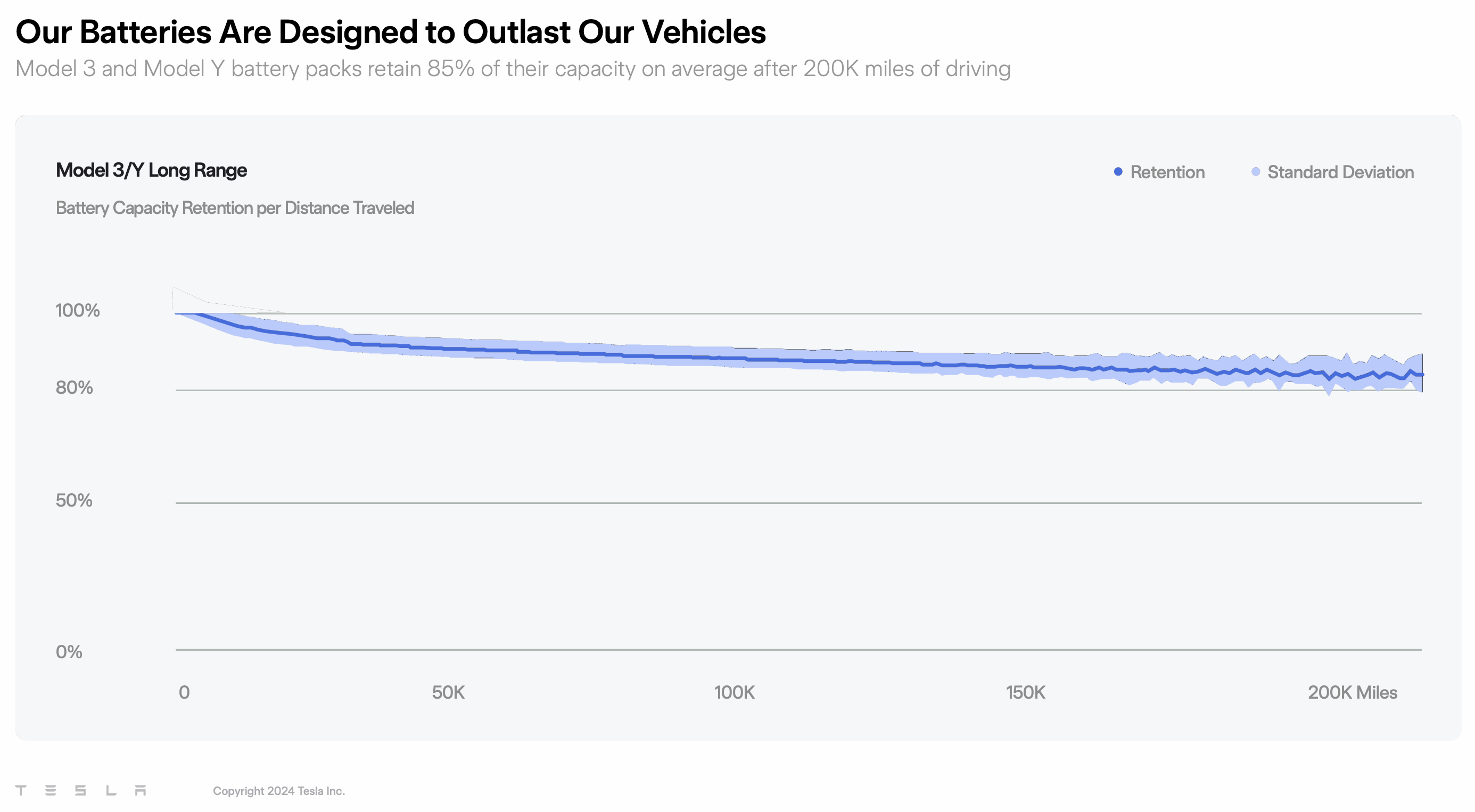

The Global Precious Metals MMI did not deviate far from its ongoing sideways trend. Indeed, since April, the index has continued to stay within a tight trading range without much movement up or down. Moreover, precious metal prices, including those for gold and silver, remain relatively high when looking at their respective price ranges over the past five years. Overall, the index moved up 2.82% between July and August.

It’s true that further drops in prices could very well happen. However, if any type of worsening financial conditions occurred in the economy, precious metal prices would witness more bullish sentiments. As noted on MetalMiner Insights, the Fed easing off interest rate hikes for the first time in over a year removed some support to precious metals.

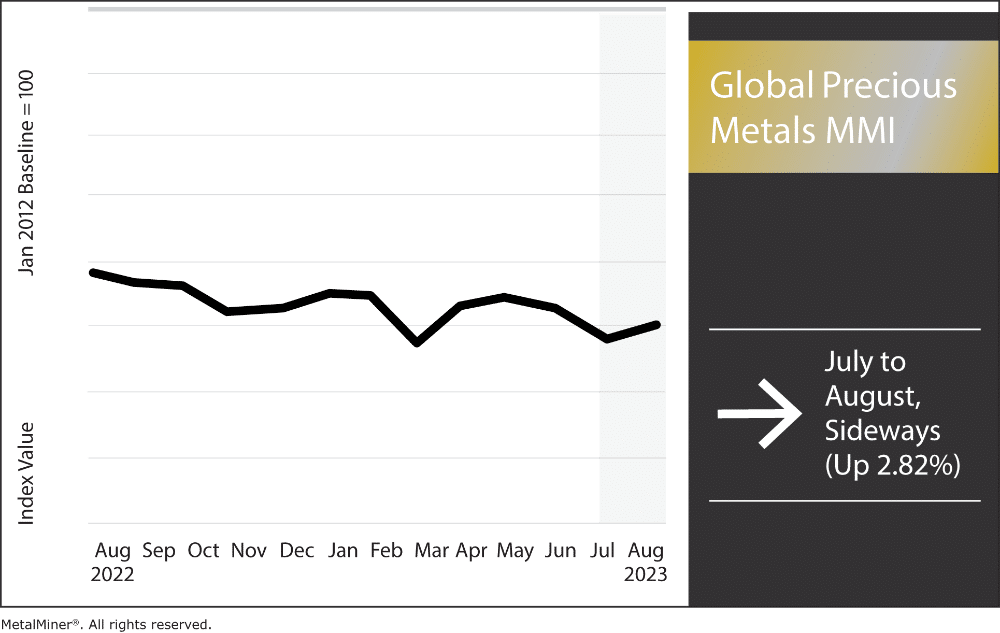

Precious Metal Prices: Gold

Gold prices recently began to slide more toward short-term support zones. This indicates a potential reversal of the overall uptrend that began late last year. Prices would need to show bullish structure and reversal patterns back to the upside. Until then, analysts expect gold prices to slide further.

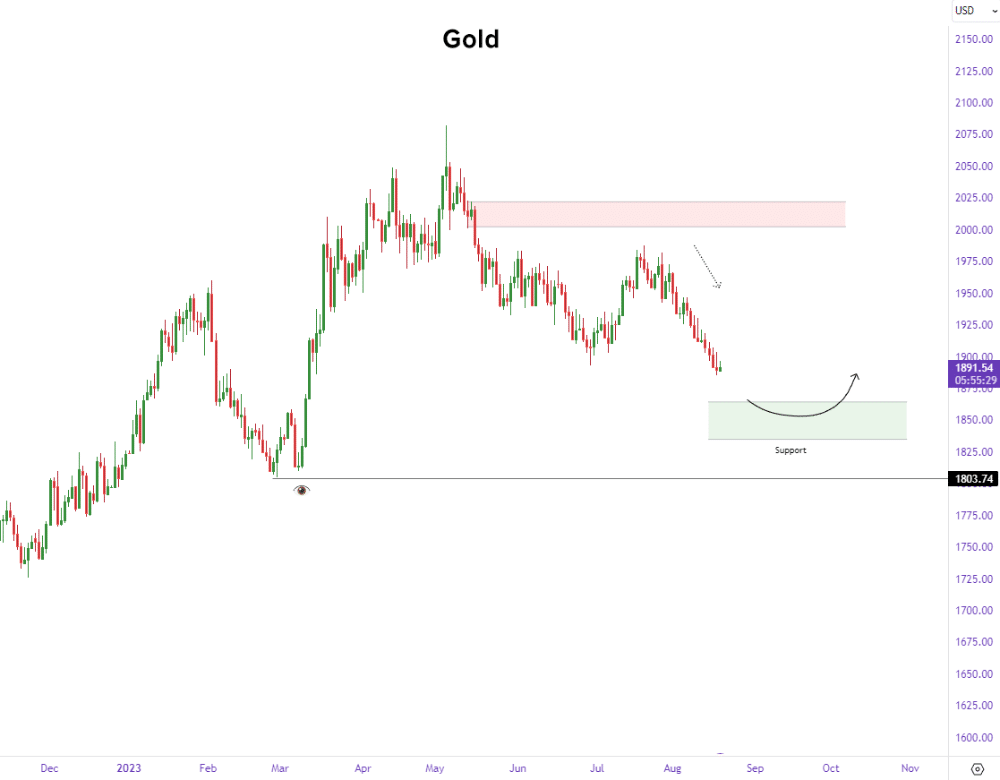

Silver Dips Down to Support Levels

Like gold, silver prices have begun to show sliding bullish strength, indicating a potential bearish structure forming within silver markets. Furthermore, as with gold, prices would need to find further support, and reverse to the upside to reestablish upward momentum.

It it time to say screw your suppliers?! Not exactly, but knowing key negotiation tactics for 2024 price projections is key. Join us on 9/21/23 for our workshop “Tackle Falling Demand, Rising Material Prices and Supply Chain Shocks”.

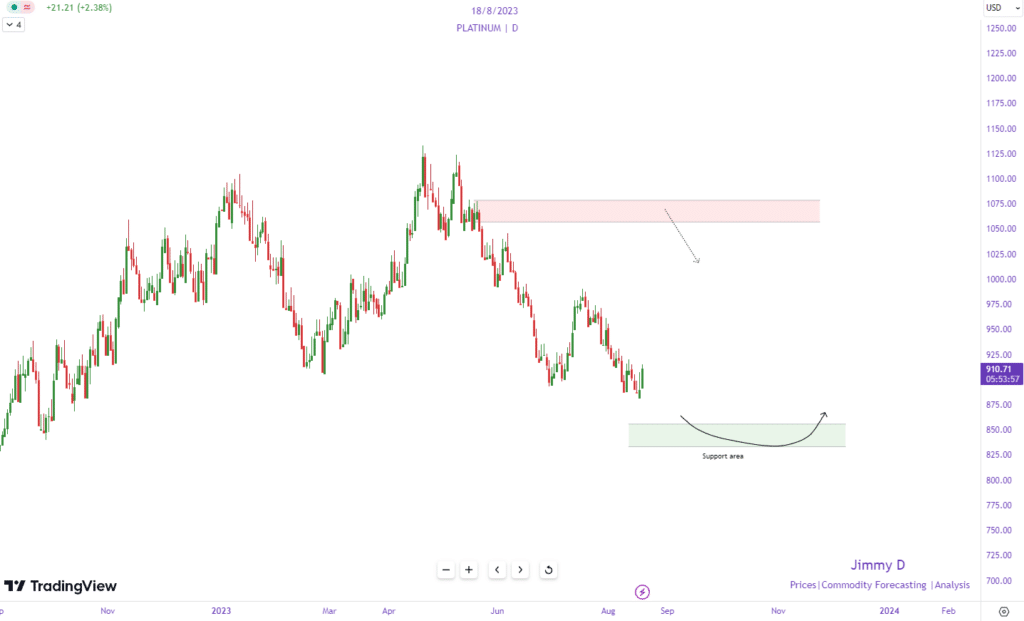

Precious Metal Prices: Platinum

Like other precious metals, platinum markets show little to no bullish strength at this time. Until platinum markets begin to display a strong bullish structure to the upside, prices appear bearish, indicating a downward trend.

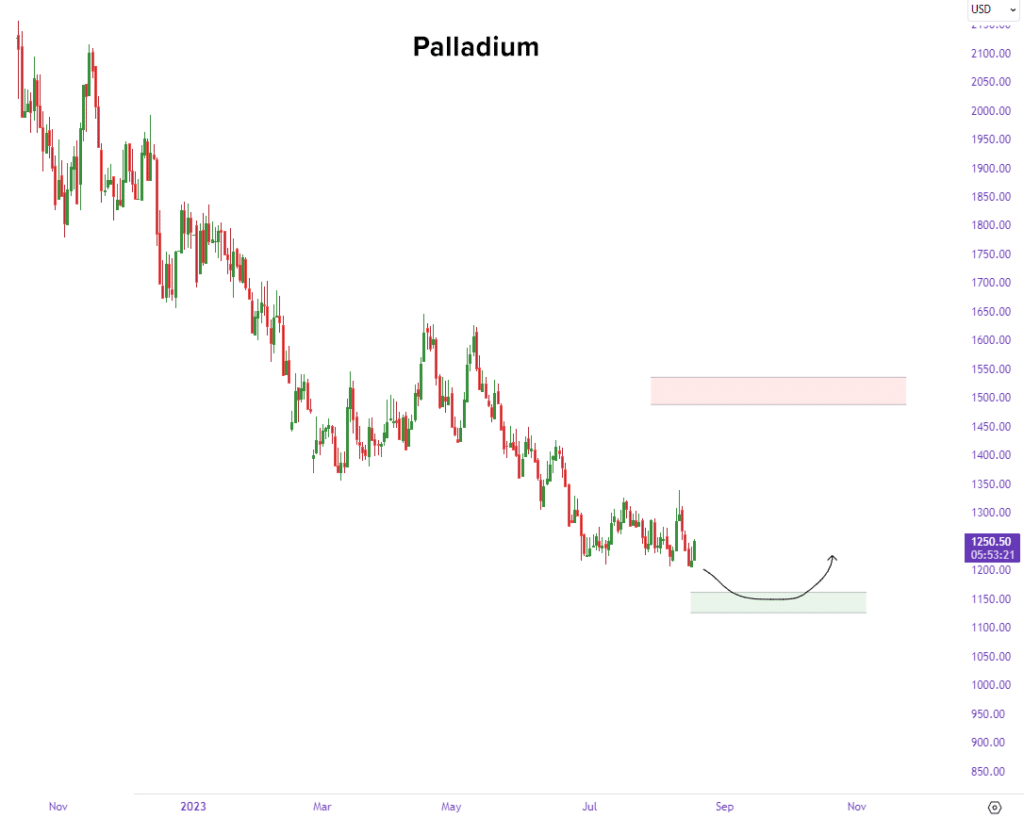

Palladium Prices Could Drop

Like other precious metals, palladium markets show little to no bullish momentum. Prices continue to slowly decline and slide toward support zones, signals of a falling market. Palladium prices would need to display strong bullish patterns and reverse back to the upside to establish a bullish bias. Until then, markets seem bearish and continue to head downward toward support.

Don’t let volatile precious metal markets catch you off guard. Sign up for MetalMiner’s free weekly newsletter and gain access to timely insights on the latest metal market trends and pricing.

Global Precious Metals MMI: Noteworthy Price Shifts

- Gold bullion prices rose by 3% to $1965.5 per ounce.

- Silver ingots went up by 9.72%, which brought prices to $24.72 per ounce.

- Platinum bar prices rose by 5.18%, marking $32.08 per gram.

- Finally, palladium bars witnessed a 5% increase, bringing prices to $1,260 per ounce.

Enjoy this article? MetalMiner’s Monthly MMI report gives you price updates, market trends and industry insight for precious metals and 9 other metal industries. Sign up for free.