The Federal Reserve’s Federal Open Market Committee (FOMC) announced a 50 basis point cut in its federal funds rate target on Wednesday. The move marks a reversal at the Fed, which had held its target rate range at 5.25 to 5.5 percent since July 2023. FOMC members previously worried high inflation might become entrenched. They now believe inflation is on a path back to 2 percent, thereby warranting a gradual transition from tight to neutral monetary policy.

At the post-meeting press conference, Fed Chair Jerome Powell described the decision as “a process of recalibrating our policy stance away from where we had it a year ago when inflation was high and unemployment low to a place that’s more appropriate given where we are now and where we expect to be.”

Market participants were grappling with two big questions heading into Wednesday’s meeting. The immediate question was whether the Fed would cut its federal funds rate target range by 25 or 50 basis points. Just prior to Wednesday’s announcement, the CME Group reported that the federal funds futures market was pricing in a slight edge (55 percent) for the larger cut.

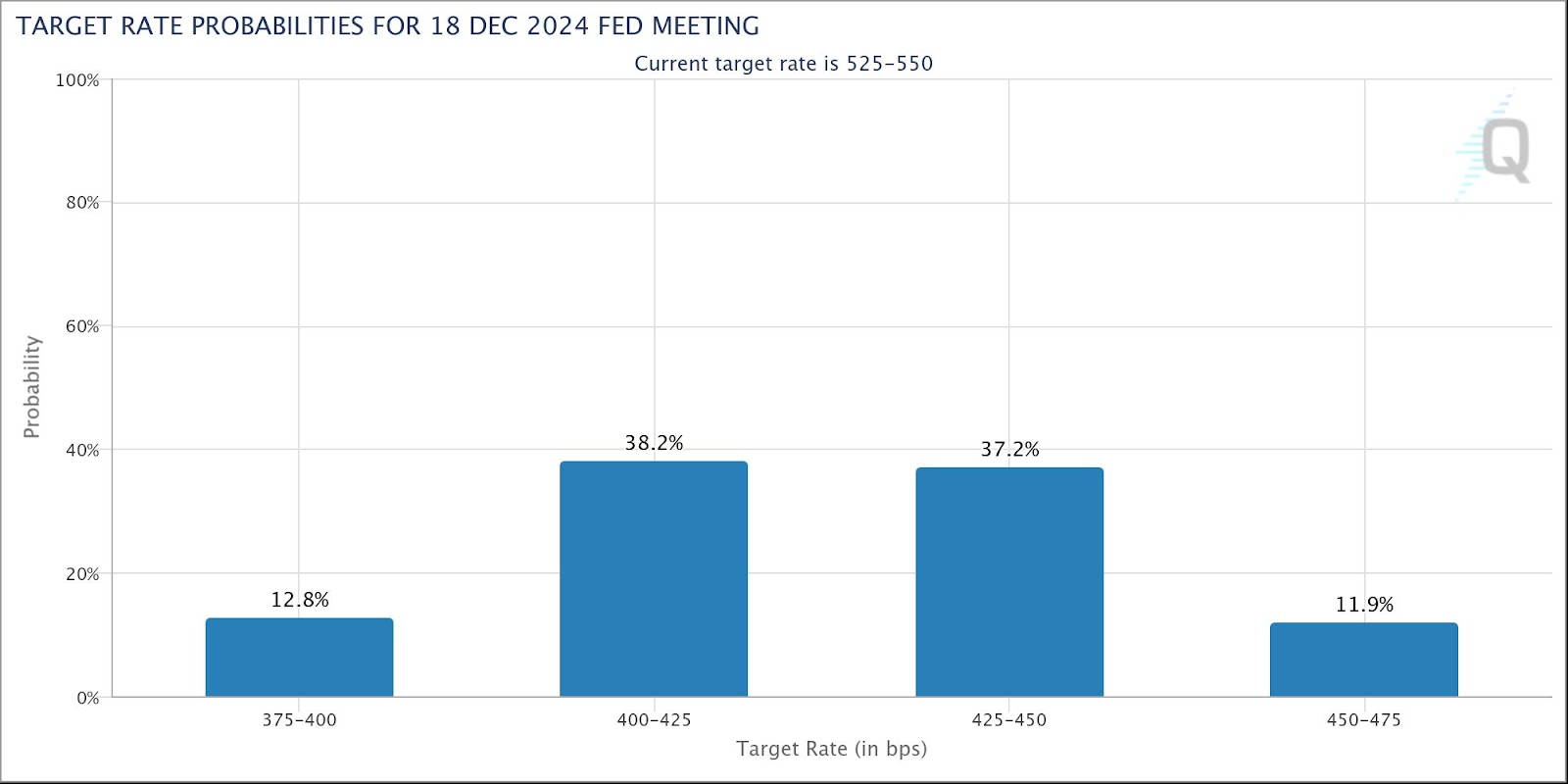

The longer term question concerned the pace of rate cuts. Prior to the meeting, futures market traders were convinced the Fed would move quickly. The CME Group reported a 12.8 percent chance that the federal funds rate target range would be 150 basis points lower by the end of the year; a 51.0 percent chance it would be at least 125 basis points lower; and an 88.2 percent chance it would be at least 100 basis points lower.

Figure 1. Federal funds rate target probabilities for December FOMC meeting, as implied by 30-Day Fed Funds futures prices and reported by CME Group

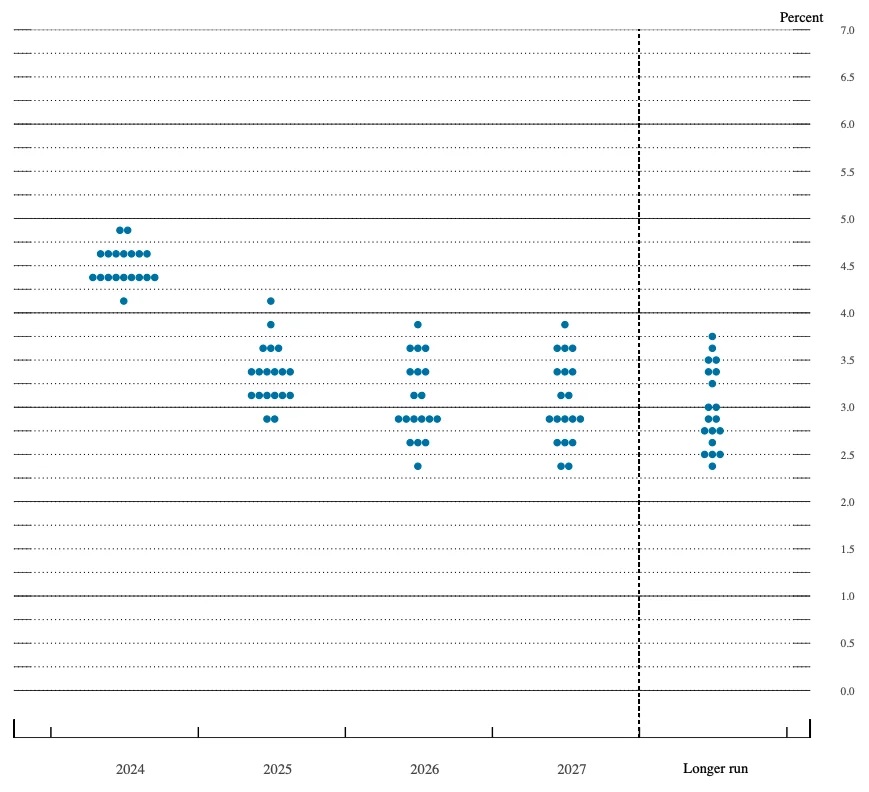

The Fed’s decision to cut by 50 basis points on Wednesday and the projections for the federal funds rate submitted by FOMC members largely confirmed market expectations. The median FOMC member projected the midpoint of the federal funds rate target range would fall to 4.4 percent this year, which is consistent with a 4.25 to 4.5 percent target rate range. One FOMC member projected the federal funds rate would fall by an additional 75 basis points this year; nine members projected it would fall by an additional 50 basis points; seven projected it would fall by an additional 25 basis points; and two projected it would remain unchanged.

Figure 2. FOMC participants’ assessments of appropriate monetary policy: Midpoint of target range or target level for the federal funds rate.

Given FOMC members’ projections for near-term rate cuts, Wednesday’s decision might be seen as an implicit acknowledgement that the Fed had gotten behind the curve. Inflation was 2.5 percent over the last twelve months, which is slightly above target. But it has averaged just 1.5 percent over the last three months and 0.9 percent in the most recent month.

Moreover, since our estimates of housing services prices adjust with a considerable lag, actual inflation—if it were possible to accurately measure it—is probably even lower. This lag caused conventional measures to underestimate inflation in 2021, when prices began rising rapidly. It has likely caused them to overestimate inflation in late 2023 and 2024, as prices began to grow more slowly.

Powell denied that the Fed was playing catch-up with its 50 basis point rate cut. “We don’t think we’re behind. We think this is timely. But I think you can take this as a sign of our commitment not to get behind.” Nonetheless, Powell acknowledged that the Fed might have cut in July had the data come in before that meeting rather than just after.

By conventional measures, monetary policy remains tight and will likely continue to remain tight over the near term if the Fed cuts rates in line with the median FOMC member’s projections. Indeed, Powell said “there’s no sense that the committee feels it’s in a rush” to return policy to neutral.

The New York Fed estimates the real (i.e., inflation-adjusted) neutral rate of interest at 0.74 to 1.22 percent. With the Fed’s 2-percent inflation target, that would imply a long run nominal neutral rate of interest of 2.74 to 3.22 percent. Correspondingly, the median FOMC member currently projects the midpoint of the longer run federal funds rate target range at 2.9 percent, which is consistent with a 2.75 to 3.0 percent target rate range. If the federal funds rate target range is 4.25 to 4.5 percent following the December meeting, as the median FOMC member currently projects, it will remain more than 100 basis points above the long run neutral federal funds rate.

Of course, we do not directly observe the neutral federal funds rate. But, as Chair Powell noted in the post-meeting press conference, “we know it by its works.” If incoming data suggests that monetary policy remains too tight, the Fed might respond by cutting its federal funds rate target faster than the median FOMC member currently projects.

“We are not on any preset course,” Powell said. “We will continue to make our decisions meeting by meeting.” The risk is that, given the long and variable lags of monetary policy, it will be too late to avoid a recession once the signs of a recession appear.

Courtesy of AIER.org and originally published here.

*********