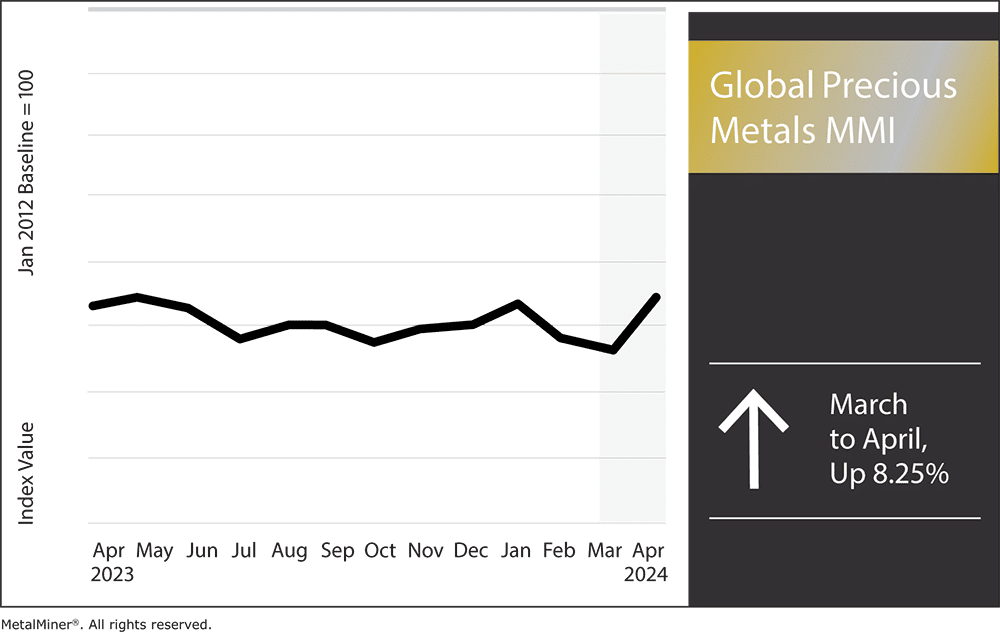

Month-on-month, the Global Precious Metals MMI (Monthly Metals Index) rose by 8.25%. However, shortly after April 1, precious metal prices, particularly gold and silver, began surging as investors flocked to purchase as many gold bullions as possible. The reasons for this newfound “gold rush” include inflation hedging, anticipation of interest rate cuts, and geopolitical uncertainty. Indeed, these factors continue to send investors flocking to the classic precious metals safe haven. But just how long will the rally last?

Precious metal prices are spiking! Don’t let volatile metal markets catch you off guard. Sign up for MetalMiner’s free weekly newsletter and gain access to timely insights on the latest precious metal market trends and pricing.

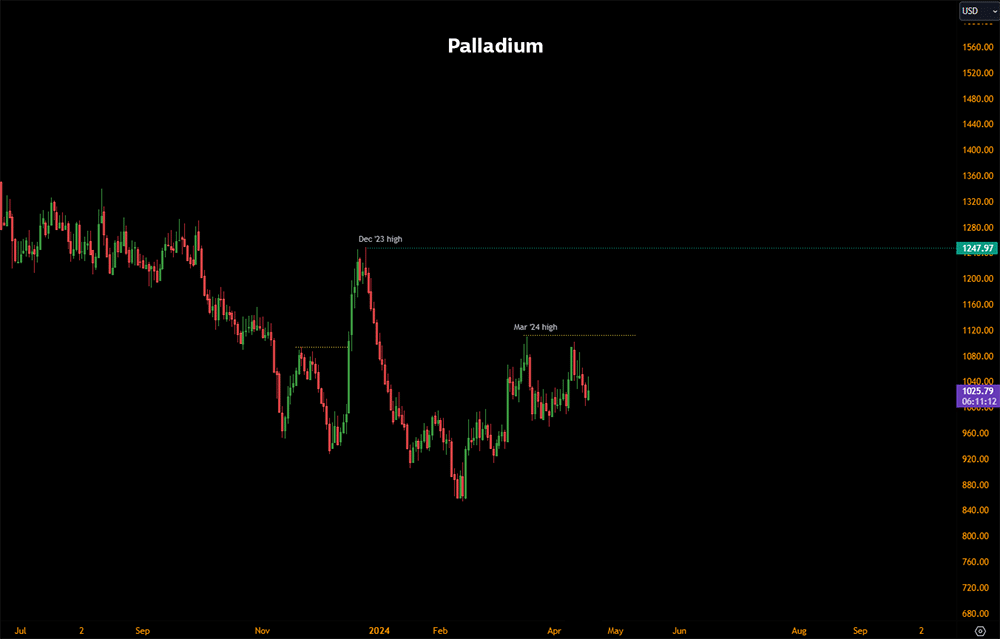

Palladium Stays Within Trading Range

Palladium failed to reach price levels when testing previous significant resistance levels, including the highs from December 2023. Although the price did edge slightly higher, it did not break out of range or trend to indicate any strong bullish momentum. And while the current trend is within range, volatility is likely due to continue given ongoing global tensions.

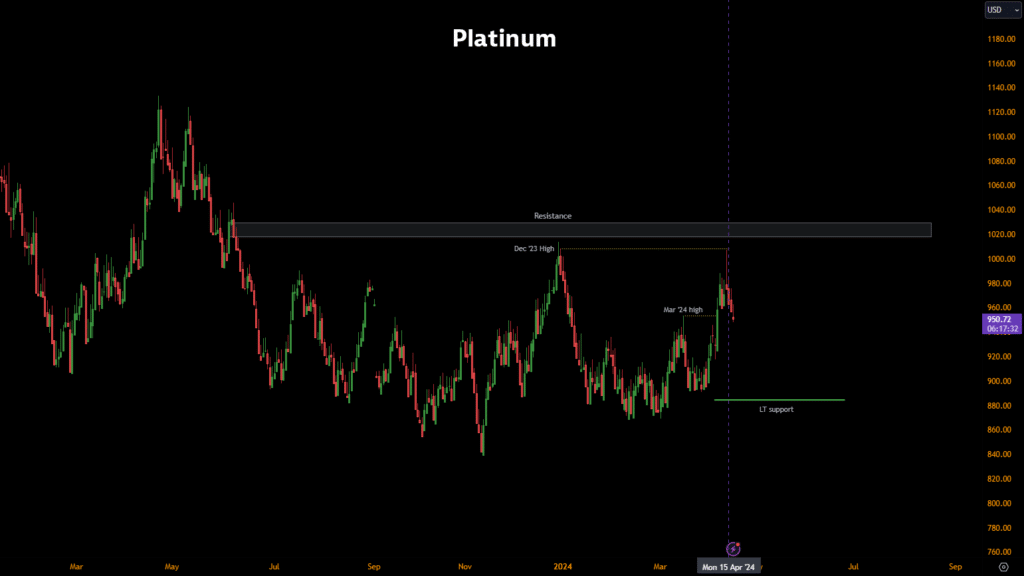

Precious Metal Prices: Platinum

Unlike other precious metals, platinum prices did not create new highs. Although the price experienced bullish momentum at the end of Q1 going into Q2, it did not break through its range and create the significant new highs needed to indicate a reversal. As with other precious metal prices, current global tensions may increase volatility.

Don’t settle for stagnant precious metal savings. MetalMiner’s custom price forecasting unlocks the true potential of your volume commitments, ensuring you maximize profit. View our full metal catalog.

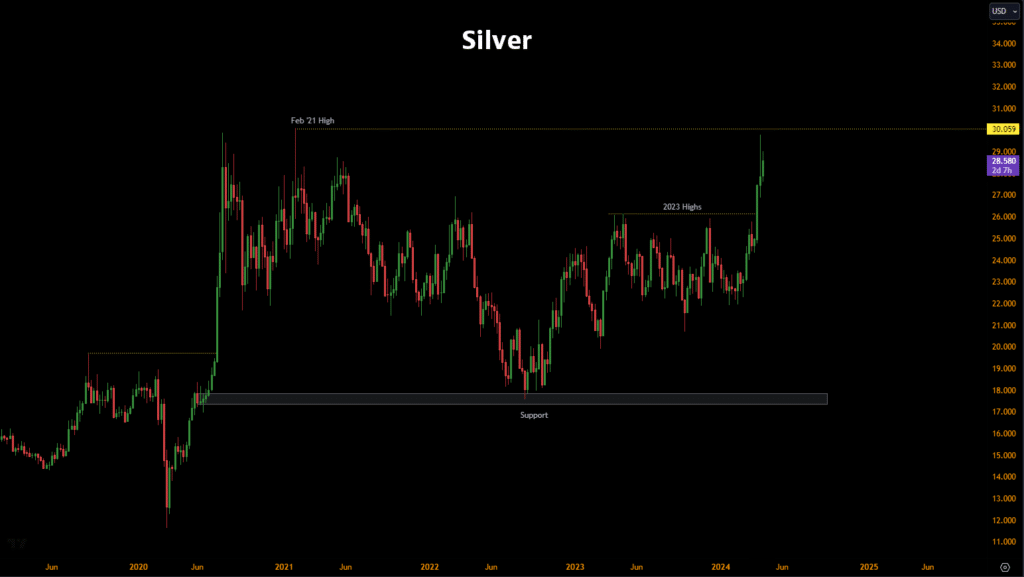

Silver Prices Experience Rally

Silver prices experienced strong bullish momentum in recent monthly price action. Typically, silver volatility increases along with geopolitical tensions. As the price breaks through 2023 highs, a possible test of the February 2021 highs seems likely. As with gold, silver prices continue to form higher lows and highs, indicating a strong uptrend. However, volatility remains a chief concern.

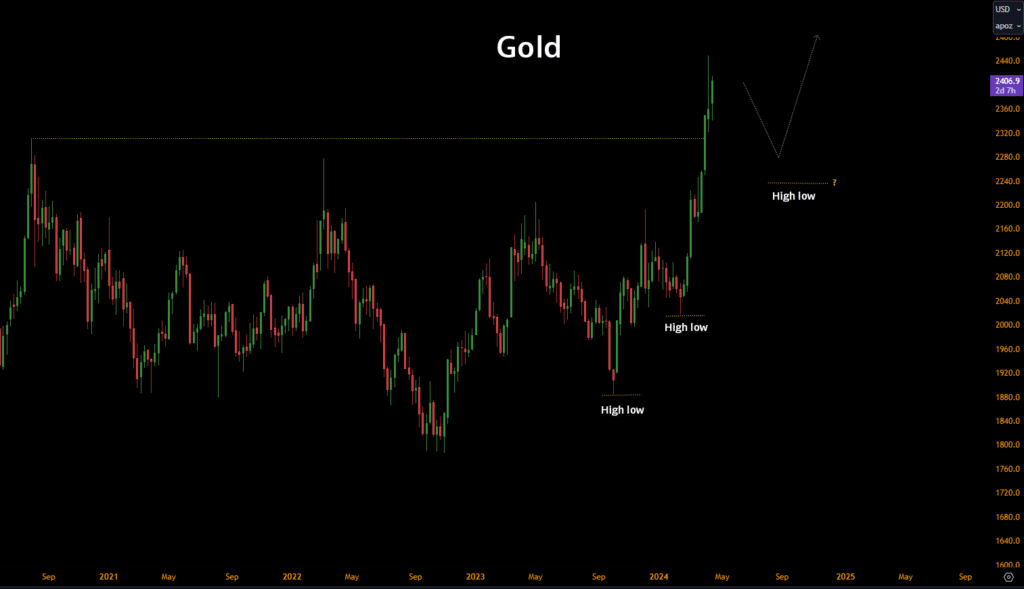

Precious Metal Prices: Gold

In recent weeks, gold prices both broke new highs and created a new range. As prices continue to form higher lows due to geopolitical tensions and rising conflict across the globe, market participants may expect a rise in volatility. With prices breaking above 2020 levels amid bullish momentum, a possible continuation to the upside remains likely.

Global Precious Metals MMI: Price Shifts

Don’t just react to changing precious metal prices – proactively optimize your sourcing strategies using MetalMiner Insights’ cost-saving AI features. Learn more.

- Palladium bar prices rose by 6.28%, which brought prices to $1004 per ounce.

- Platinum bar prices followed suit with palladium and rose. In total, prices increased by 3.68% to $937 per ounce.

- Silver ingot prices rose by 11.83% to $28.31 per ounce.

- Finally, gold prices breached an all-time high, hitting $2382.80 per ounce after rising 10.33% month-over-month.