Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

It’s not often that a novel energy storage solution crosses my screen. It’s vastly rarer that it doesn’t immediately fail a few basic sniff tests. A solution that pumps water under high pressure a few hundred to a thousand meters underground doesn’t immediately fall apart in technical terms or claims. But there are a couple of problems with it.

To be clear, it’s a form of gravity storage. And it’s not pumped hydro with reservoirs on the top of hills and the bottom connected by a penstock with reversible turbines. It doesn’t depend on the mass of water, but the mass of rock. Unlike other gravity-storage hacks, it doesn’t try to do much with the rock except take advantage of its density, which is two to three times that of water.

I’m talking about an 11-year old startup’s geomechanical energy storage. (CleanTechnica has adopted a policy of not naming and shaming, just shaming generically.) It takes a basic observation from the oil industry and exploits it for a gravity-centered mechanical energy story.

Let’s step back. In the early days of the oil industry, wildcatters used to drill in hopes of finding a gusher. That meant drilling into an underground body of oil in permeable rock held in place by a capstone of some sort. When they found a pressurized body of oil, physics would make the oil rush up the drill hole to the place of lower pressure, turning into a gusher of oil. This was a common situation and in the early days of oil often involved the gusher accidentally catching fire. Paul “Red” Adair made a career of extinguishing flaming gushers, traveling from flaming gusher to flaming gusher, something I read about yonks ago.

Why did the oil shoot up? From gravity’s pressure on the rock above it, the compressibility and deformability of the rock, and the incompressibility of the oil. Yes, oil is like water in that when you put pressure on it it doesn’t lose volume. Rock, on the other hand, does lose a bit, and porous rock loses more.

When a wildcatter hit a gusher, the incompressible oil shot up the hole, while the compressible rock started uncompressing a bit and the space the oil occupied shrank. Imagine a big, just shaken, can of soda as the reservoir and the drill bore as removing the tab that keeps its insides inside.

Two of the founders and the ones most involved with the firm have some time in the oil and gas industry, Saudi Aramco and ExxonMobil respectively, but weren’t drillers or geologists or sub-surface engineers. One is educated in electrical and physical chemistry person and spent a lot of time in academia. The other is a chemical engineer turned MBA turned McKinsey guy. Distinctly white collar, not roughneck. Both had time in other energy domains in some capacity. Definitely STEM, but not build-stuff guys. Despite the chemistry backgrounds, they saw the pressure as a mechanical engineering opportunity. That might also have been due to the third founder, who also has a startup in enhanced geothermal storage, which is fracking for hot water instead of oil or gas.

So what was their insight? That just as incompressible oil came out of compressible underground reservoirs at a high rate, water could be forced down into compressible rock reservoirs at high pressure. Drill holes down to the appropriate strata of shale capped by an impermeable upper layer. Put a big reversible pump at the top of the hole, one capable of creating 200 atmospheres of pressure, equivalent to 2 kilometers or 1.25 miles under the surface of the sea. Pump water down the pipe. The compressible rock compresses a bit. The spaces fill up with high pressure water.

So far this is just a simpler version of fracking and shale oil extraction process, which use high-pressure pumps to force water, chemicals, and sand into underground porous rock formations to create sufficient fissures for oil or gas to flow freely and be extracted. Take away the chemicals and sand, don’t do it where there is a lot of gas or oil, and the water can flow into the empty pores and create a roughly UFO-shaped disk of water underground at the pressure you use to pump it down there. In the case of the startup’s process as I understand it, that’s about 35 to 200 atmospheres. Note, this doesn’t make a cavern underground, but increases the porosity of the rock formation.

In fracking and shale oil, the sand stays behind to keep the fissures sufficiently open for oil and gas to migrate to the extraction point. In the startups’ solution, they pump a fluid down at high pressure to fracture the rock. They pump a solution with calcium chloride down, then another solution with sodium silicate. They combine, mostly, at the edge spaces of the underground fracture to form calcium silicate, which acts like a cement to seal the fracture so that liquids stay inside of it more, instead of migrating to surrounding rock as pressure mounts, if I understand their patent correctly.

Instead of leaving sand behind to keep the fractures open, they keep pressurized fluid in the fractured lens. Note that this dilutes substantially their claim that they need less water than pumped hydro, not that there’s exactly a shortage of water globally. Fresh water may be distributed unevenly, but there are vast amounts of it, especially if it is being quietly reused in pumped hydro schemes instead of polluted with fracking effluents. People who worry about pumped hydro and water usage haven’t done the math.

If they keep it plugged, the water doesn’t escape, but wants to. That creates mechanical potential energy. It doesn’t involve a lot of heat loss because water is incompressible, unlike compressing gases. This solution compresses the rock underground and expands the pores a bit instead of compressing gases in rock caverns underground.

Want the energy back? Allow the water to flow back through the reversible turbine. The compressible and porous rock decompresses, pushing the water back out.

What are the claims from the startup? They could get 1 to 10 MW of power for ten or more hours per well. They are offering specifically a long duration storage solution, where each individual component is pretty small. Long duration storage typically is expressed in the hundreds of megawatts and gigawatt hours of energy storage. Otherwise, what’s the point?

I saw a bunch of potential failure conditions, and went and found if they were problems. Most weren’t.

What about the basic physics? Turns out 200-atmosphere underground compressible rock is like a hydro dam or pumped hydro head height of two kilometers. Pressure and volume is really just the inverse of mass and height. A lot less mass would be required at the equivalent of two kilometers to create the same power for the same number of hours. Assuming 500 meters of head height for closed loop, off-river pumped hydro, only a quarter of the water would be required for 200-atmosphere subterranean porous rock formations. So far so good.

What about the subterranean stuff, geology? That checks out too. There are innumerable pressurized subterranean shale formations that could be exploited. Shale with some mostly impermeable overburden is all that is required. The cap over the sedimentary rocks is very common in oil and gas regions, because that’s what kept the oil and gas underground before we drilled down to the reservoir. Shale is much richer in organic matter than other sedimentary rocks like limestone or sandstone, hence it having a lot of oil and gas deposits.

What about the size of the pipe? A key risk in pumped hydro is that it usually involves tunneling, which per Professor Bent Flyvbjerg’s 16,000+ data set of megaprojects, is not the lowest risk thing we do. Of the 25 categories they have segregated the data set into and sorted by likelihood to go over budget and schedule, tunneling is 13th, exactly halfway from either end. It’s not nuclear generation or the Olympics, the most likely projects to go over budget and schedule, but it’s not solar, wind or transmission, the least likely.

The startup’s solution uses standard drilling techniques and diameters from the oil and gas industry, with the likely diameter being about 30 centimeters (12 inches). That’s lower risk than tunneling, in part because the shaft is vertical down from the ground, a lot cheaper than a tunnel and if the drillers hit an igneous extrusion, unconsolidated sediments, a high-pressure aquifer, karst topography, or one of the eight or nine other underground features that make drilling difficult or impossible, they can just pull the drill out and try somewhere else. Tunnels, by definition, go from point A to point B because these points need to be connected and so have to try to deal with whatever they find underground. Drilling, not so much.

What about volumes from this kind of porous rock reservoir? A normal well might return 5,000 barrels per day, about 800 cubic meters of water. At 200 atmospheres of pressure through a 30-centimeter pipe, the orifice equation — yes, that’s what it’s called — tells us that the flow rate would be 0.0092 cubic meters per second, which isn’t a lot. But it is under very high pressure, the equivalent again of a dam two kilometers in height.

The standard hydroelectric power generation equation involving turbine efficiency, flow rate, head height, gravity, and water’s density tells us that we could conceivably get about 164 kW of power and about 14 MWh of energy over a day from that kind of flow rate. This didn’t seem like that much.

It turns out the largest volumes of flow from an oil well were about 100,000 barrels per day. At 200 atmospheres, that suggests the potential for 3.3 MW of power, within the range of the startup’s claims of 1 to 10 MW. That was a function of the light oil being relatively low viscosity and able to move through the porous rock relatively quickly.

Water is a quite a bit less viscous than light oil, and so can move through porous rock more quickly. A bit of research found the Darcy-Weisbach equation, which can be adapted to determine the difference in flow rates for liquids of different viscosities. Assuming I applied it correctly, it suggests that less viscous water would flow just over three times faster, so a 100,000 barrels of oil would equate to about 320,000 barrels of water.

That 3.3 MW of power would turn into about 10 MW of power, in other words. This supports the startup’s claims that they could get 1 to 10 MW of power per well.

Having validated the power basics, some other questions sprang to mind. One is that pumps aren’t quiet and the higher the pressure the pump, all else being equal, the higher the volume. Sure enough, 200-atmosphere fluid pumps are up around 100 decibels, about where wind turbines are. My background involves far too much time understanding decibels and wind turbine noise impacts, so I know that this is well above the level where you want to be next to it with unprotected ears for more than a couple of hours a day and hearing protection is recommended. But I also know that noise, all else being equal, diffuses by the cube of distance and that it’s pretty easy to put baffles around something on the ground. The pumps won’t be allowed outside someone’s bedroom window, but with baffling could be a hundred meters away. Not a showstopper.

Next I did a bit of a cost work-up, assuming that they were drilling themselves and not reusing existing wells. Higher pressure reversible pumps for liquids fail a bit more often, so that was factored into operating costs, but the greater number of pumps vs pumped hydro for the same power and energy means that the overall impact on system efficiency was very minimal. With the increased failure rate, the adjusted cost per kWh for the startup’s geomechanical energy storage solution is estimated to be $0.0109 per kWh at the low end and $0.0251 per kWh at the high end. This is in the range to be cost competitive with pumped hydro and grid storage with CATL’s announced $56 per kWh capacity LFP batteries. So that checked out as well, although to be sure my cost workup was napkin math, not a fully vetted cost workup — adequate for this assessment.

Next I looked at spacing. Those underground UFOs of water can’t overlap without causing system problems, something referred to as a frac-hit. Guidelines from geothermal and oil and gas wells suggest that they would have to be about 500 meters apart. Would that be a problem in terms of wiring them into a power block? No, at 1 to 10 MW per well at that spacing, they are in the range of modern wind turbines, and we space wind turbines out and wire them together constantly. We’d apply the same power electronics we do with wind or solar farms in much the same way. This is just power engineering.

However, for a 10 MW system, that 320,000 barrels of water is 20 Olympic swimming pools. The reservoir can be deeper than a pool, however, so if it were the size of an American football field, it could be seven meters deep and hold all the water. Soccer fields vary in allowed sizes, so with a big field’s dimensions, it would be 6 meters deep and with a small field, 8 meters deep. Football or soccer fields six to eight meters deep every 500 meters is starting to intrude on the landscape a bit. Due to the way that they are maintaining pressure underground with water and adding more water as a working portion, the amount they would require is some multiple of this amount, just with most of it underground.

This is assuming a 24-hour power return, however. At 10 hours and 10 MW, these shrink down to 40% of the size. They can also be made a bit deeper and have a sealed top without particularly impacting power generation. This is probably manageable.

However, this led me to ask how fast this water would be moving. It’s all fun and games until someone gets hit in the face by a pressure-washer jet, after all. At first blush, water flowing through a 30-centimeter diameter pipe at a pressure of 200 atmospheres with no constraints could be seeing 200 meters per second or 720 kilometers per hour. That didn’t look good, which probably meant I’d done something wrong. Going back to the roughly 320,000 barrels of water, the viscosity comparison found over 24 hours through the same pipe suggests a much more reasonable velocity of about 8 meters per second or 29 kilometers per hour. You still wouldn’t want to be standing in front of it. It would be like being hit by a car driving 15 kilometers per hour, relatively slow moving, but enough to break bones, cause internal damage, and leave you with whiplash.

So what are the problems with this? So far, all assessments indicate that it’s reasonable, reuses oil and gas equipment, is within pressure standards for the oil and gas industry, aligns with external measures that indicate that power, and energy claims are reasonable and the like. It’s the kind of thing that should be obvious to anyone with STEM chops familiar with fracking and shale oil technologies and considering the need for energy storage. Why isn’t this just being built? And why does it need venture capital funding, which it received?

Let’s start with this being like email delivered through a web browser, as something that’s only blindingly obvious in retrospect. When Hotmail arrived on the scene, my response was not “I thought of that years ago!” but “Why didn’t I think of that, it’s so obvious?” Some innovations require people working hard to combine things which don’t obviously go together in unique ways. Given the provenance of the founders, I assume the academic, the enhanced geothermal guy or some combination of the two came up with it.

Given the background in academia, I expected to find old papers on this, but the only thing I was able to find was a 2023 paper from a fracking conference, which was both an odd and not-odd place to present it. Fracking people don’t really care about energy storage, but they are the people with the expertise to build this solution. They are also the people to consider the obvious — to them — drawbacks.

So what are those drawbacks?

Let’s start with what’s happening underground. Fracking intentionally breaks up rock structures underground with high-pressure water, chemicals, and sand. That’s a slow process, with the fluid mixture moving at 0.015 to 1.5 meters per second, according to what I was able to find, considerably slower than the 8-meter per second flow rate of the energy storage solution the startup is proposing.

The 100,000 barrels of oil rate for the fastest light oil well is a third of the velocity the startup is aiming for, assuming my assessment is correct. That’s only about 2.6 meters per second. Light oil and water have different characteristics that mean that water erodes materials faster than light oil. There’s a reason water is referred to as the universal solvent.

Remember, it’s fractured shale that is the target. Underground shale has a natural porosity of 2% to 10%, that is, the amount of water it can hold, while fractured shale goes up to about 20%, similar to sandstone or limestone. An 8-meter per second flow of water through these fractured shale would cause more fracturing, causing shale to grind against itself, and be erosive due to the mechanical and chemical nature of fast moving water. Repeating that flow twice a day, daily charging and discharge, would probably turn hundreds or thousands of cubic meters of the underground fractured shale into sand every day. That sand would in turn increase the underground erosion because of the grit.

This energy storage solution would rapidly turn porous shale into sand. Remember one of the tunneling and drilling challenges, unconsolidated sediments? That’s what sand is in underground pockets, one of the things that causes underground work to fail. Fracking and shale oil processes run much more slowly and add sand and chemicals to accelerate the process, but they only do it once per volume of underground space. They break it up, they don’t dissolve it. Pushing 312,000 barrels of water through fractured shale pores twice daily would dissolve them fairly quickly.

When a volume of fractured shale turns into sand, the ability of that volume to hold water increases substantially, from about 20% porosity to about 40% porosity.

This means that the same volume of water pumped into the same underground void filled with sand will not remotely fill up the pores. The startup would have to double the amount of water underground to achieve the same pressures. Pressure management is a big deal in the oil and gas industry, where they work hard to avoid sand production, compaction, and subsidence, per the SPE Petroleum Engineering Handbook.

That sand won’t just stay underground either. As the 29-kilometer per hour jet of water goes back up the pipe, through the turbine and into the above ground reservoir, a lot of that sand will go with it.

As the sand empties out, that underground void becomes unstable. The collapse of a 250,000-cubic-meter cavern 1000 meters below the surface would likely result in significant subsidence and potential sinkhole formation, causing damage to structures and altering groundwater flow. The seismic event induced by such a collapse would likely be of small magnitude, estimated around 0.9 to 2.5 using formulas derived from mining-induced seismicity studies, depending on the specific conditions. While this would generally not be a large earthquake, it could still be felt locally and cause minor damage. That’s not going to make the neighbors happy and is what causes fracking- and shale oil-induced tremors.

I assume that they will be aiming the turbines to be around 60 revolutions per minute to match grid frequency, so they’ll be bigger than the 30-centimeter diameter pipe. The water will flow into a bigger diameter enclosure at the top before going through the turbine, slowing down a bit. The sand will build up in this chamber pretty quickly. There are solutions for this, but it does mean probably daily removal of sand and subsequent disposal of it. This isn’t enough sand of high enough quality that it will be a salable resource.

Shale sand is generally unsuitable for use as a proppant in fracking due to its lack of strength and durability, as it tends to break down under high pressure. Additionally, proppants require a high degree of size and shape uniformity to maintain consistent permeability in fractures, which shale sand often lacks. Conventional proppants like silica sand, ceramic, or resin-coated sand are preferred because they are more durable and have the necessary uniformity to be effective in hydraulic fracturing operations.

Shale sand is typically not suitable for beach use due to its softer composition, which makes it prone to breaking down, and its angular, less uniform grain size. Additionally, shale sand is often gray, brown, or black, influenced by organic material and iron oxides, which may not be as aesthetically pleasing as the more uniform and durable quartz sand commonly found on beaches.

Expect big piles of gray, ugly, and dusty shale sand to accumulate.

The turbines won’t like this either. Accelerated degradation of hydro turbines with sand is a well understood problem in hydroelectric solutions. The angular and abrasive nature of shale particles would cause significant wear and tear on turbine components, including blades and bearings. With the very big turbines in very big dams, the overall erosive impact won’t be nearly as bad as with the much smaller turbines in the startup’s solution. Turbines probably wouldn’t last more than a year or two before they saw significant degradation of performance and require replacement. Is there a solution for this? Yes, a bigger void behind the turbine at the end of the pipe so that more sand can precipitate out before water goes through the turbine. More expense, more work to remove sand from a sealed, high pressure chamber. Even then, lots of the finer grit will be flowing through the turbines.

And then there’s the surface reservoir, that huge pool of water. Well, it would turn into a huge pool of sand pretty quickly. Even if the storage potential didn’t disappear, the reservoir’s capacity to hold water would be reduced daily, so energy storage would disappear too. Lots of dredging required to empty the sand out, but remember, it’s probably covered, so you can’t drive a backhoe in and empty it out. That probably means another system for sluicing water through the reservoir when it’s mostly empty to get the sand out. Easier than getting sand out of the seal, high-pressure chamber at the top of the pipe, but still.

Not exactly the same as shipping containers of batteries that just sit there, or a big pumped hydro solution without all of the sand.

The startup appears to claim that one of their facilities would last 40 years in operation. This reminds me of the big problem in the USA’s shale oil and fracking industry. The claimed lifetimes of fracking gas and shale oil wells initially projected by many companies were often around 20 to 40 years. These projections were based on optimistic models of well productivity and decline rates. However, actual experience has shown that the productivity of these wells tends to decline much faster than initially anticipated. In practice, many fracking wells experience significant declines in production within the first few years. Some industry reports and studies indicate that shale oil wells, for example, can see a decline rate of about 70-90% in the first three years.

I don’t believe the 40-year lifespan projection, in other words. The equipment will be challenged by grit and the underground fracture zone will get more and more fractured, turning into sand, and the entire system will stop working. My projection of the cost per kWh assumed high durability of the reversible pumps without massive amounts of grit, so was wrong. My projection assumed a 20-year amortization. With turbine blade replacements every 2 years and a 10-year lifespan, the cost per kWh shoots up to $0.13 to $0.15 per kWh, far out of competitiveness with alternatives.

This led me to ask another obvious question: do we, by any chance, mine underground rocks deposits for sand using high-pressure water? Yes, all over the world. In states like Wisconsin and Minnesota, hydraulic mining is used to extract silica sand from sandstone deposits, which is then used in the fracking process. In Russia, hydraulic mining is used in the extraction of certain minerals, including gold and diamonds, from sandy formations in remote regions. It’s an old technology, used in California during the Gold Rush.

Are the underground problems well understood in the fracking industry and carefully avoided? Yes, in reviewing a study out of China on fracking, a great deal of time is spent trying to avoid disturbing shale that’s been fracked, because it slips easy and crimps pipes. Fracking engineers spend a lot of time and effort not doing what the startup proposes to do daily.

It raises another question. Why didn’t their earlier, smaller test sites find this problem? They had a few, apparently, presumably at the 100 kW scale or some small multiple. All of their bigger pilots are still in development, it seems, and not in operations. One of the truisms of physical world prototyping is that you have to get to quarter-scale before the physical realities are exposed. That’s quarter-scale in all dimensions. My assumption is that their smaller pilots proved the power and mechanics, weren’t big enough to grind the subterranean shale formations together, weren’t big enough to re-fracture the rocks, weren’t high pressure enough, didn’t have high velocity water flows and didn’t run long enough for the erosion cascade to start. More energy, more rock displacement, more grinding, more velocity, and more erosion would have been picked up in quarter-scale tests. I assume that the bigger pilots that they are undergoing, if cycled daily for a few months or a year, will expose this problem. Perhaps they are aware of it and have done the engineering assessments to discount it. We’ll find out. Or not. They may sink quietly and without fanfare.

This all raises a few more questions. Didn’t anyone ask a fracking geologist their opinion on repeated pressure changes and high rates of water flow through underground shale formations at any point during the 11 years since the startup’s foundation? Didn’t anyone talk to subterranean sand miners about what was going to happen? Didn’t the venture capitalists in the couple of financing rounds get any technical due diligence performed on their behalf for their almost $20 million? Didn’t ARPA-E ask any of their geologists to assess the idea for their $10 million grant? Didn’t anyone ask what was going to happen to the turbines? Apparently the answer to all of those questions is no, or at least the founders spun a good story if asked.

One of the challenges with venture capitalists is that they often invest in the team more than in the technology. This is for a small handful of reasons. Venture capitalists rarely have STEM skills and even more rarely have STEM skills that are deep in the fields that they invest in. They do consider themselves excellent judges of people and business models, and so will tend to judge the thing that they can see and understand, not the thing that they don’t understand.

This is Kahneman and Tversky’s substitution heuristic. This bias occurs when individuals are faced with a complex problem or question and, instead of tackling the complex issue directly, they substitute it with a simpler, related problem that they can solve more easily. Can’t understand the science or don’t have time? No problem, do the team seem competent, driven, and flexible? Do I like the revenue projections?

That’s a fundamental component of Oren Klaff’s approach to pitching anything: make it easy for the potential investor to like things that they understand about a proposal, and keep all the hard stuff in a single box that is minimized. I’m imagining Klaff’s pitch in my head.

It’s just like fracking, which we do all the time! We’ll put those fracking engineers to work on green stuff! Look at this team! Look at these revenue opportunities!

Betting on teams and revenue projections works a lot more in software startups than in hard tech startups. Software startups can get to minimal viable product easily and pivot easily, due to the malleability of code. Hard tech can’t do either, which is why it’s more risky and more technical due diligence should be done.

It’s less clear why ARPA-E gave them $10 million, but ARPA-E is the governmental equivalent of a venture capitalist, spending money on things with low likelihoods of viability and a hope that difficult technical problems can be resolved. And it’s governmental money, so subject to a lot of other challenges. The $504 million, low-interest loan to a group that is pretending that they are going to be replacing a coal plant in Utah with a hydrogen electrical generation facility leveraged a set of those challenges.

It’s very clear why the startup has been welcomed with open arms in the oil and gas regions of North America. They are desperate to have a solution which they have all the expertise to execute on and desperate to have something that promises to reuse existing wells that are cluttering up the landscape. All those drilling resources who are standing idle because a lot of exploration has ended can be put to work with virtually no retraining. Fracking and shale oil can only sop up so many of those roughnecks.

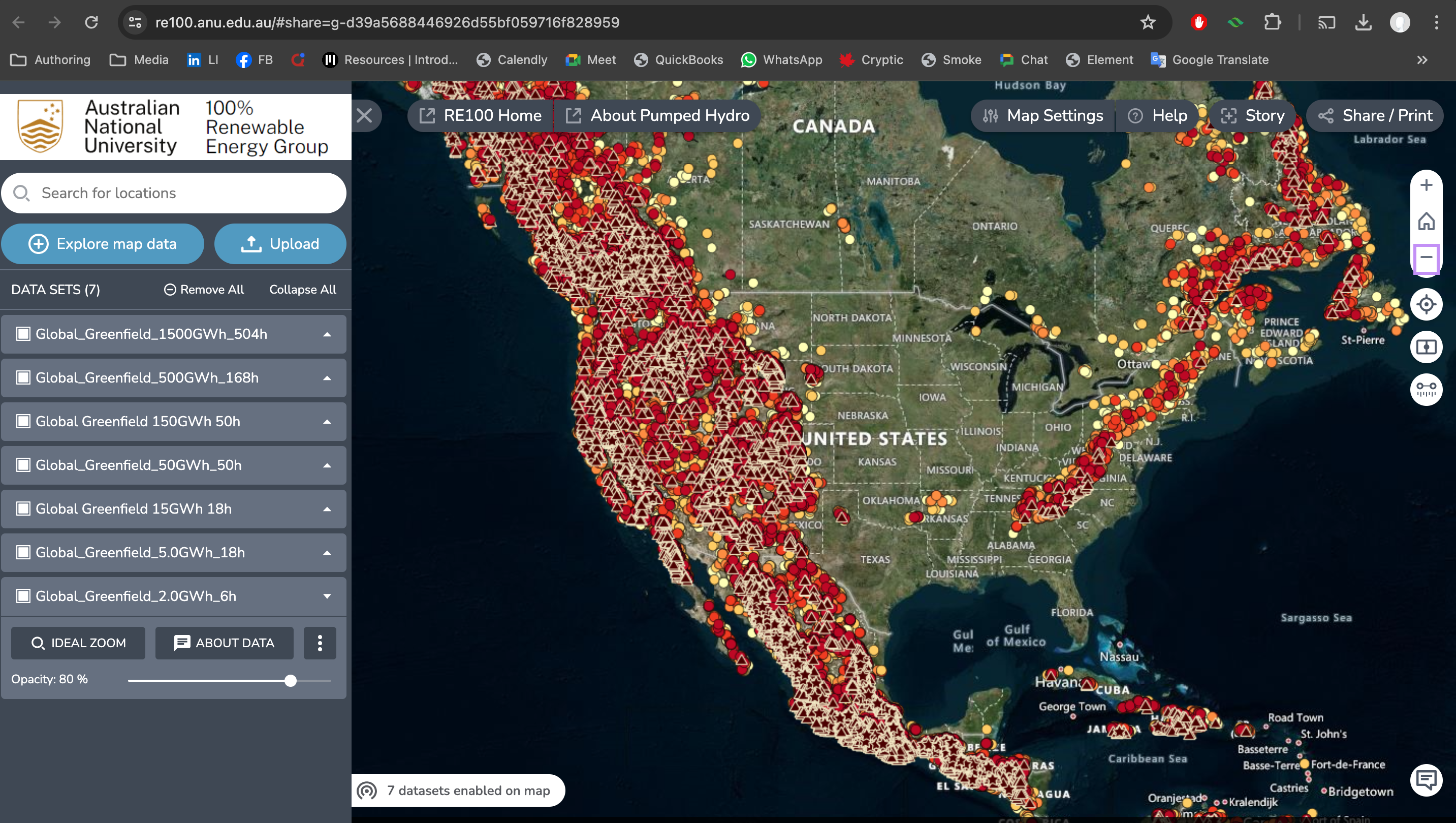

Like many startups in this space, the firm has tended to make a lot of statements about their solution being better than traditional pumped hydro. One of the remarks, very common to storage entrepreneurs trying to differentiate their solution from pumped hydro, is that there isn’t enough resource availability of good sites for it. Above is a screenshot from the ANU’s greenfield pumped hydro atlas of North America annotated with all of the locations where two reservoirs could be relocated close to one another with 400 or more meters of head height that are close to transmission, off of protected land and off of waterways. Their study shows that there is 200 times the resource capacity as the United State’s entire requirement for all power and energy storage. One pair of one-kilometer-square reservoirs with a gigaliter of water at 500 meters would provide a GWh of storage. Want more? Make the reservoirs a bit bigger and deeper, which is easy. And for those that say “But what about the Great Plains?” I ask the simple question about whether they’ve ever heard of transmission.

One of the things I like to do is ask, “What is China succeeding at doing at scale for decarbonization?” I have done that every year or two about energy, finding China is building vastly more renewables than nuclear. I have done that for ground transportation, finding that China has about 1.2 million electric trucks and buses, and perhaps 10,000 fuel cell vehicles. And for grid storage, China has 19 GW of power capacity in production, have a further 89 GW of power capacity under construction and another 276 GW planned. That’s probably double-digit TWh of energy storage, most expected to be started before 2030.

I’m currently engaged in two different pumped hydro deals, assisting one developer to assess the potential for a brownfield site and assisting an investment fund considering acquiring a stake in an existing site. Both are GW-scale, 100 times the biggest potential well in the startup’s approach, and have lifespans of over a century with relatively little maintenance. Pumped hydro facilities are run in lights-out mode all over the world and are part of black start facilities for the grid. I spend a lot of time looking at batteries as well, and one of the efforts is assessing whether pumped hydro will still have value with radical battery price reductions. That’s a good question to answer. Lithium-ion grid storage already lasts 15 years with twice a day cycles, and as noted, The startup’s facilities are unlikely to last 10. It doesn’t really compete, in my opinion.

One last question. Why don’t the startup’s principals realize this? After all, they’ve been working in this for 11 years. There are multiple possible answers. The first is that they entirely do and don’t care, which I don’t think is the case. The second is that they do and think it’s manageable with engineering compromises. The obvious one is to radically expand the underground fracking zone so that there was an enormous amount of water underground and a very limited amount injected and resurfaced. This would, if an extreme enough ratio was maintained, seriously mitigate the concerns. It would probably require multiples of the amount of water required for normal pumped hydro, so they probably wouldn’t want to talk about it. And it would probably change spacing requirements to avoid frac-hit to one to two kilometers and destroy the economics. Basically, the compromises likely to make this long lasting would make it non-viable economically, and the firm’s founders have invested a lot of intellectual, emotional, and status capital in it being viable. It’s hard to give that up. And, of course, there is the possibility that they’ve investigated this fairly obvious — to energy types with at least one-night stand intimacy with fracking or shale oil — challenge thoroughly and think that they have mitigated it. They might even be right. Maybe it’s just me.

Remember at the beginning of this when I said that it was rare that a novel energy storage solution crossed my screen and even rarer when a quick glance wouldn’t highlight the challenges? It took me about an hour to get to repeated pressure changes and moving water causing more and more fracturing and erosion of the subterranean cavity. It took me another two or three hours to do the napkin math, correct some of my errors, and arrive at a conclusion. But the basic problem was pretty obvious, and would be even more obvious to anyone that did fracking or shale oil.

I think the startup just isn’t going to deliver on its promises. I could be wrong, of course, and if so, I’ll happily admit it. Just like the startup’s founders, I’m not a geologist, fracking engineer, or sand miner. But for now, I won’t be recommending their solution to storage developers or investment funds that ask me about storage in general or the startup in specific. And when I update my grid storage projection through 2060, likely later this year, the startup won’t be mentioned, but will be in the also-ran category, competing for the thin slice that isn’t covered by pumped hydro, redox flow batteries, and cell-based batteries.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.