The crisis playing out in the Middle East has profound strategic and humanitarian implications, but what does it mean for investors, particularly those holding or considering gold and other precious metals that typically attract safe-haven demand?

The horrifying attacks on Israel by the Hamas terrorist organization are less than a week old but already we see an uptick in the price of gold compared to a lackluster 2023 performance.

Last week the yellow metal skidded to a seven-year low, with World Gold Council analysts noting September was the fourth consecutive month of outflows from gold ETFs.

Gold’s performance this year has been flat — the gains between March and May canceled out by the losses from May to October.

Headwinds have included receding fears of a US slowdown, surging bond yields and better-performing equities.

On Oct. 4, gold came within 10 bucks of a 2023 low of $1,811.20.

Then came news of the attack on Israel by Hamas, a Sunni Islamist organization that governs the Gaza Strip of the Palestinian territories.

Gold immediately reacted, climbing from $1837 on Oct. 8, the day of the invasion, to $1874 on Wednesday, Oct. 11, a bump of $37. While a 2% increase is not enough to stir excitement among gold bugs, it’s the threat of the conflict escalating beyond a mere cross-border shelling episode that Israelis and Palestinians have lived with for decades, along with macroeconomic factors, that in my opinion, will be the catalyst for the next sustained upturn in the gold price.

Spot gold since the attack on Israel on Oct. 8. Source: Kitco

IMF outlook worsens

This week, the International Monetary Fund raised its 2024 inflation forecast to 5.8% from an earlier 5.2%, while at the same time trimming its global growth forecast from 2.9% to 2.8%. Bloomberg notes this is below the 3.8% average of the two decades before the pandemic:

Factors holding back the expansion include the long-term consequences of the pandemic; the invasion of Ukraine; the breakdown of the world economy into blocs; and the central bank policy tightening.

The fund predicts inflation will stay above central bank targets until 2025.

Stagflation and gold

High inflation + low growth = stagflation.

How has gold done during stagflation? As it turns out, quite well. The chart below by Sunshine Profits shows the gold price climbing during the stagflationary 1970s, surging from $100 per ounce in 1976 to around $650 in 1980, when CPI inflation topped out at 14%.

Gold prices in yellow compared to inflation in red.

Source: Sunshine Profits

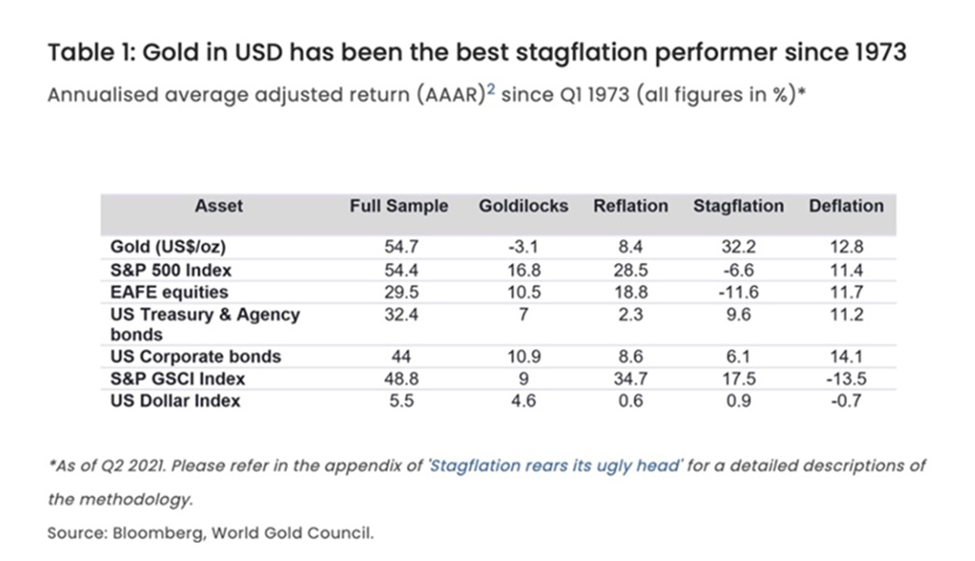

In fact, gold outperforms other asset classes during times of economic stagnation and higher prices. The table below shows that, of the four business cycle phases since 1973, stagflation is the most supportive of gold, and the worst for stocks, whose investors get squeezed by rising costs and falling revenues. Gold returned 32.2% during stagflation compared to 9.6% for US Treasury bonds and -11.6% for equities.

According to the World Gold Council, a look at US economic history back to 1971 reveals that stagflation has been the most frequent scenario (occurring in 68 of the 201 quarters) as well as the most enduring, having twice lasted eight consecutive quarters.

Conclusion

Returning to our original thesis, now may be an opportune time to own gold considering the heightened level of geopolitical turmoil in the Middle East, combined with macroeconomic uncertainty, in particular stagflation and the weak fiscal position the United States finds itself in.

In an interview on CNBC, iconic investor Paul Tudor Jones said “It’s a really challenging time to want to be an equity investor and in US stocks right now,” noting “You’ve got the geopolitical uncertainty… the United States is probably in its weakest fiscal position since certainly World War II with debt-to-GDP at 122%,” a number which will keep rising to 195% in 2053 according to the Congressional Budget Office (CBO).

As we at AOTH have stressed, staggeringly high debt is what differentiates the current economic environment from previous periods, especially the inflationary late 1970s.

The US debt to GDP ratio in the ‘70s was around 35%. Today it is nearly three and a half times higher, at 119%.

Source: FRED

This severely limits how much the Fed can raise interest rates, due to the amount of interest that the federal government is forced to pay on its debt.

Interest on the debt to track to exceed military expenditures

During 2021, before interest rates began rising, the federal government paid $392 billion in interest on $21.7 trillion of average debt outstanding, @ an average interest rate of 1.8%. We calculated if the Fed raised the federal funds rate to 4.6%, interest costs would hit $1.028 trillion — more than 2021’s entire military budget of $801 billion!

We’ve already blown past that. The FFR is 5.5%, compared to 3.5% a year ago.

The national debt has grown substantially under the watch of Presidents Obama, Trump and Biden. Foreign wars in Afghanistan and Iraq have been money pits, and domestic crises required huge government stimulus packages and bailouts, such as the 2007-09 financial crisis, the covid-19 pandemic in 2020-22, and Biden’s nearly $1 trillion, ironically named Inflation Reduction Act.

Each interest rate rise means the federal government must spend more on interest. That increase is reflected in the annual budget deficit, which keeps getting added to the national debt, now sitting at a shocking $33 trillion.

Paul Tudor Jones agrees, stating that “as interest costs go up in the United States, you get in this vicious circle, where higher interest rates cause higher funding costs, cause higher debt issuance, which cause further bond liquidation, which cause higher rates, which put us in an untenable fiscal position.”

Source: FRED

Now throw in escalating Middle Eastern violence, which in the worst-case scenario could bring in a cascade of countries including the US, Iran, Egypt, Jordan, Syria and Saudi Arabia, and gold starts to look extremely attractive as a safe haven.

(Let’s not forget the other geopolitical hotspots are still simmering and could easily boil over, this includes a belligerent North Korea, and the tense situation between China and Taiwan. An incident in the South China Sea would be all that it takes to put the United States and China on a collision course).

I personally believe we are heading for all-out war in the Gaza Strip with the next step ground troops and tanks. If Israel carries through on its threat to “crush and destroy Hamas”, I fear the fate of the hostages may be sealed, despite talk of an SAS rescue mission.

It’s unlikely the hostages will survive an Israeli ground war and so the next outcry will likely be their murder.

Source: Library of Congress

There are two carrier strike groups mobilizing towards the region which imo is a very dangerous situation for the US military. They could be sailing into a trap. Carrier fleets typically need hundreds of kilometers of wide-open ocean in which to operate; the confined space of the eastern Mediterranean shares coastline with Egypt, Lebanon and Syria, all countries harboring anti-Israel/ anti-US military groups.

Might Russia and Iran have been preparing Hamas, Hezbollah and Islamic State for this scenario all along? Could there be thousands of missiles and air and sea drones lined up along the coast, ready to strike?

********