Despite the pullback in November and December as well as the ongoing consolidation in gold prices, we are undoubtedly in a new and elevated gold price environment. This shift presents unique opportunities, particularly in the mining sector. Our primary interest lies in identifying stocks that have yet to reflect this new reality but stand to benefit significantly from the current market conditions. Specifically, we’re looking at companies that are poised to profit from the increased financial strength of major gold producers. First Mining Gold – 12 Million Deeply Undervalued Ounces In The Ground.

At current gold price levels well above USD 2,600, large gold producers like Newmont Mining, Agnico Eagle Mines, Barrick Gold, Kinross Gold, Alamos Gold or even Equinox Gold are generating substantial profits. This improved financial position is likely to have far-reaching effects throughout the industry:

- Increased exploration and development budgets

- More mergers and acquisitions activity

- Investment in new technologies and efficiency improvements

- Potential for higher dividends or share buybacks

Companies that may capitalize on the trickle-down effects of the robust profitability currently enjoyed by major gold producers and which could see outsized gains in this environment include:

- Junior miners with promising large multi-million-ounce gold projects

- Exploration companies in gold-rich regions

- Mining equipment and technology providers

- Specialized service providers to the gold mining industry

First Mining Gold Corp.

A company we identified as being one of these undervalued plays, is First Mining Gold Corp. (First Mining) (TSX: FF | OTCQX: FFMGF | ISIN: CA3208901064), https://firstmininggold.com.

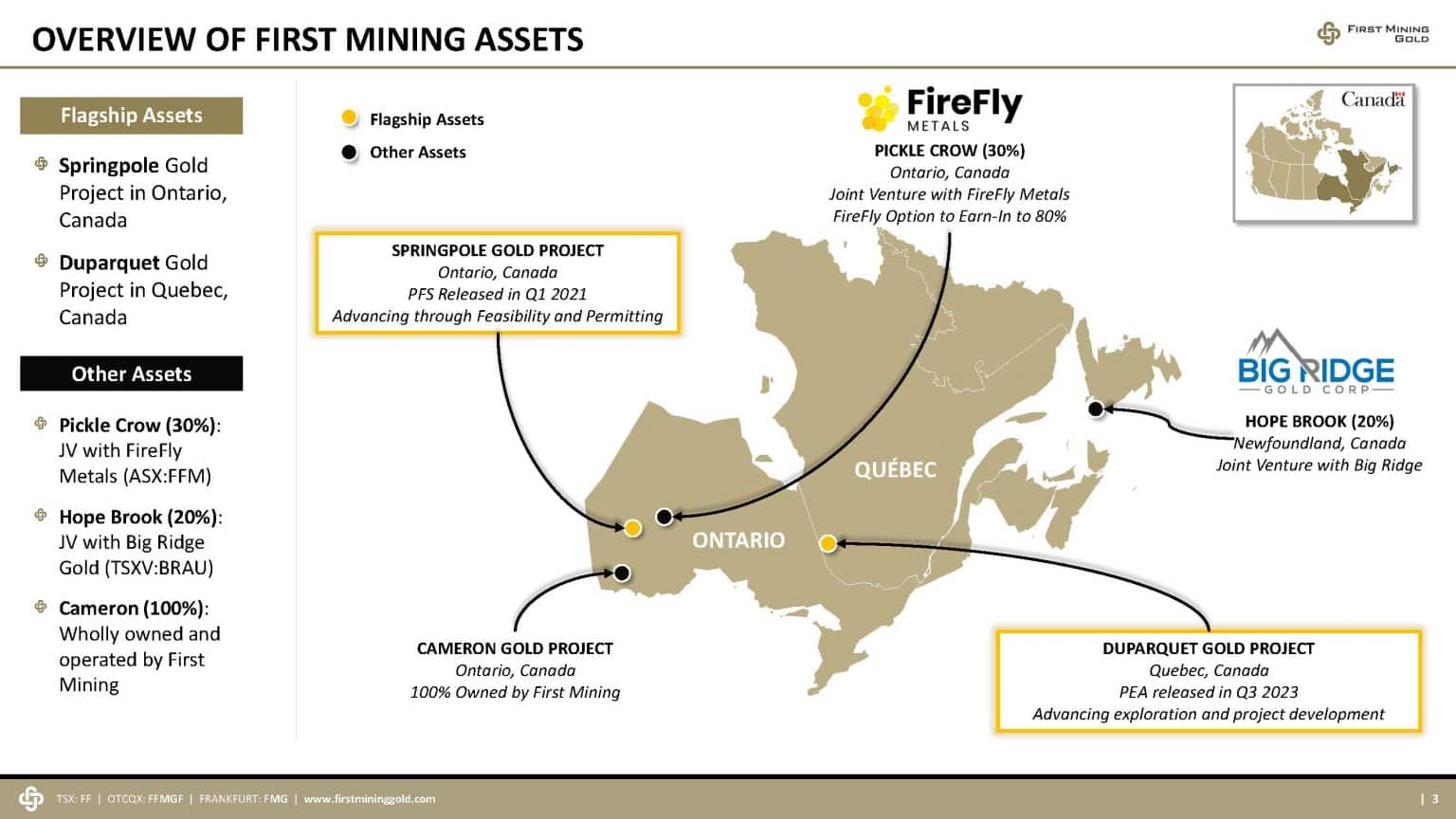

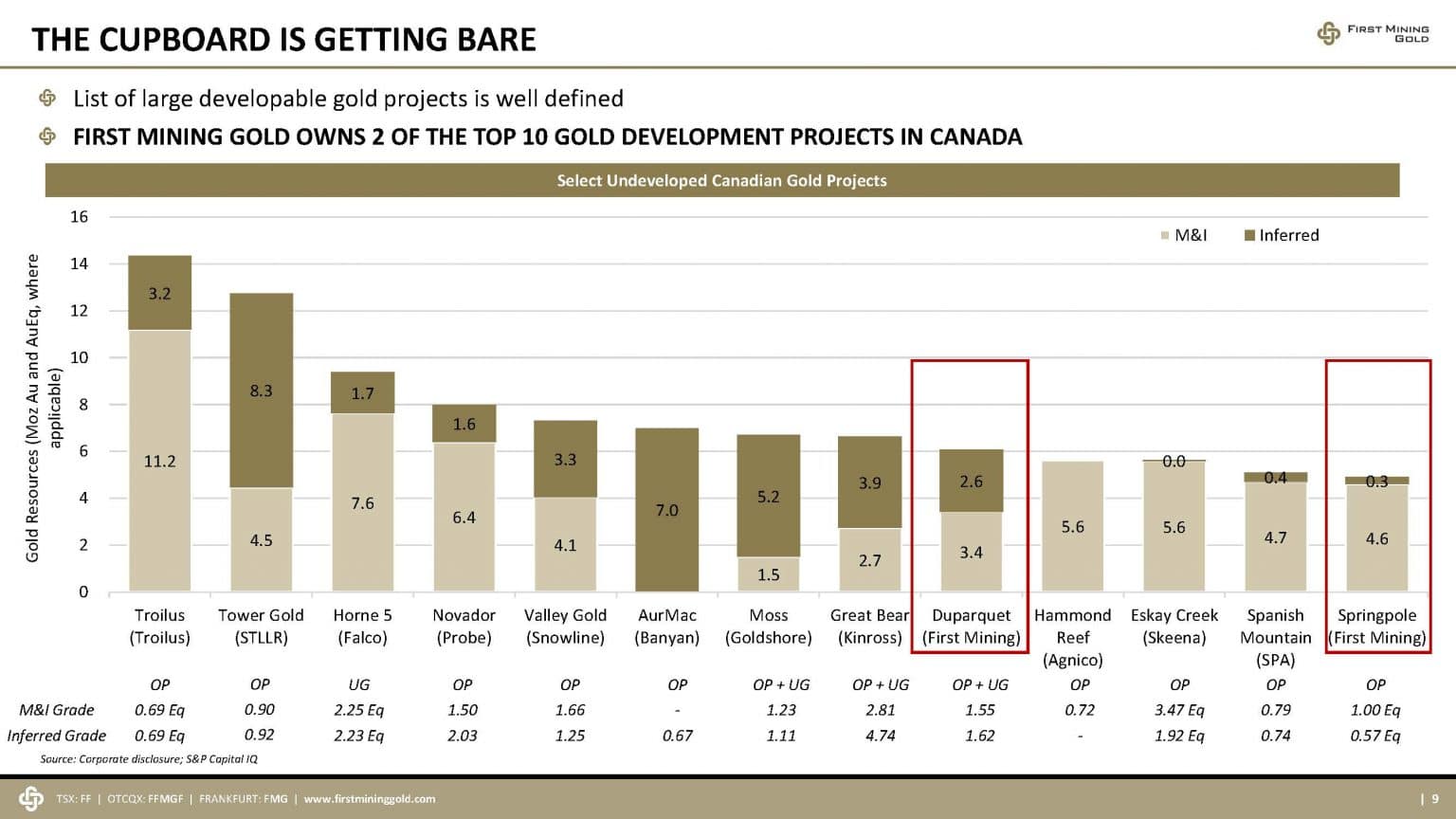

First Mining is a Canadian gold developer focused on advancing two of the largest undeveloped gold projects in Canada. The company is strategically positioned with multi-million-ounce gold projects in two of Canada’s most mining-friendly jurisdictions, aiming to unlock value through methodical project development and environmental assessment. Specifically, the two cornerstone assets Springpole Gold Project in northwestern Ontario and the Duparquet Gold Project in Quebec provide First Mining with significant leverage to gold prices and are most likely on the shopping list of any major gold producer aiming to extend their resources.

Unlocking Value: A Gold Developer Trading at a Deep Discount

Overview of mining assets (First Mining Gold Corp. Company Presentation as of December 2024)

The company’s strategy involves advancing and de-risking its key projects while monetizing non-core assets to fund development. The stock trades at a significant discount to its net asset value and peer gold developers, with an enterprise value of only CAD 140 million compared to the combined after-tax NPV5% of almost CAD 2 billion for the two main assets, Springpole and Duparquet. This valuation disconnect creates an opportunity for investors to gain exposure to two large gold development projects at an attractive entry point.

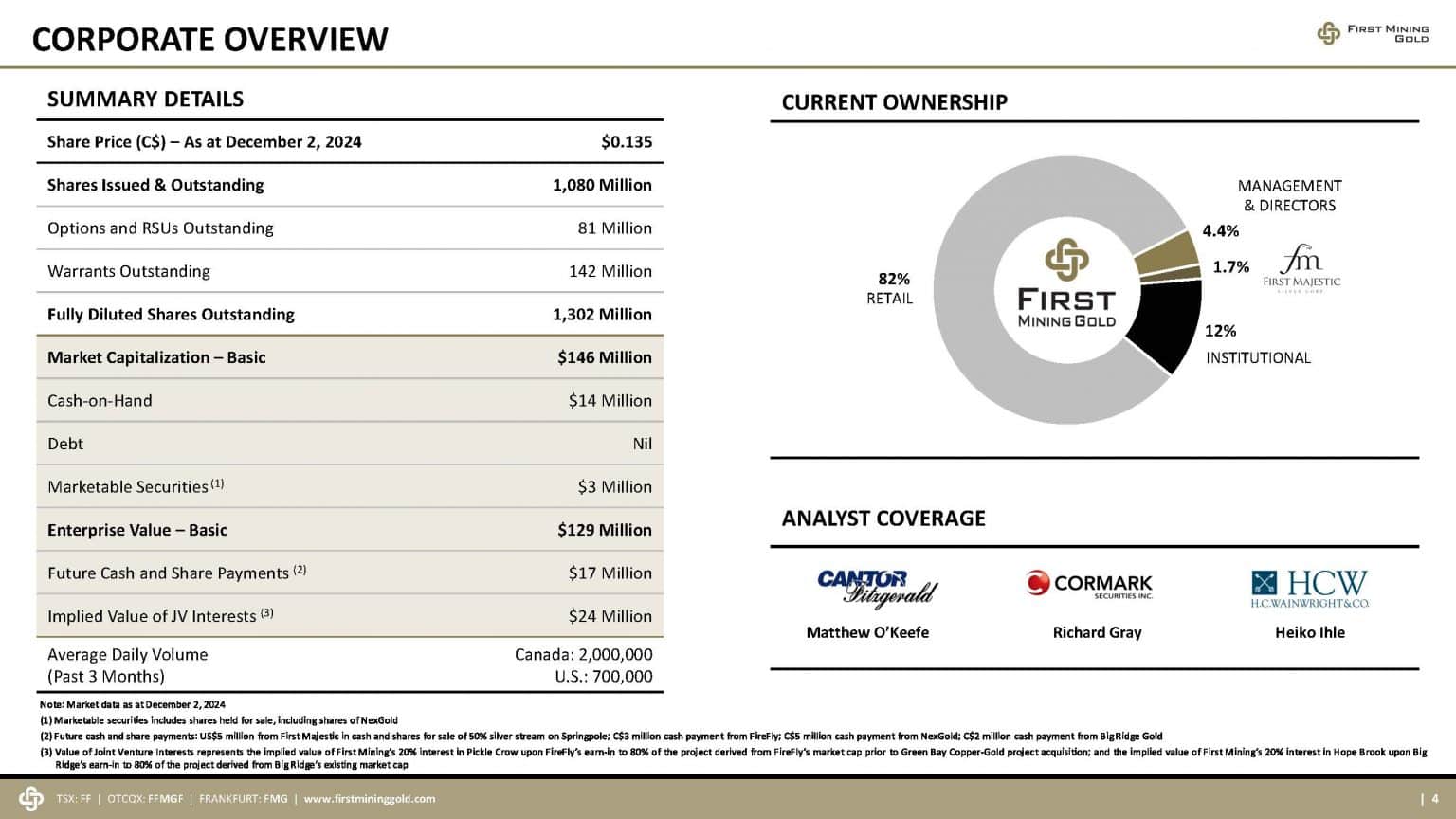

Corporate Overview

Corporate Overview (First Mining Gold Corp. Company Presentation as of December 2024)

First Mining was founded in 2015 by silver mining legend Keith Neumeyer who previously founded First Quantum Minerals (TSX: FM | OTCQX: FQVLF) | ISIN: CA3359341052) and First Majestic Silver (NYSE: AG | TSX: AG | ISIN: CA32076V1031). The company went public via an IPO in the same year and got listed on the Toronto Stock Exchange, and on the Frankfurt Stock Exchange. At a share price of CAD 0.12, the current market cap is CAD 130 million. However, just the balance sheet contains over CAD 35 million in cash, investments and joint venture interest value.

With an experienced exploration and development team, First Mining is committed to responsible mining practices, community engagement, and creating value for shareholders through its large-scale, undeveloped gold assets.

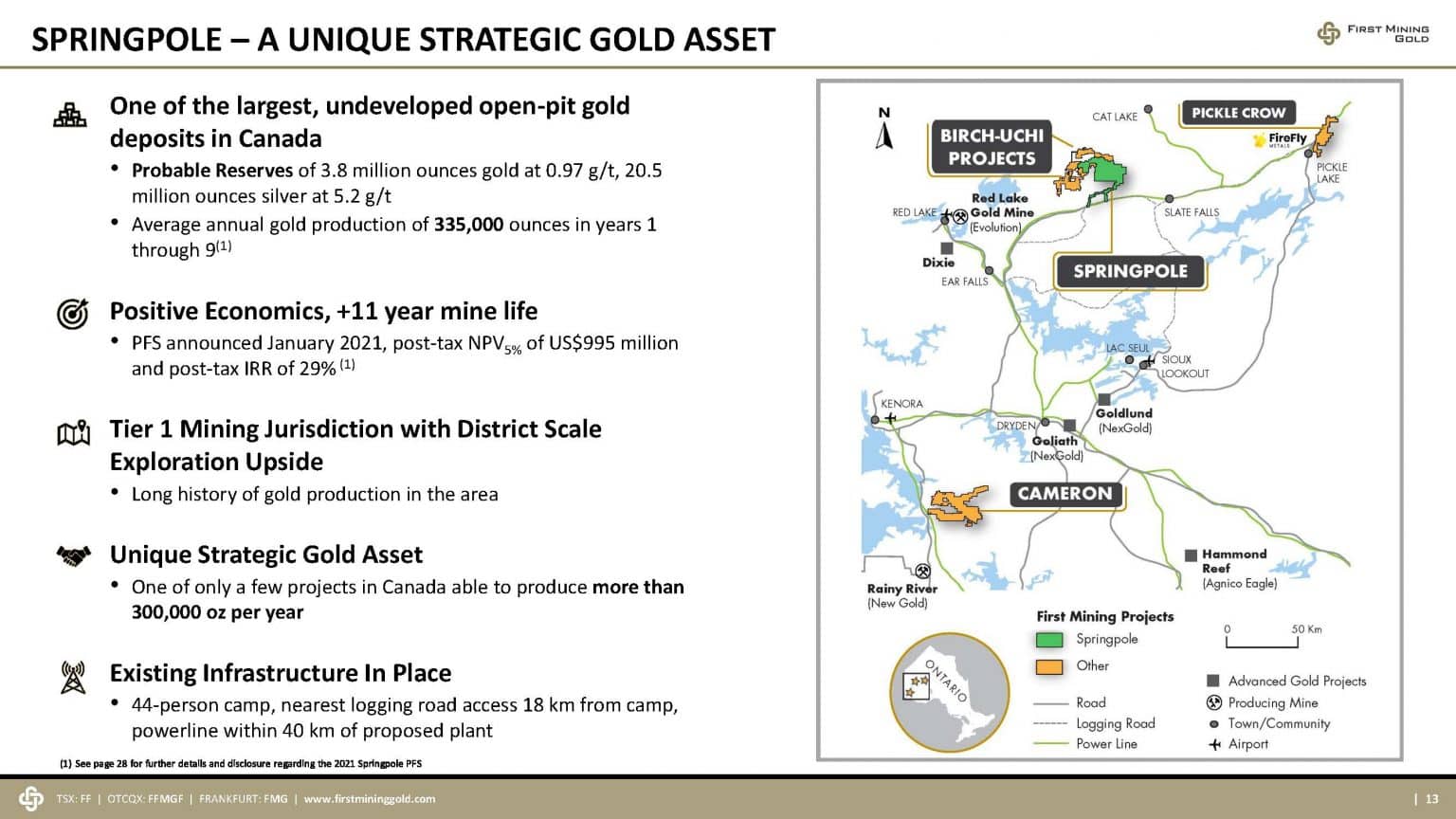

Springpole Gold Project

Springpole Gold Project (First Mining Gold Corp. Company Presentation as of December 2024)

The Springpole Gold Project is First Mining’s flagship asset and one of the largest undeveloped open pit gold deposits in North America, with 4.6 million ounces of gold in the indicated category and 0.3 million ounces in the inferred category.

The project boasts impressive reserves of 3.8 million ounces of gold and 20.5 million ounces of silver, setting a strong foundation for development. The Pre-Feasibility Study results are equally compelling, projecting an 11.3-year mine life with a post-tax NPV5% of USD 995 million at USD 1,600/oz Au, a robust 29.4% after-tax IRR, and a swift 2.4-year payback period.

The company has submitted its final Environmental Impact Statement/Environmental Assessment (EIS/EA) for Springpole in November 2024, representing a significant milestone in the project’s development. The submission incorporates over 14 years of research and data collection, assessing more than 20 environmental and socio-economic factors. A federal decision is expected by the end of 2025. It is important to note that this decision will be monumental for First Mining and for the gold industry in Canada as there are no gold projects ahead or behind First Mining in this critical permitting step. A positive decision will put First Mining in a class of its own.

As well, an Independent Geotechnical and Tailings Review Board (IGTRB) has been established to provide expert advice on key engineering components and has so far provided a positive review. Furthermore, the Feasibility Study is an ongoing work to further optimize the project.

Springpole’s Economics and Potential

Springpole’s economics are highly sensitive to gold prices. CEO Dan Wilton notes that “Every USD 100 increase in the gold price is USD 150 million increase of after-tax NPV on Springpole, and USD 250 million on our two biggest projects combined.” With current gold prices substantially higher than those used in the PFS, the project’s economic potential has improved significantly.

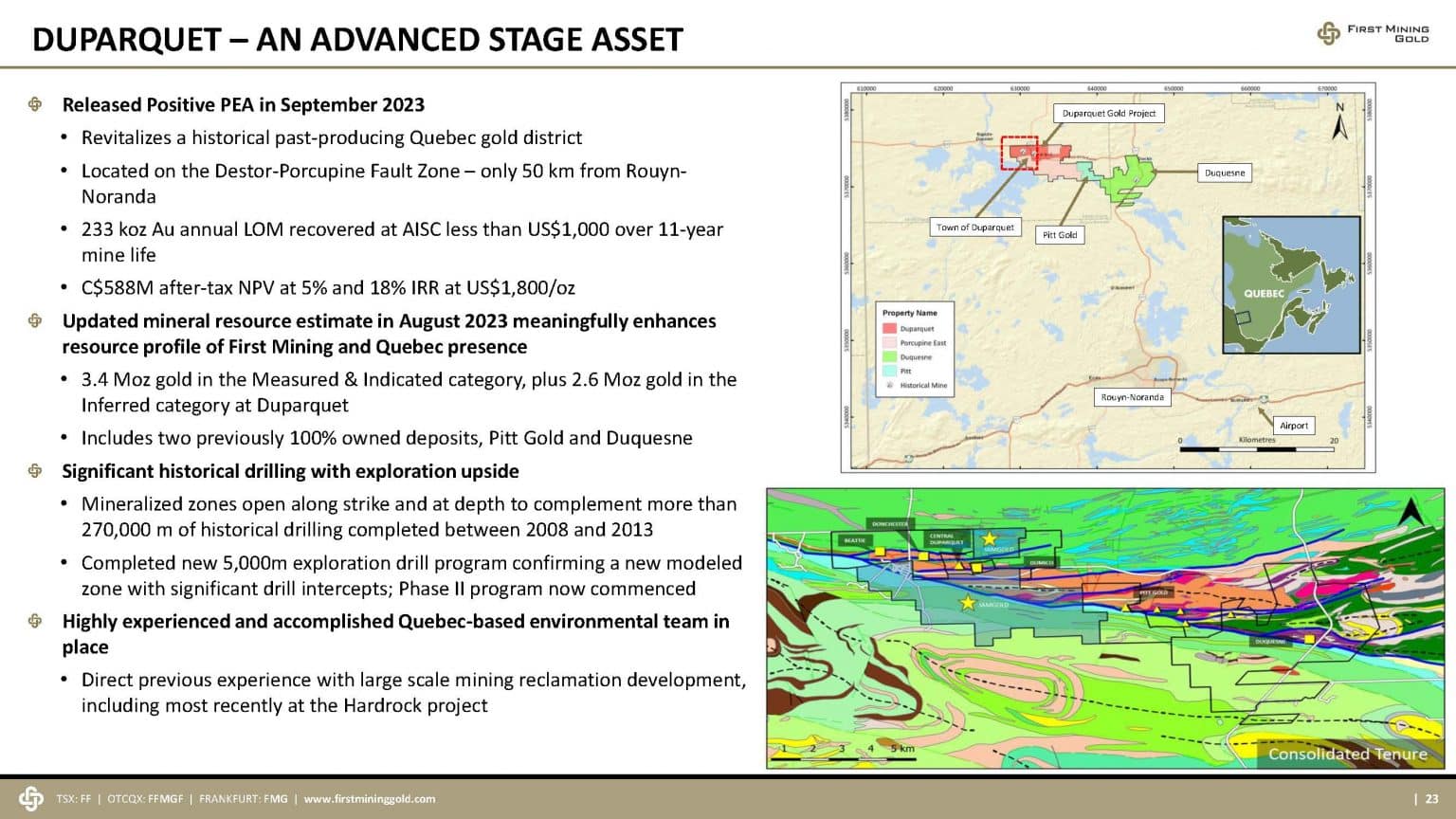

Duparquet Gold Project (PEA-stage)

Duparquet Gold Project (First Mining Gold Corp. Company Presentation as of December 2024)

The Duparquet Gold Project is the second significant asset in First Mining’s portfolio, located in the Abitibi region of Quebec, Canada. It is one of the largest undeveloped gold projects in North America, situated along the prolific Destor-Porcupine Fault Zone.

The Duparquet Project encompasses approximately 5,800 hectares with 19 km of strike length and includes the past-producing mines Beattie, Donchester, and Duquesne. Additional deposits are Central Duparquet, Dumico, and Pitt Gold.´

As of August 31, 2023, the resource estimate for the consolidated Duparquet Project contains 3.44 million ounces of measured & indicated gold resources, grading 1.55 g/t Au, and 2.64 million ounces of inferred gold resources, grading 1.62 g/t Au.

Recent Developments at Duparquet

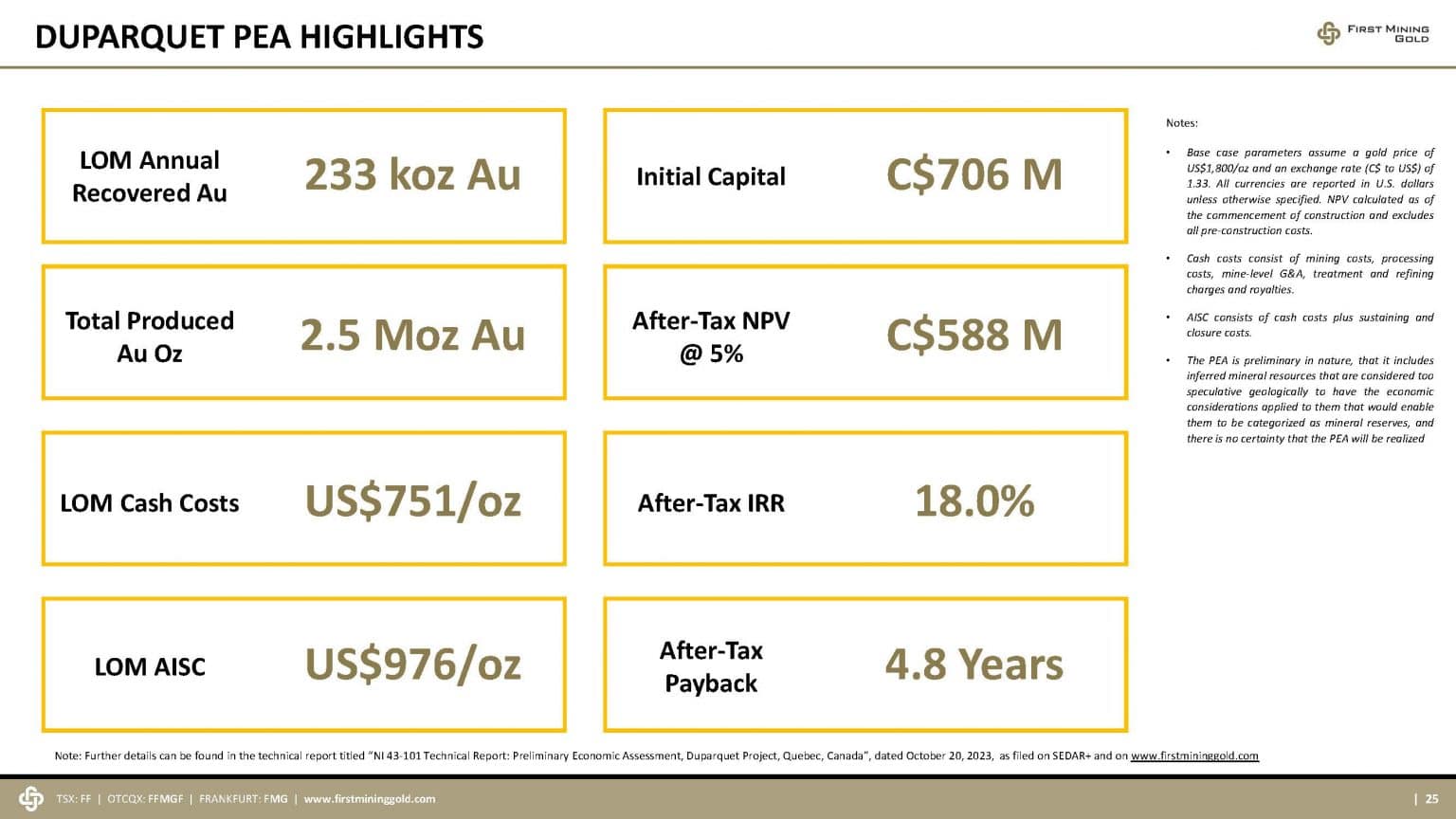

Duparquet PEA Highlights (First Mining Gold Corp. Company Presentation as of December 2024)

First Mining’s Duparquet project is advancing rapidly, with a 2023 Preliminary Economic Assessment outlining a substantial 15,000 tonne per day operation over a 11-year mine life, projecting gold production of approximately 2.5 million ounces. Building on this momentum, the company has launched an ambitious 12,000 m drilling program in 2024, complemented by comprehensive geophysical, LiDAR, and field surveys across the property. Recent drilling results have been particularly encouraging, revealing significant potential for resource expansion, especially in the Buzz Zone and North Zone, where intercepts such as 6.52 g/t Au over 4.6 m and 10.67 g/t Au over 5.3 m have been reported, respectively.

The Duparquet Gold Project represents a key second development asset in First Mining’s pipeline, complementing their flagship Springpole Gold Project in Ontario. Its location in a tier-one mining jurisdiction and significant resource base make it an attractive asset for potential future development or partnerships. As well, the Duparquet Gold Project demonstrates considerable potential for resource growth and development. First Mining continues to advance the project through ongoing exploration and technical studies, positioning it as a significant component of the company’s gold asset portfolio in Canada.

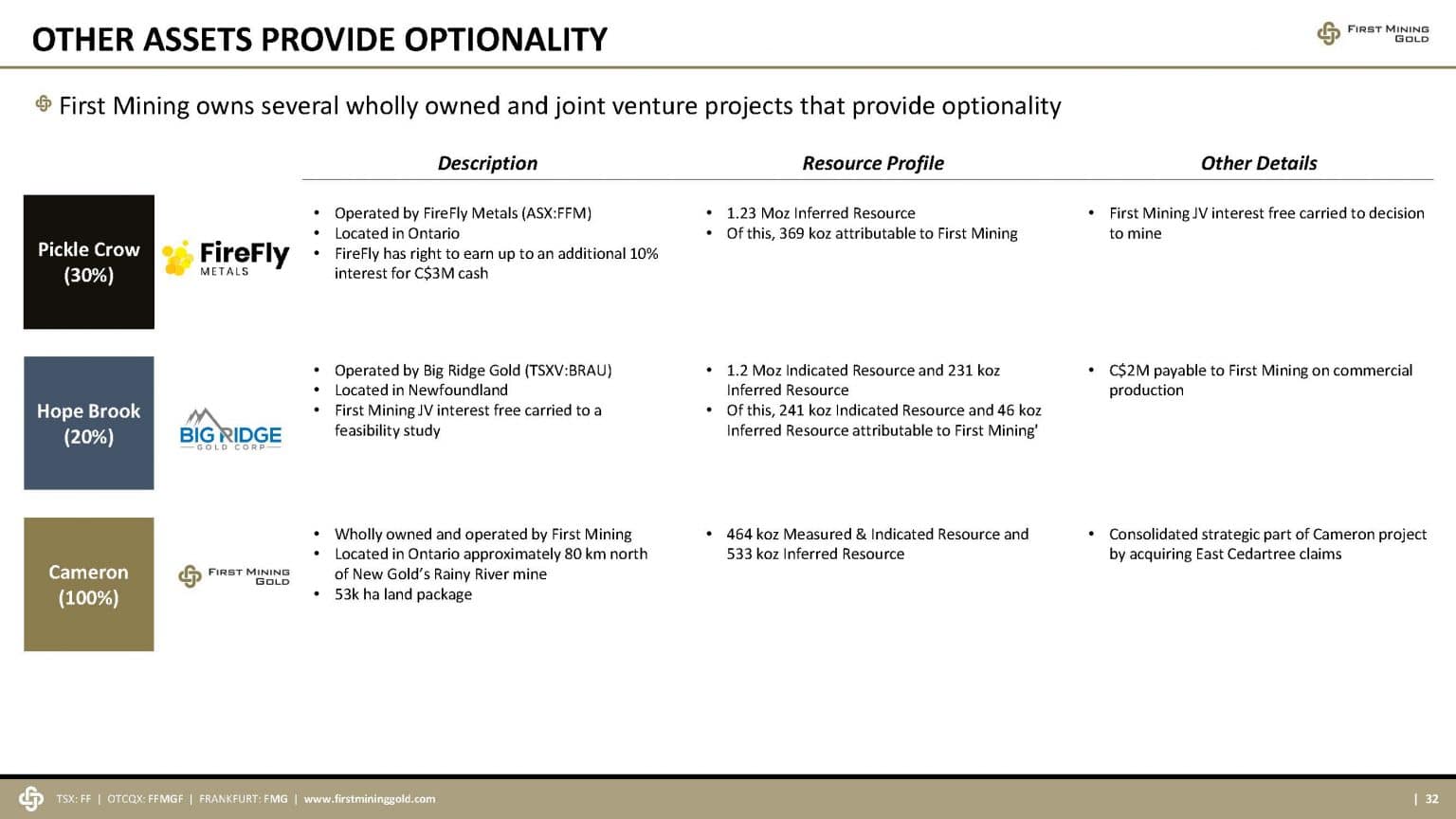

Other assets in the portfolio

Other assets in the portfolio (First Mining Gold Corp. Company Presentation as of December 2024)

In addition to Springpole and Duparquet, First Mining’s portfolio includes:

- Cameron Gold Project in Ontario

- Pickle Crow Gold Project (partnership with Firefly Metals Ltd. (TSX: FFM | ISIN: AU0000313769))

- Hope Brook Gold Project (partnership with Big Ridge Gold Corp. (TSX: BRAU | ISIN: CA08949R1073))

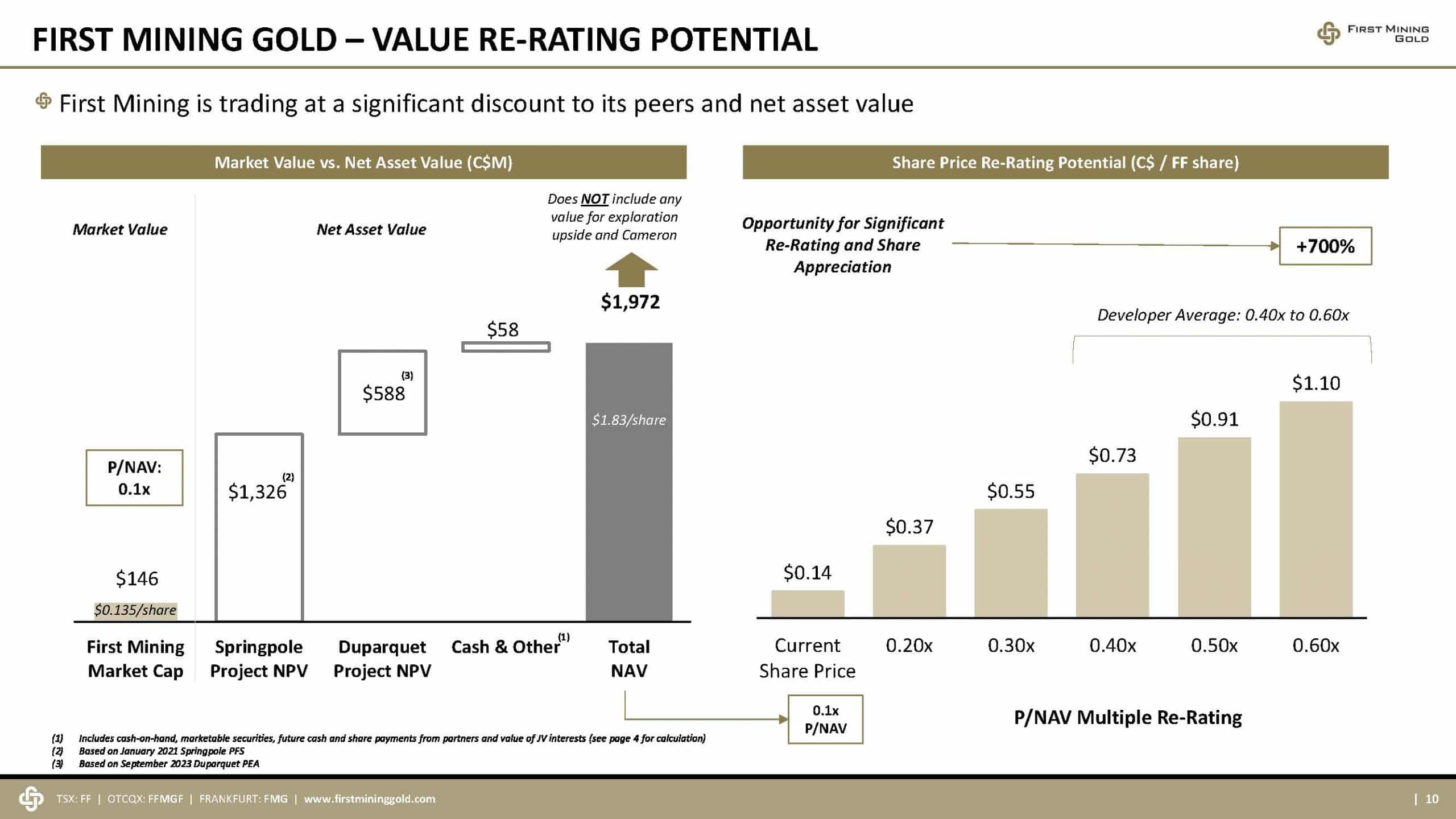

Valuation Analysis

Valuation Analysis (First Mining Gold Corp. Company Presentation as of December 2024)

On an NAV basis, First Mining currently trades at less than 0.1x NAV at historically low valuations. It should be noted that the fundamental NAV that is being used to calculate this multiple is CAD 1.83/share and is based on Springpole’s PFS done at USD 1,600/oz gold price and Duparquet’s PEA done at USD 1,800/oz gold price. In today’s gold environment where gold is more than USD 2,500/oz, the NAV would be in excess of CAD 5/share. First Mining is deeply discounted in today’s gold market environment and big catalysts over the next year provide a tremendous opportunity for share price re-rating and appreciation.

Counter-arguments and potential risks

One criticism that comes up very often is the large share count. With more than 1 billion shares outstanding, First Mining faces concerns about dilution. This high share count is primarily due to the share issuances during its formative years in 2015/2016 when Fir Mining acquired 8 projects or companies. Recently, capital raising activities have further increased the share count, including raising CAD 15 million in equity in September and October 2024 and a CAD 7 million flow-through equity financing in June 2024. While these financings have strengthened the company’s balance sheet, allowing it to advance key projects like Springpole and Duparquet, they have also increased the total number of shares. This dilution can potentially impact shareholder value and make it more challenging for the stock price to appreciate significantly on a per-share basis.

However, it’s important to note that First Mining has been using these funds to make substantial progress on its projects. The company has submitted the final Environmental Impact Statement for the Springpole Project, completed significant drilling programs, and made new gold discoveries. These developments could potentially increase the company’s overall value, which may help offset concerns about the high share count in the long term.

As well, the ongoing need for capital, which usually leads to shareholder dilution, is a potential risk which investors have to consider. Especially since the market environment for junior gold developers remains challenging. As the company is still in pre-production stage with projects requiring significant further investment and at the same time relying on achieving permits and completing feasibility studies, value investors need to have staying power.

Competitor analysis

Competitor analysis (First Mining Gold Corp. Company Presentation as of December 2024)

In the competitive landscape of junior gold mining companies, two notable players could be named as potential comparisons to First Mining: Falco Resources and Skeena Resources. Both companies are advancing significant gold projects in Canada, with Falco focusing on the Horne 5 Project in Quebec and Skeena revitalizing the Eskay Creek mine in British Columbia. These projects showcase robust economics, substantial resource potential, and are at advanced stages of development, providing valuable benchmarks for evaluating First Mining’s position in the market.

Falco Resources

A company that could be compared to First Mining is Falco Resources Ltd. which is advancing its flagship Horne 5 Project in Rouyn-Noranda, Québec. The company owns approximately 67,000 hectares of land in the Noranda Mining Camp, representing 67% of the entire camp and including 13 former gold and base metal mine sites. Falco’s Horne 5 Project is a massive sulphide polymetallic deposit with significant gold, silver, copper, and zinc resources. The project’s 2021 Feasibility Study outlined robust economics, projecting an annual production of approximately 220,000 oz Au (330,000 oz AuEq) over a 15-year mine life, with all-in sustaining costs below USD 600/oz net of by-product credits. Falco is advancing the project through the permitting process, with expectations to obtain a ministerial decree authorizing the project in H1-2025, positioning it as one of the few permitted large-scale polymetallic gold projects ready for development in North America. At the same time, the construction decision will be a billion-dollar capex with the challenge that the dewatering of the underground might take about four years. Most likely, however, Falco will come to a decision point before First Mining.

Skeena Resources

Another comparable mining company might be Skeena Resources Limited, which is a Canadian precious metals developer focused on revitalizing the past-producing Eskay Creek gold-silver mine in British Columbia’s Golden Triangle. This flagship stands out as one of the world’s most exceptional open-pit precious metals opportunities, with a 2023 Definitive Feasibility Study outlining robust economics including an after-tax NPV5% of CAD 2.0 billion and a 43% IRR. Skeena recently secured a comprehensive USD 750 million financing package with Orion Resource Partners, fully funding the project’s development towards targeted production in the first half of 2027. The Eskay Creek mine is projected to produce an average of 320,000 gold equivalent ounces annually over a 12-year mine life, with the first five years averaging 450,000 gold equivalent ounces per year. This project has recently achieved a crucial milestone by obtaining a bulk technical sample permit, allowing development activities to proceed in 2025. Skeena’s progress at Eskay Creek exemplifies the ongoing development and potential of the Golden Triangle region, reinforcing its status as a world-class mining district. Hence, there is certainly a strong value argument, as they got a higher-grade open-pit deposit, and promising economics. Yet, Skeena is sitting at a CAD 1.3 billion market cap which actually confirms how undervalued First Mining at current levels is.

Technical Analysis

After a multi-year downtrend, First Mining has basically been in deep sleep for the last one-and-a half year. During this time, the stock price has twice tried to break away from its bottoming out zone between CAD 0.10 and CAD 0.13 to the upside. So far, this endeavor has not been a lasting success.

First Mining Gold in CAD, weekly chart as of January 22nd, 2025. Source: Tradingview

On the weekly chart, the bottoming-out phase is evident and has been in place for a very long time. However, the weekly stochastic oscillator is extremely oversold and has reversed to the upside, indicating that a change in momentum to the upside might have started. The is lots of room for the oscillator to move.

First Mining Gold in CAD, daily chart as of January 22nd, 2025. Source: Tradingview

On its daily chart, First Mining has successfully tested the lower boundary of a potential bullish triangle support zone. The stochastic oscillator is bullish, indicating that the leg up has just started after prices bounced off the recent lows. The 200-MA is more or less flat, confirming the lengthy period without any sustainable trend.

Overall, there is no uptrend and neither a downtrend. The stock simply has moved dormantly sideways. However, it looks like new momentum has sparked, which could quickly propel prices towards the upper resistance zone around CAD 0.175. If bulls can take out this resistance zone, the upside would be huge as the next resistance zone comes in around CAD 0.245 to CAD 0.26.

Recent Interview

Conclusion

Conclusion (First Mining Gold Corp. Company Presentation as of December 2024)

Despite its significant assets, First Mining appears very undervalued compared to recent acquisition metrics in the gold sector. The company is trading at approximately USD 8 to USD 10 per ounce of gold resources, compared to the recent acquisition of Osisko by Gold Fields in a USD 2.16 billion deal valued at around USD 200 per ounce. This valuation gap presents a potential opportunity for investors as the company continues to de-risk and advance its projects.

In summary, we believe that First Mining represents a compelling opportunity in the gold development space. With two of the largest undeveloped gold projects in Canada, significant progress on permitting and studies, and a strong management team, the company is well-positioned to benefit from the current gold price environment and industry consolidation trends. However, investors should be aware that project development and permitting processes can be lengthy and subject to various risks and uncertainties.

Nevertheless, First Mining is well-positioned to benefit from the ongoing consolidation trend in the gold mining industry. With major producers seeking to replenish reserves and production capacity, large-scale gold projects in tier-one jurisdictions like Springpole and Duparquet highly attractive

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can also subscribe to our free newsletter.

********