Gold trading above $10,000 and silver near $300 is where President of Financial Sense Wealth Management, James Puplava sees prices later this decade, according to his Big Picture Update titled: Unsustainable.

At the turn of the century, when gold was below $300, he correctly predicted the 10-year bull run in precious metals, expecting gold to reach new all-time highs above $1000. In hindsight, he admits his call was conservative as gold nearly achieved $2000. The lesson to investors is simple: when this man speaks, you’d be wise to listen.

In this article, I’ll discuss the demographic factors supporting much higher precious metal prices and why I believe gold may be on the verge of a Major Breakout.

The Paradigm Shift

The world changed forever in 2020. Covid was the trigger, but the real reason was demographics. The largest and most productive generation the world has ever seen retired. We must understand this because baby boomers will continue to drive the economy into 2040.

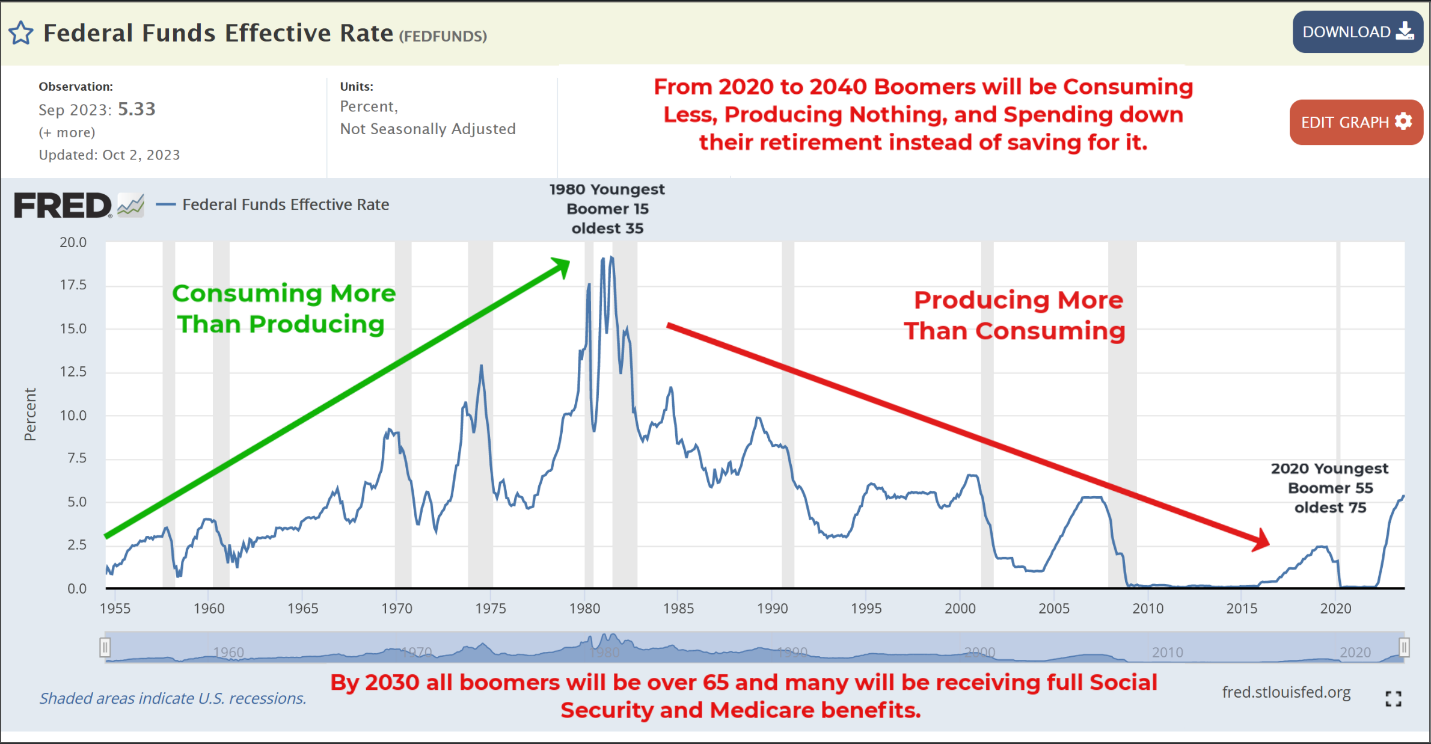

One of the simplest ways to visualize the impact of the largest generation on the economy is through a long-term chart of the Fed funds rate, which tracks inflation, a byproduct of consumption and production.

Below, you’ll see inflation rising sharply from the 1950s to the early 1980s. The world consumed more than it produced as this generation came of age. Around 1980, the boomers began entering the workforce, and we shifted to producing more than we consumed. That ended in 2020 when the average baby boomer retired.

The Chinese Miracle

Over the last 30 years, the world has experienced unprecedented productivity. China was the world’s factory, and we achieved peak efficiency through global supply chains. Inflation was non-existent. The disinflationary trends were so strong that during the 2010s, central banks lowered the price of money to (or below) zero.

The demographics in China are dreadful. For every baby boomer born in the US from 1946 to 1965, approximately 1.5 children were born in China. This workforce is largely retired, and it’s unlikely China will remain the worlds growth engine.

The Next Great Depression

ITR economics has been predicting a global depression between 2030 and 2036 for several years. Nothing as severe as the 1930s but a prolonged period of below-trend growth.

Why are they predicting it to start in 2030? Because that’s when we hit the next demographic milestone: All baby boomers will be over 65, and most will receive full Social Security and Medicare benefits.

What’s Next?

The unprecedented rise in the stock market since 1980 was a byproduct of peak productivity, declining interest rates, and millions of baby boomers saving for retirement. That ended in 2020, and we are in a new paradigm of higher inflation, anemic (real) growth, expanding fiscal deficits, commodity shortages, and rising geopolitical tension.

The appetite to address these problems is nonexistent, so governments will likely continue to print money to paper over their problems. Ultimately, I believe the dollar will be sacrificed, and a better economic system will emerge out of the 2030s, something that perhaps replaces central banks.

Precious Metals Update

GOLD WEEKLY CHART: The weekly chart formed a bullish morning star pattern, and a strong close above the dashed trendline would support an attack and potential breakout above $2090 before year-end.

Note the price action leading into the breakout above $1375 four years ago. A sustained advance above $2090 would support a $3000 price target for Q3 2024.

GOLD DAILY: The final washout I warned investors about ended quickly, and prices are back above the downtrend line. Gold could consolidate around $2000 for a few days, but a breakout above $2090 is becoming increasingly likely before year-end.

SILVER DAILY: The final washout in precious metals triggered a false breakdown in silver below the 1-year trendline. Prices have recovered, and we expect a bullish breakout above $26.00 before year-end.

GDX DAILY: Gold miners measured via GDX tagged the lower channel boundary and exploded higher once the washout was complete. Progressive closes above $30.00 would confirm a bullish breakout. If gold reaches our $3000 target for 2024, there’s no telling how explosive the move in miners could be.

Conclusion

The final washout in metals and miners is complete, and we may be entering the beginning stages of a powerful advance.

When gold breaks above $2100, I don’t think it will stop until it reaches $3000 in 2024. Gold miners could launch from here.