For the past two weeks, US interest rates have rocketed higher… yet gold has basically traded sideways.

This is one of many signs of underlying strength in the gold market.

Double-click to enlarge this stunning “rates and gold” chart.

Gold’s price action can lag interest rate changes… or lead them. It’s possible that the current sideways action in gold suggests that US rates are peaking.

That’s good news for all gold and silver bugs.

It’s also possible that the price action hints that a new wave of inflation is imminent. Could it be like the inflation surge that happened when the Ukraine war began?

For some insight into this key matter,

Double-click to enlarge. The first phase of the war saw the dollar surge against the ruble and…

The technical groundwork has been laid for a repeat of that surge again.

What about oil?

Double-click to enlarge. There are two rectangles in play on this daily chart for oil. They look like base patterns more than continuations.

A move to $93-$100 looks increasingly likely.

America’s favourite draft dodger and elderly war worshipper is of course Joe Biden, aka “The American Chucky Doll”. It appears that he has successfully dumped enough oil out of the nation’s Strategic Petroleum Reserve (SPR) to keep oil (and thus pump gas) from surging. That means most citizens stay relatively quiet while he sends debt-funded cluster bombs to future Ukraine playgrounds.

Unfortunately for him, and fortunately for the citizens of Ukraine that he hasn’t ruined yet, there’s a limited amount of oil in the SPR.

At some point Joe will have to stop dumping SPR oil and when he does… US inflation should move higher very quickly.

That will cause “stagflated” US citizens to rise and demand an end to this insane war. Gold could trade significantly higher during this period of turbulence.

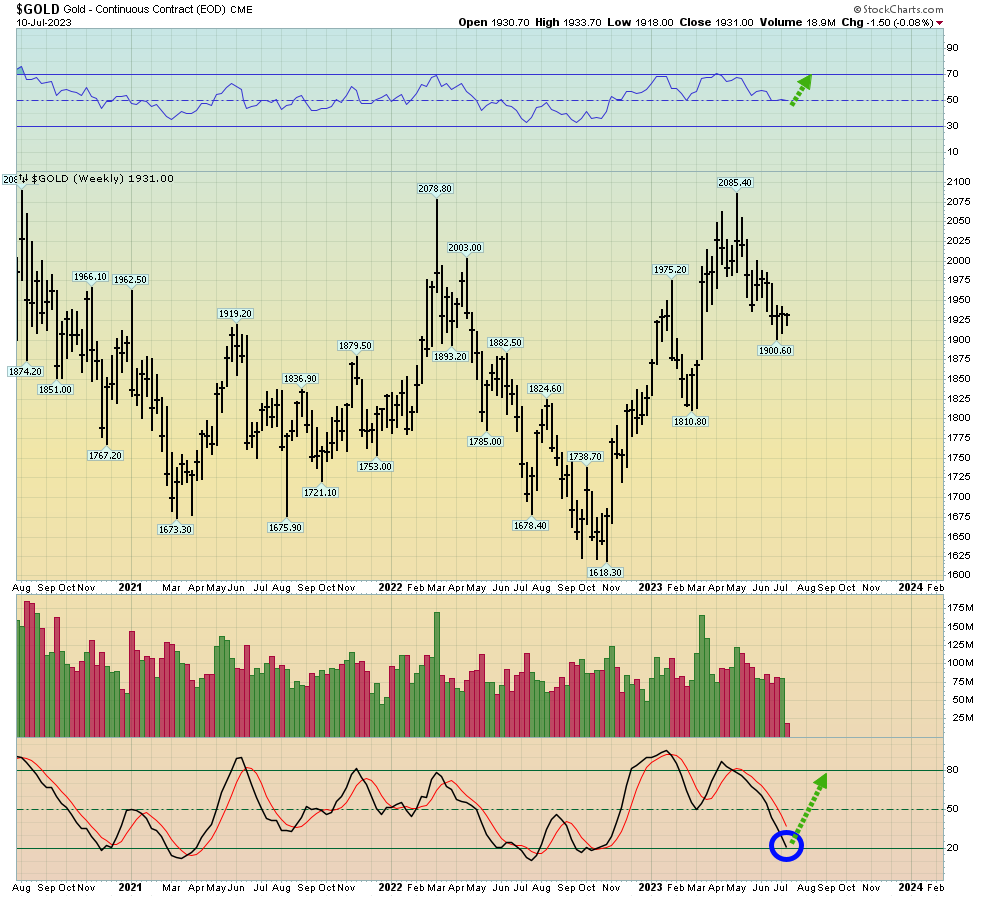

For a look at the weekly gold chart,

Double-click to enlarge. Note the position of the RSI oscillator at the top of the chart and Stochastics at the bottom.

When weekly chart RSI bottoms around 50 as Stochastics bottoms around 20, it’s typically a sign of a strong market for gold.

A daily focus on the big picture is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape. I cover this big picture 5-6 times a week with updates like this one, in my flagship Galactic Updates newsletter. At $199/year, investors feel the price is too low, but I’m offering a $179/15mths “special offer” that investors can use to get in on the winning action and meticulous analysis. Click this link to get the offer or send me an email and I’ll get you a payment link. Thanks!

Double-click to enlarge this DXY (dollar index) chart. A move under 100 would activate a descending triangle pattern and likely coincide with a huge rally for gold against fiat.

Double-click to enlarge this short-term SGOL (gold ETF) chart. Key moving averages have flattened out as an inverse H&S pattern comes into positive play.

As a loose rule of thumb, Tuesdays tend to be soft for gold, but today could be an exception.

Given all of the above, it’s clear that investors need to be gold and silver market nibblers, at a bare minimum. Gamblers can go larger, with a stoploss.

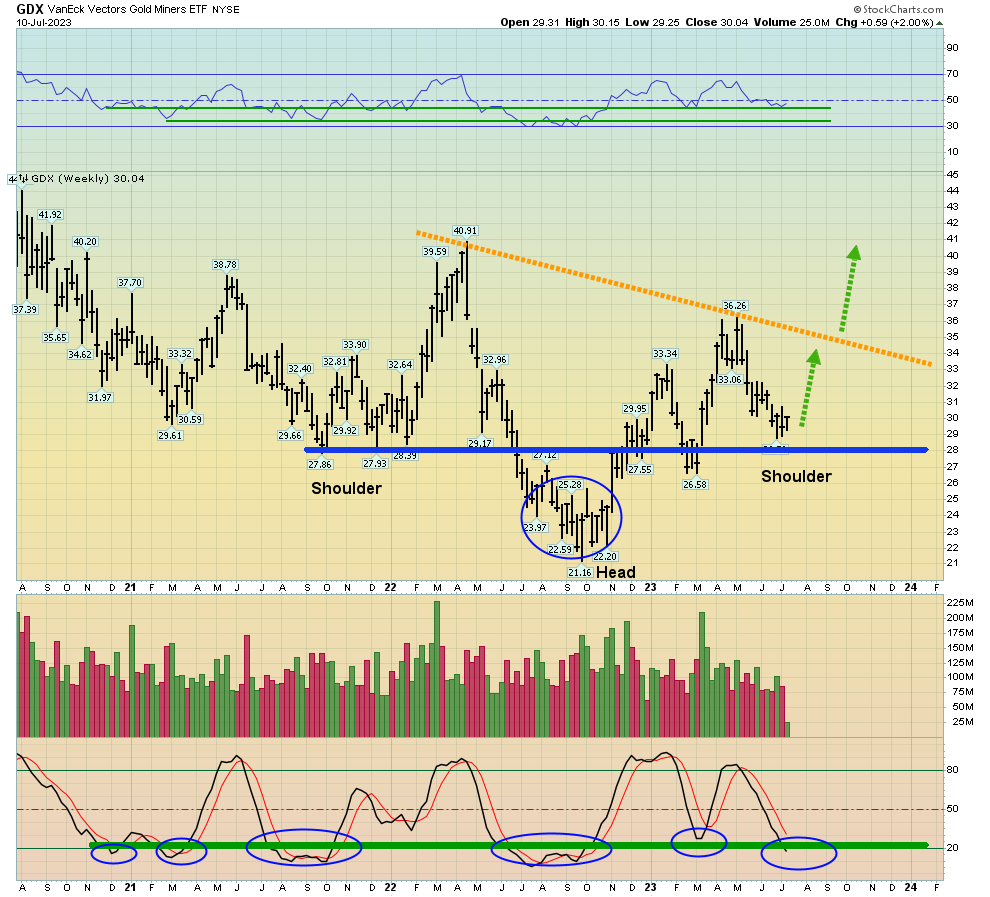

What about the miners? The mining stock charts are at least as impressive as gold.

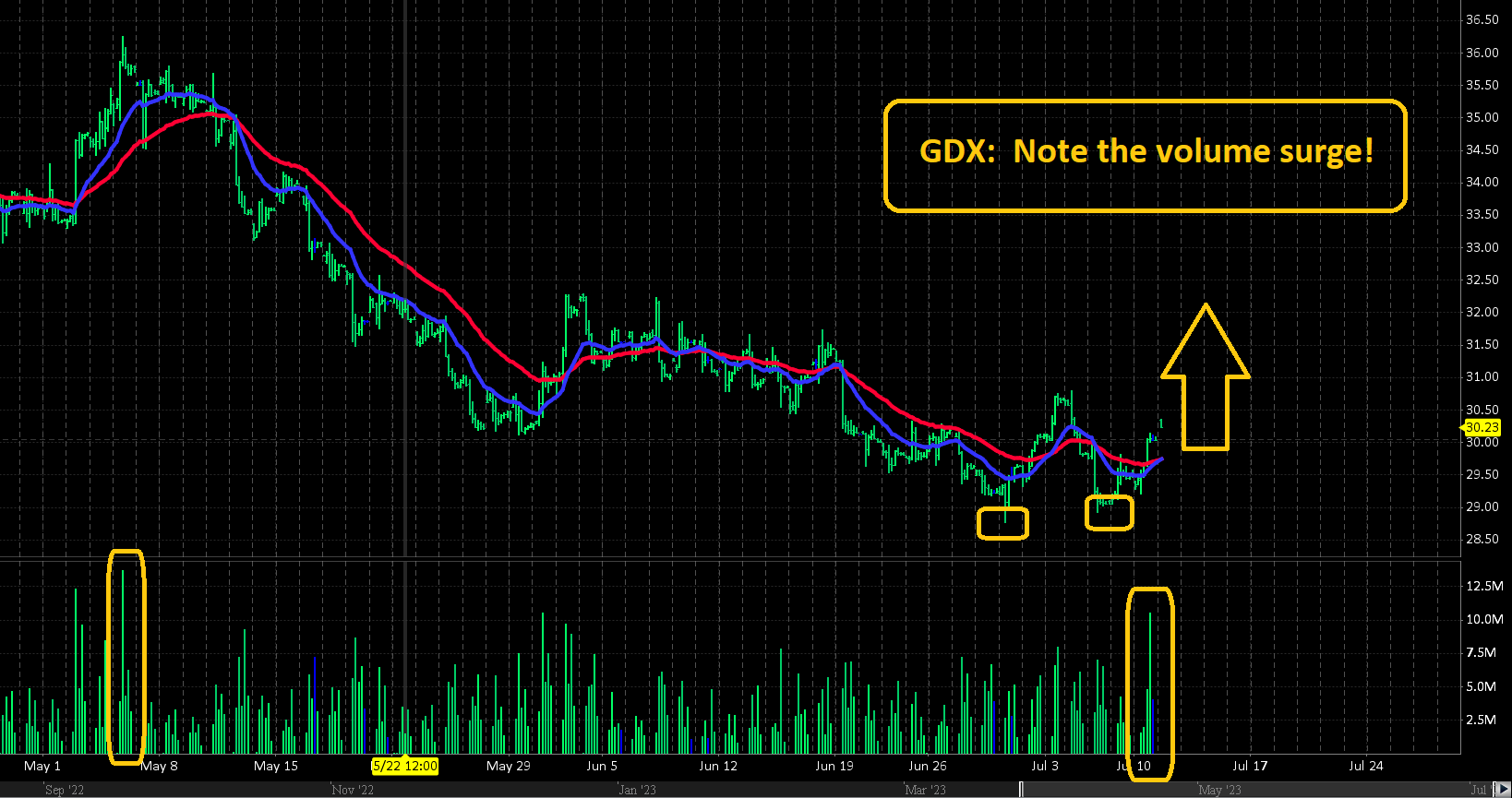

Double-click to enlarge this short-term GDX chart. There’s a double bottom pattern in play, and volume surged yesterday with key moving averages set to flash a fresh buy signal.

Double-click to enlarge. The short-term chart looks good, but this weekly chart is much more important… and it looks very positive as well.

The bottoming Stochastics oscillator for GDX suggest all gold stocks enthusiasts should be nibblers here and now, and more aggressive investors should consider some meatier buys!

Thanks!

Cheers

St

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Get Jacked With J!” report. I highlight key GDXJ stocks that could surge after Fed man Jay’s speech this week! Both core and trading position tactics are included in the report.

Stewart Thomson

Galactic Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********