanking; ’tis sick and thus the Fed must cut; again, Gold Positive;

- Globally: U.S. Vice-President Kamala Devi Harris likely assumes the role of President between now and 20 January (regardless of her party’s nominee and ensuing election), thus becoming Commander-in-Chief of the armed forces at a time when global hotspots are ever so fragile and expanding; be that President perfectly capable or otherwise unproven, the world will become more nervous; clearly Gold Positive.

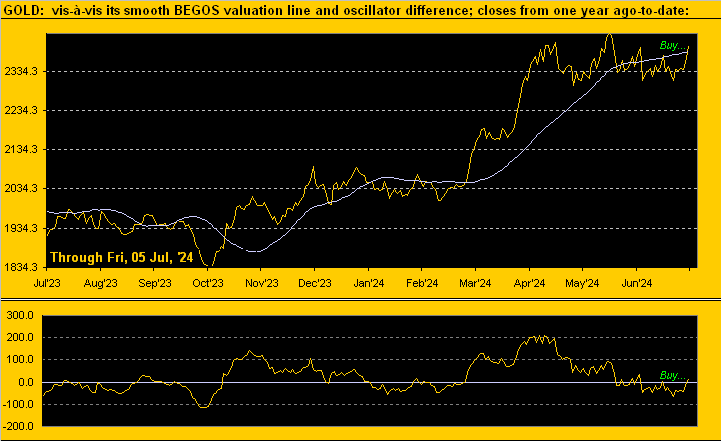

- Technically: despite the fresh weekly Gold parabolic Short stance and still-negative MACD, just yesterday came confirmation of the following Gold Positive:

If you follow the website’s analytics, the above graphic is updated daily on both the Gold and Market Values pages. And the rule of thumb is: when price breaks above its smooth valuation line, still higher price levels (by rule rather than exception) are to be expected. Yet, within the context of proper cash management, we obviously now have conflicting signals. But at the end of the day — regardless what technicals shout — ’tis by fundamentals Gold will out. No, we shan’t now disregard a test of the oft-of-late mentioned 2247-2171 structural support zone; however should a new All-Time High instead be nigh in concert with the next weekly parabolic flip to Long, then  ““I Want to Take You Higher” ”

““I Want to Take You Higher” ” shall be Gold’s song –[Sly and the Family Stone, ’69]

shall be Gold’s song –[Sly and the Family Stone, ’69]

Next we go to Gold’s two-panel display of the daily bars from three months ago-to-date on the left and 10-day Market Profile on the right. The last two daily bars are sufficiently upside robust such that upon the baby blue dots of trend consistency crossing above the 0% axis, their foundational 21-day slope shall have rotated from negative to positive. And in the Profile we’ve labeled those prices of notable volume-trading support:

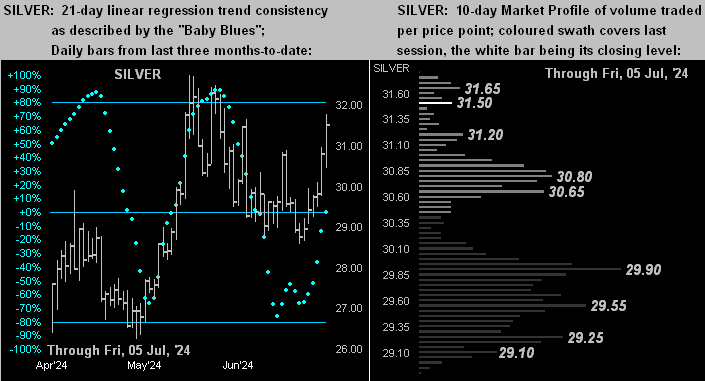

Similar is Sister Silver’s drill. Her “Baby Blues” (below left) are well in sync with those for Gold. And her Profile (below right) shows a myriad of supports. As noted early in the graphic for Gold’s Weekly Bars, the Gold/Silver ratio is now 76.1x versus 79.4x a week ago, indicative of Silver garnering interest as she remains exceedingly cheap vis-à-vis Gold, (the average century-to-date ratio being 63.3x). Indeed whilst Gold today at 2400 is just -2.2% below its All-Time High (2454), Sister Silver now at 31.53 is -36.7% below her All-Time High (49.82). So do not forget her:

In closing for this week, guess what commences on Monday?

“Q2 Earnings Season, mmb.“

Exactly right, Squire. And surely you duly noted in the aforeshown Economic Barometer the “live” price/earnings ratio of the S&P 500 is an essentially valueless 43.5x. Who owns the S&P 500 at such an historically extreme level? Look again at the Econ Baro: to bring the P/E in line with any measure of past P/E means, do we really expect bottom lines to have doubled in Q2? Of course not! And yet, the S&P 500 — void of supportive earnings and comparatively little yield (1.316%) — continues to set record highs, reaching on Friday up to 5570.

‘Course the last thing the Fed wants to see (beyond the demise of the Almighty Dollar, which is the Fed’s mandate to maintain in equilibrium) is the inevitable crash of the Great American Savings Account (aka “The Stock Market”). But you S&P futures traders with long memories (and you know who you are out there) may recall from the “Conspiratorial Truth Dept.” the sole reason which keeps the market from crashing: the Fed (so it used to be said) has a trading account on the futures floor:

“Dat’s right, you keep hittin’ dem offers dere, Jay baby!”

But can the Fed then print its way out of a margin call when it all goes wrong? Folks: you can ultimately crash and burn along with the rest in this Investing Age of Stoopid … or instead give thanks for Gold!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

********