Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

EVs Now 20% of World Auto Sales

Global plugin vehicle registrations were up 22% in July 2024 compared to July 2023. There were 1.3 million registrations. BEVs were up by just 5% YoY, but plugin hybrids jumped 58% YoY, selling over 540,000 units, which is the second record month in a row for this technology. Also, that 58% growth rate is the highest since January.

As such, it is clear that the rise of PHEVs/EREVs in China is disrupting the overall local market, and with it, the global EV market, making it impossible to ignore this new trend and bury one’s head in the sand. Plugin hybrid technology sells, even without the help of subsidies.

Now, what OEMs outside of China will do with this information is anyone’s guess….

In the end, plugins represented 20% share of the overall auto market (12% BEV share alone). This means that the global automotive market remains in the Electric Disruption Zone.

Year to date, plugin electric vehicle market share was stable at 18% (12% BEV).

Full electric vehicles (BEVs) represented just 59% of plugin registrations in July, dragging down the year-to-date tally to 63% share. A year ago, BEVs owned 70% of the plugin market….

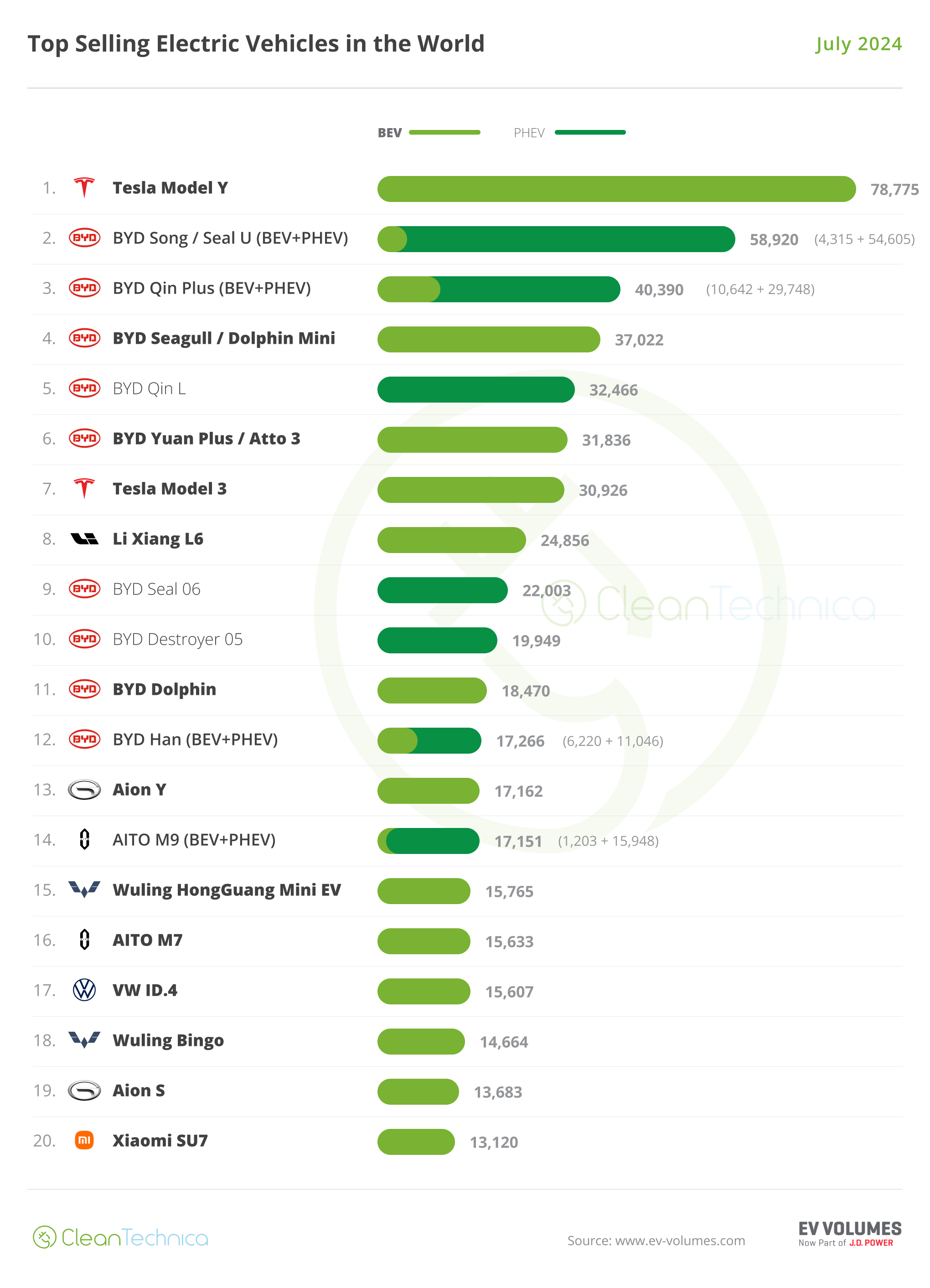

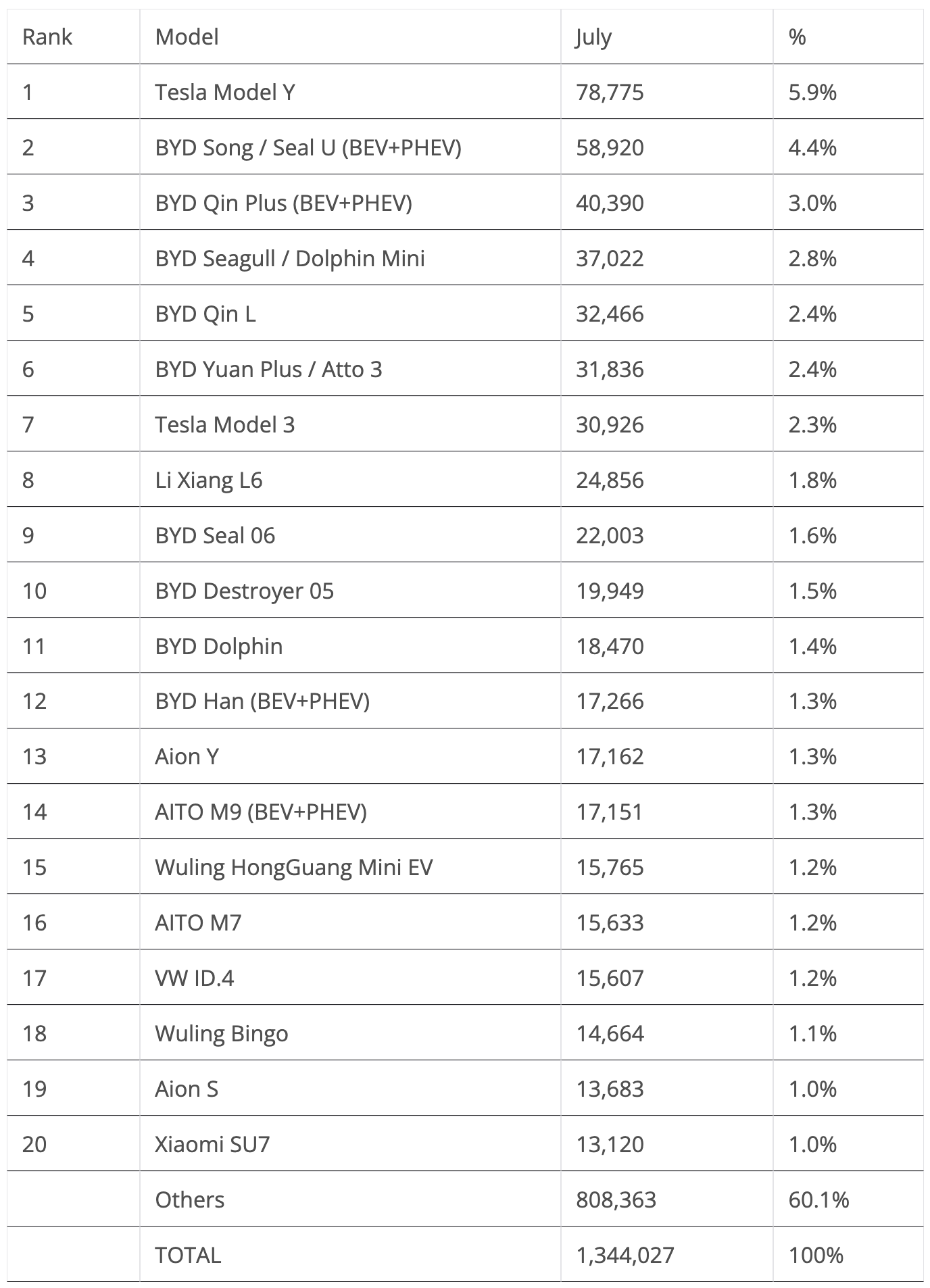

20 Best Selling EV Models in the World in July

Back to July’s best sellers, while the Tesla Model Y is in the lead (as usual) with some 79,000 registrations, up 4% YoY, the Tesla Model 3 ended July only in 7th, with close to 31,000 registrations. While a low result was expected as usual since July is the first month of the quarter, the sedan dropped 8% YoY. Which is kind of ironic. The unrefreshed model continues to grow, albeit at a moderate pace, while the refreshed model is down…. Something for Tesla to think about, especially since it is now preparing the Model Y refresh.

As for BYD, the Shenzhen make placed 9 representatives between the 2nd and 12th position! BYD’s 2024 War on ICE (and on the remaining competition, whatever their name is) is indeed paying dividends.

The only intruder in a top 12 filled with the Tesla and BYD fleets was the new Li Xiang L6. The midsize SUV registered close to 25,000 units in only its 4th month on the market, allowing it to be 8th in July. Will the startup model be able to break into the top 5?

In BYD’s looong lineup, the highlight was the brand new Qin L, which immediately joined the top 5 in only its second month on the market, with 32,466 registrations. And it has done so without disrupting sales of the regular Qin Plus (3rd, with over 40,000 units). It also still leaves space for the new Seal 06, its more outgoing twin sibling, to jump to #9, with 22,003 registrations! Add another incredible performance from the BYD Destroyer 05 (#10, 19,949 registrations) and we get four midsize sedans from BYD in the top 10 positions! With a total of 114,808 units! That is peak Model Y performance!

So, after years of talks of Tesla killers, we now have one (or four different nameplates, but that basically are the same car) worthy of the Tesla-killer name. And BYD isn’t really pushing exports of its sedan quadruplets….

Elsewhere, AITO’s M9 flagship SUV ended the month in 14th, with a record 17,151 sales, which is not bad for a model that only sells in China and starts at $65,000! The Huawei-backed startup even managed to place a second model on the table, with the slightly smaller (5 mt vs 5.2 mt) M7 ending the month in 16th.

Still on the top 20, after a weak month of June, where it failed to place any representative in the top 20, Wuling is back at the table. Its two best sellers, the tiny Mini EV and the small Bingo hatchback, are #15 and #18, respectively.

Off the table, the highlight comes from the BYD stable (what a surprise!), with the recently introduced Yuan Plus hitting 11,225 registrations. With the #20 Xiaomi SU7 ending less than 2,000 units ahead of the compact BYD, we might see the Yuan Plus in the top 20 soon.

Finally, a reference goes out to the fact that the VW ID.3 failed to win a top 20 position, with the German hatchback scoring just 11,786 units. This meant that the only legacy OEM model in the top 20 was the VW ID.4, in 17th. A mere blip? Or is there something running deeper here and soon we will have a table without any legacy OEM models?

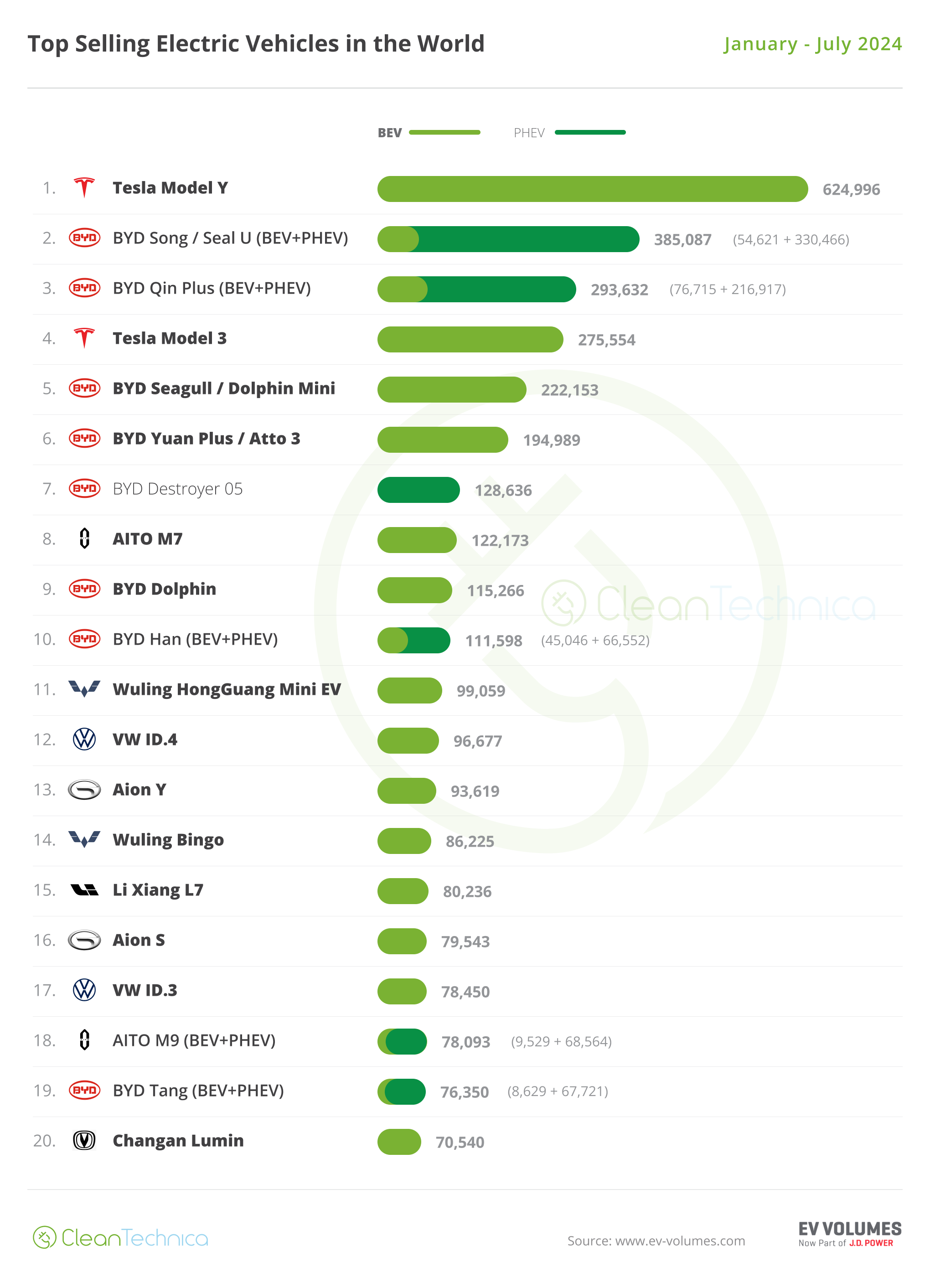

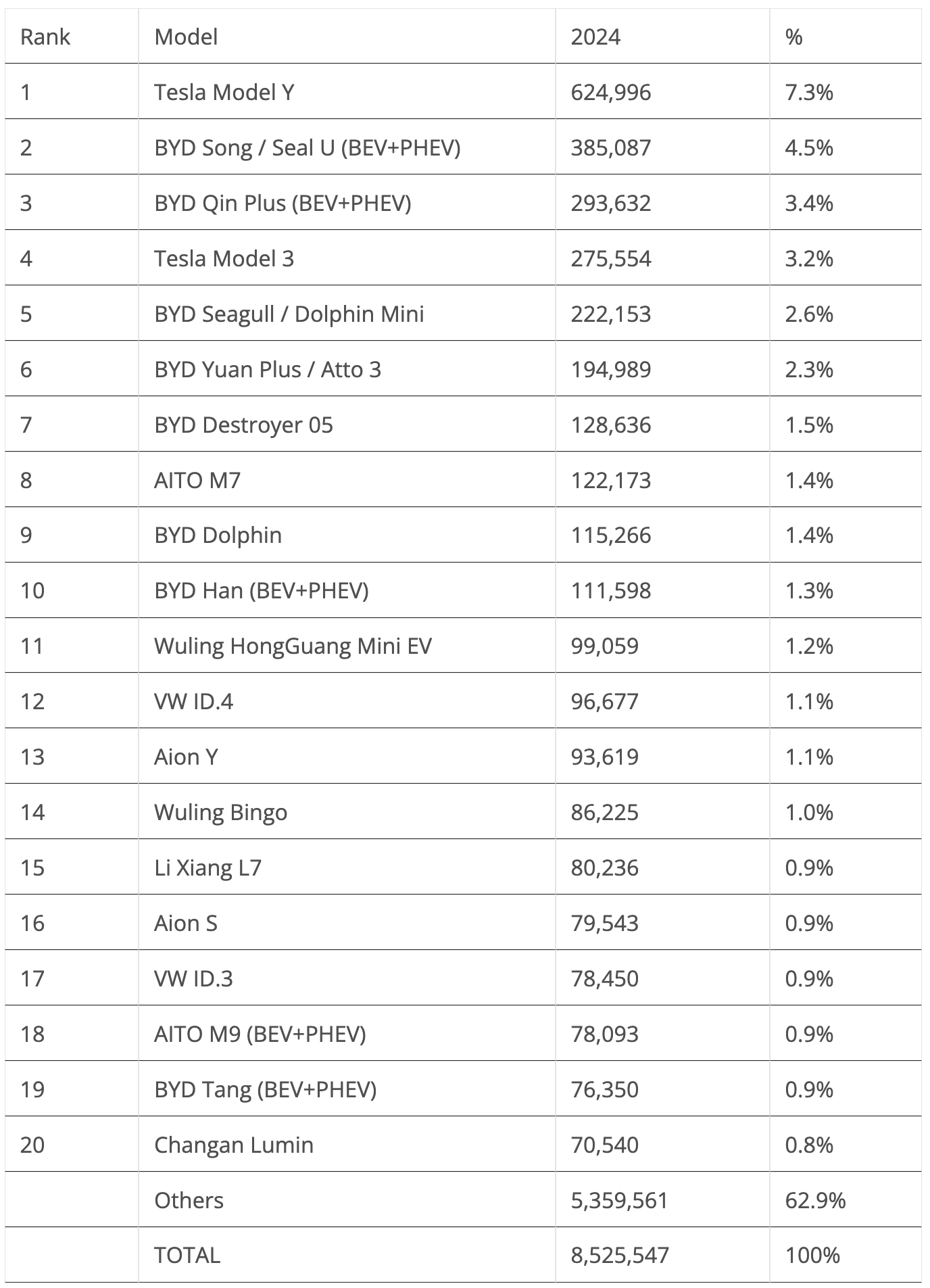

Top 20 EV Models YTD

In the year-to-date (YTD) table, the Tesla Model Y and BYD Song continue firm in the top positions, while the Tesla Model 3 lost ground to the BYD Qin Plus, now ahead of the US sedan by 18,000 units. Will the Model 3 benefit from enough tail wind in September to regain the 3rd spot?

The following positions seem all secure until the 15th position of the Li Xiang L7, which is close to where the first position change happened. GAC’s Aion S profited from the slow month of the VW ID.3 to surpass it and reach the #16 spot in July.

Finally, the AITO M9 climbed one position, to #18, kicking the BYD Tang to #19. BYD’s SUV is now six years old, which is almost Jurassic by Chinese standards, so it’s not surprising that its sales are suffering. The Shenzhen OEM knows that, and is already preparing the 3rd generation of its large SUV, set to be launched in the first half of next year.

Right now, there are as many A/B segment models (five) as there are E/F segment models in the top 20. And with the little Changan Lumin at #20, and the full size Zeekr 001 at #21, we might even see 6 full-size models in August, versus 4 of the little ones.

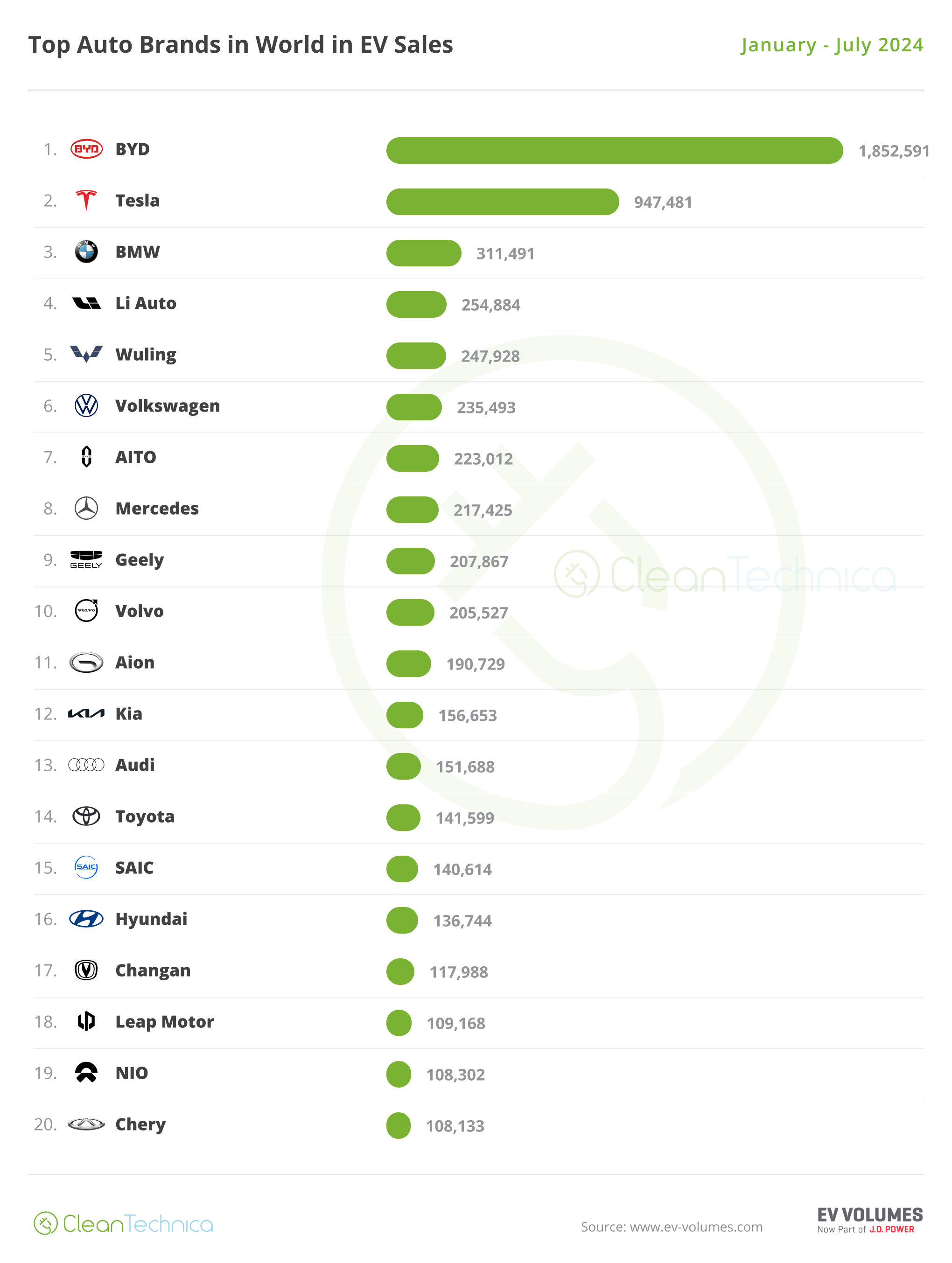

Top Selling Brands

In July, #1 BYD, now deep into pricing out the competition (ICE and EV…), didn’t disappoint. It scored some 328,000 registrations. With sales at this level already, one starts to wonder how high the Shenzhen make’s sales could go. Ain’t no mountain high enough for BYD?

As for Tesla, it continues randomly switching between black and red, between growth and dropping sales. After an 8% drop in June, the company was back in black in July, growing 4% YoY. That’s mostly thanks to additional deliveries of the Cybertruck, now running at some 4,000 units per month. So, in the first 7 months of 2024, there were three growth months (January, May, and July) and four months in the red (February, March, April, and June). As it is, the jury is still out on whether 2024 could be the first year of dropping sales for the US make.

Below the top two, this time BMW lost the last position on the podium, to Li Auto (51,000 units). Li Auto is profiting from the success of its L6 midsize SUV. It seems that the German make now has competition for 3rd place, a welcome change considering that if the German won the bronze medal this year, it would be a repeat in 2024 of the 2023 podium (#1 BYD, #2 Tesla, #3 BMW). Boooring!…

Li Auto’s nemesis, AITO, is also on the rise, ending the month in 5th with 39,552 sales. And the same could be said about Wuling, which after a horrible June was back on track in July, ending the month in 6th.

The second half of the table saw Leap Motor rise in the best sellers table to #13, with 22,168 registrations, a new year best.

In July, known brands like Ford, Peugeot, and Jeep were left out of the top 20, being replaced by more Chinese brands. Overall, China had 11 brands in the top 20.

In the YTD table, there wasn’t much to report regarding the podium. BYD has almost double the sales of Tesla, and the US brand has three times as many registrations as #3 BMW. But while BYD continues to grow by double digits, Tesla’s sales are basically stagnant in 2024….

Far below these two, which are really in a league of their own, BMW stayed in its podium position, while Li Auto benefitted from another strong month of June to climb yet another position, this time to 4th.

Not to be outdone, Li Auto’s rival AITO also gained one position in July, with the Huawei-backed brand climbing to #7 and dropping Mercedes to #8.

Li Auto and AITO currently represent everything that’s trendy in the EV market: Chinese startups, selling large EREV SUVs, in China.

In the second half of the table, Toyota benefitted from another bad month from SAIC and climbed to 15th. The Shanghai-based OEM needs to be less dependent on the MG4, because when the pointy hatchback is down for some reason, there’s really no one else to pick up the slack.

Zeekr was kicked out of the table, as Leap Motor jumped into 18th thanks to a great month of July. Coincidentally, or not, this is another Chinese startup that bets heavily on EREV SUVs. With the startup now involved in a JV with Stellantis, this could be a lifeline for the multinational conglomerate as it looks to reduce the distance it has to its Chinese competitors. If you can’t beat them…

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

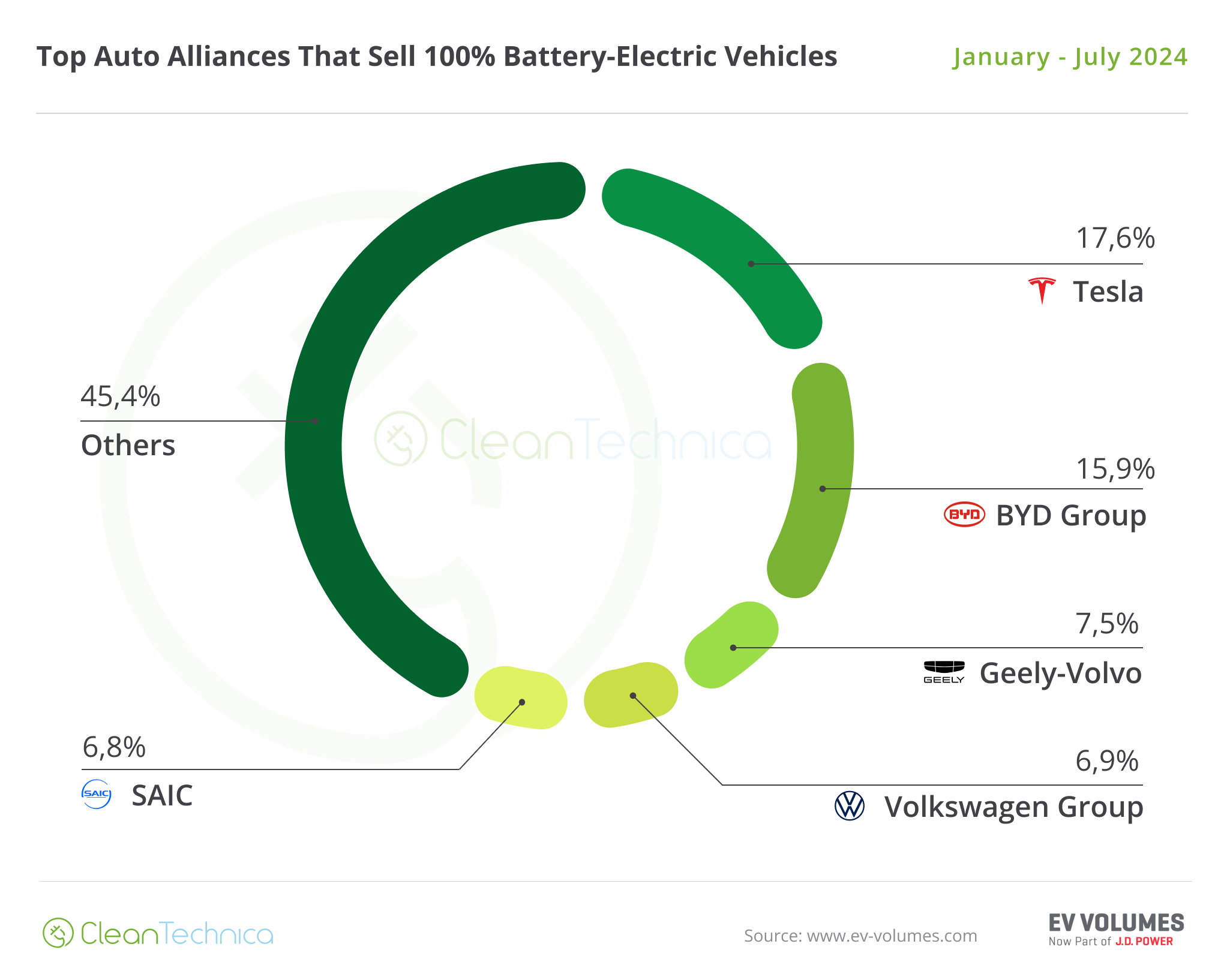

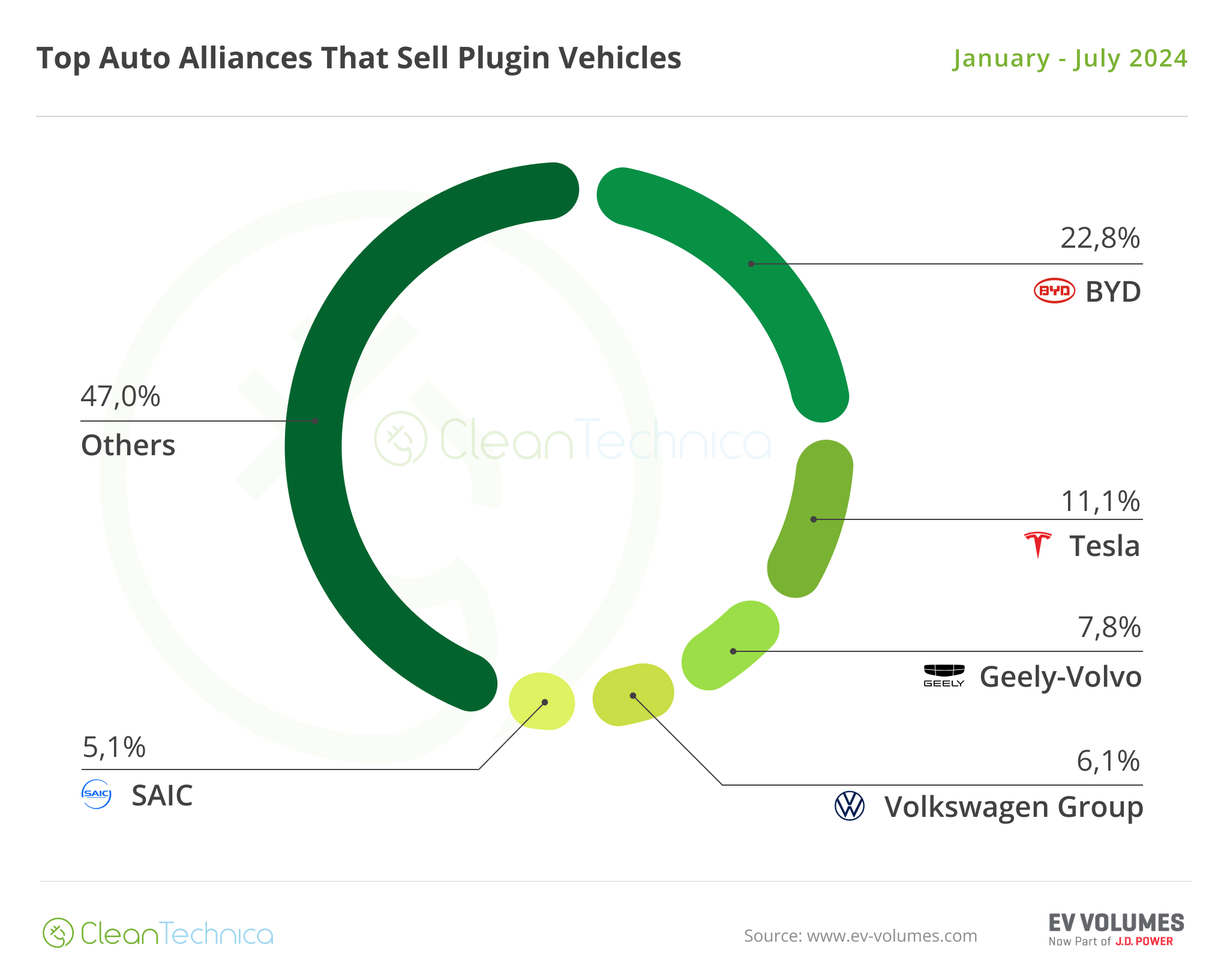

Top Selling OEMs for EV Sales

Looking at registrations by OEM, #1 BYD again gained share, thanks to its recent price cuts and new model launches, going from 22.4% to its current 22.8% (it had 21.8% a year ago), while Tesla ended July with 11.1% share (it had 14.5% in the same period of 2023).

3rd place is in the hands of Geely–Volvo, with the OEM steady at 7.8%. The Chinese OEM is the one that most progressed in the top 5, going from 6.1% in June 2024 to its current 7.8%.

Considering Tesla’s recent share drop and Geely’s significant growth, will we see the Chinese juggernaut threaten Tesla’s silver medal by year end?

Answer: No, it’s still too early. In 2025, however … it will all depend on the US make. The Model Y refresh needs to be successful, and the future, cheaper model(s) need to make an impact. On its side, Geely will probably have some 33 new model launches, just to keep the lineup fresh.

Meanwhile, #4 Volkswagen Group (6.1%, down from 6.3% in June) lost share, losing some distance over #5 SAIC (5.1%, down from 5.2%). Despite losing share, SAIC lost less than the German OEM, thanks to Wuling’s positive month, which helped to minimize the slow month in the rest of the lineup.

Below SAIC, #6 BMW Group (3.9%, down from 4% in June) lost ground over the competition, with #7 Changan (stable at 3.8%) closing in. #8 Stellantis (3.6%, vs. 3.7% in June) continues in freefall. This is particularly worrying, because the multinational conglomerate has lost significant share compared to July 2023, when it had 4.7%.

The multinational conglomerate needs to react fast — its cheap EVs (Citroen e-C3 EV, e-C3 Airscross EV, Opel Frontera EV, Fiat Grande Panda EV, etc.) need to land as soon as possible and in significant volumes (a refresh on the Fiat 500e wouldn’t hurt either…). This year, Stellantis not only lost touch with the top 5 OEMs, but it is at risk of being swallowed by the competition.

Stellantis is in serious risk of losing yet another position in August, as #9 Hyundai–Kia (3.5% share) has been closing in on the multinational group.

In an interesting note, BYD was the only OEM in the top 10 that gained share in July. Talk about a black hole effect…

Looking just at BEVs, Tesla remained in the lead with 17.6%, but it has lost 3.3% share compared to the same period last year. In second is BYD (15.9%, up 0.1%). With Tesla losing share, we might see BYD surpass it in early 2025.

It is not doing it sooner, because the Shenzhen OEM is now focusing on PHEVs, as can be seen by the fact that its BEV business was actually down (-4% YoY) in July, to some 130,000 units, while its PHEV division scored its 5th record performance in row(!!!!!) in July, by delivering around 200,000 units in the same period.

Geely–Volvo (7.5%) remained stable, thanks to good results across its long lineup of brands. Comparing the OEM’s performance to where it was 12 months ago, the progress is visible, jumping from 5.7% share in July 2023 to the its 7.5%!

In 4th we have Volkswagen Group (6.9%), but we have seen SAIC (6.8%, up from 6.7% in June) getting closer, so we should see an entertaining race for #4 in the remainder of the year.

Below the top 5, #6 BMW Group (4.5%) is stable, followed by #7 Hyundai–Kia (4.2%, down from 4.3% in June), and while both shouldn’t be able to reach the rear of #5 SAIC this year, in 2025, the Chinese OEM will have to work hard if it wants to keep these two behind it.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy