Gold is correcting as the dollar bounces – we see prices bottoming later this month. I’ve included preliminary price targets in the charts below.

Gold is correcting as the dollar bounces – we see prices bottoming later this month. I’ve included preliminary price targets in the charts below.

Record fund flows into the S&P 500 ETF support elevated complacency among investors, and multiple factors support a 2024 recession.

After the January bottom in gold, we expect a decisive breakout above $2100 and an explosive rally into the presidential elections.

Quick Economic Summary

- ADP employment came in higher than expected at 164,000 jobs versus 130,000.

- Initial jobless claims were lower than expected at 202,000 versus 219,000.

- Non-farm payrolls reached 216,000 in December versus the 170,000 expected – the unemployment rate remained at 3.7%.

- Overall, the economy is surprising to the upside, which means the Fed may have to keep rates higher for longer, disappointing stock bulls.

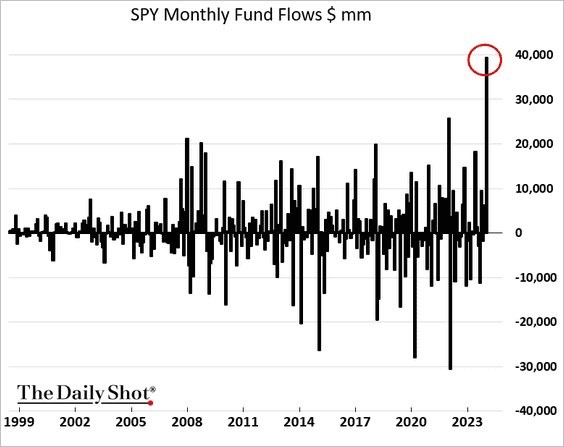

SPY Fund Flows

In December, monthly fund flows into the SPDR S&P 500 ETF (SPY) hit an all-time high. It seems no one is anticipating a bear market.

source: https://twitter.com/jessefelder/status/1742259011683262774/photo/1

Soft Landing Narrative

Below is an excellent chart from Michael Kantro showing how the market consistently believes the economy will experience a soft landing as the Fed ends its rate-hiking campaign. The orange vertical bars represent articles citing a ‘soft landing.’ Currently, the only higher reading was in 2000, which resulted in a significant hard landing.

source: https://twitter.com/matthew_miskin/status/1742888632317350363/photo/1

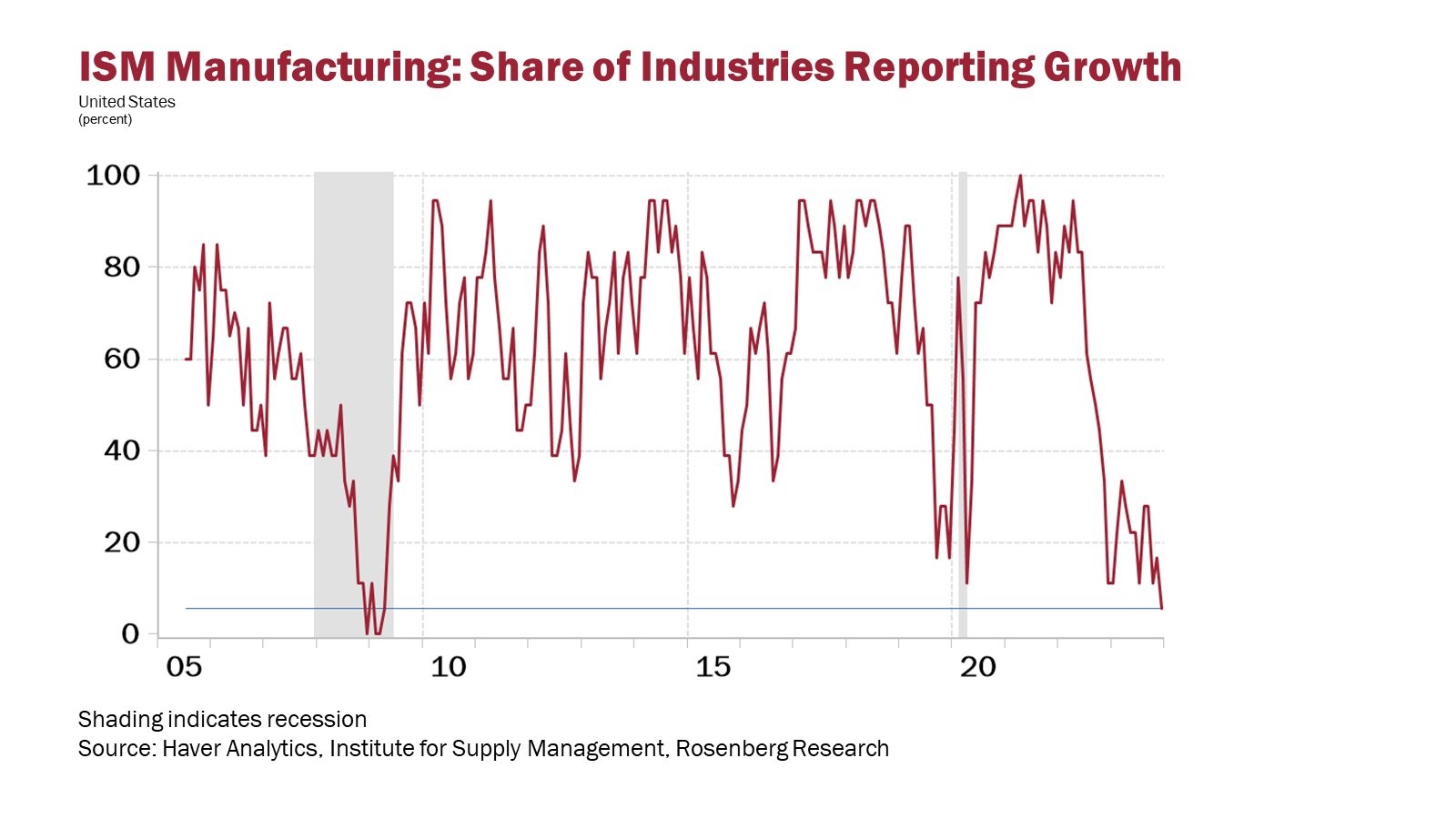

ISM Manufacturing

Everyone believes the economy is recession-proof. Yet, the ISM shows that just 5.6% of purchasing managers are experiencing growth, according to economist David Rosenberg. The last time we were here was in April 2009.

source: https://twitter.com/EconguyRosie/status/1742646371977461794/photo/1

Druckenmiller Recession Proxy

The Druckenmiller recession proxy suggests large parts of the US market are still pricing in something nasty to happen. Year-over-year performance in cyclicals is rarely this low outside of a recession.

source: https://twitter.com/jessefelder/status/1742978954573885871/photo/1

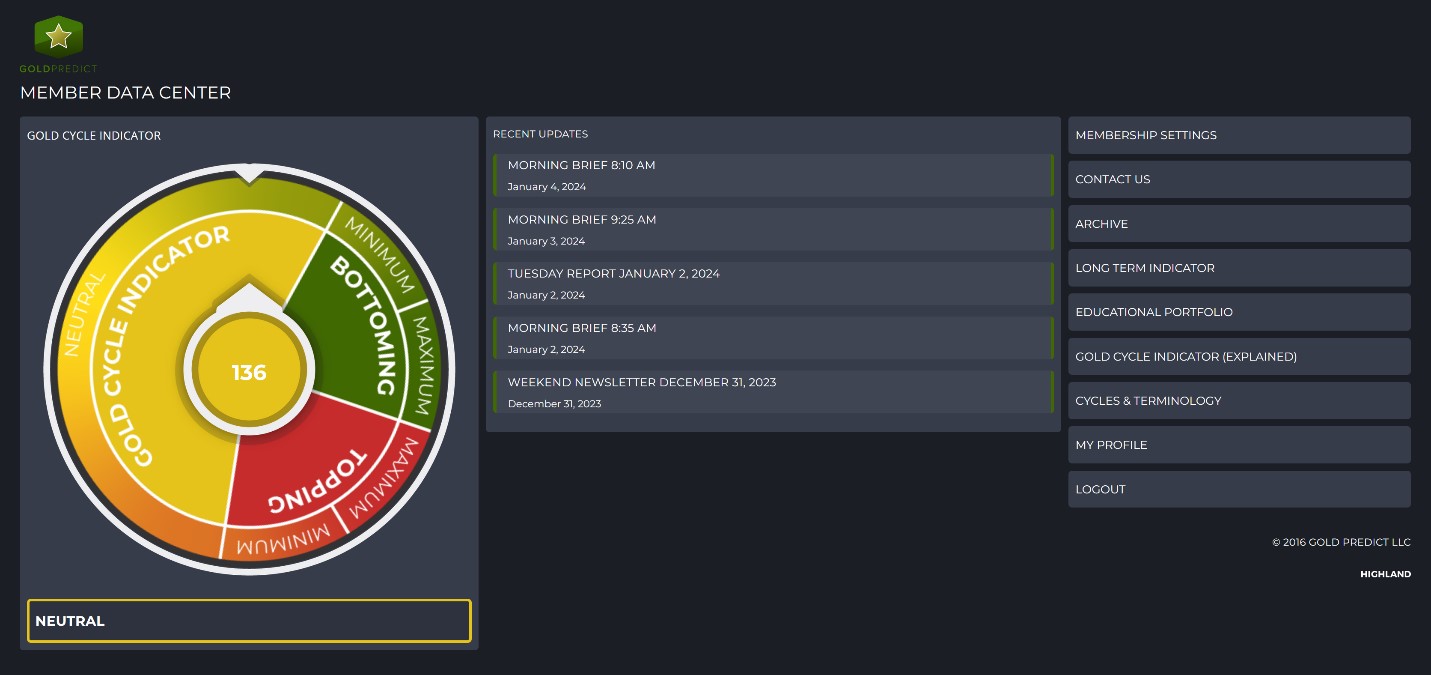

Our Gold Cycle Indicator finished at 136 and is heading towards minimum cycle bottoming. We expect an important bottom later this month.

US DOLLAR- The dollar is bouncing as expected, and the next level of resistance arrives at the price gap near 102.75. Ultimately, I’m looking for a rebound to 103 or 105, as precious metals and miners are correct.

GOLD- Gold needs progressive closes below the 50-day EMA to confirm an intermediate decline. I’ve drawn a preliminary target box for a January low. Once prices bottom, I expect a decisive breakout above $2100 in February or March.

Note: Escalation in the Middle East could cause an early termination of this correction.

SILVER- Silver is following gold into an intermediate low, and we expect prices to find support around $22.00. Big picture: prices need to breakout above $26.00 to signal a new bull run, which we foresee later this year.

PLATINUM- Platinum is correcting and should find support around $900 later this month. Big Picture: We believe prices are profoundly undervalued and will surpass gold someday.

GDX- Gold miners are correcting, and we see support arriving near $28.50 later this month. Once complete, we expect a decisive breakout above $32.50 in February or March.

GDXJ- Juniors are below the 50-day EMA. We drew a January target box surrounding the $34.50 area.

SILJ- Silver Juniors are already testing the 50-day EMA. We expect prices to base around $9.00 later this month. Once prices bottom, we foresee a decisive breakout above the $10.60 resistance area in February or March.

WTIC- Oil is working on a bottom, and prices need to close above $73.19 to form a swing low. Progressive closes above the downtrend line would signal a trend change and new advance.

S&P 500- Stocks are down for the third straight trading day, and we could see a pullback to the 4600 area, which is not surprising given nine consecutive up weeks. Overall, we see a peak sometime in the first quarter followed by a sharp decline later in the year, possibly to the low 3000s.

Conclusion

This is a normal intermediate-degree pullback in metals and miners that should terminate later this month. Once completed, we see sharply higher prices and new record highs in gold that will finally force investors to pay attention. The precious metals train is leaving the station – be sure to take (and keep) your seat.

AG Thorson is a registered CMT and an expert in technical analysis. For regular updates, please visit www.GoldPredict.com.

*********