Physical gold is no longer cheap.

Physical gold is no longer cheap.

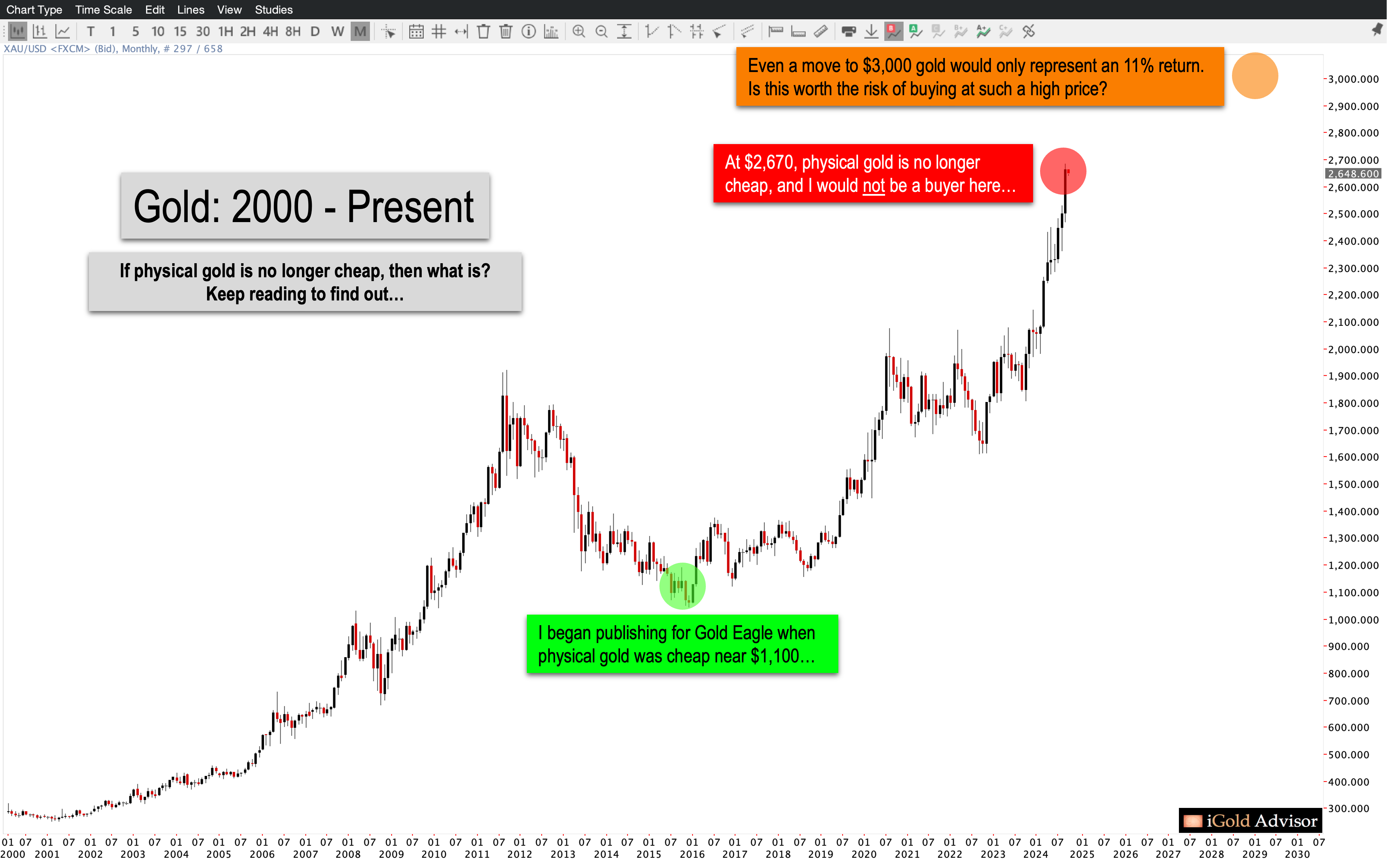

When I began publishing for Gold Eagle in late-2015, physical gold was trading near $1,100 per ounce.

It had been declining for four years, following the September 2011 peak at $1,920 per ounce. No one wanted it.

The mainstream narrative was that the Federal Reserve was going to hike interest rates for the first time in a decade in December 2015, and higher rates were bad for gold.

I thought the opposite – that higher rates would be good for gold – and I said so in this article.

What ended up happening?

Gold bottomed the day after the Federal Reserve interest rate hike in December 2015, and hasn’t looked back since. As this article is being written, gold is trading at an all-time high of $2,670 per ounce, nearly triple the price it was trading at just nine years ago.

Indeed, a quick look at the gold chart below shows the obvious: gold has had a fantastic run. Congratulations to anyone who followed this analysis back in 2015.

However, nothing moves higher forever, and it is at this point that we must state the obvious: physical gold is no longer cheap.

Gold No Longer a Bargain

No – the 5,000-year store of wealth is no longer a bargain. It was in 2015, but it is not today.

To state it simply: physical gold is not something that I would buy at present levels.

I consider myself a contrarian, and I do not buy assets that have moved aggressively higher as gold has done recently.

Instead, I buy assets when they are falling and are either unloved and ignored by the masses. This was gold in 2015. Congratulations to those of us who bought then.

However, gold is no longer a bargain and thus carries a significant amount of risk.

A Real World Test of Value

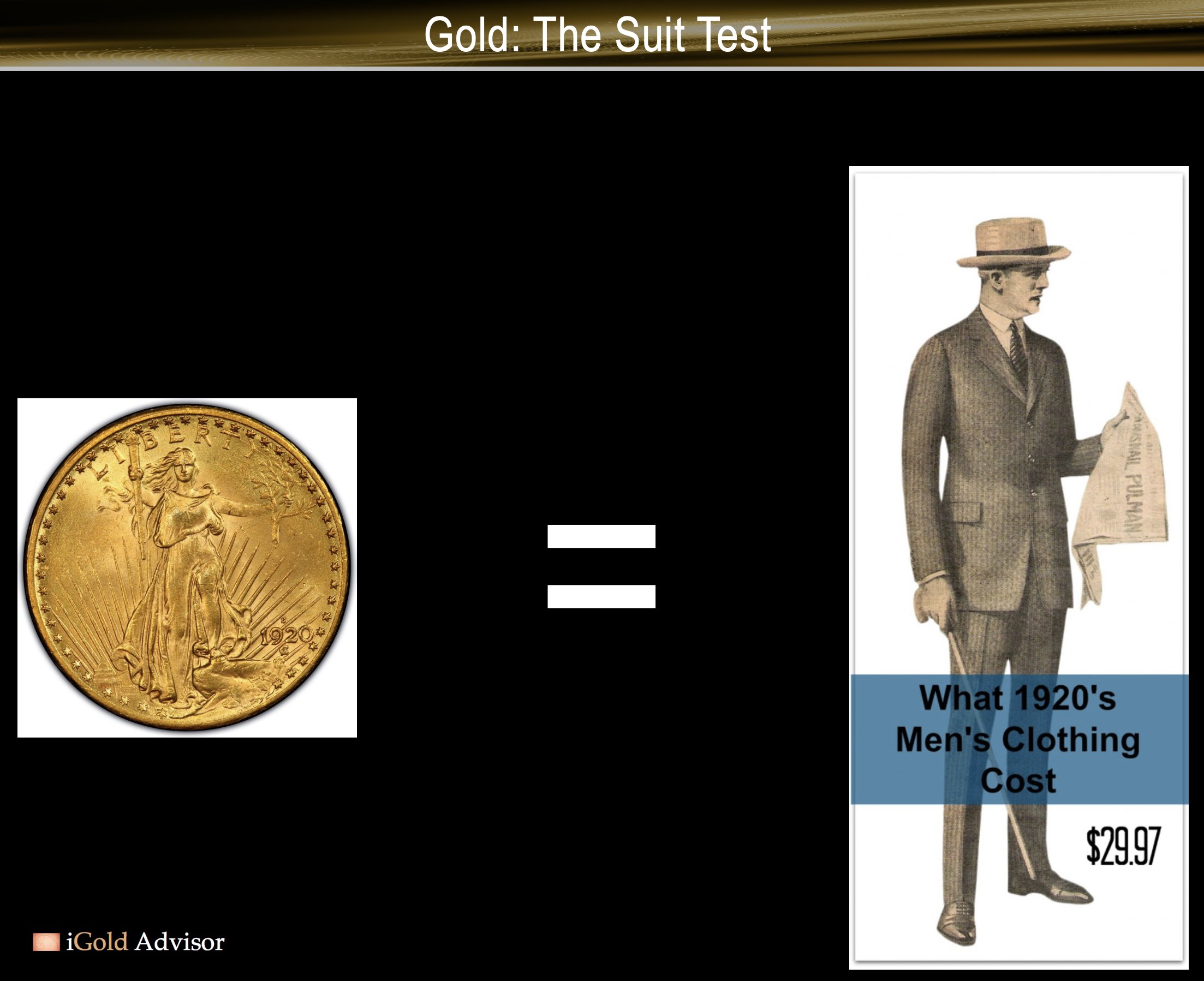

Let us move away from the chart and consider a real-world example to consider gold’s value: the suit test.

The centuries-old adage says that it should take roughly one ounce of gold to buy a fine men’s suit.

Amazingly, if we go back 100 years, we have good examples of this from men’s clothing catalogues. For example, this suit from the 1920’s cost $29.97 at the time:

The price of gold in the 1920’s? Approximately $20.65.

Thus, it cost 1.45 ounces of gold in the 1920’s to buy a nice men’s suit, which also included the shoes, the shirt, a tie, and a top hat. The suit itself was therefore closer to one single ounce of gold.

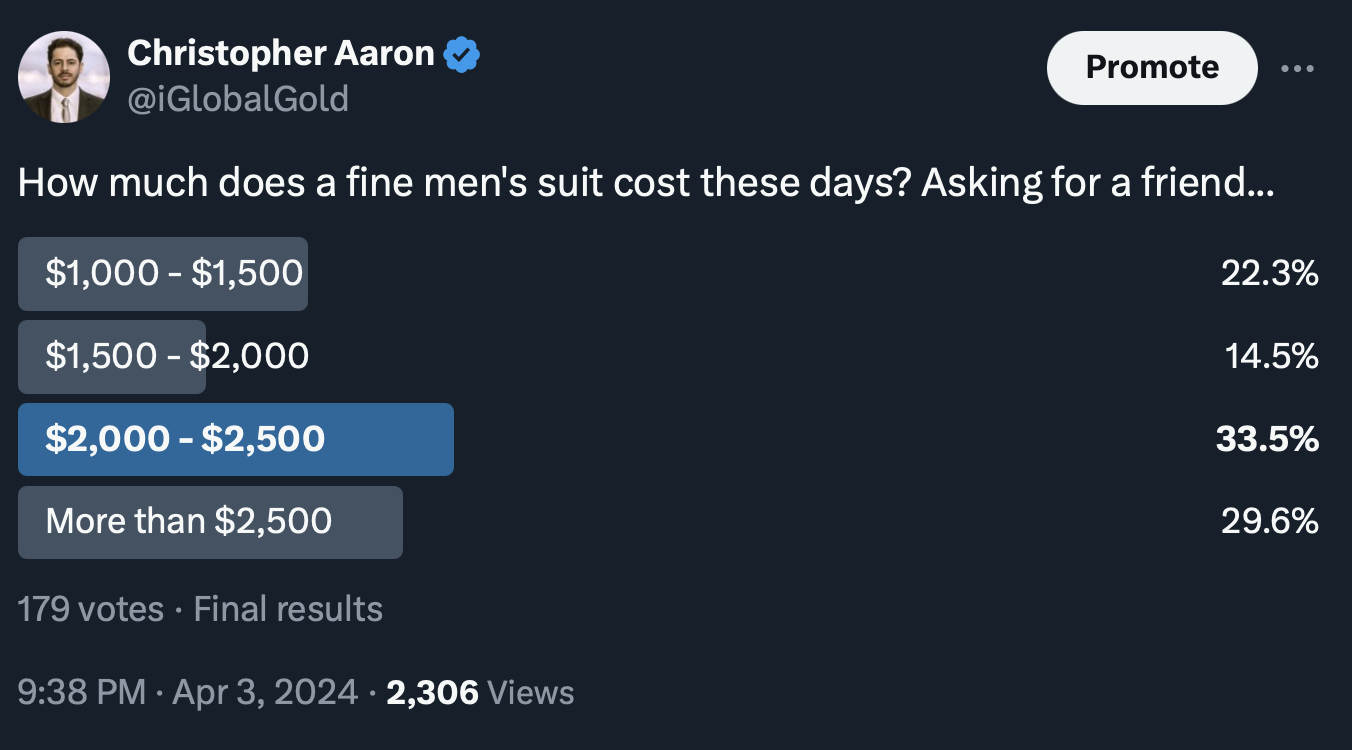

Let’s fast forward to today. What does a fine men’s suit cost?

I took a poll of 179 clothing shoppers to ask this question:

The consensus answer? $2,000 – $2,500.

I then did a search online for men’s suits at random department stores. The average price of the first eight results? $1,838. Add in a nice pair of leather shoes, a tie, a shirt, and a hat, and the price would easily exceed $2,500.

The current gold price? $2,670.

In sum, it still costs in the range of one ounce of gold to buy one fine men’s suit, just as it did 100 years ago.

Gold has held its value incredibly well.

However, this solid performance means that gold is now fairly valued. Gold is not now cheap. Gold was cheap nine years ago when it traded near $1,000 per ounce. It is not now.

What To do?

If gold is not cheap, what is an investor to do? Sell all his gold?

Not necessarily. Such a decision depends on a host of factors, including how much gold one owns, what percentage of a portfolio this represents, one’s age, income level, diversifying investments, etc. I work with investors individually via consultation to assist in navigating these specific life factors.

Yet I will say this again: I would not be buying physical gold at $2,670 per ounce, because it is not cheap. I am a contrarian, I like to buy assets when they are out of favor… and gold has risen too far too fast for it to be cheap now.

So what is cheap these days?

It just so happens that gold in the ground is cheap.

Gold In The Ground Is Still Cheap!

Yes, while gold above ground is currently trading at a not-bargain $2,670 level… there are many instances of gold in the ground trading at still-cheap levels. I’m talking $10 per ounce in the ground… $5 per ounce in the ground… and sometimes cheaper.

Take the following examples, each of which are gold companies that myself and my subscribers own shares in:

- Provenance Gold Corp. (PVGDF – USA / PAU – Canada)

Provenance is an emerging gold mining company which owns the flagship Eldorado project in eastern Oregon, USA. Eldorado is unique in that it has three historical resource estimates which were produced by previous owners in the 1980’s – 1990’s. The average of the three historical estimates place Eldorado at 2.2 million ounces of gold in the ground at a grade of 0.76 g/t. Eldorado would be an open-pit mine where it is economic to mine such grades.

The market cap of Provenance today? $14 million US dollars.

This means that each ounce of gold in the ground is currently being valued at $6.30! This is an absurdly low figure when we consider that gold above ground is trading for $2,670.

What more, Provenance has just completed its first reverse-circulation drill program which confirmed many of the historical grades found on the resource estimates. Two of the most spectacular holes were 118.8 m of 3.27 g/t gold and 114.3 m of 3.08 g/t gold.

Finally, Provenance has just discovered visible gold in a new drilling program below the previous estimates. This means that the deposit may be much larger than the historical estimates. The sky may be the limit here on Eldorado.

While there are no guarantees in the investment world, Provenance’s gold could easily be valued at $50 – $100 per ounce in the ground after the company verifies the historical estimates. This would represent a 8X – 16X return from current levels!

At $6.30 per ounce in the ground, this is cheap gold. As a contrarian, this is the type of investment that interests me, not the $2,670 gold above ground.

- Sirios Resources (SIREF – USA / SOI – Canada)

Sirios owns the flagship Cheechoo gold project in Quebec, Canada. The project already has an indicated resource of 1.9 million ounces of gold at a grade of 0.94 g/t.

The market cap? Only $11.6 million.

This means that each ounce of gold in the ground is trading at just $6.10! Again, an absurdly cheap valuation when gold above ground is trading at 437 times this valuation.

Sirios is also working on a land-sharing arrangement with its neighbor, which would add an estimated 500,000 additional ounces of gold to Sirios’ balance sheet.

Again, in previous cycles, gold has traded at a range of $50 to $100 per ounce while still in the ground. This would represent a similar 8X – 16X upside potential for Sirios shares.

Takeaway on the Gold Market

Gold above ground was cheap a decade ago when it was trading just over $1,000 per ounce. It has nearly tripled since then. Even if gold continues to rise, there is higher risk in buying it now. I personally would not buy physical gold at these levels.

Historical valuations – such as the men’s suit test – show us that gold above ground is properly valued. It is not undervalued.

As contrarians, we must search for the next asset class which has the potential to move from undervalued to fairly valued.

Right now, gold still in the ground is undervalued. The market has been overlooking high-quality gold deposits, focusing only on the gold one can hold in one’s hand. And while this manual obsession may be ingrained in us from 5,000-years of using gold as money – it makes for poor investment decisions in the current market.

Gold above ground is not cheap. Gold below ground is cheap. We should place our investment dollars where the revaluations higher may occur in the future, not where they have occurred in the past.

At www.iGoldAdvisor.com, we have recently purchased shares in both Provenance Gold Corp. and Sirios Resources. We will be buying new undervalued gold in the ground deposits in the near future.

In Precious Metals Intelligence+, we publish the research of the exact mining companies we are investing in, for investors who would like to follow along with our decisions.

For higher net-worth investors we offer Elite Private Placements. This service allows investors to receive FREE warrants in addition to their shares in mining companies, which results in even greater upside potential as compared to buying these same companies in the open market. Our last private placement is up over 38% in 3 months, even while silver itself is flat. This type of outperformance is possible only by finding cheap precious metals still in the ground.

********