The final washout I warned gold investors about is over, and the breakout rally above $2100 may have begun.

The final washout I warned gold investors about is over, and the breakout rally above $2100 may have begun.

Gold miners could explode higher if gold reaches new all-time highs; they remain insanely undervalued and under-owned.

Silver must get back above $24.00 to establish a lasting bottom. Above $26,00, and I think prices could soar.

Geopolitical Update

Gaza is under siege, and a ground offensive could soon follow.

In all likelihood, the conflict in the Middle East is significantly closer to the beginning than the end.

Under a worst-case scenario, crude oil could shoot above $120, shattering the economy

CPI Update

The annual CPI rate remains stubbornly high at 3.7% after reaching 3.0% in June.

The 0.4% increase in September was just above estimates, primarily due to higher fuel prices.

Energy increased 1.5%; the most significant jump was in Fuel Oil, up 8.5%.

source: https://www.bls.gov/news.release/pdf/cpi.pdf

Fed Watch Tool

The odds for a November rate hike have fallen below 8%, and a rate hike in December is about 30%. Gold needs sufficient evidence that the Fed is done hiking for its next big rally, which may be beginning.

source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?r…

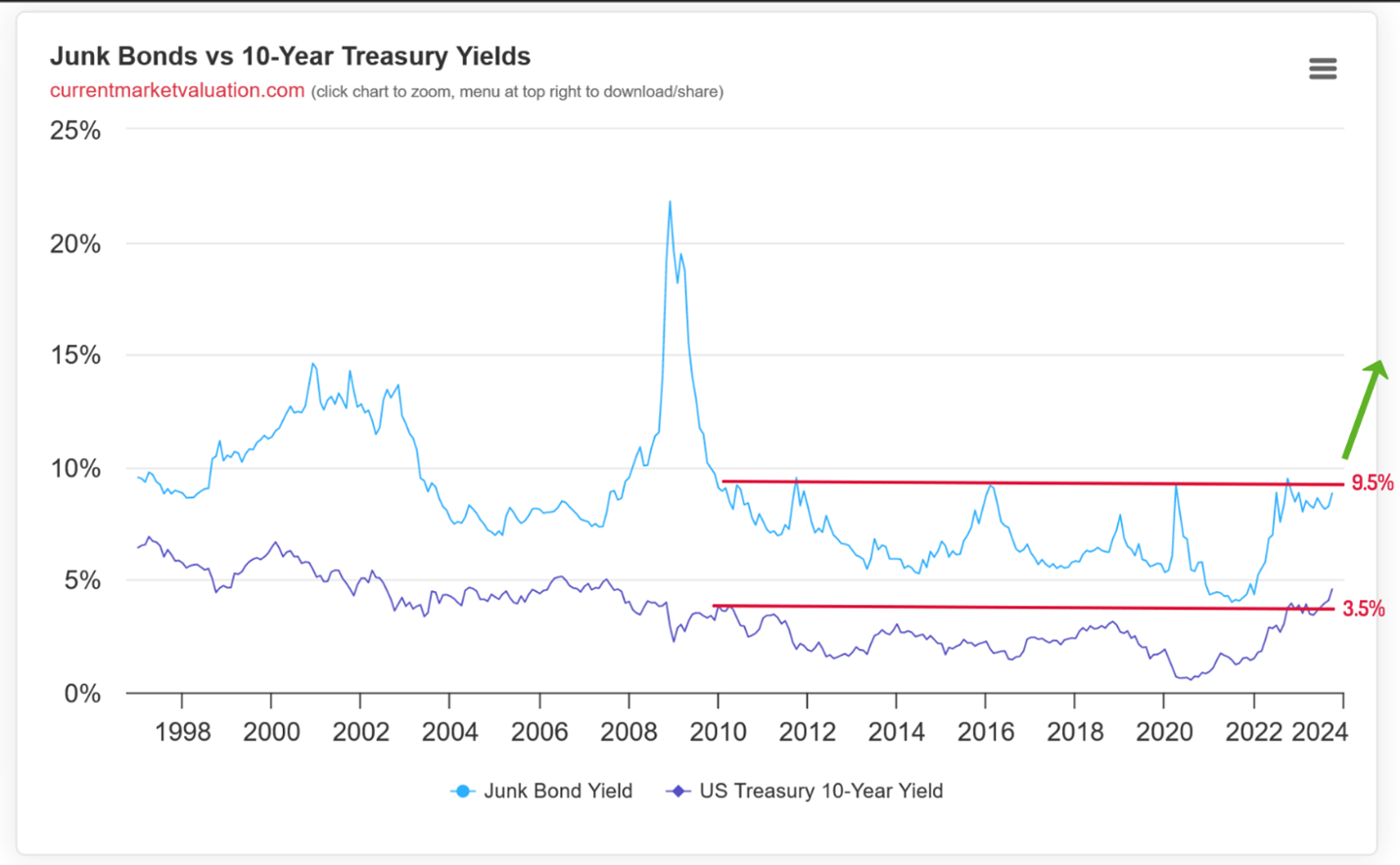

Credit Spreads

High-yield credit spreads are among the best places to look when assessing stress in financial markets. The spread between junk bonds and US Treasuries is currently 4.25%, which is surprising given the record number of bankruptcies in 2023. A breakout above the trendline in the coming weeks/months would confirm the next recession and bear market in equities.

source: https://fred.stlouisfed.org/series/BAMLH0A0HYM2

Credit Spread Divergence

This chart shows the 10-year Treasury yield (bottom panel) compared to Junk bonds (top panel). The Junk bond yield has stayed below 9.5% since 2010, bumping against it several times.

With the 10-year yield diverging and breaking to multi-year highs (above 3.5%), I suspect junk bonds could soon follow, which could trigger a surge in high yields towards 15%.

source: https://www.currentmarketvaluation.com/models/junk-bond-spreads.php

Metals Update

GOLD DAILY- The final washout is complete, and a strong breakout above the trendline in October would promote a retest and likely breakout above the $2090 level before year-end.

SILVER DAILY- If silver closes the week above $22.50, it will reverse last week’s breakdown, signaling a new advance. Progressive closes above $26.00 would support a major breakout.

GDX DAILY- Gold miners remain deeply undervalued and may be on the verge of an epic rally. A breakout above the upper trendline in the coming days would support this outlook.

NOTE: Roughly every three or four years, miners enter a parabolic advance, leaving many investors behind. That could be happening now.

Conclusion

The final washout in metals and miners is likely over, and we may be in the beginning stages of a powerful advance.

When gold breaks above $2100, I don’t think it will stop until it nears $3000. Gold miners could rocket higher from here.

********