Let’s start with this, courtesy of the “It’s Not About Us Dept.”

A week ago we herein thoroughly vetted the state of these Big Three eventualities: Gold’s stop, Fed’s pop, S&P’s flop.

Thus in the spirit of the late, great Meatloaf:  ““Two Out of Three Ain’t Bad“

““Two Out of Three Ain’t Bad“ –[1977] here’s a swift three-bullet update:

–[1977] here’s a swift three-bullet update:

- As penned for Gold: “…we can thus see the 1940s-to-1930s near-term…” price in turn this past week reaching down to 1942;

- As penned for the Fed: “…preparing for another +0.25% FedFundsRate pop…” which unsurprisingly came on Wednesday;

- As penned for the S&P: “…concluded its 34th day as “textbook overbought … akin to nearly falling off the edge of the Bell Curve…” now instead having extended through 39 days!

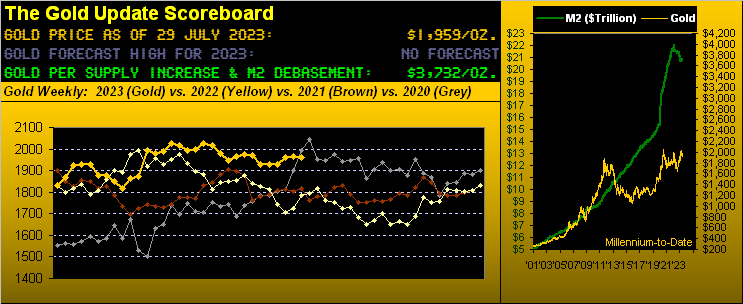

But wait, there’s more per this seasonal note: as July comes to a close each year, Gold is seeing its COMEX contract volume roll from that for August into that for December. Annually, this the largest volume transfer leap by months for any of the BEGOS Markets (Bond, Euro/Swiss, Gold/Silver/Copper, Oil, S&P 500). And given the increasingly higher cost of money, Gold’s contango this time ’round is a whopping +40 points, the largest we’ve ever witnessed for the August-into-December contract rollover. In round numbers, August Gold settled this past week yesterday (Friday) fairly “spot on” (if you will) at 1959; whereas December Gold settled at 1998.

“Such phenomenon arising from what, mmb?

We love Squire’s occasionally leading question toward making the author look good, (especially in this case as our good man ostensibly worked on vault design in Amsteg).

But ’tis quite simple: as interest rates rise, so in turn does the cost to storers of physical Gold; they thus pass such cost on to those obliged to purchase that Gold in the future. The point is: when we again meet in a week’s time, the change in Gold’s price for this ensuing week shall “benefit” from a +40 point bump … just in case you’re scoring at home. Moreover, such bump could lend enough “umph” to flip Gold’s key weekly parabolic trend from Short to Long. For the present, here’s the picture, the rightmost red dots of declining trend having completed their stint’s 10th week:

Either way, it being month-end (save for a day), scoring the most so far this year as we turn to the BEGOS Market Standings is again the ridiculously overvalued S&P 500, the podium positions still respectively rounded out by Gold and the Swiss Franc. And pity the poor ol’ Dollar: back at February’s end, the Buck placed third in this stack, from whence ’tis sunk like a leaden sack. Thus for you StateSiders contemplating that late-summer spree to The Continent: how’s that travel budget workin’ out for ya? Hat-tip ZurichSpots: the average cost of your two-sip espresso therein is CHF4.50 (i.e. USD5.20). Your five bucks “Gone in 60 seconds!” –[1974, Halicki Junkyard & Mercantile Co.] Here’s the table:

‘Course as we all know, the more Dollars there are, the less is their worth. And even as the Federal Reserve has shrunk the StateSide money supply (basis “M2”) by -6% from $22.05T (18 April ’22) to $20.76T (today), ’tis still nonetheless +34% net since the $15.45T level at the commencement of 2020.

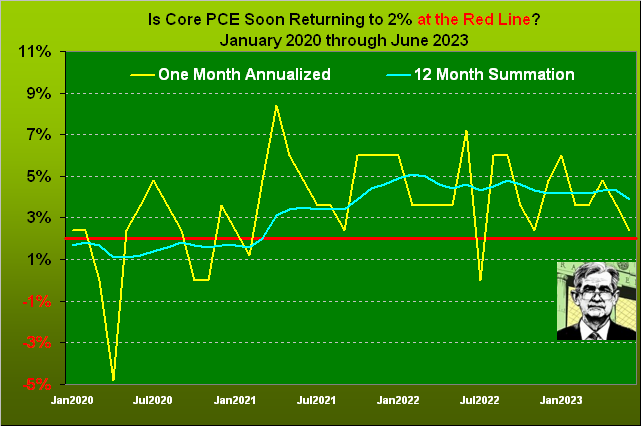

However, the rate of inflation by the Fed’s favoured gauge (Core Personal Consumption Expenditure Prices) is trending toward the 2% goal per the following graphic. Indeed, annualizing Core PCE for June (0.2% x 12) we’re nearly there at just 2.4%; but by the 12-month summation, ’tis still nearly double (3.9%) that desired by Jay Powell and his Merry Open Market Committee. How might this appear and be judged through July’s Core PCE (due 31 August) with the FOMC’s next Policy Statement (on 20 September)?

Too, there’s the old adage that “the rising tide of inflation lifts all boats” which (save for the price of the descending Bond, its yield thus rising) we next see via these grey diagonal trendlines across the last 21 trading days in going ’round the horn for all eight BEGOS components. ‘Course, the cautionary note now is the “Baby Blues” of trend consistency beginning to run out of puff…

Further, “a lot can happen in seven weeks”, including the Fed having to acknowledge a massive stock market “correction” … at least we continue to anticipate such. As we penned away back on 28 January with respect to the S&P 500 for this year: “We anticipate sub-3000”, a mere -35% from here (4582 –> 3000). Simply for our “live” S&P price/earnings ratio now 58.0x to revert — as always happens — to its own lifetime mean of 40.1x (from the year 2013-to-date) necessitates an El Plungo of better than -30%. Too, as we tweeted (@deMeadvillePro) on Thursday, the S&P’s MoneyFlow relative to the Index itself clearly is becoming less supportive. And ’tis the Flow that leads your invested dough, (to the extent it can be retrieved upon it all going wrong, you know).

Yet fortunately for stock market bulls, earnings generation (or lack thereof) no longer matters. And you may have caught on to that at which we hinted in last week’s missive. But this time ’round let’s do the math:

One year ago today the S&P 500 stood at 3819, its “live” P/E that day 30.0x: the imputed earnings (i.e. price ÷ ratio) thus 127. Now let’s impute that for today … Oh Dear! Only 79! Have S&P year-over-year cap-weighted earnings actually plummeted by -38%? How come this isn’t on Foxy, nor Bloomy, nor CNBS? (Rhetorical question). As is our wont to say, the Investing Age of Stoopid continues.

Meanwhile continuing to yo-yo like there’s no tomorrow is the Econ Baro, its 22-year record of directionally leading the S&P 500 having come to a halt during 2020, concurrent with the commencement of COVID. The following view from one year ago-to-date is not indicative of the StateSide economy being poor; rather ’tis merely reprising the 1995 Chris Isaak piece:  ““Goin’ Nowhere“

““Goin’ Nowhere“ :

:

And yo-yoing indeed: of the past week’s 12 incoming Economic Barometer metrics, period-over-period six were better and six were worse. Belying the most recent months of the Baro was the first peek at Q2 Gross Domestic Product having picked up by an annualized rate of +2.4%; however, some 48% of total nominal growth was purely inflationary (per the Chain Deflator). Still, the best of the week’s reports were for July’s Consumer Confidence along with June’s Durable Orders and Personal Spending, all three of those beating consensus and their prior periods, all also revised upwards. However: the week’s biggest stinker was June’s New Home Sales, which missed consensus and slowed from the prior period, itself revised lower.

But at least the S&P 500 yesterday recorded a nearly 16-month closing high … whew! To again quote former Buffalo Bills Head Coach Marv Levy: “Where else would ya rather be?” Ummm… Gold?

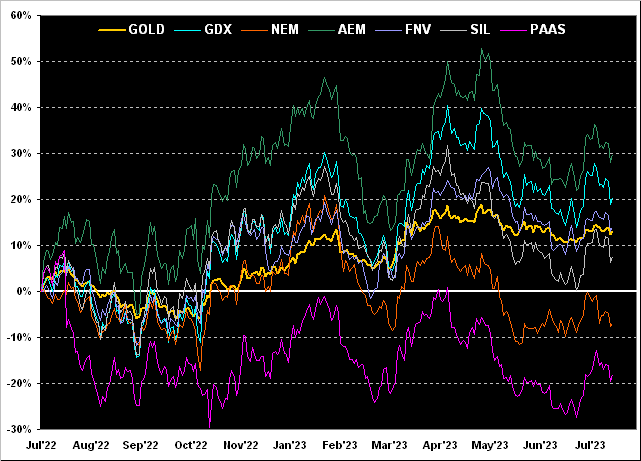

Speaking of which, again it being all but month-end, let’s next assess Gold year-over-year along with the cream of its equities crop. From worst-to-first we find Pan American Silver (PAAS) -18%, Newmont (NEM) -7%, the Global X Silver Miners exchange-traded fund (SIL) +8%, Gold itself +13%, Franco-Nevada (FNV) +14%, the VanEck Vectors Gold Miners exchange-traded fund (GDX) +20% and Agnico Eagle Mines (AEM) +30%. Yet have we said in the past not to pass on PAAS? Its average ratio to the price of Silver century-to-date is 1.23x … but per yesterday’s settle ’tis just 0.64x. “A word to the wise is sufficient” –[Plautus and Terentius, 200 BC]. Here’s the graphic:

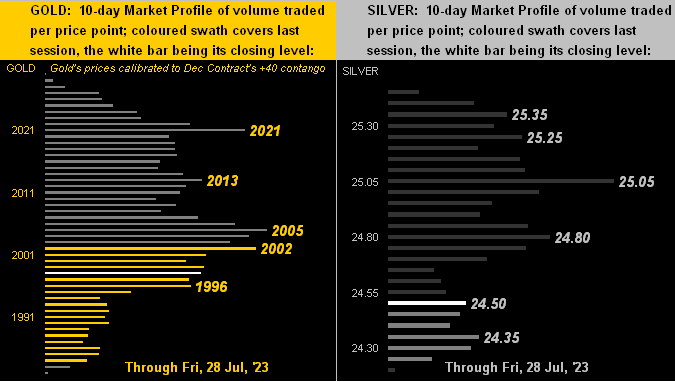

From latin playwrights to living profiles we go, specifically with Gold’s 10-day Market Profile on the left and same for Silver on the right. Note that the yellow metal’s pricing is calibrated for the now volume-dominant December contract, whilst the white metal is still attuned to September, both metals well off their respective fortnight highs:

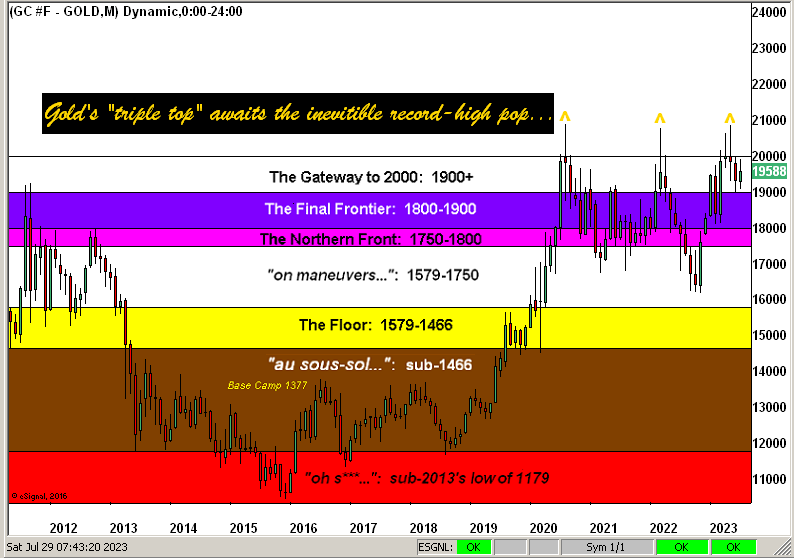

Toward this week’s wrap we bring up Gold’s Structure by the monthly bars from 2011-to-date. Ripe for the taking remains that “triple top”:

Peeking ahead to the ensuing week’s barrage of incoming Econ Baro metrics, we find four “by consensus” expected to improve, but seven expected to slow, including StateSide job creation. Which with rising interest rates portends stagflation?

Best to avoid that which is raving and go — as is this wise youngster — with what’s behaving … Gold!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on Twitter: @deMeadvillePro

*********