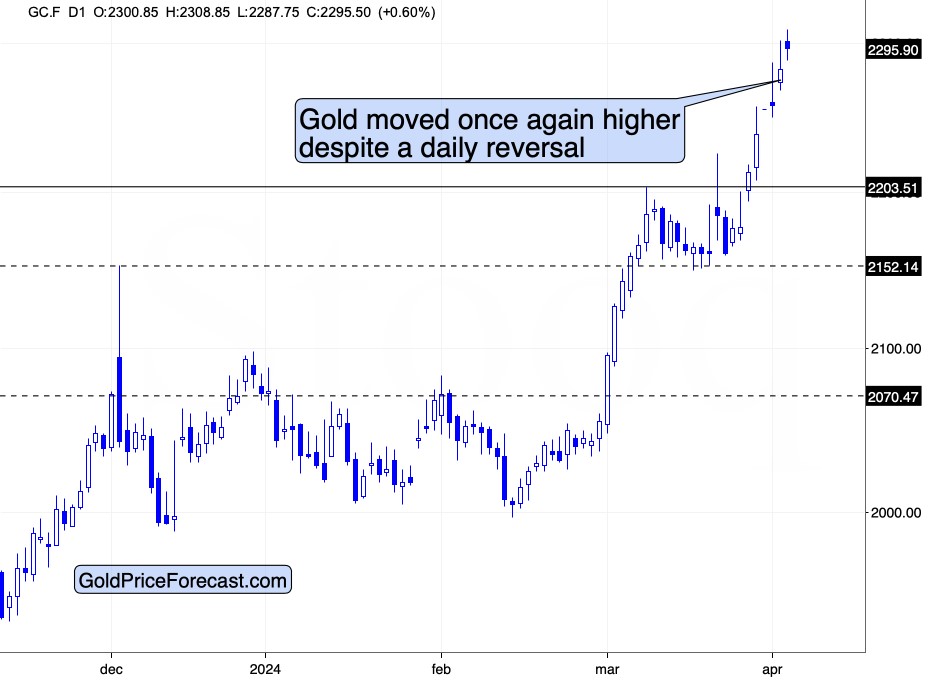

Gold is rallying regardless of what’s happening in other markets, and while there are signs of a top, gold appears to simply not care about them at the moment.

Gold is rallying regardless of what’s happening in other markets, and while there are signs of a top, gold appears to simply not care about them at the moment.

In particular, gold price keeps on forming daily reversal candlesticks, which “should” be tops, but they likely aren’t. The emotional momentum is so strong that it takes gold even higher despite the overbought status and despite the clear technical top signs.

Did the technical analysis stop working? No, it’s simply the case that given the medium-term analogies, short-term indications yield. Let’s take a look at gold’s long-term chart for more details:

There are several techniques that point to gold’s upside potential at about $2,340 – $2,380.

The one that I started the above gold’s-upside-target analysis with is the analogy to the previous times when the RSI moved above 70, then gold consolidated, and then it moved up once again despite that recent overbought status. After all, this is what we see now, so the question was what happened in previous analogous cases.

I marked the previous cases (based on the RSI readings) with orange rectangles, and I then copied the post-consolidation declines to the current situation – they are all marked with dashed, blue lines.

There were two areas that gold is likely to end up in given this kind of analogy. The lower one is more or less at the current price levels, and the higher one is at about $2,340 – $2,380.

The upper area is confirmed by several additional techniques:

- The upper border of the rising trend channel based on the 2022 and 2023 lows and the mid-2023 high (marked with black, dashed lines).

- The upper border of the rising trend channel based on the late-2023 and 2024 lows and the late-2023 high (marked with purple, dashed lines).

- If we treat the recent supposed-to-be-double-top price movement as a flag pattern, then the move that follows it is likely to be analogous to the move that preceded it. I marked that with red, dashed line.

- The 1.618 Fibonacci extension based on the 2022 low and the early-2023 high.

- The 1.618 Fibonacci extension based on the late-2023 low and the late-2023 high.

At the moment of writing these words, gold futures are trading at about $2,270, so we might be looking at an upside potential of another $100.

The above is a quote from Monday’s analysis, and today, gold futures are trading at about $2,296.

Gold reversed today, but… It also reversed yesterday, and on Monday, and those days were followed by higher prices, so it seems that gold can still rally further despite those reversals.

Another $50 – $90 rally seems to be in the cards.

I previously wrote that gold might rally as long as there’s no breakout in the USD/YEN currency exchange rate and this remains to be the case. In particular, I wrote that this currency pair can continue to trade sideways for days and that would give room to gold’s rally. And that’s exactly what’s been taking place.

The USD/YEN is on a verge of a breakout, but it hasn’t broken yet, and gold price is taking advantage of it.

It seems that this can persist for several more days, and then gold could top while the dollar soars. This creates a good trading opportunity, and there’s a way to limit the risk, too.

Of course, the above is up-to-date at the moment of writing these words, and as soon as the outlook changes, I’ll post an update. In fact, I’ll be posting quite many updates in the following days and weeks, and if you’d like to receive them, I invite you to sign up for my free gold newsletter. sign up today.

Thank you.

Przemyslaw K. Radomski, CFA

Founder, Editor-in-chief

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski’s, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********