Summary

- State policies favoring clean-energy have oil companies fuming

- Exxon, Chevron each to take about $2.5 billion in impairments

Jan 29 (Reuters) – It is the end of an era for Big Oil in California, as the most populous U.S. state divorces itself from fossil fuels in its fight against climate change.

California’s oil output a century ago amounted to it being the fourth-largest crude producer in the U.S., and spawned hundreds of oil drillers, including some of the largest still in existence. Oil led to its car culture of iconic highways, drive-in theaters, banks and restaurants that endures today.

On Friday, however, the marriage will officially end. The two largest U.S. oil producers, Exxon Mobil and Chevron will formally disclose a combined $5 billion writedown of California assets when they report fourth-quarter results.

“They are definitely getting a divorce,” said Jamie Court, president of advocacy group Consumer Watchdog, which said the companies long ago stopped investing in California production, and now want to hive off their old wells there. “They’ve been separated for more than a decade, now they are just signing the papers,” he said.

Exxon Mobil last year exited onshore production in the state, ending a 25-year-long partnership with Shell PLC, when they sold their joint-venture properties.

The state’s regulatory environment has impeded efforts to restart offshore production, Exxon said this month, leading to an exit that includes financing a Texas company’s purchase of its offshore properties.

The No.1 U.S. oil producer’s asset writedown will cost about $2.5 billion and officially end five decades of oil production off the coast of Southern California.

Chevron will also take charges of about $2.5 billion tied to its California assets. It is staying but bitterly contesting state regulations on its oil producing and refining operations in the state, where it was born 145 years ago as Pacific Coast Oil Co.

California’s energy policies are “making it a difficult place to invest,” even for renewable fuels, a Chevron executive said this month. The company pumps oil from fields developed 100 years ago but has cut spending in the state by “hundreds of millions of dollars since 2022,” the executive said.

ENVIRONMENTAL AWAKENING

If oil companies fed California’s car culture, their oil spills spurred the U.S. environmental movement. A devastating oil well blowout in Santa Barbara in 1969 led to the National Environmental Policy Act that for the first time required federal agencies consider environmental effects of permitting decisions.

In the 70s and 80s, the state set curbs on drilling near homes and businesses and regulations on air pollution – rules that have been copied widely across the U.S. In 1996, California introduced reformulated gasoline to fight smog, developing the country’s most stringent and costly environmental standards.

That mixed legacy overshadowed oil’s economic contributions. California’s high-tech industry long ago replaced oil as a major employer and its governor, Gavin Newsom, has called for the state to ban sales of new gasoline-powered vehicles by 2035.

His administration last September filed a lawsuit targeting the oil industry for “lying to consumers for more than 50 years” about climate change. He signed into law a bill seeking to hold Chevron and other refiners liable for allegedly price-gouged consumers, opens new tab.

The American Petroleum Institute, the industry’s trade association, said climate lawsuits hurt “a foundational American industry and its workers” and represent “an enormous waste of California taxpayers resources.”

INDUSTRY IN DECLINE

For now, the acrimony makes the story of California and oil sound a lot like a tragedy.

“This is a green transition,” said Daniel Kammen, a professor of Energy at the University of California, who argues oil firms need to move to clean energy and away from fossil fuels. “There is a pathway for these companies. But if they chose otherwise, they are dinosaurs.”

Reuters Graphics

Reuters Graphics

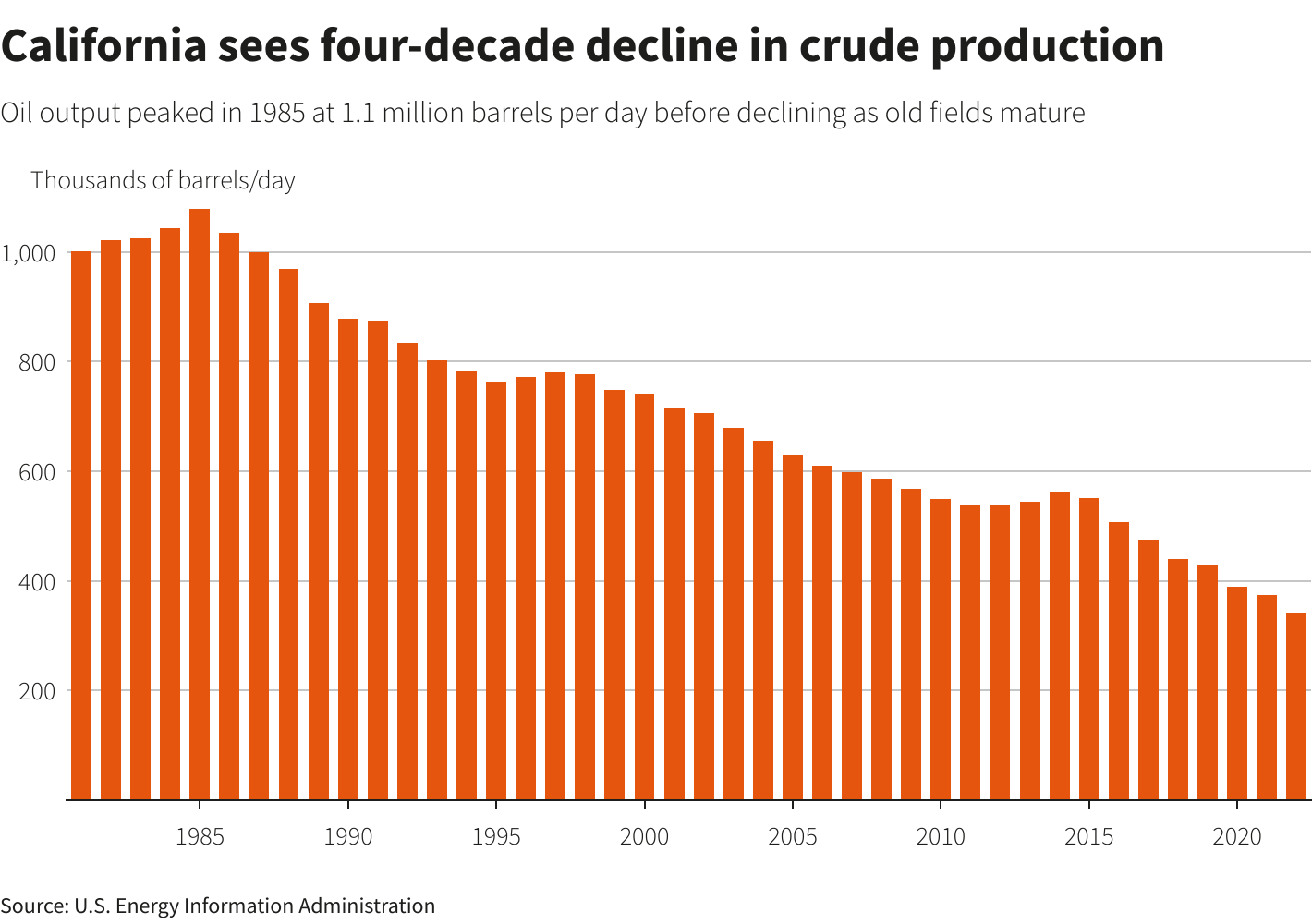

Oil production in the state has been on a steady decline for almost four decades. Crude output, including at its historic Kern County fields in southern California, is off by a third since its 1.1 million-barrel-per-day peak in 1985.

The state has lacked new oil development projects and the legacy fields that produce heavy oil have not been suitable for state mandates for high quality gasoline.

As of September, more than 50% of oil drilling permits issued to companies have gone unused, according to the California Department of Conservation. Unemployment in oil producer Kern County is at 7.8%, compared with the overall 4.9% average for the state.

And California today has six times more clean-energy as oil-related jobs.

“California can’t have both,” said UC Berkley’s Kammen, who formerly was a Science Envoy in the Obama administration. “That means there is no room for oil and gas after that.”

Reporting by Sabrina Valle Editing by Gary McWilliams and Marguerita Choy

Share This: