Support CleanTechnica’s work through a Substack subscription or on Stripe.

We have been covering the developments in the Kenyan electric vehicle sector for over 7 years now — from the early days of a few startups converting one or two internal combustion engine motorcycles in small warehouses to electric, to seeing the sector grow to over 50 players in the industry. The electric motorcycle sector is the best performing in terms of growth in Kenya’s transition to electric mobility. The share of electric motorcycles rose to 3.6% in 2023 from 2.8% in 2022 and 0.5% in 2021. 2024 was even better, as the market share surged to 7.1%. The KNBS Economic Survey Report (2025) shows that 68,804 new motorcycles were registered in Kenya in 2024. Of these, 4,862 motorcycles were electric according to data presented by the Electric Mobility Association of Kenya (EMAK). That is where the 7.1% market share comes from.

There is also significant progress in the electric bus sector thanks to players like BasiGo that are leading the way and plan to introduce over 1,000 electric buses over the next couple of years. Looking at EV penetration in the prominent vehicle segments, in 2024, just over 7% of new motorcycle registrations were electric (as already mentioned), followed by 4% for electric tuk-tuks, 1.1% for electric buses and minibuses, and then 0.18% for electric cars. As you can see, electric car adoption is lagging in a big way, but this also presents an opportunity, especially for funders and investors.

The electric motorcycle sector has made so much progress over the past few years thanks to funders and investors backing several startups in Kenya, helping them evolve from early pilots to early commercial rollouts and now to full commercialization. With Kenya having over 2 million ICE motorcycles, you can understand why funders and investors saw a potentially large addressable market to get involved in. With the motorcycle market and of course the electric tuk-tuk market seeing increasing market shares in Kenya, investors and funders looking for a new growth opportunity should seriously look into Kenya’s electric car ecosystem. While some may feel they may be late to the electric motorcycle party, everyone getting in now and supporting companies that are active in the electric car ecosystem will essentially be early or coming in just as the party is getting started.

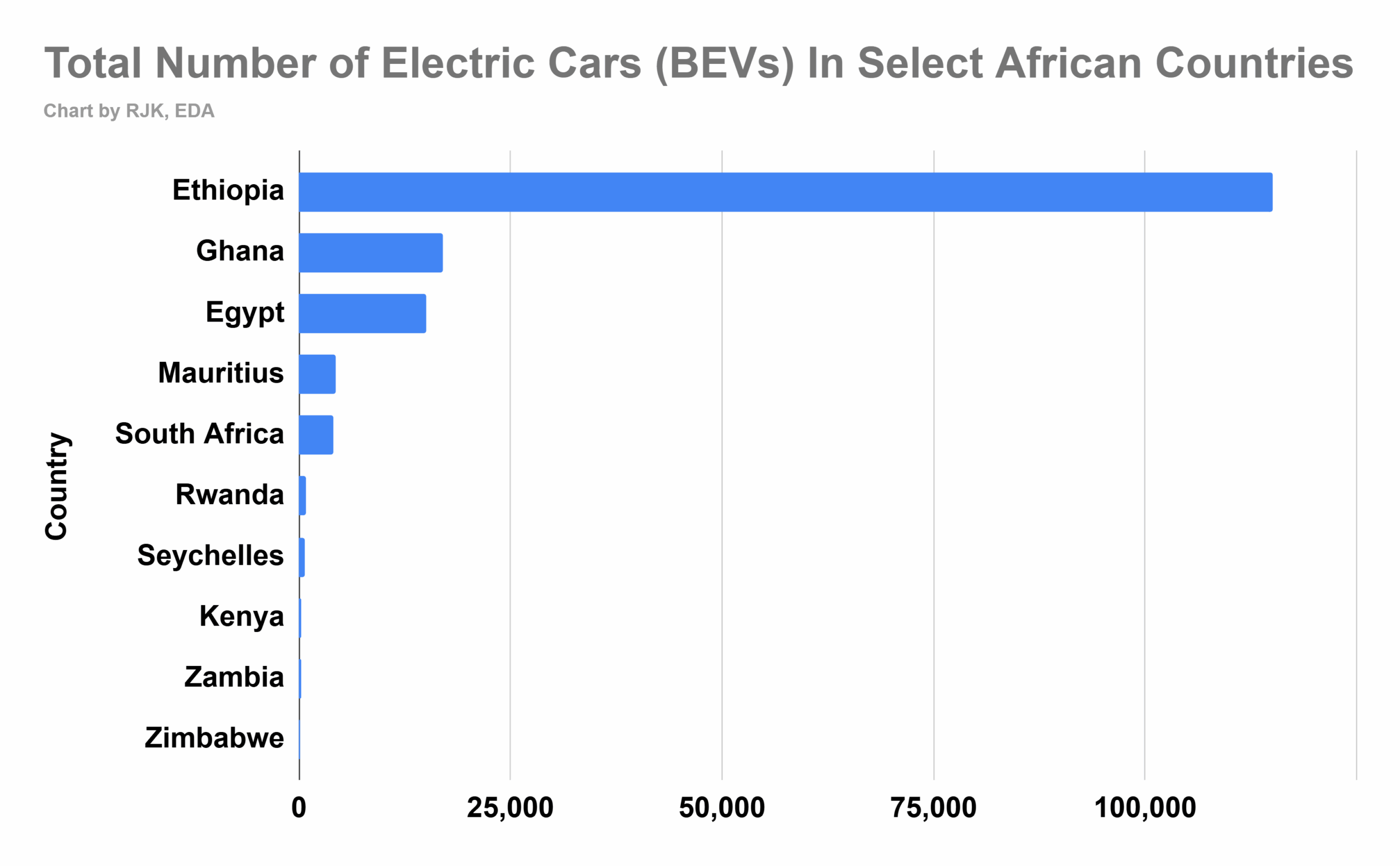

That’s because the industry and ecosystem is still in its nascent stage, presenting not only early bird opportunities, but also immense growth opportunities in a market that is actually way behind its African peers. Let’s look at some of the leaders in electric car adoption on the African continent. Topping the list is Kenya’s neighbour, Ethiopia, with over 115,000 electric cars according to Ethiopia’s Transport Ministry, followed by Ghana with over 17,000, then Egypt with over 15,000 according to various reports. Mauritius and South Africa have just over 4,000 electric cars each, and just to show how far behind Kenya is and just how big the growth opportunity is, Kenya has just over 300 electric cars according to EMAK/NTSA reports. Shockingly low for a country that is known for its innovation and speed of tech adoption. This again shows immense upside and potential for funders and investors.

A number of things are now also falling into place to support takeoff of Kenya’s electric car market. These include:

- Growing number of used electric cars in traditional source markets such as the United Kingdom, Japan, and Thailand. 90% of cars sold in Kenya are used ICE vehicle imports from these countries and the increasing number of used EVs there naturally means these will start finding their way to several African markets, including Kenya.

- Increasing number of more affordable right-hand-drive brand new models from China, widening the available options for consumers looking for new energy vehicles.

- Growing number of official dealerships of brand new EVs in Kenya, such as BYD, Hyundai, Moja EV (NETA), as well as several independent dealerships and importers.

- Improving driving range of electric cars and faster charging technology.

- Kenya Power’s impressive time of use special E-Mobility Tariff.

- Increasing acceptance of electric cars in Kenya’s buzzing ride-hailing industry.

- Promising public charging infrastructure in Kenya’s major cities and towns.

So, which areas should funders and investors look at for a start? There are two areas that have a number of startups that have gained significant traction along with increasing monthly recurring revenues.

1. Charge Point Operators

As always, the biggest question is which comes first, the chicken or the egg? In this case, the cars or the charging network? Charge point operators in Kenya set out to establish charging networks a couple of years ago, securing strategic sites around Nairobi and other towns in anticipation of cars coming. The cars are now starting to come, as shown by recent utilisation data by one of the leaders in this sector, EVChaja. The utilisation at EVChaja’s sites keeps improving, as the number of charging sessions in 2025 so far are already more than double the number of charging sessions in 2024, showing good growth in utilisation. And as more cars come on the market, utilisation will grow, presenting revenue growth opportunities and a launchpad to scale operations.

Another charge point operator, Knights Energy, recently added an impressive hub consisting of DC and AC charging stations that is also seeing significant increase in utilisation.

2. Electric Car as a Service/Leasing Platforms

There are now a number of firms offering electric cars through leasing and vehicle as a service programs via both B2B and B2C channels. This will help lower the barriers to entry for companies and consumers seeking electric cars for personal use. These kinds of companies could also be options for funders and investors. Some of them are bringing in small city cars and renting them out to drivers on ride-hailing platforms for a daily fee, in a similar manner to boda-boda rental platforms.

Accelerating the adoption of electric cars will also help solve one of Kenya’s major headaches. Kenya has a big problem of low electricity demand overnight, resulting in the utility company curtailing some good renewable geothermal generation capacity. As EVs mostly charge overnight when their owners are sleeping, accelerating the adoption of electric cars could help with this. Reports also say Kenya’s demand for fossil fuels is now close to $500 million per month! That’s a huge chunk of Kenya’s total import bill. At this pace, in 12 months, Kenya would be spending $6 billion on fossil fuel imports! Kenya therefore really stands to benefit a lot from accelerating the adoption of electric cars and electric vehicles in general.

I have been observing over several years that even calls and awards from grant bodies, donors, UN programs, etc., have been skewed towards electric motorcycles and three-wheelers. Kenya’s electric car scene has been falling behind its peers and now is a great time for all these grant bodies, funders, and investors to get involved to help Kenya catch up, locking in the upside from all this potential.

Disclosure: I own a few shares in EVChaja, and I have been an advisor to some companies in the Kenyan EV space, my small effort to help play a role in advancing Kenya’s electric mobility sector.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy