As mentioned in my last article back in February, Gold was in a correction phase – but was into bottoming territory, as represented by a key cycle that we noted at that time. That cycle ended up troughing with the February 14th tag of 1996.40, and with that should be headed higher into April – before another key top attempts to form.

As mentioned in my last article back in February, Gold was in a correction phase – but was into bottoming territory, as represented by a key cycle that we noted at that time. That cycle ended up troughing with the February 14th tag of 1996.40, and with that should be headed higher into April – before another key top attempts to form.

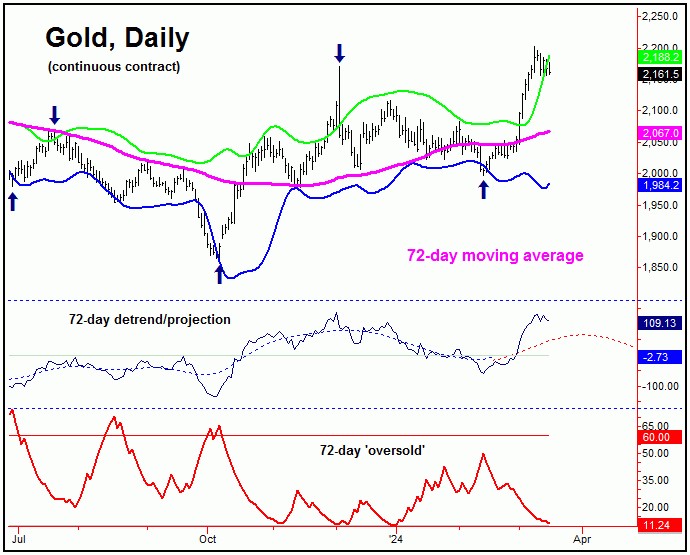

Gold’s 72-day Cycle

From the comments made some of my past articles, the next low of significance was expected to come from the most dominant cycle in the Gold market, our 72-day wave – which is shown again on the chart below:

This 72-day cycle component was projected to bottom into the late-January to mid- February region – as per the path suggested by our 72-day detrend indicator. Its actual bottom came in with the February 14th tag of 1996.40 (April, 2024 contract). This action was confirmed by taking out a key upside price reversal figure for Gold.

From my 2/18/24 article: “in terms of price, we have a key ‘reversal point’ for Gold, a number – when broken to the upside – will confirm the next upward phase of this 72-day wave to be back in force, with more precise details noted in our Gold Wave Trader report.”

With the above said and noted, our key upside reversal level for Gold was noted well in advance in our Gold Wave Trader market report. That ‘reversal point’ was the 2085.60 figure (April, 2024 contract).

With the above said and noted, once our reversal figure of 2085.60 was taken out to the upside, that was the trigger for a sharp move higher for Gold – one which was projected to be some 10-14% off the bottom.

In terms of price, that targeted a test of the 2195 (minimum) to 2270 level for the metal – with the lower-end of this range having already been met, with the spike higher into March 8th.

Having said the above, in terms of time, the average rally phases with this 72-day cycle have lasted around 39 trading days or more before peaking, which suggests its current upward phase will push higher into the early-April timeframe (or later) before forming yet another top with this wave. In terms of price, I see the potential for a push up to the 2230-2260 region before the upward phase of this wave is complete.

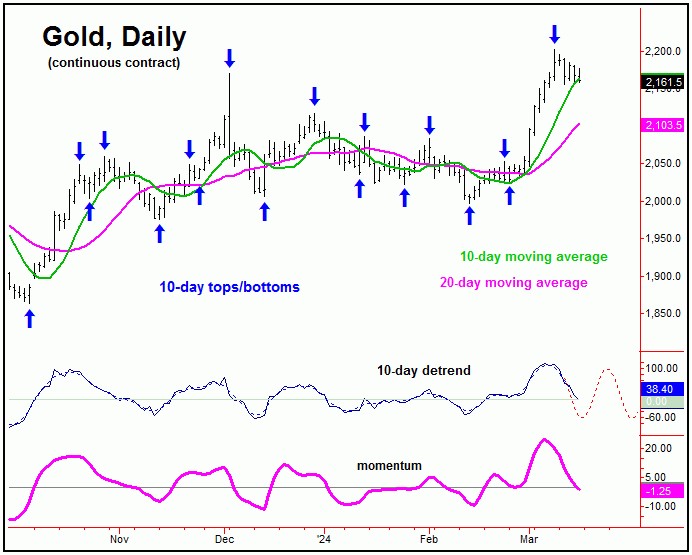

Gold’s Short-Term View

For the very short-term, however, the metal has been in a smaller-degree correction phase, coming from the combination of 10 and 20-day cycles. The smallest of these waves – the 10-day cycle – is shown on our next chart:

In terms of price, a more recent analysis called for a minimum drop back to the 10-day moving average for Gold – following my rule that a cycle will revert back to a moving average of the same length, better than 85% of the time.

However, due to the position of a larger 20-day wave (not shown), there is some potential for a drop back to the lower 20-day moving average, though – in bigger uptrends – the market will often hold around the shorter-term 10-day average.

Regardless of the above, due to the position of our larger 72-day cycle, the probabilities should favor the most recent correction to end up as countertrend, with first support around the 10-day moving average, then the lower 20-day average, if attempted.

If the above assessment is correct, the next upward phase of the short-term waves should take the metal back above the 2203.00 swing top into what looks to be the early-April timeframe. On or after that, the metal will then be set for the next decline of significance, expected to come from the aforementioned 72-day cycle.

Gold’s Bigger Picture

From the comments made in past articles, the overall assumption was that the most recent correction with our 72-day wave would end up as countertrend, due to the position of our larger 310-day cycle – shown below:

Our 310-day cycle last bottomed back in October of last year (where it was projected), and with that has been seen as pushing higher into late-Spring to early-Summer of this year. In terms of price, I have mentioned in past months the potential for Gold to reach up to the 2270-2300 level, simply based upon the average rallies with this cycle.

With the above said and noted, another 72-day top made on or after early-April would seem favored to give way to a countertrend correction on the next downward phase of this wave. If correct, a final push back to higher highs for the bigger swing should ideally play out into what now looks to be the Summer of this year, before peaking our larger 310-day component.

For the mid-term picture, once our next 310-day cycle top does form, a larger percentage decline would be expected to play out in the months to follow – a decline similar to the one seen from the May, 2023 peak into October, 2023 bottom. In terms of time, this decline is likely to play out into (tentatively) the Spring of 2025, with more precise details of how this decline will unfold, posted in our Gold Wave Trader report.

Jim Curry

The Gold Wave Trader

Market Turns Advisory

http://goldwavetrader.com/

http://cyclewave.homestead.com/

********