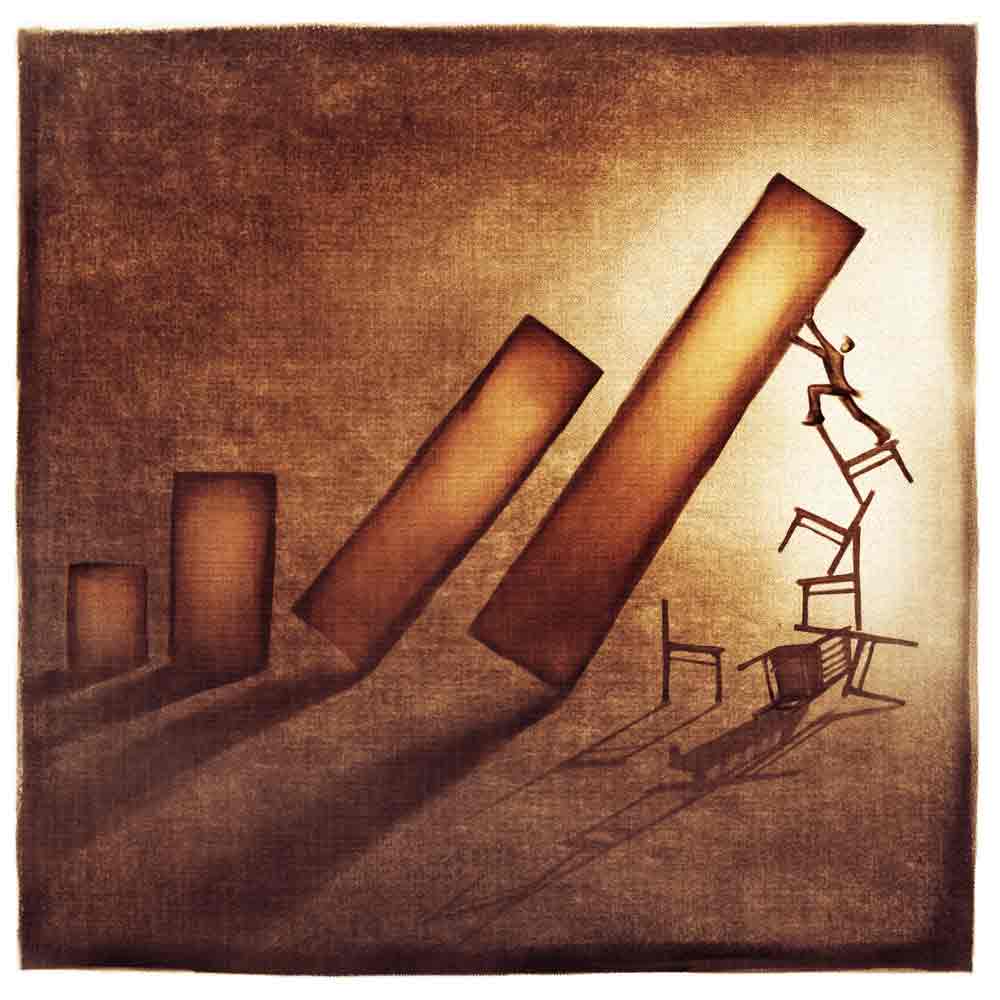

Metals and miners are dropping into June intermediate lows, and our work supports a bottom next week.

Metals and miners are dropping into June intermediate lows, and our work supports a bottom next week.

Once gold bases, we expect a powerful rally that could push prices toward $2800 by mid-August.

The potential in silver is striking; after prices bottom (next week), we see the potential for an epic run towards $40.00.

Technical Update

GOLD DAILY– The decline into a cycle low is never straightforward; there are often twists and turns. Gold almost always (90% of the time) closes at least once below the 50-day EMA before reaching a bottom. That has yet to happen, so I’m still looking for one more drop.

SILVER– Silver formed a swing low after tagging the upper boundary of the target box. The odds still favor a dip below the 50-day EMA with ideal support between $28.00 and $29.00.

PLATINUM– Platinum pulled back precisely to support at the 50-day and created a swing low. This is the perfect place for a technical bottom. Support around $960 should prices dip further.

GDX– Miners reversed Monday’s gap and formed a swing low after briefly dipping into the June target area. Generally, I like to see at least one close below the 50-day EMA before considering a cycle bottom, so I’m not convinced prices bottomed. Ideal support between $32.50 and $33.50.

GDXJ– Juniors formed a swing low and reversed Monday’s bearish gap. The odds favor a dip below the 50-day EMA before this cycle bottoms. Progressive closes above $47.00 would signal a cycle low.

SILJ– Silver juniors didn’t reverse Monday’s gap but did form a swing low. I’d need progressive closes above $13.00 to support a cycle low; otherwise, I expect one more dip for the June low.

Conclusion

Metals and miners should form cycle lows within the next week or two. From there, we expect aggressive upside before peaking in August or September. Our long-term forecast predicts $10,000 gold and $300 silver by 2030.

********