Recession Outlook

The recession I’ve been expecting is taking far longer to materialize than envisioned. I believe it’s because businesses and consumers locked in ultra-low rates during Covid, and that’s keeping their heads above water. Employment has also been resilient but is showing signs of slowing.

In a recent study, Mike Green showed that 85% of junk bond issuers are currently profitable, but that number would plummet to 7% if they all adjusted to today’s rates. Over time these companies will need to refinance, which will be disastrous.

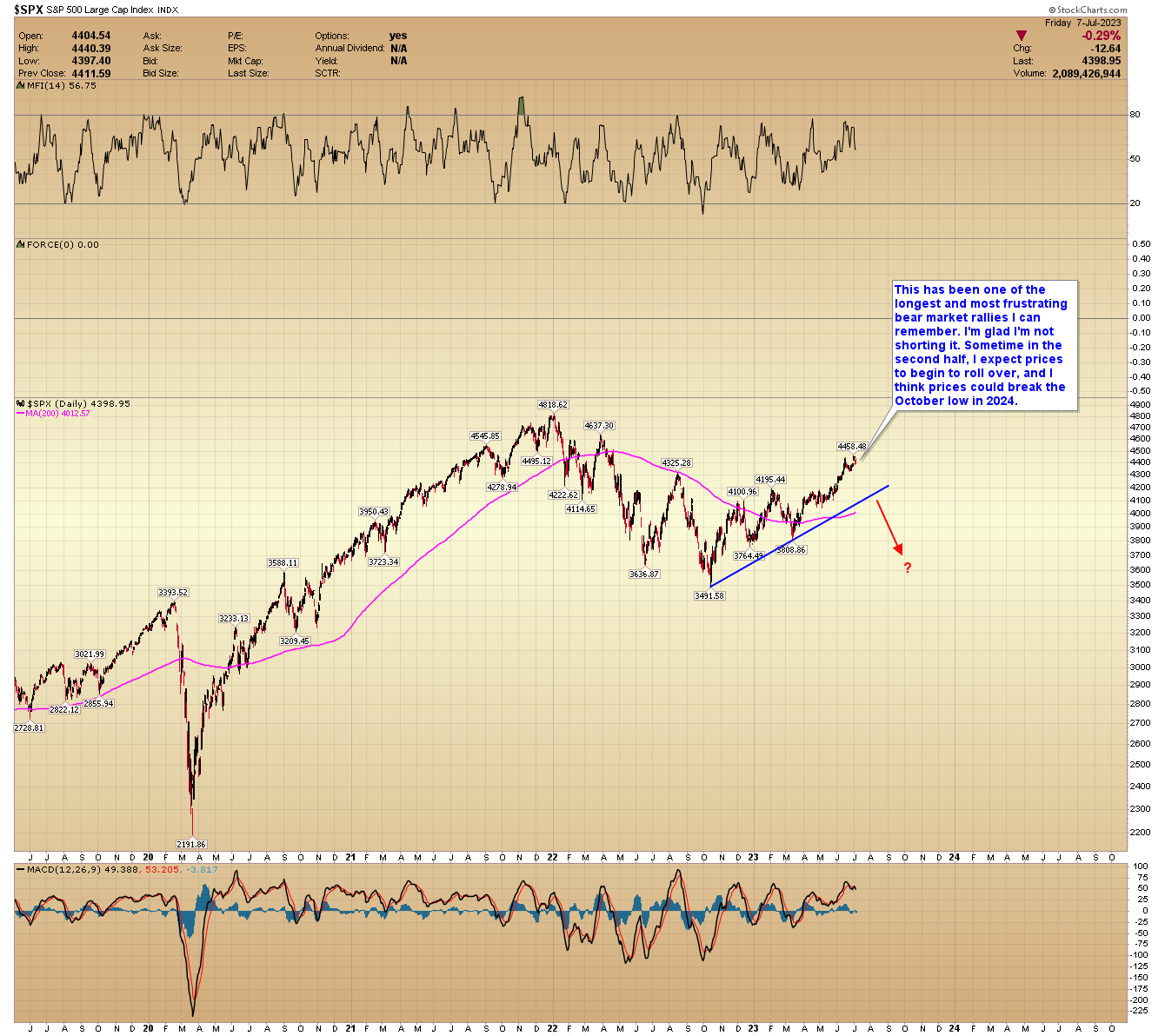

I’ve heard the term “echo bubble” used to describe the rally in stocks off the October lows. That phrase seems appropriate, as most of the gains have been from just a hand full of high-flying tech stocks. For example, Apple is up 47% in 2023 despite year-over-year sales -2.51%, and from a valuation basis, it’s 72% more expensive than it was at the 2007 peak.

This year’s biggest beneficiary, however, has been Nvidia, whose stock is up 190% year-to-date. Prices are currently trading at 40X sales, comparable to Amazon’s peak in 1999 before prices collapsed 95%.

Take Away

The recent strength in stock indices is not representative of the whole, and I still consider this a bear market rally. Over time higher interest rates will chip away at marginally profitable companies, and the economy will roll over. The deepest part of the recession will likely come in 2024, and I wouldn’t be surprised to see a renewed banking crisis or meltdown in commercial real estate.

Inflation Update

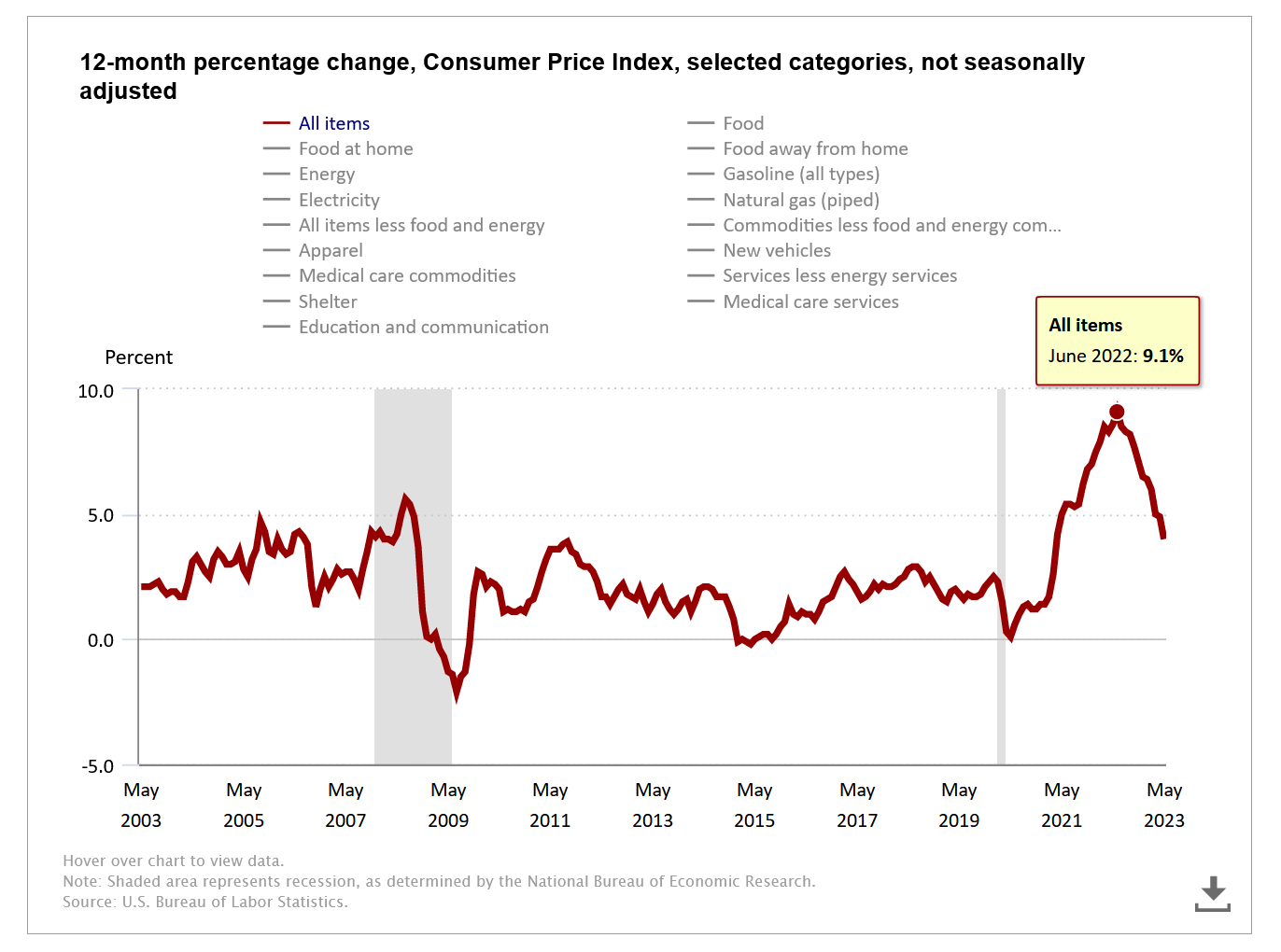

Headline CPI peaked in 2022 at 9.1% and has fallen sharply. Next week we will get the June report, and inflation is expected to reach 3.1%. I think that could be the low for the year and see the potential for CPI to creep back towards 4.0% by year-end. Meaning the Fed will probably have to keep rates high into next year.

source: https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-…

BRICS Gold-Backed Currency

In August, a coalition of nations (Brazil, Russia, India, China, and South Africa) will reveal a new gold-backed currency to compete with the US dollar. It’s unclear how the currency works: will it be convertible to gold on demand or something else? We should learn more soon. Either way, it could reduce demand for the dollar and threaten its hegemony.

Rate Hike Odds

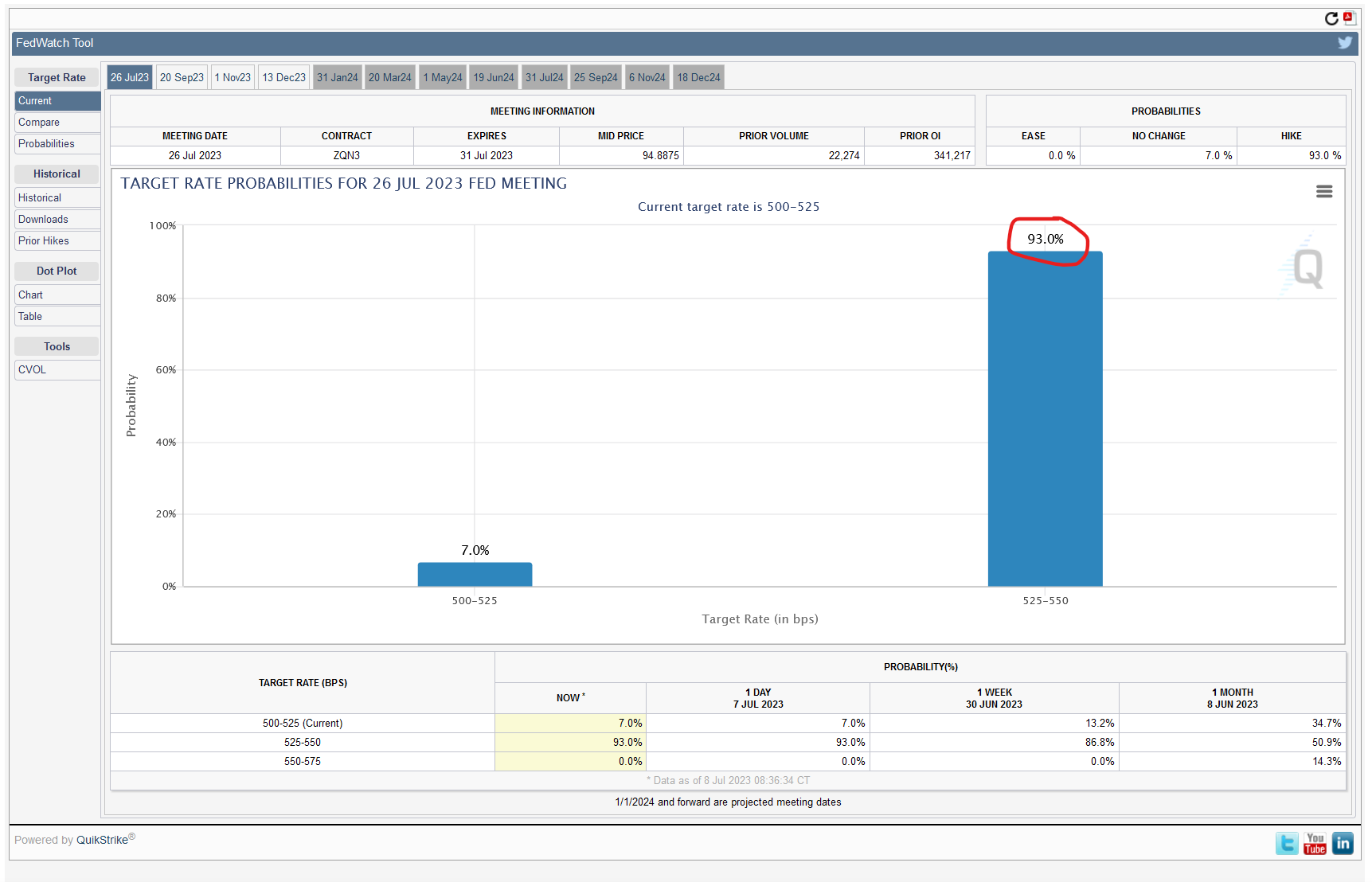

The best thing that could happen to gold near-term is if the Fed doesn’t hike rates on July 26th. Unfortunately, despite Friday’s lower-than-expected employment report, and downward revisions, the odds for a rate hike remain near 93%. The only thing that could dramatically lower these odds is if June CPI comes in far below estimates.

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?r…

The Gold Cycle Indicator finished at 88. We remain in minimum cycle bottoming, and we should be close to a low.

GOLD– Gold is trying to put in a cycle low, but the threat of more rate hikes is proving formidable. Prices are in a descending wedge, and progressive closes above the upper trendline would support a bottom. In contrast, a July rate hike could push prices slightly lower, and we may retest or undercut the lower boundary in a final washout.

SILVER– The verdict is still out on silver. Prices have been consolidating in a potential bear flag above the 200-day MA but are yet to break lower. A final washout to test the trendline remains possible and is likely contingent on the potential for more rate hikes. Registered COMEX inventories have risen from 27 million to 35 million ounces.

PLATINUM– It remains unclear if platinum bottomed or if we will see a little more downside. I’d like to see a robust close above $940 to support a cycle low.

GDX– Miners fell sharply and retested the recent low; prices are trying to bottom. We have a positive divergence in the MFI (top indicator) supporting a cycle low, but I can’t rule out a final washout to close the price gap at $28.00.

GDXJ– Juniors must close above the cycle downtrend line to support a bottom. Until then, a little more downside remains possible.

SILJ– Silver juniors are trying to put in a cycle low, which is proving difficult with the threat of more rate hikes. A robust close above last week’s $9.62 pivot would support a local bottom. However, it would take a breakout above the downtrend line to recommend a new bull market advance.

AAPL– Apple’s market cap is at $3 trillion dollars, which is higher than the GDP of France (the world’s seventh-largest economy). Year-over-year sales are down 2.51%, yet prices continue to make new all-time highs. From a valuation standpoint, on average, prices are 72% more expensive than during the peak of 2007. To me, this is evidence supporting an echo bubble.

S&P 500– This has been one of the longest and most frustrating bear market rallies I can remember. I’m glad I’m not shorting it. Sometime in the second half, I expect prices to begin to roll over, and I think prices could break the October low in 2024.

The June CPI data comes out Wednesday, and Core PPI on Thursday.

Conclusion

The gold train is about to leave the station, and the next 12 to 18 months should be exhilarating. Timing the exact bottom is irrelevant if gold reaches our $3000 target in 2024. Gold miners should benefit greatly; some could rally 200% or more.

********