Support CleanTechnica’s work through a Substack subscription or on Stripe.

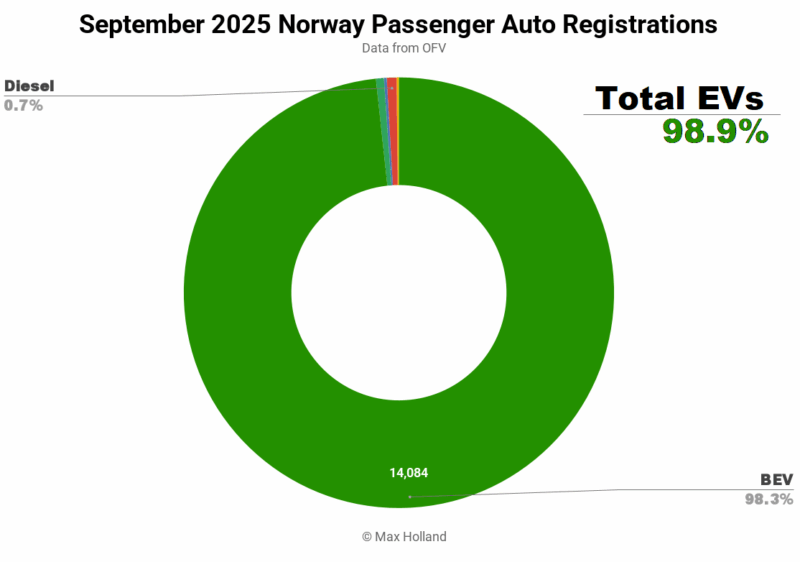

September saw plugin EVs take a record 98.9% share in Norway, up from 97.5% year on year. BEVs alone took 98.3% share, also a record high. Overall auto volume was 14,329 units, up some 11% YoY. The Tesla Model Y was the best-selling vehicle.

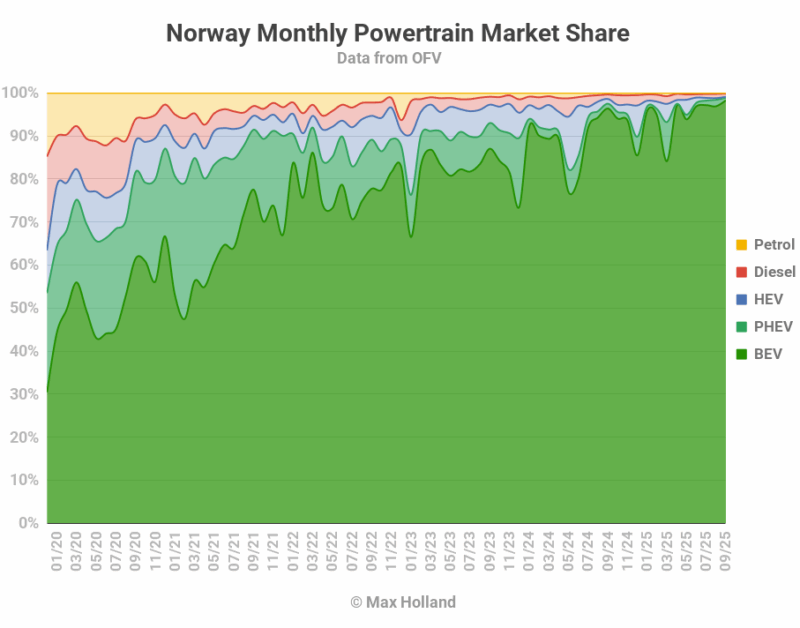

September’s auto market saw combined EVs take a record 98.9% share in Norway, comprising 98.3% full electrics (BEVs) and 0.6% plugin hybrids (PHEVs). These compare with YoY figures of 97.5% combined, 96.4% BEV and 1.1% PHEV.

This is the fourth consecutive month of record combined EV share, and the third consecutive month of record BEV share. This all suggests that the tax tweaks which came in at the start of April have had their desired effect to further disincentivize anything other than BEV purchases.

In terms of the residual powertrains, PHEVs (0.6% share) are now more popular than HEVs (0.2%), and petrol-only (0.2%), which seems rational. Unfortunately diesel-only powertrains (0.7%) are still occasionally ahead of even PHEVs. This, however, likely only reflects that some niche segments still have few BEV or PHEV models on offer, combined with the fact that diesels have a tried-and-tested image of reliability for some buyers, which may be highly valued in certain rare instances “just in case”.

The existence of these hard-to-reach niches is common in technology transitions where marginal use-cases often value reliability, adaptedness, and predictability over the advantages of the newer technology. Still, at only 0.7% of the market (and gradually diminishing), diesel-only sales are not something to be overly concerned about. In my view, diesel buyers should not be blanket-penalized (e.g. by ever higher taxes) without understanding their needs and why EV options are perceived as not yet the right fit for them (for infrastructure reasons or otherwise). In the fullness of time, further advances in BEV (or PHEV) technology, and even more ubiquitous and reliable charging infrastructure, will likely take care of the needs and concerns of these users.

Best-Selling Models

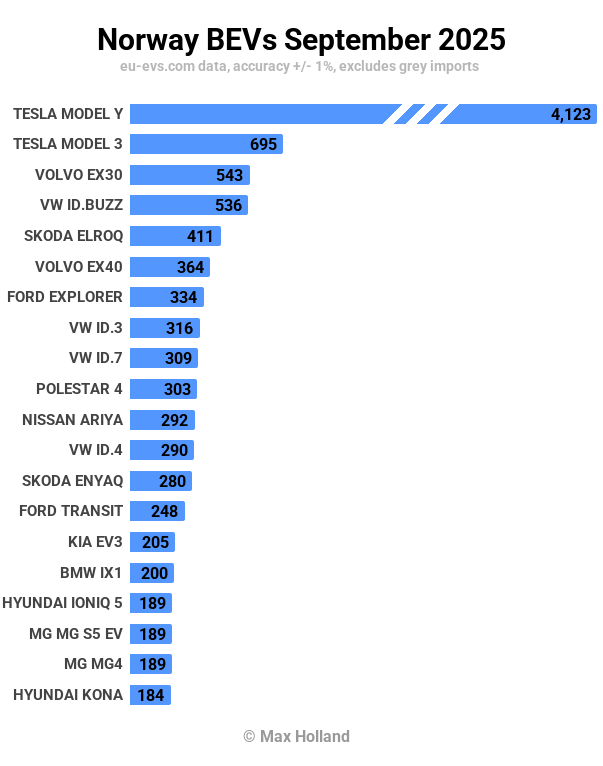

The Tesla Model Y was once again the best-selling auto in Sweden, with a huge 4,123 units sold in September. This represented around 29% of the entire auto market, and more than the next 10 models combined.

Its sibling, the Tesla Model 3 came in second place, with 695 units. In third was the Volvo EX30, with 543 units.

Most of the top 20 faces are familiar ones, with no outright newcomers joining the top 20. Some normal monthly variations in ranking occurred, especially from those brands that deliver to this market in irregular volume (e.g. Tesla, Polestar, Volvo, MG).

As for notable performances, the Skoda Elroq (which debuted in February) continued to steadily climb, reaching its highest rank of 5th in September, with a record volume of 411 units. This is a great result for Skoda.

The Ford Explorer saw its highest volume of the year, with 334 units (and 7th spot). The Polestar 4 also saw its highest ever volume (303 units), and took a rare 10th spot. However, as alluded to above, Polestar’s deliveries are highly erratic (averaging 75 monthly units in July and August). We can chalk September’s elevated Polestar 4 numbers up to a temporary burst shipment to catch up with a demand backlog, rather than indicating a higher level of sustained demand.

There were a couple of BEV debutants in September. MG Motor launched their new IM5 and IM6 models, with 20 and 24 units respectively. These are large E-segment vehicles, with the IM5 being a sedan, and the IM6 an SUV. The IM5 starts from 399,000 NOK (€34,360) for the base 75 kWh battery (100 kWh optional), and the IM6 from 489,900 NOK (€42,200), coming as standard with the 100 kWh battery.

These new MGs come at affordable prices for E-segment vehicles, especially given the ~400 kW charging speed of the 100 kWh variants. For more technical info on these new models, check the UK report from July, when they debuted over there. I can see the IM6 SUV potentially doing well in Norway, so let’s keep an eye on them.

The other half-debut was for the upcoming Isuzu D-Max pickup truck, though just registering a single unit for testing for now, as the D-Max will have its proper commercial launch in early 2026. We’ve covered the D-Max’s basic specs in the UK August report, so take a look over there for more details.

Talking of BEV pickup trucks, the KGM Musso increased from its August debut volume of 5 units, up to 29 units in September, a strong start for such a niche vehicle. The Maxus eTerron had seen showroom units in June, but first customer deliveries in August (5 units), and increased to 15 units in September. Have a look back at last month’s report for a comparison between these two pickups. In short, the Musso is a slightly more modest pickup truck than the eTerron, but still offers plenty of utility and range for many users – and at a much lower price point (from 469,900 NOK, €39,900).

The new Mercedes CLA, which had debuted in August with 8 units, stepped up to 27 units in September. Based on its quick rise in neighbouring Sweden (already near the top 20 after just 2 months on sale), the CLA could potentially have a lot further to climb in Norway also.

August’s other newcomer, the Renault 4, increased to 28 units in September, and will climb higher from here, potentially close to the top 20 at some point. Its sibling the Renault 5 is already seeing 100+ units per month, and ranking around 30th, with room to grow further. The Renault 4 is based on the same platform, but in a 10% larger SUV shape which is a better fit for Norwegian preferences. The Renault 4 might thus be the better seller of the two. Let’s keep an eye on them.

As for other small-and-affordable BEVs, the Hyundai Inster took 33rd spot with 82 units. It’s too early to say whether its recent monthly volumes of just under 100 units are a plateau, or just a pause on a longer ascent, so let’s keep an eye on it. Due to some technical teething troubles (which are being resolved), the Citroen e-C3 is having a quieter time, with 54 units in September, down from its initial peaks (100+ units) in the spring. It still may recover. The BYD Dolphin Surf has still not launched in Norway, so there’s every prospect that the A & B segments will continue to grow in volume (and competition) over the next year or so.

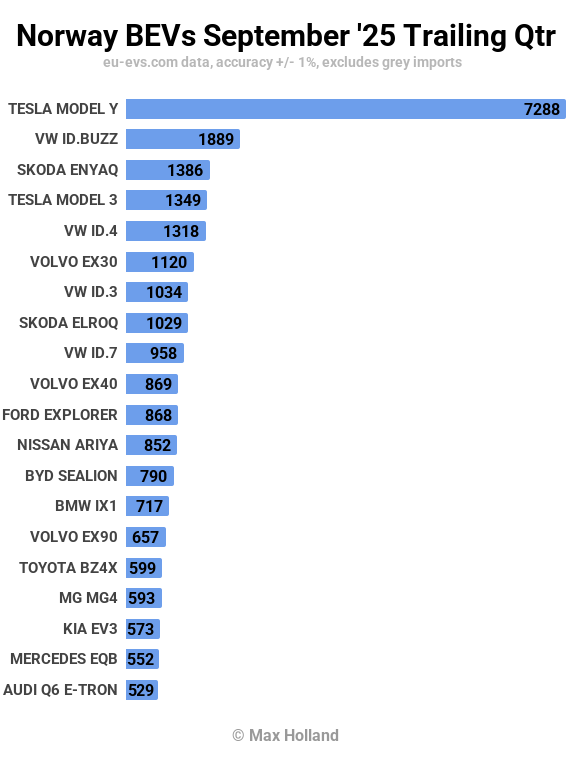

Let’s check up on the trailing quarter charts:

With a big August, and a bigger September, the Tesla Model Y has a monster lead, with more volume than the next 5 models combined. The Volkswagen ID. Buzz is in second, and the Skoda Enyaq is in third.

The most consistent climber is the Skoda Elroq, now up to 8th spot, from 21st in the Q2 period. It has further to climb, and may reach the top 5 by the end of Q4 (depending on allocation).

Just outside the chart, in 22nd spot, the MG S5 is steadily improving (from 33rd in Q2), and may yet break into the top 20 in the coming months.

We can also expect to see the Ford Explorer (now in 11th) to potentially climb further in the near term, in part because Ford typically has an end of year push to meet its fleet emissions requirements.

The highest ranked small-and-affordable BEV is the Renault 5, in 32nd spot, with 312 units in Q3 (up from 155 units in Q2). The Hyundai Inster is just behind in 37th, with 233 units (from 164 in Q2).

Fleet Transition Update

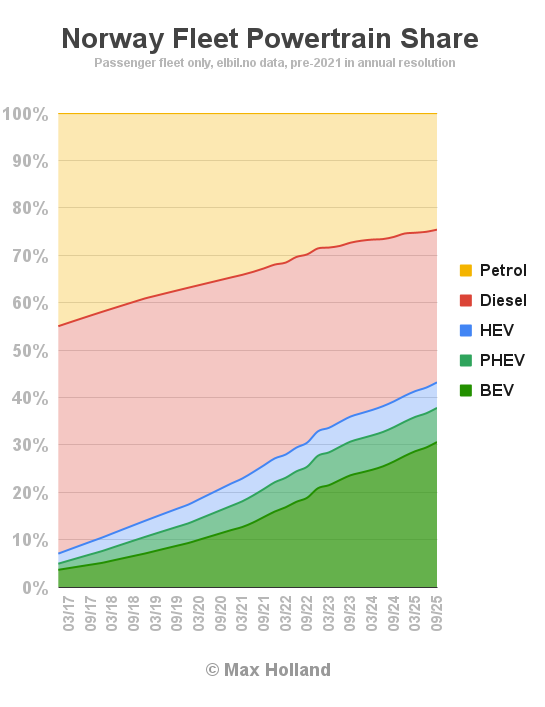

Updated fleet data from the end of Q3 shows a steady increase in EV share at the expense of both petrol and diesel powertrains. Combined plugin share at the end of Q3 stood at 37.8%, with 30.6% BEV. This is an increase over Q2’s share of 36.7% combined, with 29.5% BEV.

We can see that BEV share has increased by (a little over) 1.1% over the three months. Meanwhile, PHEV share is now just past its high point (around 7.2% of the fleet), because PHEV sales peaked around 4 years ago, and have now fallen to only around 1% of the new car market. Their share of the fleet peaked around 18 months ago, and will only slowly diminish over the coming years (by around 0.1% per year in the near term), because most of the PHEV fleet is still relatively young and not yet near retirement age.

Likewise the HEV fleet already peaked at around 5.4% share about a year ago, and new HEV additions (sales) have dropped off dramatically over the past 18 months. Since this fleet is a bit older on average (with the Prius and similar models having been sold for a few decades already), it will diminish at a slightly higher rate than the PHEV fleet, likely by around 0.15% per year in the near term.

The oldest cars in the fleet are diesels (on average) as these had their sales peak back in the 2008-2011 period. They are still the largest portion of the fleet, at 32.2%, but are currently losing around 0.6% share every quarter (~2.5% per year). This means that the BEV fleet’s (growing) share will surpass the (shrinking) diesel fleet’s share before the end of this year, as we will see in the end-of Q4 update.

The petrol fleet is of “medium age”. Once diesels had passed their peak sales in 2011, petrols were the best sellers until they were overtaken by BEVs in 2018. This means the average petrol car is currently around 10 years old and still has a few years of service left. Petrols currently hold 24.6% share of the fleet, and are currently losing around 0.4% each quarter on average. The petrol fleet figures are complicated slightly by seasonal deregistrations and re-registrations of older petrols which are used in the summer months but hibernated during winter. Overall, petrols will likely fall under 20% of the fleet in around 3 years time.

Note that fleet powertrain shares are only one component of how many passenger KM get driven annually by each powertrain. New vehicles get driven much more (annual KM) than 10 year old vehicles, on average. The average BEV is much newer than e.g. the average diesel, and BEVs’ combined annual KM have already overtaken that of diesels, even though diesels are still slightly more numerous within the fleet.

To see these dynamic effects, and how they combine to impact the diminishing demand for road fuels, see my deep dive report on fleet dynamics.

Outlook

Norway continues to make consistent and rational progress in the EV transition, with consistent policy support and consumer acceptance of the new technology. Only China comes close to the rational transition that Norway has pioneered (arguably more impressive because China is not nearly as wealthy as Norway, and has to actually build these cars at immense scale, where Norway can simply buy them from outside, in relatively negligible volumes). Sweden, France, Germany, the US, and many other regions, have been erratic, inconsistent, and frankly often insincere in making the transition.

Norway’s auto market has grown 23.5% year to date, a good sign, since that growth (now effectively all BEVs) is speeding the fleet transition.

As a reminder, Norway’s macroeconomic figures are typically highly erratic due to the large size of public spending, and the disproportionate influence that fossil-fuel sales (and their variable pricing) have on national accounts. The latest YoY GDP figures remain those from Q2 2025, with a big swing to negative 2.1%. Inflation crept up to 3.5% in August (latest data) from 3.3% in July, and interest rates reduced further, to 4% (from 4.25%) in mid-September. Manufacturing PMI increased modestly to 49.9 points in September, from 49.6 points in August.

What are your thoughts on Norway’s auto market, and what can the rest of the world learn from Norway’s approach to the transition? Or perhaps not be able to easily replicate? Please jump into the comments below to share your perspectives.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy