The sun rose the next day. The end of the world did not arrive on Trump’s electoral triumph. The Trump trade actually worked. Why did mainstream media, pollsters and some normally savvy investors get it so wrong? Maybe America is not as polarized. Maybe the fear mongering was just politics.

Simply, voters again and always vote with their pocketbooks. The Democrats simply forgot politics 101 – “it’s the economy stupid,” ignoring voters’ discontent over the economy. Ironically while voters rejected the Democrat’s interventionist and spending policies that brought inflation and high deficits, Americans elected a man that will make inflation even worse.

The new electoral map saw president-elect Trump gain ground in 48 of 50 states. In addition, he became the first Republican to win the popular vote since George W. Bush in 20 years. He rang up big numbers in traditional Democratic-controlled states and even swept the swing states. Republicans gained a majority in the House of Representatives and control of the Senate, giving Trump’s party the trifecta of American politics.

Abortion was to be an issue but voters only increased protection in seven states. In fact, Trump surprisingly broadened his appeal increasing the women vote, black vote and Latina vote, once a major part of the Democrat coalition. Divided States of America? November 5th, they were united on the need to be heard. Democracy was saved.

All The President’s Men

Mr. Trump’s Cabinet nominees are largely anti-establishment types promising disruption and sweeping changes. Most are Wall Street billionaires with Trumpian cadres like John Paulson and Cantor Fitzgerald’s Howard Lutnick in the inner circle. There have been billionaires before, Ross Perot and Michael Bloomberg. This time the richest man in the world, Elon Musk is head cheerleader and his staunch support of Donald Trump gave him a seat at the White House table as well as head of yet another bureaucratic agency, Department of Government Efficiency (DOGE) designed to shrink the vast federal bureaucracy tasked ironically to implement his legislation. And then there is that other Kennedy, anti-vaxxer RFK Jr. who has targeted Big Pharma and will head the government health agency. As Secretary of State, Trump selected China-hawk Marco Rubio promising hard talks ahead. To push the envelope, he also sent Fox TV host Pete Hegseth, who believes that women shouldn’t fight in the military, to the Pentagon. Mr. Trump’s nominations is open warfare against the “Deep State” and, subject to confirmation by that other arm of government, the Republican controlled Senate.

Now the job begins.

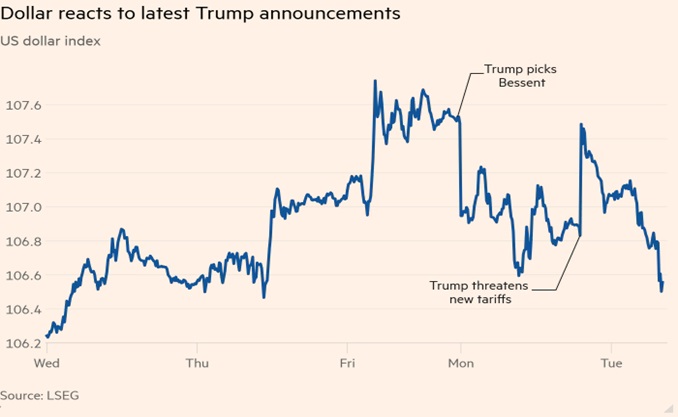

The stock market greeted the victory rising to record levels, the dollar soared and a new dawn emerged. The honeymoon will be short. We think that sweeping 1930s tariffs, tax cuts, and larger deficits will rekindle inflationary pressures after the worst inflation in a generation that hasn’t been subdued yet. In his first term, Trump’s actions rarely matched his rhetoric as his 2018 tariffs widened the trade deficit and markets sank from January to August. This time, as he has reshaped the Republican party in his own image, so will he do with government. Ironically while inflation was a big part of voters’ unhappiness, it will get worse under Mr. Trump. America wanted change, they are going to get it.

Tariffs, Tax Cuts and Trump

And this time, the best quant models or algorithms won’t help investors. Instead, investors will need a sense of history, sociology and psychology to protect their assets. Starting with his first term, the president-elect is set to remake the world in his vision, testing boundaries. To be sure the Western-led multilateral order is at an end as Mr. Trump pivots America to its isolationist past. August bodies established after the Second World War, such as the World Bank, International World Trade Organization and military bodies like NATO will undergo change.

Going back to the 1980s, Donald Trump described himself as an unrepentant “Tariff Man” and “Free Trader” who views 19th century-style tariffs as a bludgeon to increase US market dominance, the solution to what ails the US. He promises again to build a wall, a tariff wall. And as part of his MAGA economic agenda, he wants to lower corporate taxes and even mused to abolish income tax. However if successful, his punitive tariffs on everyone would have limited impact on the trade deficit and only deliver half of income tax revenues.

We have been here before. The “Roaring Twenties” was a decade of economic prosperity, income and racial inequality, and a Gatsby-like period of exuberance. While Europe was rebuilding after World War I, America benefited from electrification enabling radio which transformed communication like the internet of today. Technological and manufacturing efficiencies allowed the production of cars for the masses. The stock market boomed and new financial vehicles such as investment trusts were created. The historical record also showed that the last time a Republican president Herbert Hoover, and a Republican-controlled Congress raised hefty tariffs (Smoot-Hawley) to help American farmers and businesses, it was the largest single increase in taxes during peacetime which precipitated massive retaliation by foreign governments and the catalyst that helped cause the Great Depression. The Dow Jones plunged 89% from 1929 to 1932 as output collapsed by a third. Unemployment reached a quarter of the population. It was a global catastrophe. Britain went off the gold standard in 1931 and Germany saw the rise of Hitler.

Following the Great Depression in order to avert another collapse, bankers from 44 nations gathered in Bretton Woods, New Hampshire and established the International Monetary Fund, a new monetary system centred on the dollar, and other organizations like the World Trade Organization. Back then exchange rates were fixed and the US dollar was tied to gold. However in 1971, faced with rising international indebtedness, the US severed the linkage to gold and floating exchange currencies to accommodate a profligate US government. And now, a mere 100 years later, will history repeat itself?

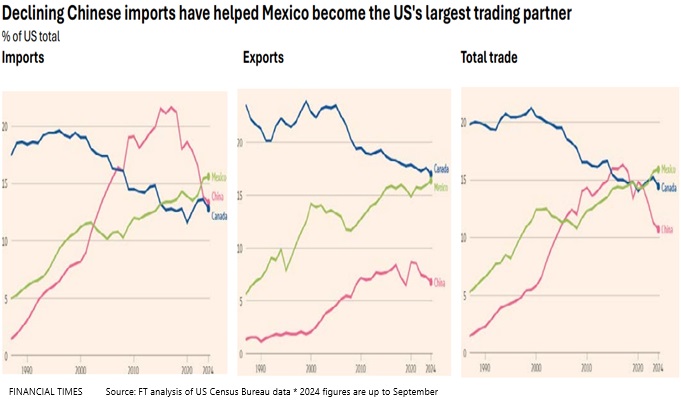

We believe that with a new sheriff in town, the mercantilist push for new levies will radically alter the post-1945 world order. Yet Mr. Trump is a transactional type and the “Art of the Deal” salesman relishes in the “give-and-take” negotiations, so make him a deal he can’t refuse might prove to be a winning strategy. While Trump’s first term triggered an adversarial approach that triggered the US-China trade war, a 60 percent tariff on some $430 billion in goods imported each year would hurt both economies and also fuel inflation. Companies have already moved from China, shifting production to Vietnam, Indonesia and Mexico. Others are stockpiling goods, holding a higher level of inventories adding to costs. On social media the president-elect’s opening salvo was to impose 25% tariffs on all imports from neighbouring Canada and Mexico which would abrogate the USMCA agreement as well as 35% tariffs on Beijing, America’s biggest trading partners. Will Trump be the deal maker or Trump the competitor?

The Greening of China

Mr. Trump believes that his tariffs will narrow America’s trade deficit, whilst doing little damage elsewhere. Despite the previous round of levies, the trade deficit actually grew 17 percent and talking about trade barriers was easier than erecting them as American farmers and exporters pleaded for relief. Also, in reducing the deficit with China, increased deficits with others. Last year, Mexico overtook China as the biggest importer. True, tariffs might be a negotiating gambit, but retaliation hurts everyone, particularly if iPhone prices are set to go up by 60%.

In the interim, China has overtaken the West and has effective control over the processing of key minerals needed for green technology, while also grabbing a lead in everything from manufacturing solar panels to batteries to EVs with unbeatable prices. While the Trump administration is expected to slap onerous tariffs on Chinese imports, it leaves the US an expensive and inflationary problem of catch-up, at a time when climate change is relegated to the back seat, particularly when China’s manufacturers take an increasingly larger global share, resulting in higher prices for American consumers.

There is more. In the need for a scapegoat there is the demonization of everything Chinese, amid a new era of trade restrictions, economic nationalism and mutual suspicions. There is a different reality. Thanks to its own five-year industrial policy, China relies heavily on manufacturing and exports to boost an economy hit by weaker consumer demand, following the property downturn and punishing tariffs imposed to even the playing field. Another reality is that China’s technological advances in greening their economy underpinned its exports as well as decarbonize their economy. China produces more clean energy than any other country. In addition, China has more savings than the US, and in a debt-bubble world, is that so bad? The Chinese have also become creditors to the world whilst the US has become the world’s largest debtor.

Worrisome is that climate change is one issue that despite Trump calling it a “Chinese hoax,” the widespread damage has cost billions. Hurricanes, typhoons and torrential rains have become the norm as our waters heat up, helping form hurricane-like conditions devastating both coasts. That hot air did not come from Washington or London but the warming of the seas which has resulted in a build-up of energy that can only be released via evaporation and, thus the storms. Trump’s election will imperil climate change and the failures of the G20 summit and COP29 is yet another sign of the end of global co-operation.

As for the tariffs, China will retaliate. Retaliation leads to escalation. China has a range of measures including blacklisting companies such as Apple or Elon’s Teslas or stop buying Boeings or agrifoods from US farmers whose largest buyer is China. China could introduce its own tit-for-tat tariffs or cut off American companies’ access to crucial supply chains or critical minerals. China could even dump its US Treasuries causing havoc in the markets. It is a two-way street and the cold war between the two biggest economies will be costly for all. But the ultimate tariff buster is exchange rates. The US dollar has been the strongest currency in the world, offsetting in part any export advantage by tariffs. In turn, China could allow the yuan to fall against the dollar, giving its exports yet another advantage raising the risk of a Thirties-type competitive devaluation currency war. Nonetheless, no matter the scenario, the Trump years promise more uncertainty, more volatility, heightened geopolitical rifts and his spending policies will add fuel to the inflationary fire. Gold will be a good thing to have.

Trump Redux

The power brokers of Wall Street and corporate America are cheering the end of an era. Europe’s car industry is the backbone of the EU economy, employing 13 million workers. Profit warnings and closure of Volkswagen’s first plant in 80 years reflects not only the belated swing to EVs but also the slowdown in Europe and China’s markets. In America, the slow adoption of EVs reflects that they only made up about 9% of new car sales in the third quarter, despite Biden’s $7,500 a car subsidy. Trump’s victory will scrap that subsidy in addition to dismantling Mr. Biden’s regulatory activism, including his hallmark Inflation Reduction Act centerpiece. Although the S&P 500 is up 70% over the Biden era, Big Business is celebrating the new environment on hopes that the Biden era of activism, including high-profile anti-trust and securities law enforcement agencies will be reigned in.

Adore him or abhor him, Mr. Trump will be a catalyst for change with the world fracturing along a broader geopolitical alignment. Protectionism is one of Trump’s main likes. But it is not all about the adversarial battle between China and the US. Trade accounts for more than 60 percent of world GDP, yet the world doesn’t seem to be getting along with each other. In his first term, Trump negotiated the trade agreement with South Korea and the trade deficit has gotten worse, problematic since South Korea’s national assembly voted to block the President’s shock declaration of martial law. Within a fragmented global economy, there is political dysfunction in the UK, France and Germany. The gap is getting wider. Consider the headlines in Germany and Italy over the potential takeover of iconic Commerzbank by Italian-based Unicredit which is acquiring rival BancoBPM. Germany, once Europe’s powerhouse, is experiencing a recession as falling production in energy intensive sectors and growing competition from China hurts Germany’s auto exports. Or there is American opposition to the proposed acquisition of US Steel by Japan’s Nippon Steel. A ruinous Trump tariff war will only accentuate the differences, in part because of the lack of cheap import substitutes. Capital too will be restrictive as sanctions and tariffs alter the flows of capital, undermining efficiencies of the global capital ecosystem.

However, there are other pillars of isolation besides the US. In self-defense, China has turned inward, reducing its dependence on US markets. China has a tighter control of its economy and has emphasized a made-in-China policy from AI to EVs to food security. While the West wastes tens of billions of dollars replicating expensive battery plants and electric vehicles, China is a leader in self-sufficiency and renewable technologies. Where are the high-speed trains in North America? Ironically, China has moved to a multi-polar world while the US shifts to unilateral action. Regional commerce has increased but flows between the US and China have decreased. For instance, in addition to making many portfolio investments in Africa and Asia, China has enlisted 22 resource-rich Latin American and Caribbean nations in its Belt and Road Initiative (BRI). China-led BRICS group added new members at the Kazan Summit in Russia and the group represents some 46% of the world’s population and 20% of global trade, eclipsing the G7. Economic zones like Peru’s billion-dollar Chancay megaport and a proposed new currency is part of the remaking of the world’s financial plumbing system. HSBC recently joined China’s CIPS international payments system, an alternative to Western dominated SWIFT payment system.

Guns and Butter Has Returned, Bringing Inflation

In a throwback to the past, Mr. Trump’s isolationist “America First” policies are helping to facilitate all of this. And after decades of misadventures in Vietnam, Afghanistan and Iraq, Mr. Trump promises to end the Ukraine war and Israel’s Gaza war. Peace in our time? More likely since America has long ceased to be the hegemon, his hard-nosed realpolitik approach will exacerbate an already unstable international world order.

The world is becoming more dangerous. Putin knows that the West’s gung-ho misadventures searching for weapons of mass destruction (WMD) ended in retreat (Iraq and Afghanistan). Sanctions replaced guns. Pointedly a victorious Putin amidst Trump’s preoccupation on domestic issues could decide to again enlarge his borders, beginning with the Baltic corridor or Moldova to reestablish the Soviet Union. NATO with an empty arsenal is too preoccupied with its own existence.

The widening conflict in the Middle East and the 1,000-day Ukraine war has absorbed the West’s resources, armaments and attention as a multi-lateral axis emerged. President Biden’s decision to allow Ukraine its long-range missiles raises stakes in the endless war. The deployment of North Korean forces to aid Russia’s war effort is also unsettling since it threatens to further internationalize the fight and upset the fragile equilibrium in East Asia. But tighter ties could lead China into a replay of the Cold War in the 1950s, when China, North Korea, and the Soviet Union formed an alliance against South Korea, Japan, and the United States. China entered the sphere of great power relations in 1972 as a counterweight to the Soviet Union, thanks to Richard Nixon’s opening of relations with China. That succeeded but Russia’s invasion creates another dynamic. While Mr. Trump’s pending arrival has altered the dynamics over a war that has stoked instability from Europe to Asia, maybe another visit by a Republican president is needed to restore the balance of power between the US, China and Russia.

What’s Old Is New Again

Under Mr. Trump, the US oil industry is set to benefit from lower taxes, reduced emission caps and incentives for more production as Mr. Trump’s “energy dominance” strategy will make American industry great again. Ironically Canada is going the other way proposing an emission cap on its oil and gas industry which would not only curtail needed investment but raise domestic costs and prices. Canada also embarked on a path of more regulation, increased taxes and ambitious net zero targets that would cripple our domestic energy producers. At a time of competition for investment, Canada is an ideal target for Mr. Trump risking a serious backlash, and more tariffs from the president-elect and GOP controlled Congress. Canada has even taxed digital media which will run afoul of Big Tech, USMCA and Mr. Trump. Change is coming. In addition to 25% tariff hike, Canada faces major challenges because “friendshoring” is no longer friendly.

Not only are America’s finances in trouble but others too like the UK and France are stretched. The French government is on the brink of collapse. Europe, no longer dependent on cheap Russian gas is now connected to the volatile and expensive global energy markets that exposes them to the tug of war for sea-borne fuel with Asia. In a throwback to the fiat French inflation in the late 1700s, the UK has put “land” on its balance sheet so it could borrow more. Germany faces another recession after having lost its cheap energy advantage. And now Mr. Trump’s anti-war tendencies and promise to end the Russia-Ukraine war creates new uncertainties for Europe. Ironically in the interim, the US has replaced Russia as the largest exporter of LNG, providing almost half of Europe’s needs but at a higher price. Unsettling for Europe is that the Trump victory jeopardizes NATO, the protector of Europe’s border. Eight years ago, Trump castigated its members for falling short on their commitments and it will be hard to fill the vacuum if America declines to perform that task. What would an embolden Russia do? Then there is that other front, the Pacific where America is undercapitalized, risking a maritime fight 5,000 nautical miles from its naval base which would require a major investment in maritime infrastructure and people.

America, the Bubble

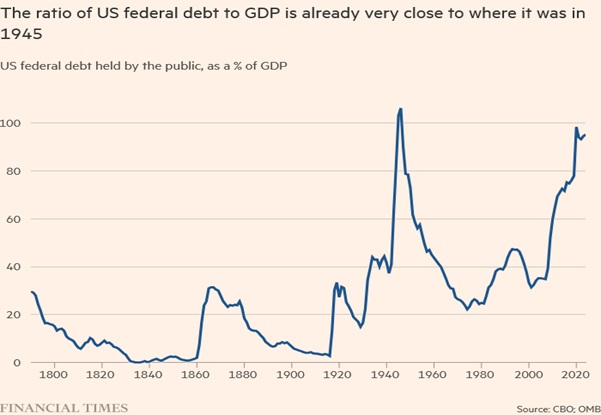

The cost will be high. US protectionism comes at a time when Mr. Trump must also deal with America’s staggering mountain of debt with refinancing risks triggering a meltdown, surpassing that of the 2008 Wall Street financial collapse. In his first term, President Trump oversaw the most significant fiscal expansion in US history, massively increasing the supply of high-powered money. Today US debt stands at $36 trillion, much larger than its economic output and up $33 trillion from 1989, Taylor Swift’s birth year. That is 10 times the amount of debt amassed in two hundred years (1789 to 1989) history. While revenues are stable, spending has reached new highs as a percentage of GDP. The Federal Reserve enabled that profligacy with “free money” which became the foundation for the worst bout of inflation in decades.

Following the election, US debt is set to grow with a deficit to GDP at a whopping 8% or 4 times past norms, coinciding with an expansionary fiscal policy putting further upward pressure on Treasury yields. Cutting taxes is easier than cutting spending. And exacerbating the perilous state of finance is a spending problem with government expenditures set to grow faster than revenues which will be a challenge for the billionaire fund manager Scott Bessent, a former Yale economic history professor and current Treasury Secretary-elect whose “3/3/3” agenda’s goals would increase US oil production by 3 million barrels per day, achieve 3% economic growth, and reduce the budget deficit to 3% of GDP.

The Committee for a Responsible Budget, on the other hand, estimates that Trump’s unfunded tax cuts will cause instability in the $27 trillion Treasury market by adding $7.5 trillion to an already substantial debt load over the next ten years. America’s growing national debt is unsustainable because it crowds out the private sector and reduces investment. None of that debt will be paid back. US borrowings to fund consumption rather than investment is unsustainable, particularly since the new Commerce Secretary, Howard Lutnick promises to use the nation’s balance sheet to “drive” revenues. If US economic growth is strong, why cut rates? At the same time Mr. Trump promises an epic deregulation, dismantling and neutering many of the institutions that were brought in to stabilize the financial system after the 2008 crises. Today, a frothy stock market wave of financial innovation and growth of derivatives not only helped create a billionaire class but pushed up market valuations. Of concern is that dismantling the guardrails amid those stretched valuations and growth “at any cost” is reminiscence of the aforementioned Roaring 20s, which of course ended with the Great Depression. Déjà vu?

The Trouble with American Exceptionalism

Donald Trump’s DNA as a real estate developer is to use other people’s money (OPM). Today as president, his fiscal strategy promises more government money to finance his tax cuts and spending which will be deficit-financed by other people’s money. We believe however that time has run out of the prospect that America can grow its way out of indebtedness. US deficits are so large that the ratio of debt to GDP of 130% is made worse by the fact that the government must roll over $9 trillion or at a third of its debt next year. Ironically his tax cuts will generate more demand for imported goods leaving the Fed to use its balance sheet at $8 trillion as a debt financing mechanism to finance not only America’s growing deficits but the cost of entitlement programs which have climbed faster than federal revenues.

Price increases are to come. In 2021, Covid supply chain disruptions pushed US inflation from 2% in early 2021 to 7.2% by June 2022. Then Joe Biden’s greening of the economy pushed inflation higher. This time, Trump’s policies are set to reignite inflation for a second time in five years as demand-driven inflation is exacerbated by the Trumpian supply-side shocks. Mr. Trump’s campaign promise to renew his 2017 tax cuts will cost $5 trillion and doubling down, he wants to further reduce business tax breaks from 21% to 15%. Revenues? Those punitive tariffs? Last year the United States imported $3.1 trillion in goods. However slapping a 20% tariff would net only $620 billion, far short, leaving the Fed to take up the slack. With the Fed abandoning its program of quantitative easing, there are even fewer buyers, particularly since that task was left to foreign buyers like China who have instead, sold America’s debt. That leaves Wall Street private equity and fickle hedge funds to finance an uncertain environment beset today by bond market vigilantes.

Stock markets celebrated Trump’s decisive victory with the dollar hitting six-month highs. Markets too appear unfazed by Mr. Trump’s promise of higher tariffs and massive tax cuts even though the prospect of higher inflation from tariffs spooked Treasuries. Markets also are unbothered by prospect that the Fed could lose its independence, particularly at a time when the Treasury needs market co-operation. Sooner or later, America’s red ink will exact a heavy price. To date market pricing has been benign, partly because the US dollar is the world’s reserve currency and the world needs dollars. In his first term Mr. Trump considered selling dollars to boost exports but US intervention would have shaken market confidence. This time he again wants a lower dollar but the weaponization of the dollar will not only exacerbate inflation but destabilize the world economy. Gold again will be a good thing to have.

In Gold They Trust

These days, Wall Street’s derivatives and cheap money have caused financial markets to become disconnected from the economy. Leverage accommodated by the Federal Reserve and the prospect of deregulation will only inflate already inflated asset prices. The consequence of the fragmentation of the US economy is a concentration of wealth and growing inequality. History shows that what begins as permanent fiscal disorder evolves into permanent monetary disorder.

Today there is a great deal of complacency. Earlier the rise in gold reflected that the investing climate was not well. Central banks were building up their war chests because gold is an alternative investment to the dollar. For others, gold is sanction-proof. Mr. Trump would like a weaker dollar if only to offset his large tariffs. However taxing imports discourages capital inflows needed to finance America’s twin deficits. A possibility then is that Mr. Trump could revive a grand bargain as happened in 1985, when five nations in a “grand bargain,” signed the Paris Accord to manipulate the dollar down. They succeeded but inflation soared and since then foreigners have questioned the dollar as a store of value. Ironically, he might not need a grand bargain to stop the de-dollarisation move. The US may be able to keep living on debt for years, even another term but one morning this could change. The sustainable is unsustainable. The loss of trust around the dollar cannot be stressed enough. Donald Trump’s threat to slap 100% tariffs on BRICS members if they dedollarise shows concrete concern over the dollar’s vulnerability. Tariffs to protect the dollar? He may get what he wished for. One can detect the decline of confidence in every part of the world. Inflation threats and geopolitical turmoil are real. The country may well be the divided states of America, but nothing is as good or as bad as it seems. The dollar is not forever. For central banks and investors alike, gold is an alternative to the dollar.

We believe that while gold has given up some gains following Trump’s victory (buy on mystery, sell on history), the pullback presents an ideal purchase opportunity. Technically gold has broken out through our short, medium and long-term moving averages. Gold’s fundamentals remain intact. Speculative positions have fled. The US has elected another inflationary president. No one stands for sound money. To us, the rise in gold is not a surprise. While $2,650 may seem high, it is less than 50% above the 2011 peak. Gold rose nearly 2,400% from 1971 to the January 1980 inflation high. From 2011, gold rose from $252 an ounce to $1,900 in 2011. Despite the correction, gold is up 35% this year and we continue to believe it will surpass $3,000/oz. The warning signal is clear, gold’s bull market has just begun.

Recommendations

Gold shares have lagged despite record quarterly free cash flows. Some have boosted dividends and others instituted buybacks. Balance sheets are strong and the miners have become “value investments.” Yet they are shunned by the Street. Part of the reason is geographic risk as some countries have plucked the golden goose by increasing taxes, raised royalties or outright nationalization. Another problem is the rising cost of reserve replacement and finally, while a rising tide lifts all boats, some such as Newmont are leaking from expensive acquisitions.

Once friendly jurisdictions are turning out to be unfriendly. There was Kyrgyzstan’s nationalization of Centerra’s Kumtor Mine which resulted in a paper settlement when control was “handed” over to the government. Mali’s military juntas’ shakedown of Australia’s Resolute Mining resulted in the payment of $160 million after detaining executives. The Mali junta also arrested four mining executives despite Barrick paying $85 million to “resolve” disputes. The Mali government changed the mining law in 2023 which retroactively boosted the government’s stake to 35% from 20% with the arrests an expensive way to do business. Then there was Panama’s Court blocking First Quantum’s $10 billion Cobre Panama which resulted in the suspension of mining. Closer to home there are permitting issues frustrating investors.

Red tape is holding up the development of Ontario’s “ring of fire” with different mining regulations despite Canada being a resource-rich country. Different provincial mining regulations also makes it more difficult for junior companies to obtain funding. While Canadian miners are facing desperate times, they also face obstacles in funding any discovery since it can take up to 15 years to obtain permits and financing to build the mines needed to meet the future demands of a net-zero emission world. Capital markets have also changed with formerly active mining fund managers and brokers no longer financing plays as markets instead support high growth technology ideas. Ironically Canada and others are spending tens of billions of taxpayer dollars to replicate EV battery plants that are already up and running in Asia at cheaper prices. Better that the tens of billions of government largesse instead goes to build and nurture a domestic mining industry to build future champions to fight Chinese rivals.

Then there is the grievous Canadian policy to ban Chinese investment which resulted in the move of Solaris to Switzerland after a “security” review blocked China’s Zijin Mining plan to invest $310 million in its Ecuadorian Warintza copper/gold deposit. Earlier Canada blocked investment in lithium juniors, notwithstanding that the assets were not in Canada. Juniors need capital and Canada’s draconian rules are chasing investment away. If not Chinese, expect more American defense dollars and who wins then? In Mexico, the world’s top silver producer, plans to block open pit mining and lifting of royalties to 8.5% which would impact $7 billion of investments according to the local Chamber of Commerce. Hopefully Canada won’t catch the Mexican flu.

Notwithstanding these obstacles, we believe that the gold mines are poised to outperform the metal. Reserves are declining and it remains cheaper for mines to replace those ounces on Bay Street than explore. Orla acquired Musslewhite for $850 million at a whopping $500 an ounce in the ground. Gold Fields bought Osisko’s Windfall project for $2.2 billion. Reunion in Guyana was bought by G Mining ventures at a premium price, without a feasibility study. In addition to miners buying each other in cannibalistic fashion, there are the sovereign buyers like China with Yintai outbidding Dundee’s bid for junior Osino Resources for $370 million. Simply there is more money than mines, with gold deposits having “scarcity” value.

Consequently we like the senior producers like Agnico Eagle and Barrick. Developers are among the next favoured group who are bringing on new mines over the next couple of years like B2Gold, Endeavour, McEwen Mining and Eldorado. Centamin was recently bought out at a premium as M&A activity is expected to continue with Lundin Gold, Skeena and Omai Gold among potential players in this game of musical chairs with few chairs left.

Agnico Eagle Mines Ltd.

Agnico Eagle had one of its best quarters with record free cash flow of $620 million and income of $1.14 per share at AISC of $1,300/oz. With 80 percent of Agnico Eagle’s gold production in Canada, the miner benefited from the lower Canadian dollar and strong gold prices which allowed them to reduce net debt to $490 million from $1.5 billion at year end. Contributions were strong from Macassa and Fosterville which achieved record mining tonnage offsetting lower grades. Detour Lake also set a record quarterly throughput. Meadowbank is expected to produce 480,000 to 500,000 ounces and Nunavut continues to perform well. Organically Agnico is developing several brownfield projects like Odyssey underground which should be completed by mid-year, Wasamac and Detour expansion. Hope Bay however is too far off in the future. Guidance is unchanged at 3.3 to 3.5 million ounces at $1,200/oz AISC. We like the shares here.

Barrick Gold Corp.

Barrick had a flat quarter, earning $0.30 per share generating free cash flow of $444 million on gold production of 950 million ounces at AISC $1,000/oz. Nonetheless guidance was reaffirmed with the ramp up at Pueblo Viejo JV in the Dominican Republic continuing as recoveries increase to 78 percent of nameplate capacity. Barrick’s results were disappointing. Growth is expected to pick up next year but at a slower pace than earlier expected. Barrick’s results include the closure costs of some of their older mines, which is an ongoing liability but often overlooked. Nevada Gold Mines JV had a solid quarter with contributions from its four operating mines with better grades at Turquoise Ridge. Barrick also shed light on its promising 100% owned Fourmile adjacent to Goldrush and a potential Tier-1 asset outside the joint venture. Down the road, Barrick’s Lumwana’s Super Pit expansion will double production and the feasibility study is to be released shortly. Reko Diq in Pakistan is also expected to be in production in 2028 boosting copper output. In Africa, Barrick’s largest gold mine Kibali is running on renewable power which is scarce in that part of the world. Of concern is that Barrick politics again clouds the outlook as they continue in negotiations with the Malian military government after four of its employees were “detained.” Barrick’s Loulo-Gounkoto complex is vulnerable. Noteworthy however over the last two years, Barrick has reduced debt whilst investing in its major mines, and returning some $5 billion to shareholders. With a focus on cost control, Barrick has an attractive array of high-quality Tier-1 mines and the senior producer has become a value play partly because of geographic risk. Nonetheless we continue to recommend the miner for its disciplined approach in replacing reserves.

B2Gold Corp.

B2Gold’s third quarter production of 181,000 ounces at AISC of $1,600/oz was in line with expectations. The Goose Back River project in Nunavut is slated to be in production in the second quarter 2025. Otjikoto and Masbate offset a weak quarter at flagship Fekola. Of note was Goose’s capex increased again to almost $300 million to $1.5 billion as development of the open pit and underground was impacted by inflation and logistical challenges. B2Gold’s balance sheet has $431 million cash on hand. Like Barrick, B2Gold was in extensive negotiations with the Mali military government and an agreement was reached for a one-time $30 million tax accrual payment. Royalties were also increased which unfortunately is the cost of doing business in that part of the world. Importantly, a new framework agreement allowed the go-ahead for B2Gold’s flagship Fekola and Fekola Regional, allowing exploration to proceed with the all-important Fekola underground starting mid next year. The key is the start-up of high-grade Back River whose all in cost will be around $1,100/oz and a company builder that will produce 150,000 oz/year with LOM plan growing to more than 300,000 ounces a year. We like the shares here.

Centerra Gold Inc.

Intermediate miner Centerra had solid results producing 93,000 ounces of gold and almost 14 pound million pounds of copper in the third quarter. Gold recoveries at Mt. Milligan slipped, however, Centerra has a strong balance sheet with cash and cash equivalents of $600 million and dusted off the Langeloth and Thompson Creek moly feasibility study to bring the moly business under one roof. At Centerra’s Öksüt mine in Türkiye, production was 50,000 ounces at AISC of $1,092/oz. Centerra’s feasibility study boosted the moly IRR to 22 percent based on a moly price of $20/oz, adding about 12 million pounds with a 12-year life at a cost of about $400 million. We are not impressed with the moly business nor returns. Centerra, having lost its flagship Kumtor Mine through an effective nationalization by the Krygh government, is hard pressed to replace those ounces. Mount Milligan and Öksüt are not adequate replacements, nor is the molybdenum business. Sell.

Eldorado Gold Corp.

Eldorado reported a third quarter of $0.35 per share on 126,000 ounces of gold production at $1,335/oz. The results were weaker than expected. Guidance was lowered due to poor recoveries at Kışladağ in Türkiye resulting in production of 41,000 ounces. Efemçukuru produced almost 20,000 ounces. Lamaque in Québec delivered about 43,000 ounces at a cash cost of $728/oz. However, the buildout at flagship Skouries in Greece continues with 1,000 workers on site including underground development. Eldorado has a growing production base with Lamaque, Kışladağ, Olympias and Skouries’ copper/gold project coming on stream in Q3 2025 at which time the shares will be revalued upward. Eldorado has sufficient liquidity of $885 million including $677 million of cash and cash equivalents to complete the build-out since Skouries is about 79 percent built. We like Eldorado for its growing production and Skouries. Buy.

Endeavour Mining PLC

West African player Endeavour had a disappointing quarter producing 270,000 ounces at an AISC of $1,300/oz from its five mines including Sabodala BIOX, Houndé, Mana and Lafigué which made important contributions. Nonetheless Endeavour maintained guidance at 1.2 million ounces at AISC of $1,200/oz. The lower results were due to lower grades at flagship Sabodala-Massawa mine in eastern Senegal. A preliminary feasibility study (PEA) is expected at Côte d’Ivoire’s Assafou deposit which is Endeavour’s likely next mine with 4.7 million ounces at 1.9 g/t with a mineralized strike of 3 kilometers. Endeavour generated positive cash flow of about $100 million in the quarter and repaid $160 million on their revolver. Endeavour plans to pay out $435 million in dividends this year and next, while maintaining an ambitious exploration programme targeting 12 to 17 million ounces. We like the shares here.

IAMGOLD Corp.

Mid-tier player IAMGOLD’s results were solid producing 168,000 ounces at AISC of $1,800/oz due to contributions from Côté Gold, Essakane in Burkina Faso and Westwood Québec. IAMGOLD generated positive free cash flow with the construction of Côté near Sudbury largely complete. However with an average grade at 1.02 g/t, cost control and development will be key. Grades at Essakane slipped but the mine was a strong contributor. IAMGOLD will produce 490,000 ounces with Côté in commercial production in August and Westwood is expected to produce about 120,000 ounces but costs at $1,900/oz are too high. Essakane had a good quarter producing 173,000 ounces, up from 109,000 ounces last year. IAMGOLD’s cash costs remain high with AISC at $1,800/oz. IAMGOLD ended the quarter with cash and equivalents at $553 million and have begun repaying debt. Execution at Côté is key, thus at current levels and an expected slower ramp up, we prefer Eldorado here.

Kinross Gold Corp.

Kinross had a strong quarter, reporting earnings of $0.24 per share with contributions from Fort Knox’s 70% owned Manh Choh satellite deposit which recently came in on stream but at disappointing AISC of $1,600/oz. Kinross produced 564,000 ounces at a cash cost of under $1,000/oz due to production from Tasiast and Paracatu. At Bald Mountain, the company is currently residual leaching since the mine has run out of reserves. La Coipa in Chile had a good quarter however. Kinross is making a big bet on the Great Bear project in Ontario with a PEA having a 12-year mine life producing 5.3 million ounces averaging 400,000 oz/year. Although the resource to date is only 2.7 million ounces and inferred of 3.8 million ounces, Kinross is spending a whopping $1.4 billion to complete the project that has sustaining capital of a billion dollars. While construction continues, not all permits have been granted. Nonetheless Kinross has sufficient financial capacity with free cash flow over $900 million that allowed them to repay $350 million of debt in the quarter. Given our skepticism of the big Great Bear bet, we prefer B2Gold here.

Lundin Gold Inc.

Lundin reported a strong quarter from the Fruta del Norte (FDN) mine in southeast Ecuador. Guidance was unchanged at 450,000 ounces with AISC under $900/oz. Cash flow from operations was $218 million. Lundin produced 125,000 ounces with mill throughput at 4,623 tpd at a whopping 10.3 g/t. Construction of the upgraded tailings pipeline was completed and commissioned in the quarter. Lundin produced 122,000 ounces in the quarter and its abundant free cash flow allowed the buyout of the Newmont stream credit facility for $330 million which was part of the project financing package to build FDN. Lundin Gold has an aggressive 80,000 metre exploration program with 10 rigs turning, including three underground. Results have been positive, in particular with the new discovery of the Bonza Sur deposit, 1 km south of the FDN mine. Bonza Sur grows as four rigs active focusing on a large mineralized system extending 2.6 kilometer in length, open in all directions and at depth. A resource estimate is expected next year and Bonza Sur could add a couple hundred ounces annually. Lundin Gold has a debt-free balance sheet, an exciting exploration programme and is one of the richest mines in the world. Buy.

McEwen Mining Inc.

Mine developer McEwen Mining had an improved quarter with cash flow up $23 million allowing for the expenditure of $5 million at Fox and Gold Bar and, $6 million at Los Azules, the large scale copper project in Argentina. McEwen Copper is working to complete the all-important feasibility study for Los Azules which is expected in the first half of next year. McEwen Copper will likely go public next year at a valuation that allocates nothing for all McEwen’s three gold mines. Los Azules is one of the 8th largest underground copper deposits in the world and with partners Rio Tinto and Stellantis, funding the deposit should not be a problem. We like McEwen Mining because it is an undervalued development player on a sum of the parts basis. Buy.

Newmont Corp.

Newmont shares underperformed due to disappointment over an earnings miss and costs that were more than 10 percent higher with AISC reaching $1,600/oz in the quarter on a slippage in production. Nonetheless Newmont expects to produce 1.8 million ounces in the last quarter at a more reasonable all in cost due to improved grades from Penasquito and Tanami. The sole bright light was Newmont’s surpassing its $2 billion “garage sale” target but having a book value of $5.7 billion. With the sale of Éléonore and $850 million from Musselwhite at a whopping $500/oz to Orla Mining, the remaining assets are the CC&V mine in Colorado, Coffee in Yukon and Porcupine mine in Ontario. However we believe it will be more difficult because the Porcupine mine has huge closure costs. In fact, Newmont discovered that after paying premiums for Goldcorp and Newcrest, one of the negatives of acquiring other mines is the expensive sustaining costs, higher capex and reclamation costs – thus the big writedowns. In addition Newmont learned that acquiring assets sometimes buys other people’s problems as well as the accompanying expensive closure costs. With so much shareholder destruction, Newmont shares have underperformed because the acquisitions were more problem-prone, producing not only higher costs that has resulted in billions of writedowns. In this case bigger was not best. Newmont will be in the doghouse for awhile. We prefer Barrick here.

John R. Ing

Please refer to the Legal Section of our website (maisonplacements.com) for our Research Disclosures for an explanation of our rating structure at https://maisonplacements.com/research-reports/

*********