Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

In recent months it’s become clear that there’s a distinctly non-cottage industry in Germany producing unintentionally and intentionally misleading reports about hydrogen for energy. Today yet another significant and respected organization crossed my screen, dena, or the German Energy Agency. (Lower-case is their branding and it’s an acronym of a German language name.)

It’s a think tank that was set up by governmental and industry actors in 2000 to be a competence center for applied energy transition and climate protection. Its governance body is mostly governmental representatives. It has about 550 employees per its website and 460 per LinkedIn. German academics and governmental types in general frequently don’t consider LinkedIn a platform to be engaged with or represented on, it seems.

Some red flags start to appear fairly quickly, at least a far as hydrogen for energy is concerned. The first, of course, is that it’s the German Energy Agency. By definition it views the molecule through the distorted lens of energy, not through its true role as an industrial feedstock. Confusion ensues.

The second is that it’s not stock full of STEM and economics literate staff. It is, from the outside looking in, a policy, regulatory, and legally focused organization. Its top two staff are lawyers. Nothing wrong with lawyers at all. I have tremendous respect for a lot of the profession I’ve worked with. But if I’m talking about energy and hydrogen, a lawyer isn’t who I would turn to.

And so to what triggered me to have a closer look, which was a LinkedIn post by Dr. Robert Stüwe, Lead Expert, Hydrogen, Foreign Economic Policy, EU, per LinkedIn. He’s dena’s top hydrogen guy, it seems.

#Hydrogen bridge between Australia and Germany suffering delay once again shows the need to take parallel efforts to get #H2 pipeline projects over the finishing line that connect sources closer to Europe. This would in the long term pay off in terms of supply security and ensure a greater diversification of sources. #H2Importkorridore

This was a head-scratcher. Hydrogen pipelines, which I’ve looked at numerous times without them making any economic sense. Shipping hydrogen from distant regions, which once again is absurdly expensive and uncompetitive with alternatives.

Not to get too ad hominem, but what are Stüwe’s credentials for being a hydrogen expert? STEM chops? None apparent. Economic chops? Nope. Sociology, law, and political science. This in no way makes him a slouch or someone not to respect, but it means that when it comes to hydrogen and energy, he’s most likely running off of received wisdom, not bottom-up cost estimates and energy balances he’s done himself. He’s missing a bunch of background knowledge — once again from what is presented in his public profile — to be able to judge hydrogen as an energy carrier.

And so, he’s similar to the Chair and Managing Director in being focused on energy from a distance and not focused on running the numbers himself. Once again, this isn’t a bad thing if the received wisdom he’s running on is aligned with empirical reality. But this is hydrogen for energy we are talking about.

So what does dena do? It researches, writes, and publishes reports and papers. It recommends policies, frameworks, subsidies, and regulations to align with a decarbonized energy system. Its staff does media interviews about same. It influences. It’s a think tank. That’s okay. There is a requirement for organizations who do all of these things. Unless they are misaligned on empirical reality.

Stüwe’s post suggested that they might not be aligned. So I went and looked at a handful of their publications about wasserstoff, which is the word for hydrogen in German.

What was that about projects? Well, they seem to get most of their funding from conducting what are best described as consulting engagements to write reports on behalf of and paid for by various of their shareholders and other organizations. Their shareholders are governmental ministries and dena itself.

But 13% of their funding comes from private companies. 2021 funders included synthetic fuel manufacturers, biogas firms, BP, Daimler aka Mercedes Benz Group, LNG liquifiers, Lufthansa, Shell, the German Gas and Water Association — foreshadowing –, gas utilities, ExxonMobil, electrolyzer firms, hydrogen firms, cement firms, industrial heat associations, and compressor firms.

And a bunch of other firms and organizations which are focused on various aspects of the energy transition including transmission, renewables, and other organizations. Perhaps my favorite was the Lower Bavarian chimney sweeper cooperative eG.

But that first list is concerning. It means that a bunch of organizations which aren’t aligned with empirical reality concerning the transition because they are facing extinction are paying for reports which dena is producing. And those reports are shaping German policy.

Once again, to be clear, I looked at the first 4-5 publications that came up out of apparently 1,500 projects that they have done, specifically looking for hydrogen-focused efforts. I’m sure many of their projects, especially those funded by electrical utilities, transmission organizations, and possibly even automotive OEMs are more aligned with the reality of deep electrification and renewables.

What’s Up With Germany & Hydrogen?

Before diving into a few odd dena reports, let’s step back and survey that German non-cottage industry related to hydrogen.

For a bit of context, hydrogen is part of an ongoing political scandal around energy that’s involved a couple of Chancellors. Gerhard Schröder, Merkel’s predecessor, was tight with Putin and Russia and has received a million a year since 2005 for sitting on the Board of Nord Stream, Russia’s gas export pipeline business and a subsidiary of Russia’s state-owned Gazprom. He’s become a pariah for his decades of promoting close energy ties with a Russia which was obviously trending away from being a good global actor even then.

The current Chancellor Olaf Scholz, Merkel’s successor, and one without anything remotely like her STEM chops, has been part and parcel of this, establishing hydrogen diplomacy offices in Moscow, Riyadh, Luanda, and Abuja, with one intended for Kyiv as of just before the Russian invasion.

That highest level political engagement around hydrogen as an energy carrier pervades the country, to its detriment and to the detriment of Europe actually decarbonizing. I’ve been observing the symptoms of this irrational focus on the wrong solution in my assessments of research and think tank organizations for the past few months.

Let’s start with the International Council on Clean Transportation. Wait, it’s a US think tank established by American philanthropical organizations, including both the Hewlett and Packard foundations. What does it have to do with Germany?

Well, in November of 2023 it published a remarkably odd total cost of ownership study on heavy freight road trucking in Europe which made the false case that hydrogen trucks would have energy costs per kilometer not much more than electric trucks. This was brutally obviously wrong, yet they tried to defend it and still have not acknowledged how credibility-destroying wrong they were.

What does this have to do with Germany? The lead researcher and author on that study is based in Berlin.

Hmm. Far from definitive. What else?

Well, there was the German working group established to identify pathways to road freight decarbonization that similarly low-balled hydrogen trucking costs. Once again, they failed to make hydrogen-powered trucking pencil out, but they put a lot of thumbs on the scale, including hard-to-believe assumptions of a massive network of hydrogen gas utilities and dirt-cheap green hydrogen imports. They really tried to make hydrogen pencil out. Still failed. The working group focused on synthetic fuels for trucking, one which was overloaded with automotive industry representatives, fared better at pretending that very expensive fuels would be fit for purpose and internal combustion engines would continue to dominate.

Then there was the PIK Potsdam Institute for Climate Impact Research study I looked at recently. That’s a German research organization as well. It was funded by the governments of Germany and the German state of Brandenburg, founded in 1992. They have a couple of models that they appear to be too reverent of, LIMES-EU and REMIND, which have extraordinarily low prices for hydrogen embedded in them, €1.67 consumer price per kilogram in LIMES-EU and €2 and €3.50 consumer prices in REMIND.

The researchers, internal reviewers, and peer-reviewers missed this completely because all of the consumer energy prices were normalized into MWh and no one has a benchmark in mind for hydrogen in MWh. It appears the researchers thought that putting in assumptions for electricity prices would automatically lead to green hydrogen made with those electricity rates, but weren’t able to spot that the models had no relationship between electricity prices and hydrogen prices. Bad units led to bad outputs.

The EU JRC’s 2022 hydrogen transportation study, which I assessed recently, actively packed underlying assumptions with unrealistically low costs related to the manufacturing and distribution of hydrogen, then carefully wrote the policy brief to give the misleading impression that green hydrogen would be available at vastly lower prices than any realistic numbers.

Any realistic cost work-up for shipping hydrogen finds that it would be vastly more expensive than LNG or coal imports and as such cripple the importing country economically.

Then there’s Daimler Trucking, a subsidiary of Mercedes Benz Group. One of its Board of Directors, Dr. Andreas Gorbach, regularly posts about Daimler’s hydrogen trucking initiatives.

As happens with hydrogen for energy types, Daimler’s hydrogen trucking efforts ran into the brick wall of 700 bar hydrogen compression failures and drivetrain problems. Instead of accepting that it was a bad energy choice and pivoting fully to battery-electric, Daimler followed a well-worn path into liquid hydrogen.

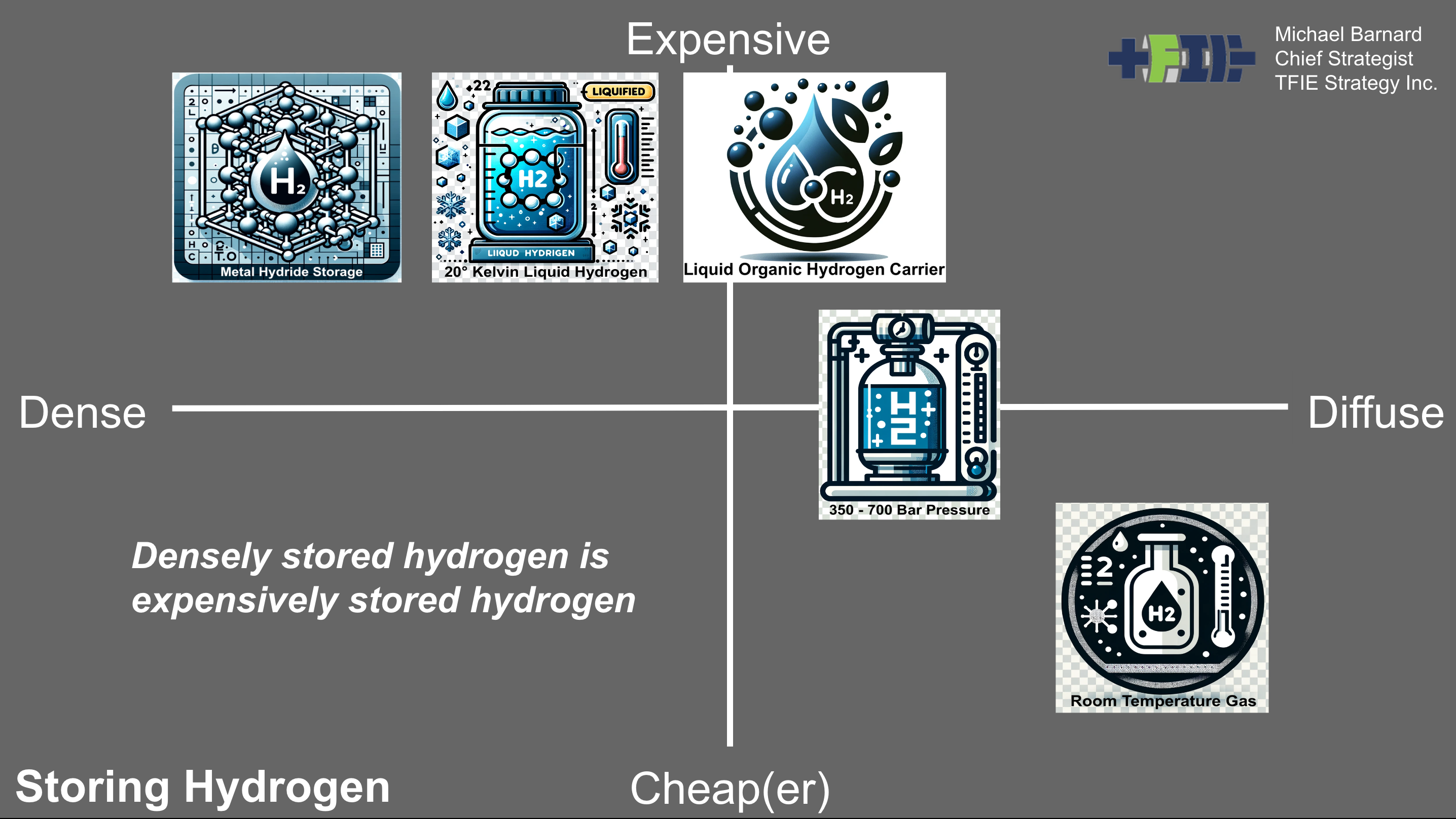

They’ve just set up a liquid hydrogen refueling station to go with their liquid hydrogen fueled freight truck. As a reminder, hydrogen is only a liquid at 20° above absolute zero, 17° above the temperature of deep space. To make liquid hydrogen requires a full third of the energy in the hydrogen. To keep it liquid long enough requires massive, globular, highly insulated tanks.

Safety requirements for handling it are very high due to the absurd cold which would flash freeze a person exposed to it and the massive amounts of highly flammable gas it would immediately turn into.

Liquid hydrogen is shipped by truck today, but only where it literally is the only option for the end use case and it’s not financially viable to build a hydrogen manufacturing and liquification plant at the site. NASA still uses it for getting rockets into orbit, but the space industry as a whole is moving away from it because it’s so hard to handle.

Yet German institution Daimler thinks it’s going to be at hundreds of truck stops and truckers are going to be pumping it safely. And Daimler thinks hundreds of tanker trucks full of the stuff on European highways with texting drivers and school buses is a reasonable idea.

This is par for the course for organizations and individuals who commit to hydrogen. At some point they lose track of objective reality and think that a new bad idea will solve the problems that they found everywhere else in hydrogen. I wrote about all the hydrogen pathways and their dead ends extensively recently.

But Gorbach and Daimler’s hydrogen lead promote and defend liquid hydrogen trucking fairly constantly, committing Daimler to a dead end instead of focusing on building a battery-electric truck from the ground up. It’s a bad strategy based on an inability to get away from hydrogen. It’s going to end badly for Daimler. But to be clear, it’s becoming obvious that Daimler is stuck in an echo chamber of German energy types. They aren’t strong enough to resist it. That won’t help them, but maybe it’s an excuse.

Right now, Daimler is leaving the traditional ladder frame of their trucks alone and jamming diesel, hydrogen, and battery-electric drivetrains in. This is just as bad an idea for efficient battery-electric trucks as it is for every other vehicle, yet Daimler’s adherence to hydrogen is preventing building a real semi tractor skateboard architecture.

The hydrogen lead in Daimler might have an excuse. They aren’t a STEM-focused person per their educational and career history so might not be able to do the technical due diligence required to realize how bad an idea this is. They have their job and they are doing it to the best of their ability. I have some sympathy for that.

But Gorbach, who is on the Board of Directors, has hardcore STEM credentials. He has a PhD in chemical engineering and a masters in system dynamics and controls. He should know better. Instead he’s a major cheerleader for hydrogen publicly and undoubtedly internally. To be fair, he is also a promoter of their battery-electric trucking efforts, which are delivering trucks to customers today.

Has dena Lost The Plot On Hydrogen As Well?

So there’s a gap between reality and the dena hydrogen expert’s public statement noted above. But that could be a blip, a misstatement, the representative getting out over their skis, or simply a mistake. What do a sampling of dena’s reports related to hydrogen say?

A dena paper from May 2023, Business models for decentralized hydrogen concepts (translated from German), includes this gem.

… seasonal hydrogen storage in the neighborhood and in homes

We’re now at 54 independent studies that find zero use for hydrogen in homes. Oh, wait. A few days after the meta-analysis was published, a 55th study surfaced. And seasonal storage? Homes will be storing hydrogen in the summer for those cold winter days?

That’s true for commercial buildings as well. No hydrogen will be involved in residential or commercial heating of water or air. No heating, no gas distribution pipeline network. There simply won’t be an economic case for hydrogen gas utilities unless there is massive residential and commercial demand for it.

There is certainly no need for hydrogen cogeneration for district heating with district geothermal heat pumps and heating networks. Vastly cheaper per unit of energy coming and going. Other parts of dena appear to know this, so once again, this is a subset of the agency, not the entirety. But they are publishing reports which confirm the bias of policymakers and investors instead of being an actually thinking tank.

Later in the same distributed business model study, adding hydrogen production co-located with a repowered onshore wind farm is considered. It posits 7.6 MW of electrolyzers running roughly 80% of the time that the wind farm is running, as wind turbines generate electricity about 85% of the time, but just not at nameplate capacity. So far so good, one would think.

But what exactly is going to be done with the hydrogen?

7.6 MW is only about 150 kg of hydrogen an hour. That’s far too little to put a pipeline in for. It’s not like there will be a big consumer hydrogen distribution network if it’s not used in a large percentage of buildings. So onsite storage and compression.

Then trucks show up to transfer it. And hydrogen trucking costs of €7.50 to €10.50 apply per US DOE studies of real world experiences.

The same decentralization report talks about blending hydrogen into gas networks as if that’s going to be broadly done, even though it admits openly that 20% hydrogen would be only 7-8% of energy. What it doesn’t say is that the hydrogen would be vastly more expensive than gas per gigajoule, so customers would be hit twice in the pocketbook.

First, they would only be receiving 87% of the energy for the same volume of gas, and second they would be paying a lot more for it. It’s a nonsensical idea loved only by the natural gas utilities. What’s really happening with gas utilities is that they are being faced with the utility death spiral and will be closing up shop.

Utrecht has the right idea. It’s shutting down its gas distribution network sub-isolation network by sub-isolation network and providing a mixture of district heating and heat pumps for all buildings.

Later, of course, the report asserts that pure hydrogen distribution networks will exist and that existing pipelines can be repurposed cheaply. Clearly the report didn’t read the German pipeline studies carefully. Vastly lower volumes of hydrogen would flow through repurposed pipelines to enable them to last more than a few years.

Pressure changes and hydrogen embrittlement at joints and welds make for radically lower lifespans unless much lower pressures are used, instead of the 3x pressure required for the same volume of energy in the form of hydrogen.

Dena thinks that repurposing existing gas pipelines is cheap and easy and that the rapidly escalating costs of proposed hydrogen pipelines from and to nowhere aren’t an issue. Paul Martin, a chemical engineer who worked professionally with hydrogen for decades and a co-founder of Hydrogen Science Coalition, has read the reports carefully.

Under the hydrogen design code, the design pressure of an existing fossil gas line would need to be de-rated to perhaps 1/2 to as little as 1/3 of its original rating if it were switched to carry hydrogen. That’s going to have a very large impact on the energy carrying capacity of those lines, likely necessitating either twinning or replacement of any transmission line switched to hydrogen.

But they are probably influenced by bad studies on hydrogen vs HVDC transmission, which are also rife in European circles. Those studies share a lot of bad assumptions and framing.

The report does love the idea of making small amounts of hydrogen locally for storing electricity, positing local 2,000 MWh per year storage. As a reminder, turning electricity into hydrogen and then back into electricity is deeply inefficient, returning about a third of the electricity it started with and requiring a full industrial electrolysis, hydrogen dehumidification facility, hydrogen purification facility, compression, storage, and fuel cells which require pure hydrogen and HEPA-grade air filters.

That facility would have high maintenance costs, as hydrogen compressors are very high maintenance and fuel cells are finicky beasts.

All for 2,000 MWh of storage per year, something a couple of Tesla Megapacks can do, which can be delivered on a trailer, have no moving parts, and just sit there without maintenance.

At the scale envisioned, the hydrogen electrolysis facilities are vastly under the economic scale of an industrial facility, so balance of plant and operations will be much more expensive as a ratio. The price points of hydrogen manufacturing aren’t realistic, in other words.

The report then assesses flexible electrolyzers for soaking up excess demand.

This, of course, requires electrolyzers which actually can scale up and down flexibly, so that’s PEM electrolyzers, at least in theory. In reality, PEM electrolyzers are not nearly as flexible as has been widely assumed, with only the most expensive being able to ramp up and down quickly without significant degradation.

Once again, basic assumptions don’t stand up to scrutiny.

Even then, the report finds: “It is therefore not possible to build a business model for flexible electrolysers based on the provision of control energy.”

Yup. All that capital, operation, and maintenance cost can’t be paid off with only a third return of electricity even if they sell waste heat too, although of course they wouldn’t have nearly as much with variable load PEM electrolyzers anyway.

We’re now onto p.66 of the report and the chickens are coming home to roost. Dena’s copyright guidance is clear that reusing graphics or material from their reports without express permission isn’t allowed, otherwise I would grab a screenshot. The report is linked above for anyone interested.

There are three charts of the cost of distribution of hydrogen. For low volume consumers, aka homes and commercial buildings in their context, the costs of distribution are incredibly high, €2 to €4.39 per kWh.

Yes, per kWh. That’s a unit of electricity that’s ten to twenty times cheaper than the hydrogen delivery price when it’s delivered through wires.

That is vastly more than any building or small business is going to pay for energy. Only much larger demand centers for hydrogen, i.e. existing industrial consumers who have pipelines already, will see remotely inexpensive hydrogen delivery. Once again, dena authors lean into the inaccurate idea that it will be dirt cheap to repurpose existing natural gas lines.

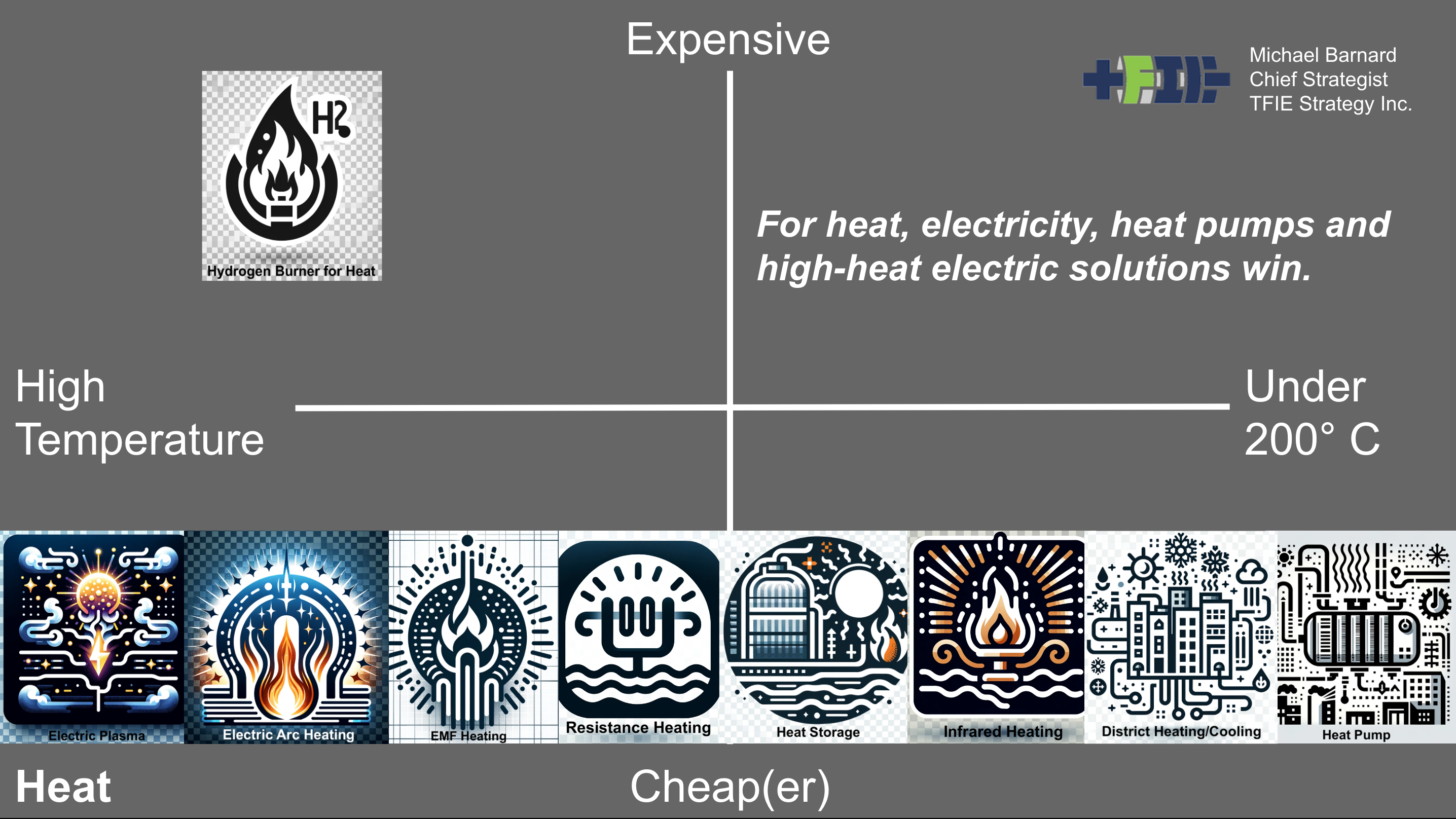

Those are euros per kWh of energy in the form of hydrogen by the way, which is to say heat energy, which is to say that they are double that for actually useful electricity if that’s the use case. If it is for heat below 200° Celsius, heat pumps would require a third the energy in the form of electricity and at a fraction of the cost. Hydrogen for energy is already out of the running without those distribution costs.

Given that most of the industrial centers that have a business case for gray hydrogen pipelines already have them, and small and medium businesses won’t be using hydrogen for energy, once again, the gas distribution network will be shutting down and restricted to industrial users.

Those users don’t consume hydrogen for energy today and won’t in the future. We’re well into multiples per kWh of delivered heat energy already compared to using electricity directly and more multiples with heat pumps. Who exactly is going to pay for very expensive energy when they could just use convenient electricity?

And on p.76 we find the theory behind the silly idea of seasonal hydrogen storage in neighborhoods. The electricity grid which has been successfully and massively scaled can’t scale per the report, so they’ll add much higher load electrolysis machines to level the demand. And they’ll be in homes in neighborhoods.

buildings with local hydrogen storage

Electrolysers for domestic use can store up to 1,500 kWh.

This is such a cockamamie concept and so vastly understated in terms of actual capex, opex, and maintenance for the hydrogen energy train that no one would seriously do this once an actual design had been worked out and costed.

Hydrogen value chain components have very poor mean time between failure statistics. That hasn’t changed much in decades. Very high compression of very tiny molecules is incredibly tough and demanding, so compressors are very expensive and fail regularly. Fuel cells require pure hydrogen and HEPA-filtered air and still degrade.

This is a case where a paper study by people with no HVAC, construction, or operational experience makes something very complex and inefficient seem like a good idea. I’m sure that the researchers are well-meaning, but that they were actually proposing and studying manufacturing hydrogen in homes with summer sunshine to provide winter energy in … checks publication date … 2022 is astounding. This is the kind of thing found in gee-whiz tech and enthusiast sites over 20 years ago. It’s very difficult to take the report seriously at all when it includes this kind of thing.

And then we get to industrial process heat.

45% of industrial heat is below 200° Celsius. That’s entirely viable with heat pumps which are at minimum 3x as efficient as hydrogen or other burnable fuels.

Vastly more of the remainder of industrial process heat can electrify than the report assumes. There’s an embarrassment of riches of technologies which aren’t used today simply because burning fossil fuels without abatement is dirt cheap.

If an industrial site can’t keep burning dirt cheap fossil fuels and its only option is burning very expensive hydrogen or derivatives, it simply won’t be economic and will fail as a business. This is Economics 101.

Assuming that an existing industrial facility can’t radically electrify heating is a bad assumption. Assuming that if they can’t electrify that they’ll be competitive with vastly higher energy costs is a bad assumption. New facilities that are built for electricity will eat their breakfast, lunch, dinner, and those extra snacks they don’t tell their spouse about.

Where burning is required for the characteristics of flames, it will be biomethane most likely. Much easier to work with and cheaper. Hydrogen can’t and won’t compete.

Of course, dena loves hydrogen pipeline infrastructure. How can it not when so many of its stakeholders are Europe’s natural gas transmission and distribution firms?

In the report, How can the hydrogen network infrastructure be set up in Germany and Europe?, innumerable bald-faced assumptions about massive hydrogen demand are made that don’t stand up to much scrutiny.

Dena recommends a crash course of building thousands of kilometers more hydrogen pipelines, up to 8,500 km by 2032.

The report is all about the regulatory, policy, business model, and subsidy structures necessary to make this pipe dream a reality. More wasted digital ink.

As a reminder, Europe assumed green hydrogen could be cheap to make and cheap to ship. BCG called it a ‘consensus’ of €3 per kg by 2030. That consensus was only among STEM- and economics-illiterate hopeful types, not people with the basics of both who had done actual cost workups.

And lo, as BCG announced recently, it was indeed an illusion, with €5-8 per kg being the manufacturing price point in Europe in the 2030s. Green hydrogen deals that actually reached final investment decision in 2023 average €9.49 per kilogram. That strike price isn’t going to come down easily because of the economics of manufacturing hydrogen. And that price is before transmission and distribution.

In the report, Hydrogen projects in Germany, dena lovingly lists hundreds of hydrogen projects in the country, without indicating what their status or likelihood of success is.

But as BCG again reported from their data set of about 1,300 hydrogen projects, only 0.2% by volume had reached operation and the vast majority weren’t going to reach final investment decision. Not that they put it that way, but that’s what the data reported says even if they were loathe to say it.

Meanwhile, only 10% of hydrogen projects planned for 2030 even had an off-taker, per BNEF.

And the IEA makes it clear that only 7% of the theoretical number of hydrogen projects is going to be online by 2030.

Dena’s tables are undoubtedly full of projects that won’t reach final investment decision.

And now we get to the report, Sustainable heavy-duty transport from Nov 2023. Fresh off the press.

Bizarrely, two of the three authors are from DVGW, Germany’s gas and water association. One of them is explicitly a natural gas and LNG expert. The other is a young urban planning and policy person. Neither have any background in transportation. The dena representative once again lacks STEM and economics credentials, but has been doing marketing, policy, and regulatory work related to transportation for a while.

My heart sinks when I think what this report is likely to say. Let’s find out.

Naturally, hydrogen plays a starring role: “The use of hydrogen in heavy-duty transport can make a major contribution to reducing greenhouse gas emissions (GHG emissions) in the transport sector.”

For context, no credible total cost of ownership finds hydrogen trucks are competitive with battery-electric. As David Cebon of Cambridge, founder and director of the Centre for Sustainable Road Freight found, fuel cell trucks will have double the capital expenditure and three times the operational expenditure of battery-electric freight trucks. And fuel cell buses are proving to have 50% higher maintenance costs than diesel and double that of battery-electric, per my published assessment of California fleet data.

Unsurprisingly, next up are natural gas and biomethane. The DVGW folks are showing their colors. Naturally this is all very available and all fit for purpose — for gas distributors. Naturally it’s nonsense, as battery-electric trucks are much cheaper to operate and maintain, with total costs of ownership at current trajectories under those of diesel by 2030. Apparently just like maritime ships, lots of trucks seem to be burning LNG in Europe, part of the great success of the gas industry at pretending that it was a better alternative.

Pro-tip: methane is a massive climate change problem and any widespread use and distribution of it contributes to that problem.

Among other things, there are over 500,000 electric trucks on China’s roads, along with probably 700,000 electric buses. Road traffic is a solved problem. Methane, whether fossil or bio, is not required.

The absolutely massive public electricity charging network, the high-speed charging network, and the megawatt-scale chargers that are available now are ‘practically nonexistent’ infrastructure. The almost 20,000 high speed charging stations compared to the 18 heavy vehicle hydrogen stations that they document in the report should have been a clue as to what was actually going to occur.

To be clear, the massive, swift, and inexpensive rollout of high-speed charging, compared to the expensive, slow, and fraught rollout of hydrogen refueling stations should be an abject lesson.

And there are their assumptions about battery-electric trucks and energy density.

“It is expected that batteries with capacities of 600 to 850 kWh can be made available for 700 km routes by 2030”

Tesla Semis already have 800 km ranges today. CATL is delivering batteries in 2024 with twice the energy density of Tesla’s, enabling 1,600 km of range. The US NACFE Run on Less in September of 2023 saw Teslas run 1,600 km in a day with fast charging, and other vendors’ electric trucks run 800 km in a single day of loaded service.

Yet again a hydrogen-focused trucking report ignores the reality of battery energy density and electric trucks today.

And, of course, they downplay the problems of hydrogen pumping stations and make it seem as if megawatt scaling charging stations are deeply unlikely to be viable due to grid limitations.

As a reminder, I recently assessed California’s hydrogen pumping stations in the same period when I was looking at their public data on bus fleets. The last six months that they reported maintenance data were the first half of 2021. The 2022 report I assessed showed that the stations were out of service for maintenance 20% more hours than they were actively pumping hydrogen into cars, a full 2,000 hours more, in fact. The biggest issue was compressor failure.

My initial methodology suggests that this represents a 30% of capital expenditure spent on maintenance annually, not the 3-4% assumed in total cost of ownership studies. It aligns with the recommendation of 10% of capital expenditure annually that a contact had been given by a vendor selling lower pressure 350 bar refueling stations.

I’ve shared these results with an international group of road transportation researchers and suggested that they find funding to recreate the study with any methodological improvements and data that they see fit to include. After all, there are a lot of hydrogen refueling stations in Europe, South Korea, and Japan as well.

So What’s Going To Happen With Germany?

The country has wrapped so many of its major academic and research organizations around the axle of hydrogen energy that it’s unclear how they’ll ever see straight again. Academic reputations are already suffering. Previously credible and respected organizations are being found to be non-credible, with their work of several years subject to retrospective doubt.

German politicians seem to be sunk into this morass and determined to lead Germany into an era of extremely high energy costs. When other countries are embracing electrification, building modern industrial facilities that run entirely on green electricity and avoiding all of the negative externalities associated with burning anything, but especially with burning fossil fuels, they are going to be having much cheaper value chains.

German companies are falling into the same pit. Daimler is just one of many. BMW is still wasting time on hydrogen fuel cell light vehicles. In 2024. While fuel cell car sales are plummeting globally.

And so to that odd word in the title of this piece, gruppendenken. That’s German for groupthink.

Groupthink is a phenomenon that occurs when a group of individuals reaches a consensus without critical reasoning or evaluation of the consequences or alternatives. Groupthink is based on a common desire not to upset the balance of a group of people.

Yes, the rational Germans, often held up as the epitome of hard-headed and disciplined engineers, have a societal failure of critical reasoning or evaluation of consequences and alternatives. Their cognitive biases are leading them to misread reports on hydrogen pipelines to see what they really want to see. They avoid cost comparisons.

If this was Lichtenstein or Andorra, this wouldn’t be as consequential. But Germany is a very powerful force in the EU. It’s the biggest economic entity by far, with a GDP €1.4 trillion more than the second best, France. It’s been driving hydrogen for energy policies that are contrary to empirical reality for a long time. A great deal of Europe’s confusion about hydrogen can be laid at Germany’s door.

And as noted early on in this discussion, a great deal of that leads back to German political alignment with Russia over energy of all types. Major strategic mistakes have been made for over 20 years that have led to this point. It is not, however, too late.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.