Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

It’s been over three years since I bothered to publish an article on the dead end but glitzy space of urban air mobility with their origami electric vertical take-off and landing passenger aircraft. Instead, I focused my aviation related assessments on how aviation will actually decarbonize over the next few decades, starting with regional air mobility where conventional fixed-wing aircraft take off from boring old airstrips, but running on electricity. Oh, and heavy lift drones for crop spraying, tree planting, and solar panel installation, among many other use cases of high merit.

But recently there’s been enough news of very predictable — and predicted — failures that it’s worth returning to the space.

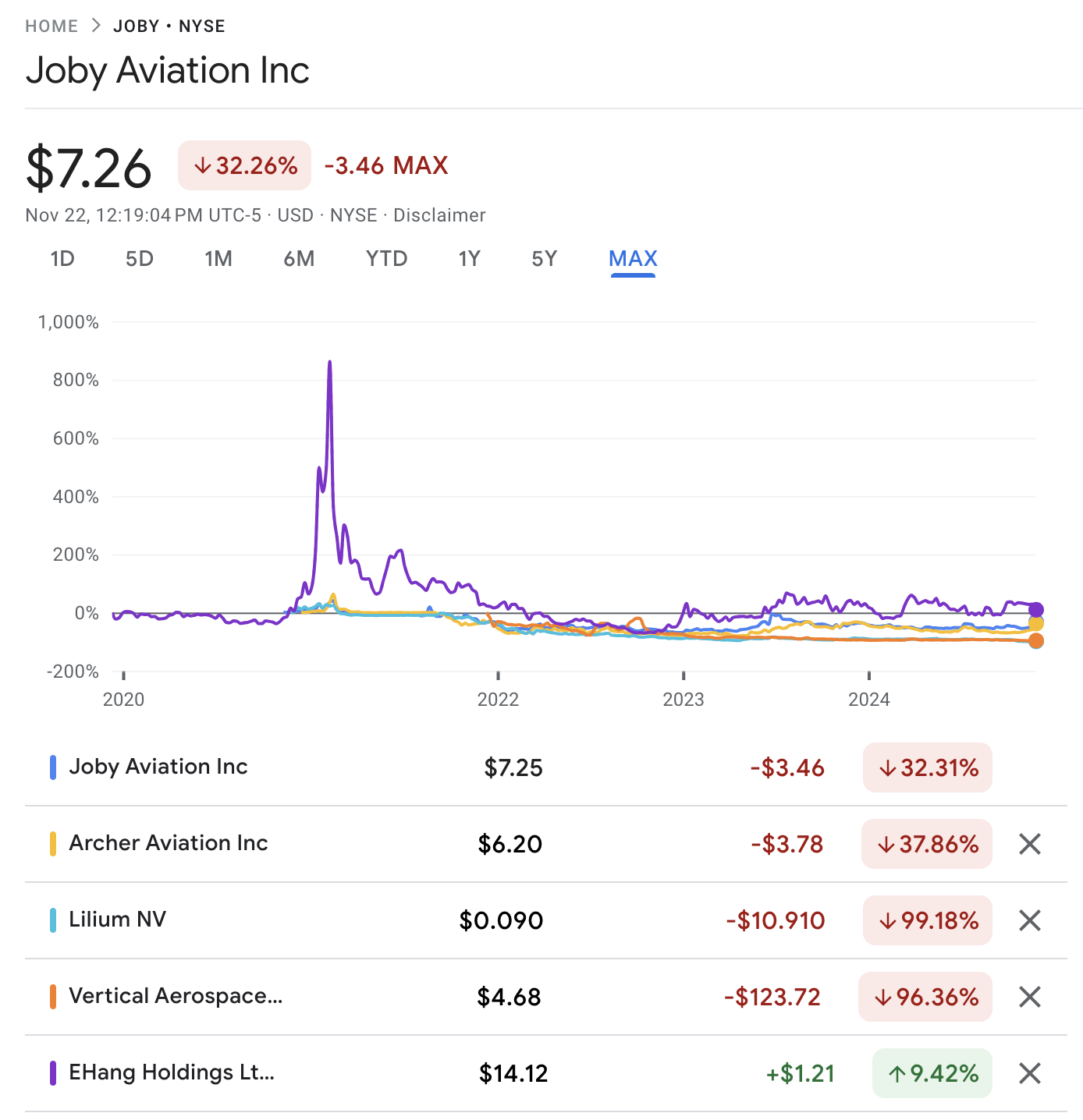

Electric vertical take-off and landing aircraft (EVTOLs) were heavy into the SPAC — special purpose acquisition company — pump and dump scam investment space that Wall Street bros foisted off on unwitting investors after IPOs, ICOs, and NFTs had made them their millions in bonuses, enabling them to stock up on Cristal and Ferraris. As a I wrote in 2021, the publicly listed EVTOL firms had already lost investors $16 billion of the peak capitalization of $28 billion, and the stock prices have just continued to go down.

That’s not a good look at all. Of the publicly listed firms, only one is ever so slightly up from its original valuation, about 10% over five years, so nothing at all to write home about. What company is that? Chinese firm eHang, with its customer Cuisinart knee-high blades. But that firm, having seen a major stock bump when the SPAC craze blew through the market, masks the depth of failure of the rest of the stocks. Let’s remove it.

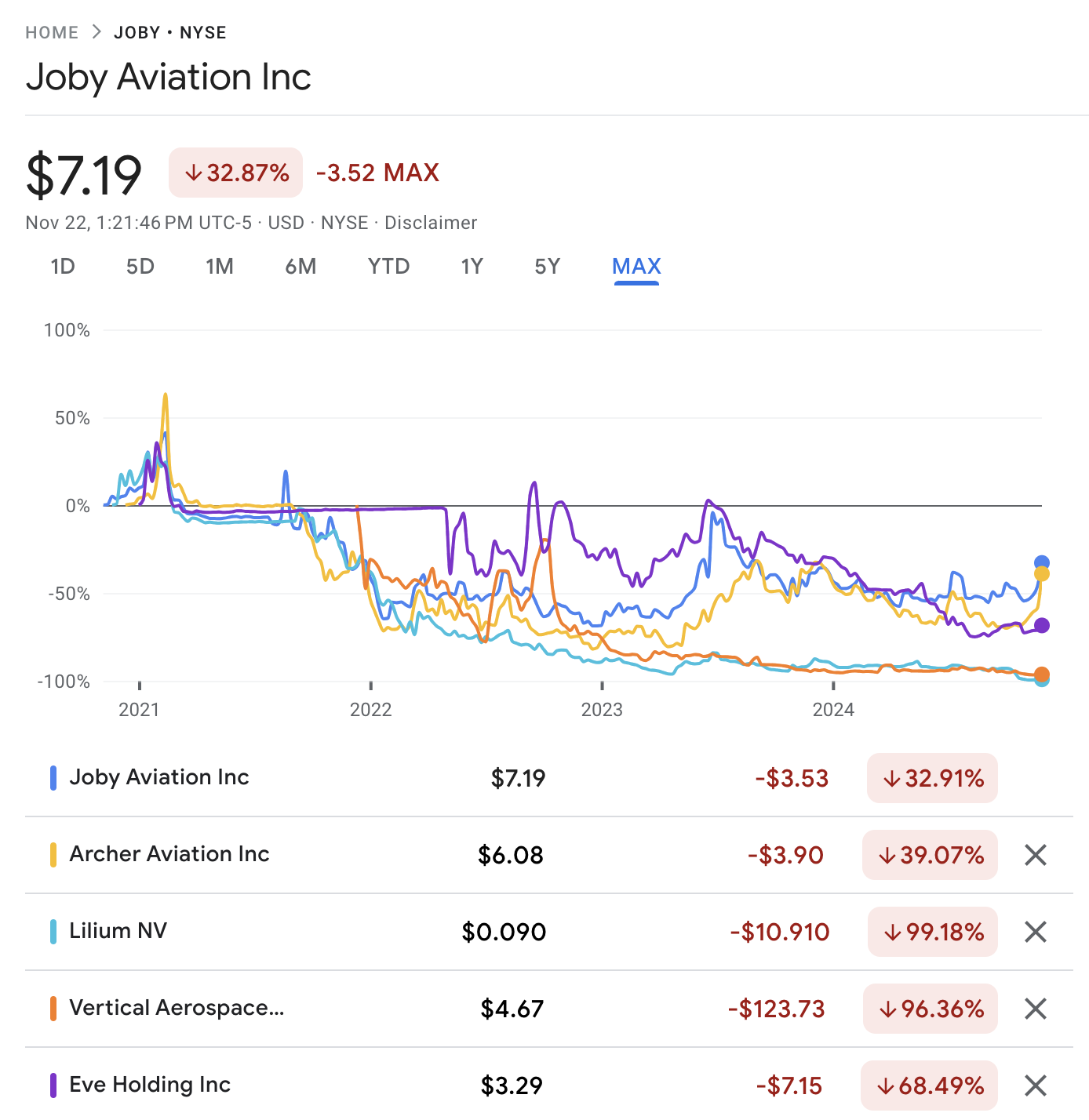

Now there’s a stock chart to make investors green in the gills from airsickness. It also makes the 2021 SPAC-fueled pump and dump spike very clear. Google Finance only allows five stocks, so I replaced eHang with Eve Mobility, the Embraer subsidiary.

Many people seem to think that the continued existence of these companies is indicative that they have value and merit. That’s a misreading of the situation. The Wall Street SPAC bros did very well out of them, selling off and taking a lot of the raised capital before it dissolved into losses. That’s left the firms with insufficient funds to actually certify and manufacture their aircraft, but enough to keep going and for the founders and executives to keep taking big annual salaries to show up at air shows, hang around aviation types, and fail slowly.

That time is coming to an end. Lilium is the first to reach the end of the runway and crash into the barriers at the end, declaring insolvency recently — equivalent to bankruptcy in North America — and entering administration in the UK and Australia. NASDAQ announced it was delisting the stock three weeks ago, but it takes a while for the process to complete, hence their existence on the charts.

Of course, there are other failures to consider from firms that were never listed separately as a stock.

Kitty Hawk Corporation, the Silicon Valley-based EVTOL pioneer backed by Google co-founder Larry Page, announced in September 2022 that it was ceasing operations. The company failed to achieve commercial viability with its Heaviside EVTOL though its joint venture with Boeing, Wisk Aero, continues to pursue autonomous air taxi solutions. That’s a dead end for Boeing, with Wisk being more of a sexy distraction from real airplanes’ doors falling off and planes plummeting out of the sky than an actual business venture. That said, the absurd degree of regulatory capture of the US Federal Aviation Authority by Boeing detailed in Flying Blind: The 737 MAX Tragedy and the Fall of Boeing means that Wisk might get through certification, something unlikely for all of the rest. (Note: eHang managed a limited certification which allows it to operate as a rural fairground ride, but that’s the extent of the certification good news in the space.)

Rolls-Royce’s ambitions in the electric flying taxi space came to an end in September of 2024, as the British aerospace giant shut down its Advanced Air Mobility division. Despite years of research and investment, the company failed to attract buyers for its EVTOL technology, once again completely predictably.

Vertical Aerospace, a prominent UK-based EVTOL company, entered advanced negotiations with creditors in November 2024 in a bid to secure its financial future. The firm, which had been developing the VX4 EVTOL aircraft, struggled to balance the high costs of certification and production with limited capital reserves. One of the reasons it’s struggling is that Rolls-Royce stopped backing it during its exit from the space. I expect Vertical to follow Lilium into administration in the coming weeks. Who would throw more money into this empty hole in the sky?

Joby, borne of a group of people who failed — again predictably — in the field of airborne wind energy, continues to pretend it’s going to have aircraft certified and in the air real soon now. The company originally pretended that its first-of-a-kind aircraft with multiple novelties and a class history of falling out of the sky and killing people — there’s a reason only the military flies VTOLs — would be certified and available for sale in 2023. Now they are pretending it’s 2025. If they actually survive to mid-2025, I predict the launch will be changed to 2027 or 2028. For an example of SPAC proceeds, the reverse takeover raised $1.6 billion, but Joby only received $1.1 billion of it. At that, they are the best financed EVTOL firm in existence, so might be the last one standing. They are in bed with Toyota now, which doesn’t bode well, as that firm has a recent history of betting on the wrong technology.

Beta Technologies is another US entrant in the stable of sway-backed nags pretending to be Arabian thoroughbreds. It’s stayed private, getting multiple series of investments from organizations that should know better — Amazon’s Climate Pledge Fund and Fidelity Management & Research Company — and funds I don’t expect much from — Qatar Investment Authority and TPG Rise Climate. It’s managed to raise $1 billion, which sounds like a lot.

However, I’ve had multiple discussions with experts in aircraft certification in the past five years and reviewed certification requirements for both the FAA and EASA related to this class of decorative objects. We agree that getting one of these things certified is in the range of $1.5 billion, and that none of the volumes in the business cases, adjusted for reality, remotely support the expenditure. They would need to sell thousands per year when the market might be a few hundred in total, and they are pretending that they will be flying 12 hours a day with turnarounds like Formula One pitstops on the ground. I reviewed a lot of the business cases four years ago and none of them study up to the slightest scrutiny, lighter-than-air confections that pretended to be steak and potatoes.

Eve Air Mobility, listed under Eve Holding Inc, a subsidiary of Embraer, is even more off the mark. It was another SPAC pump and dump, managing only a tiny $4.14 stock price bump before the dump in 2021. It picked up $400 million in capital and has added another $300 million or so to that, but recently it’s only been getting loans, which frankly is a bad sign for an aircraft that has raised half the money it needs just to certify. I assume Embraer has been keeping it alive because other major aircraft manufacturers have been playing the game for marketing dollars, and as they exit one by one, Embraer is just choosing when to do so. I give it a maximum of a year before the aerospace engineers and executives are asked to find other, more productive things to do with their time.

Volocopter, a German sibling firm of already failed Lilium, is struggling as well. It’s only managed to raise about $700 million as well from investors like Daimler AG, Geely, Intel Capital, BlackRock, NEOM, and Micron Ventures. The ground transportation connection is stronger with the firm, but NEOM is a big red flag as that fund thinks an unlivable linear city through a desert is a great idea. Earlier this year it failed to launch at the Paris Olympics, one of a couple of embarrassing parts of an event that promised to be a real climate winner. It was supposed to be able to ferry one passenger at a time — without luggage except maybe a carry-on bag — from a barge in the Seine to the airport, but unsurprisingly failed to get certification for that. The only good things I have to say about Volocopter is that at least, like eHang, it has opted for simplicity with no origami shape-shifting, just rapidly spinning blades, but unlike eHang at least put them safely above passengers’ heads. I’m pretty sure it’s heading for insolvency, likely in early 2024.

Requiring a card of its own to play, the biggest aircraft manufacturer in the world, Airbus, has its concept car… err… EVTOL to show off at airshows — the CityAirbus NextGen. It keeps how much it has spent on this marketing venture close to its chest, and unlike many of the other entrants on this list of avionic shame, doesn’t pretend that memorandums of understanding that would dissolve in a gentle misting of rain are orders, claiming none at all. With Rolls-Royce gone, the need to be able to play the card diminishes, so I expect the CityAirbus to vanish into the junk drawer of old renderings in a year or two at maximum.

There are a couple of other EVTOL firms that no one has ever heard of, Skydrive out of Japan and ASML out of Australia, but like all the rest, they fly under all radar systems because they are never leaving the ground. They’ll dissolve into the aether soon enough, although the Japanese one might turn into the hydrogen fuel-celled car of the 2030s. Never count out the Japanese ability to persist in doing something for decades past the time when all rational reasons for doing so have disappeared. On that note, Japan’s latest energy plan is finally heavy on renewables, so the country can still learn.

It’s unlikely I’ll bother to write another article about this space unless I do a retrospective of the hulking carcasses in the graveyards of aircraft at some point to point out how much money and engineering talent was wasted as an abject lesson in another hype bubble. They always arise, and it’s useful having a set of collateral that enables us to ask why the next hype bubble is different than the last one. For all those wishing for a Jetsons future — you know who you are — let it subside into wistful daydreaming instead of active hoping.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy