Last month, the Global Precious Metals MMI (Monthly MetalMiner Index) finally broke its sideways trend, dropping 3.15%. However, after the Hamas attack on Israel, both gold and silver prices reacted strongly with dramatic increases. Furthermore, surge affected both spot precious metal prices and 3-month futures. This proved a result of investors running to these two commodities as an investment safe haven from geopolitical uproar.

Other precious metals, such as platinum and palladium, didn’t react quite as strongly. However, it is important to note that both silver and gold face heavy bullish pressure in the short-term. Whether or not the “bull charge” will continue depends on which direction the war in Israel takes.

Times of geopolitical conflict cause extreme volatility in precious metal prices. However, AI and historical precious metal price data helps mitigate investment risks by predicting where prices are most likely to fall. Read more.

Precious Metal Prices: Palladium

Unlike other precious metals, palladium prices have fallen since the start of October. Indeed, downtrends continue to pressure this market into bearish territory, indicating that investors should anticipate further downside risk. Except for palladium, the Middle East turmoil pushed other metals into bullish/sideways trends.

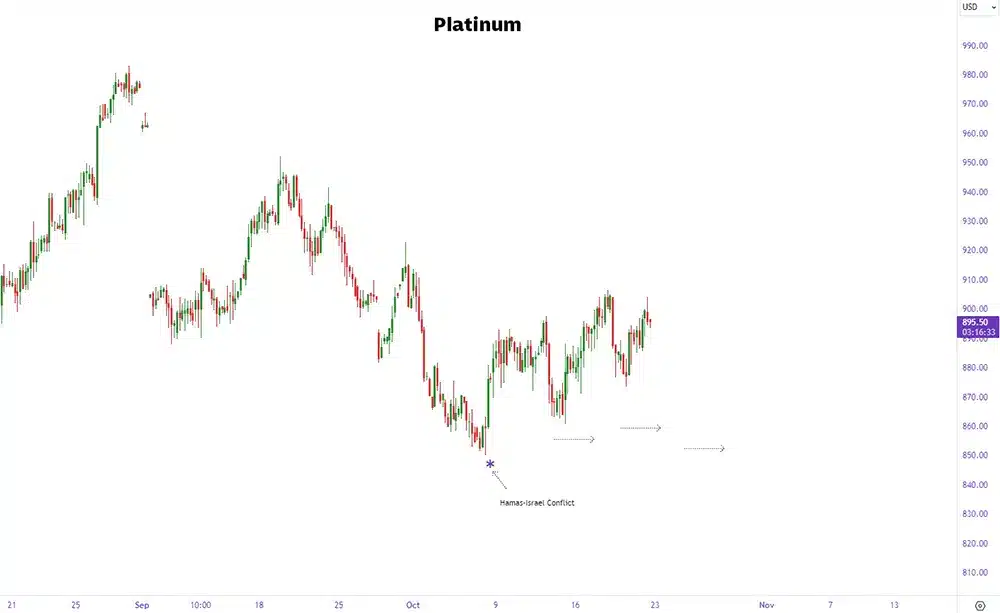

Platinum Prices

Prices for platinum continued to move sideways since the start of the month. Currently, prices remain mainly unaffected by the conflict in the Middle East, leading to an unclear and uncertain market direction for this particular precious metal.

MetalMiner Insights covers price points, correlation charts and price forecasting for a full suite of industrial and precious metals. See our full metals catalog.

Silver Prices See Boost

Although silver prices increased at the start of the conflict, prices have yet to break any significant levels like gold markets. Indeed, prices for silver still trade under $24.5/oz, which puts markets under the September 2022 high. At the moment, it remains unclear whether or not silver prices will continue up or reverse back down.

Precious Metal Prices: Gold

Since the start of the conflict in the Middle East, prices for precious remain volatile. For example, gold prices rallied into historical resistance zones and past the September high. And though prices are currently up, they remain at risk of bearish pressure as they near the 2000/oz mark.

Subscribe to MetalMiner’s free weekly newsletter today to get regular information about changing precious metal prices and other valuable commodity news.

Global Precious Metal MMI: Notable Price Shifts

- Palladium bars rose by 3.84%, bringing prices to $1,244 per ounce.

- Platinum decreased by 7.17%, leaving prices at $906 per ounce.

- Silver ingot prices dropped 8.09% between September 1 and October 1 before reversing after the Hamas attack on Israel. Prices sat at $22.60 per ounce as of October 1.

- Finally, gold bullion prices decreased by 4% between September 1 and October 1. As with silver, prices then reversed after Hamas’ attack on Israel. As of October 1, prices stood at $1,864.30 per ounce.