London, October 29, 2025, (Oilandgaspress) –––Rising global heat is now killing one person a minute around the world, a major report on the health impact of the climate crisis has revealed. It says the world’s addiction to fossil fuels also causes toxic air pollution, wildfires and the spread of diseases such as dengue fever, and millions each year are dying owing to the failure to tackle global heating. The report, the most comprehensive to date, says the damage to health will get worse with leaders such as Donald Trump ripping up climate policies and oil companies continuing to exploit new reserves. Governments gave out $2.5bn a day in direct subsidies to fossil fuels companies in 2023, the researchers found, while people lost about the same amount because of high temperatures preventing them from working on farms and building sites. Read More

New report about power from shore: Power from shore as replacement for gas turbines has been the most important abatement to reduce greenhouse gases emissions offshore . Since 2015, these emissions have been reduced by 4.1 million tonnes, or 27 per cent.

This is reflected in the Norwegian Offshore Directorate’s new report on power from shore. This report builds on the report “Power from shore to the Norwegian shelf” from 2020 and was prepared on assignment from the Ministry of Energy. During the period from 2020 to 2025, the number of fields that have or have decided to use power from shore increased from 16 to 39 when associated fields are included. Additional emission reductions are expected once all the projects under development become operational. Read More

Aston Martin announced a new landmark real estate partnership with Valor Real Estate Development that will construct an ultra-luxury residential project in Daytona Beach, Florida – Aston Martin Residences Daytona Beach Shores – a new 86-unit development on the Atlantic coast. Located just minutes from the iconic Daytona International Speedway and overlooking one of the world’s most famous beaches, Daytona Beach Shores marks the latest addition to Aston Martin’s established world class real estate portfolio, starting with the Aston Martin Residences in Miami to the recently completed four-bedroom town house in Tokyo’s Omotesandō neighbourhood. As with the previous Aston Martin residential projects, the new development is a close collaboration between Aston Martin’s design team and the project real estate partner. This ensures that all properties reflect the highly crafted, beautifully proportioned and cutting-edge technology of Aston Martin’s award winning automotive models, creating unique living spaces that reflect the ultra-luxury, high performance British marque. Read More

MDL has supported Maersk Supply Service in a dynamic riser assembly installation offshore Brazil.

The operation at Mero field, in the pre-salt Santos basin, has enabled connection to a PRM (Permanent Reservoir Monitoring) sensor grid on a deepwater field. MDL had developed a bespoke solution for simultaneous handling of the dynamic cable riser, DUTA (Data Unit Transfer Assembly), pigtails and backbone cables – all deployed from 9.2m reels.

The MDL spread, mobilised in Peterhead, Scotland onboard the Skandi Involver, featured a Wheeled Horizontal Lay System (WHLS), Generation 2 Reel Drive System (RDS) and four tensioners ranging from 12Te up to 110Te line pull capacity. It was complemented by several hydraulic winches from recently-launched MDL Winches & Lifting Solutions, ranging between 5-30Te. The back-deck arrangement of the tensioners and custom deflectors – engineered by Maersk Supply Service and MDL in-house, to ensure optimised handling to minimise stress on the multiple products – enabled the simultaneous installation of the pigtail lines; while the large-capacity tensioner combined with the WHLS frictionless wheel mechanism, facilitated low-friction deployment of the dynamic riser assembly and connected pigtails, reducing drag and ensuring optimal product integrity during installation.. Read More

TAQA (Industrialization & Energy Services Company), a leading global provider of well solutions in the energy sector, announced the launch of Esaar™ mud motor, its next-generation drilling tool engineered for durability, operational flexibility, and serviceability. Developed in direct response to field feedback, the Essar™ mud motor is tailored to meet today’s complex drilling demands, delivering reliable performance across a wide range of applications. At the heart of Esaar™ is a custom mud-lubricated bearing pack engineered to excel in high-torque and corrosive environments. This robust design extends tool life and boosts operational reliability. Maintenance is streamlined with optimized bearings and housing that allow for rapid servicing and on-site adjustments, minimizing downtime and maximizing efficiency. . Read More

Neste’s Interim report for January–September 2025

Neste’s revenue in the third quarter totaled EUR 4,534 (5,624) million. Lower market prices affected the revenue EUR -0.1 billion year-over-year. The increase in sales volumes had a positive impact of approximately EUR 0.1 billion on revenue, driven by the increased capacity in Renewable Products. Currency exchange rates as well as lower trading volumes had an approximately EUR -1.1 billion negative impact on the revenue.

The Group’s comparable EBITDA was EUR 531 (293) million. Renewable Products’ comparable EBITDA was EUR 266 (106) million, thanks to higher sales volume and margin compared to the third quarter of 2024. Oil Products’ comparable EBITDA was EUR 232 (141) million, impacted by both increased sales volumes and higher margin compared to the third quarter of 2024. Marketing & Services’ comparable EBITDA was EUR 34 (32) million. Comparable EBITDA for Others was EUR 1 (9) million.

One-off costs related to organizational restructuring, totaling EUR 4 million, were booked in the third quarter results. These one-off costs have been eliminated from comparable EBITDA.

The Group EBITDA was EUR 447 (301) million, impacted by inventory valuation losses of EUR -23 (-176) million, and changes in the fair value of open commodity and currency derivatives totaling EUR -58 (141) million. Profit before income taxes was EUR 152 (26) million, and net profit EUR 106 (23) million. Earnings per share were EUR 0.14 (0.03).

Third quarter in brief:

• Comparable EBITDA totaled EUR 531 (293) million

• EBITDA totaled EUR 447 (301) million

• Renewable Products’ comparable sales margin was USD 480 (341)/ton

• Oil Products’ total refining margin was USD 15.5 (10.6)/bbl

• Cash flow before financing activities was EUR -50 (16) million

January–September in brief:

• Comparable EBITDA totaled EUR 1,083 (1,084) million

• EBITDA totaled EUR 893 (861) million

• Cash flow before financing activities was EUR -49 (-803) million

• Cash-out investments were EUR 679 (1,245) million

• Leverage ratio was 38.0% at the end of September (31.12.2024: 36.1%)

• Comparable earnings per share: EUR 0.25 (0.30)

• Earnings per share: EUR 0.04 (0.05)

Figures in parentheses refer to the corresponding period for 2024, unless otherwise stated Read More

Subsea7 – SUBC – EX. DIVIDEND NOK 6.50 TODAY .• Issuer: Subsea 7 S.A.

• Ex. date: 29 October 2025

• Dividend amount: NOK 6.50

• Announced currency: Norwegian Krone Read More

Nel ASA reported revenues from contracts with customers of NOK 303 million in the third quarter of 2025, down from NOK 366 million the same quarter last year. Total revenue and income was NOK 349 million (Q3 2024: 391) and EBITDA in the quarter came in at NOK -37 million, an improvement from NOK -90 million in the third quarter of last year. Reported EBITDA from the PEM division improved q/q and compared to the same quarter last year, and the Alkaline division delivered better than the two previous quarters largely due to milestone revenue recognition from customer projects. Order intake for the quarter was NOK 57 million, and at the end of the quarter the order backlog stood at NOK 984 million. The company reported a healthy cash balance of about NOK 1.8 billion.

Quarterly highlights

• Revenue from contracts with customers in the third quarter 2025 was NOK 303 million, a 17% reduction compared to the third quarter 2024 (Q3 2024: 366)

• Total revenue and income in the third quarter 2025 was NOK 349 million (Q3 2024: 391)

• EBITDA in the quarter was NOK -37 million (Q3 2024: -90)

• Net loss was NOK -85 million (Q3 2024: -115). The development was mainly explained by decreased operating loss of NOK 41 million, offset by NOK -10 million decreased net financial items

• Order intake in the quarter amounted to NOK 57 million, a 64% decrease from the corresponding quarter last year (Q3 2024: 161)

• Order backlog was NOK 984 million at the end of the quarter, down 47% from the third quarter of 2024 and down 21% from the previous quarter

• Cash balance was NOK 1 757 million at quarter end (Q3 2024: 1 941)

“Considering the challenging macro environment, I am very pleased with how the organization is delivering. We continue to push hard to bring new technologies to the market, develop an attractive sales pipeline, and at the same time preserve cash” says Håkon Volldal, President and CEO of Nel.

Nel’s focus on commercializing new technologies trickles through the whole organization. The next generation pressurized alkaline platform is scheduled to come to market first half of 2026. This solution will bring overall hydrogen project investment cost substantially down and also deliver higher energy efficiency than what is currently available in the market. The next generation PEM solution under development is expected to come to the market a bit later, potentially with even better performance. Read More

During the period from 20 to 24 October 2025, Eni acquired on the Euronext Milan no. 3,271,315 shares (equal to 0.10% of the share capital), at a weighted average price per share equal to 15.2844 euro, for a total consideration of 49,999,991.92 euro within the treasury shares program approved by the Shareholders’ Meeting on 14 May 2025, previously subject to disclosure in accordance with applicable legislation. Read More .

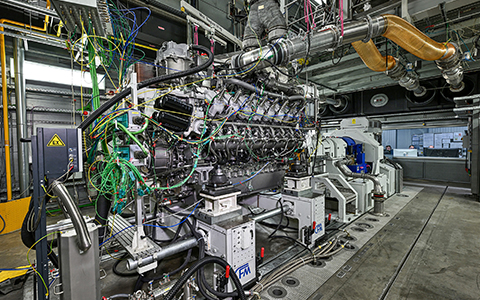

World first: first high-speed 100 percent methanol engine for ships

Rolls-Royce has successfully tested the world’s first high-speed marine engine powered exclusively by methanol on its test bench in Friedrichshafen. Together with their partners in the meOHmare research project, Rolls-Royce engineers have thus reached an important milestone on the road to climate-neutral and environmentally friendly propulsion solutions for shipping. The joint project meOHmare is funded by the German Federal Ministry for Economic Affairs and Energy and combines the expertise of Rolls-Royce, injection system specialist Woodward L’Orange, and the WTZ Roßlau technology and research center. The goal is to develop a comprehensive concept for a CO2-neutral marine engine based on green methanol by the end of 2025. Read More

Google has announced a partnership with NextEra Energy to accelerate nuclear power deployment in the US, beginning with the restart of the Duane Arnold Energy Center in Iowa. NextEra Energy confirmed two transformative agreements with Google, which will strengthen U.S. nuclear leadership and help meet growing energy demand from artificial intelligence (AI) with clean, reliable nuclear energy.

The cornerstone of this collaboration is the planned restart of the Duane Arnold Energy Center (Duane Arnold), Iowa’s only nuclear facility, which is located in Palo, near Cedar Rapids. Once operational, Google will purchase power from the 615-MW plant as a 24/7 carbon-free energy source to help power Google’s growing cloud and AI infrastructure in Iowa, while also strengthening local grid reliability, creating thousands of direct and indirect jobs, and driving significant economic investment to the Midwest region.

In addition to Google’s 25-year agreement to purchase carbon-free nuclear energy from the Duane Arnold plant, one of the plant’s current minority owners, Central Iowa Power Cooperative (CIPCO), will purchase the remaining portion of the plant’s output on the same terms as Google. NextEra Energy has signed definitive agreements to acquire CIPCO and Corn Belt Power Cooperative’s combined 30% interest in the plant, which will bring NextEra Energy’s ownership to 100%. Duane Arnold, which was shut down in 2020, is expected to be online and delivering electricity onto the grid by the first quarter of 2029, pending regulatory approvals to restart the plant.

The power purchase agreement with Google enables the investment to restart the plant and covers costs for the production of energy from Duane Arnold. Restarting the plant will increase generation capacity for the region, and energy customers in Iowa will not bear any costs associated with the power Google purchases from the facility. NextEra Energy’s strategic investments in nuclear and advanced generation help position Google to deploy AI that can grow the American economy, create jobs, accelerate scientific advances, improve health and educational outcomes, and strengthen national and global security.

To that end, NextEra Energy and Google have also signed an agreement to explore the development of new nuclear generation to be deployed in the U.S., which would help power America’s growing electricity needs.

The board of directors of NextEra Energy, Inc. declared a regular quarterly common stock dividend of $0.5665 per share. The dividend is payable on Dec. 15, 2025, to shareholders of record on Nov. 21, 2025. Read More

| Oil and Gas Blends | Units | Oil Price | Change |

| Crude Oil (WTI) Oilprice | USD/bbl | $60.42 | Up |

| Crude Oil (Brent) | USD/bbl | $64.70 | Up |

| Bonny Light 27/10/25 CBN | USD/bbl | $66.66 | — |

| Dubai | USD/bbl | $64.94 | Down |

| Natural Gas | USD/MMBtu | $3.21 | Down |

| Murban | USD/bbl | $65.57 | Down |

| OPEC basket 28/10/25OPEC | USD/bbl | $65.46 | Down |

| At press time October 29, 2025 . |

Equinor will on 30 October 2025 commence the fourth and final tranche of up to USD 1,266 million of the share buy-back programme for 2025, as announced in relation with the third quarter results 29 October 2025. In this fourth tranche of the share buy-back programme for 2025, shares for up to USD 417.8 million will be purchased in the market, implying a total tranche of up to USD 1,266 million including shares to be redeemed from the Norwegian State. The tranche will end no later than 2 February 2026. Read More

Equinor delivered an adjusted operating income* of USD 6.21 billion and USD 1.51 billion after tax* in the third quarter of 2025. Equinor reported a net operating income of USD 5.27 billion and a net loss of USD 0.20 billion. Adjusted net income* was USD 0.93 billion, leading to adjusted earnings per share* of USD 0.37.

Key information relating to the cash dividend to be paid by Equinor for the third quarter 2025.

Cash dividend amount: 0.37

Announced currency: USD

Last day including rights: 13 February 2026

Ex-date Oslo Børs: 16 February 2026

Ex-date New York Stock Exchange: 17 February 2026

Record date: 17 February 2026

Payment date: 27 February 2026

Date of approval: 28 October 2025

Other information: The cash dividend per share in NOK will be communicated on 23 February 2026.

TRATON GROUP managed to keep its sales revenue in Europe nearly stable in the first nine months of 2025. Nonetheless, the Group’s sales revenue declined by 8% to €32.3 billion (9M 2024: €35.3 billion), primarily due to lower truck unit sales in Brazil and North America. The Vehicle Services business remained stable, with its share of total sales revenue increasing slightly to 20% (9M 2024: 19%). Sales revenue in the TRATON Financial Services segment increased by 13%, benefiting from the further increased portfolio volume. Adjusted operating result of the TRATON GROUP was €1.2 billion lower at €2.0 billion (9M 2024: €3.3 billion) and adjusted operating return on sales fell to 6.3% (9M 2024: 9.3%). The major factor behind this was the decline in sales revenue combined with the lower capacity utilization in the production of heavy-duty trucks. Moreover, currency effects, expenses in connection with the build-up of the new plant in China, and higher material costs due to tariffs all weighed on the operating result and the operating return on sales.

At 202,100 vehicles (9M 2024: 189,800), incoming orders were up 7% year-on-year. This was mainly driven by a strong replacement demand from truck customers in the EU27+3 region. In North America, customers remained cautious amidst ongoing uncertainty regarding the US tariff policy and its potential impact on the US economy. This led to a noticeable drop in the demand for trucks. In Brazil, incoming orders for trucks also decreased against the backdrop of increasingly challenging economic conditions. Incoming orders for buses declined significantly in the first nine months of 2025, particularly in North America. By contrast, demand for the MAN TGE van rose by almost a quarter in the wake of the model change.

As already reported, unit sales of the TRATON GROUP declined by 9% to 224,500 (9M 2024: 245,400) vehicles in the first nine months of the year. As incoming orders were lower than unit sales, the book-to-bill ratio amounted to 0.9 (9M 2024: 0.8). Read More

More Energy, Oil & Gas Stories !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Victor Cole , victor@oilandgaspress

OilandGasPress.com is a website that provides news, updates, and information related to the oil and gas industry. It covers a wide range of topics, including exploration, production, refining, transportation, distribution, and automotive market trends within the global energy sector. Visitors to the site can find articles, press releases, reports, and other resources relevant to professionals and enthusiasts interested in the energy, oil and gas industry.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

“Stay informed with Oilandgaspress.com—your independent source for global energy, oil, gas, EV, and automotive industry news and analysis.”

Submit your Releases or contact us now!, victor@oilandgaspress

Follow us: on Twitter | Instagram

Your Daily Source for Oil, Gas, Renewables & EV Market Insights :