Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

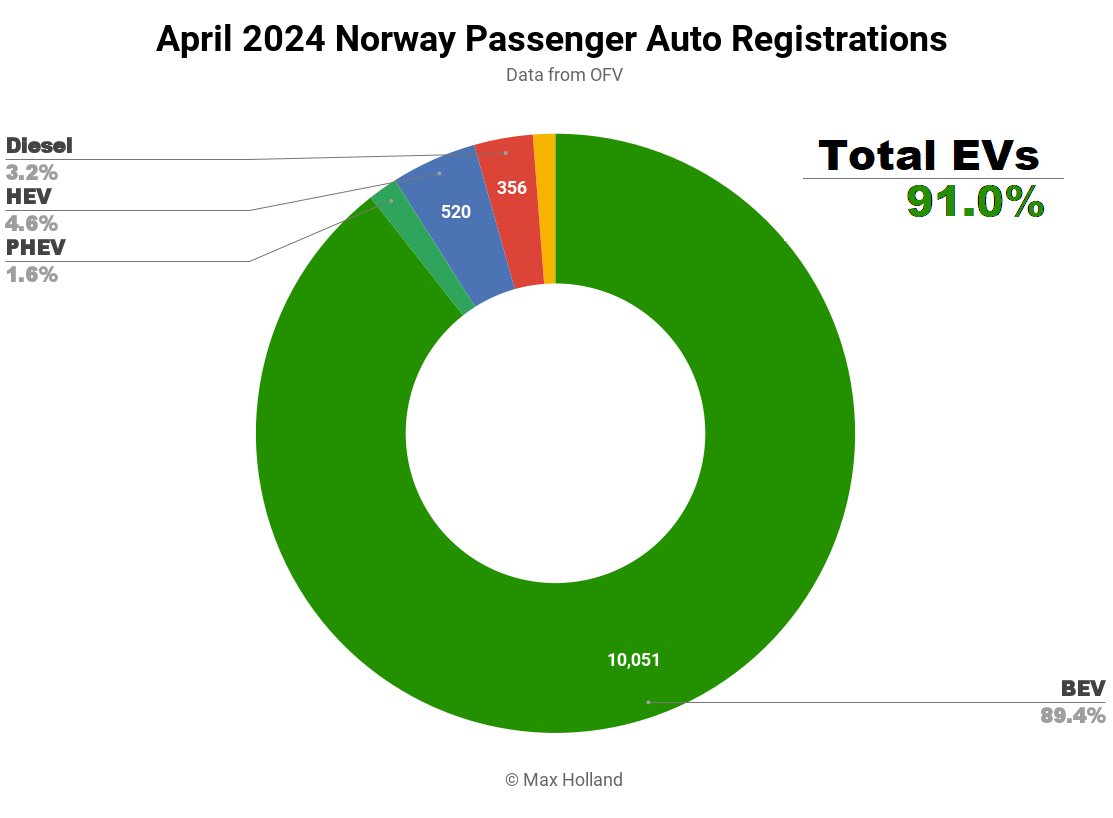

The auto market saw plugin EVs take 91.0% share in Norway in April, roughly flat from 91.1% year on year. BEVs alone took 89.4% share, up from 83.3% YoY. Overall auto volume was 11,241 units, up 25% YoY, a recovery over recent months. April’s best selling BEV was the Volvo EX30.

April’s sales data saw combined EVs take 91.0% share in Norway, comprising 89.4% full electrics (BEVs), and 1.6% plugin hybrids (PHEVs). These compare with YoY figures of 91.1% combined, 83.3% BEV and 7.8% PHEV.

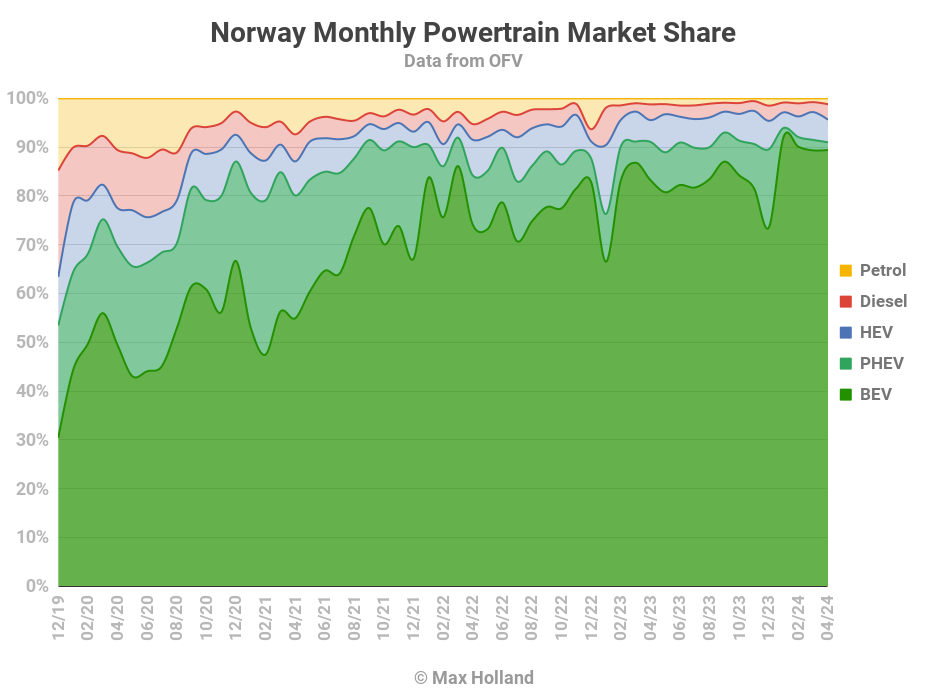

The policy changes from January 1st are certainly limiting PHEV sales, and have given a further boost to BEV sales. An unfortunate side effect is that HEVs are now selling almost 3× more than PHEVs, which is not any kind of win. Why not? PHEVs can be driven on electricity alone most of the time (when used as designed), whereas HEVs have to derive all their energy from combustion.

There is also likely a residual hangover effect for PHEVs, which had a strong pull-forward ahead of the January 1st changes (see graph below). The hangover may pass in the coming few months and see PHEVs and HEVs more balanced. If not, tweaks to the policy dials may be required.

Nevertheless, BEVs now account for 90% of the auto market year to date, and all other powertrains are on the way out. Petrol-only sales are especially weak, with under 1% of the market so far in 2024. Diesel-only share is around 2.5% of the market YTD.

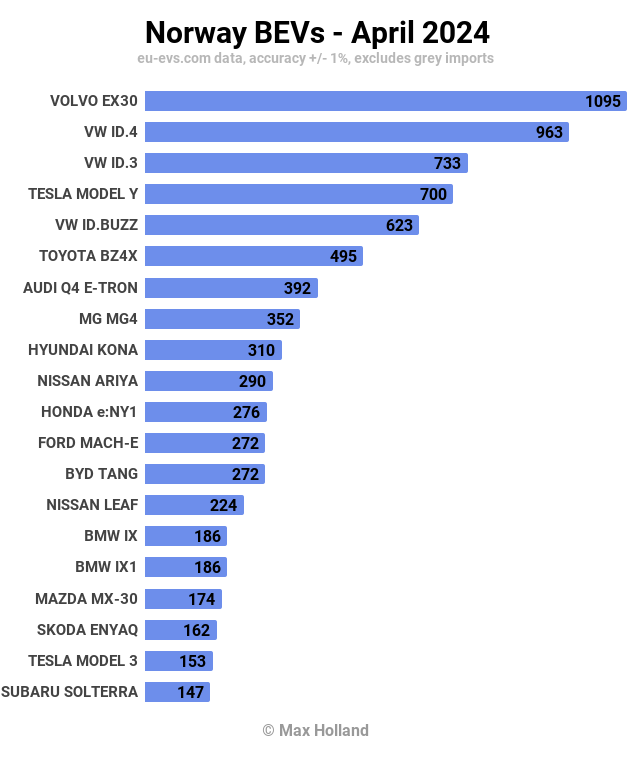

Best Selling BEVs

Having launched back in January, the new Volvo EX30 has had a great climb, and reached the top spot in April, with 1,095 units sold.

The Volkswagen ID.4 took second place with 963 units, and the ID.3 came in third with 733 units.

I have to apologise for not listing the Volvo EX30 in Norway’s result previously, as it in fact debuted in Norway in January (with 87 units and the 12th spot). My source data did not pick up on its initial sales until now, so I was also in the dark.

That omission is now corrected, so let’s fill in the missing data — it sold 213 units in February (6th spot), and 344 units in March (3rd spot).

Now in 1st place, this is an astonishingly fast rise for the new Volvo compact SUV. It is priced from NOK 321,900 (€27,500) for the base 49 kWh battery variant, with the larger battery option (64 kWh usable) priced from NOK 366,900 (€31,300).

This undercuts the price of the very popular Hyundai Kona, which has been in (or close to) Norway’s top 10 since 2018. The Kona that comes with a closely matched 65.4 kWh battery has an MSRP of NOK 388,900 (€33,200). The Kona is now (after the 2024 refresh) the slightly larger of the two (4355 mm vs 4233 mm), however, and has about 8% more real world range.

And yet, the EX30 is faster on long journeys thanks to much faster DC charging, with 10% to 80% in just 25 minutes (vs 41 minutes for the Kona). It is also a lot more powerful, even out-accelerating the base Tesla Model 3 and Model Y, with a 0 to 100 km/h time of 5.3 seconds (or 5.7 seconds for the 49 kWh variant). What’s not to like?

Getting back to April’s top 20 rankings, both the ID.3 and the ID.4 (and to some extent the Audi Q4, and Skoda Enyaq) recovered from a unusually quiet first quarter for the Volkswagen Group MEB models.

There were a few new BEV models debuting in April. The Smart #3 saw 5 units registered, its first since a single unit had appeared in February. The Smart #3 shares a platform with the Volvo EX30, but is larger and more expensive.

Another debut model was the Mini Countryman, with 17 initial units (for basic specs, see the Sweden report).

Finally, two BYD models came to Norway in April, a few months after appearing elsewhere in Europe. These are the BYD Seal (49 units), and the BYD Dolphin (49 units). The Seal is a Tesla Model 3 rival, whereas the Dolphin is an MG4 rival. These are relatively good value BEVs, and are huge sellers in China, so let’s see how they get on.

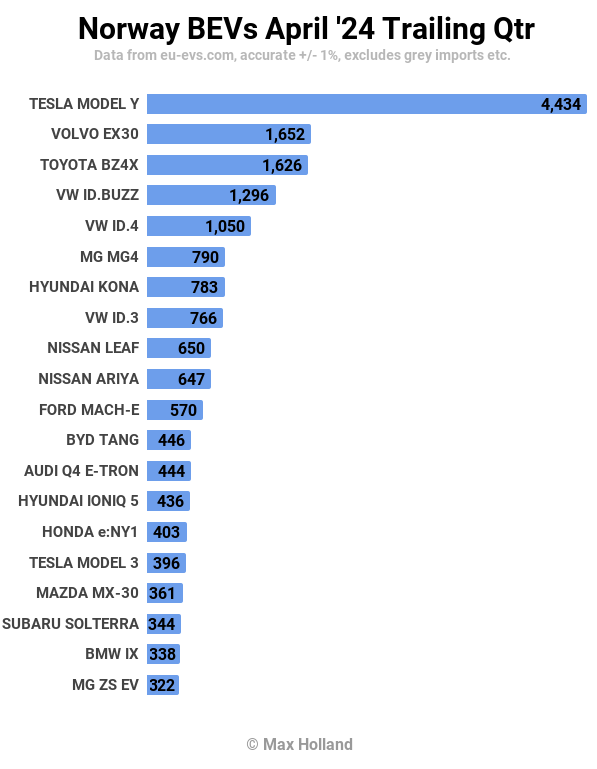

Let’s check up on the trailing 3 month chart:

Despite its relatively low volume in April, the Tesla Model Y is still hugely dominant in Norway over the longer term, and this is unlikely to change much this year. It almost matches the sales of the next 3 most popular models combined.

The Volvo EX30 has already taken the second place behind the Tesla, and soon these two will be a good gap away from the followers.

Note the Volkswagen ID. Buzz is now in 4th place after a strong April. This is a remarkable performance for a large MPV, and is helped by its relatively low pricing in Norway compared to all other markets. It is available from NOK 618,100 (€52,800), whereas the MSRP in other parts of Europe is typically over 20% more (e.g. Germany, €64,600).

Fleet Update

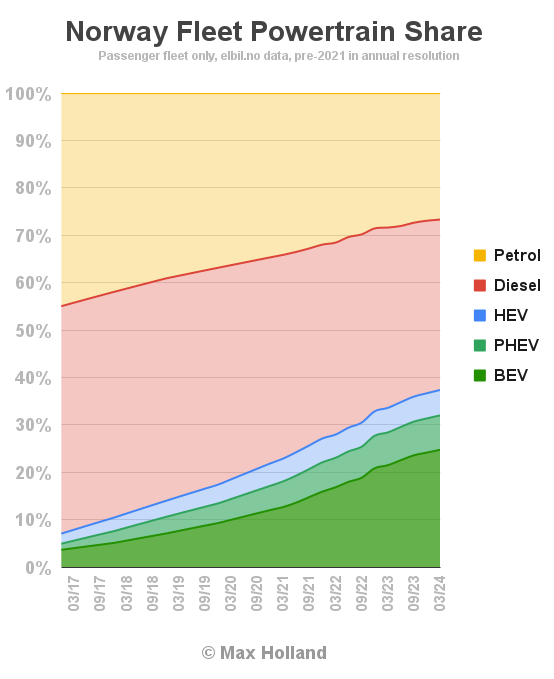

Here’s the latest fleet transition chart, now updated to include the Q1 2024 data:

We can see that Norway’s fleet transition to plugins is slowing, because of the slow down in new auto sales over the past year or so. This won’t change until the economic situation recovers (discussion below).

Over Q1 2024, the BEV share of the fleet grew from 24.2% to 24.8%, just a 0.6% change. Combined with PHEVs, overall plugin share grew from 31.4% to 32.0%, also a 0.6% change (with PHEV sales being negligible during Q1).

This is a long way from the halcyon days of 2021, when the fleet transition to plugins was happening at a rate of 1.4% per quarter in some periods, and close to 5% per year overall.

Outlook

Norway’s auto industry association, the OFV, points to national economic factors playing a role in the general slowdown of the auto market. We don’t yet have Q1 2024 data on Norway’s GDP, though January was better than recent months. The data for Q4 2023 showed 0.5% YoY growth, from negative 1.9% in Q3. Inflation improved to 3.9% in March (latest data) from 4.5% in February. Interest rates have been flat at 4.5% since December. Manufacturing PMI improved to 52.4 points in April, from 50.7 in March.

The OFV stated that “People have a more strained economy… We now show greater moderation and buy smaller and more affordable new cars… We will probably have to wait until the first interest rate cut before optimism returns to new car buyers” (OFV April statement, machine translated).

What are your thoughts on Norway’s EV progress? What needs to happen now to meet the aspirational goal of 100% zero emission by 2025 — is it still possible? Please join in the discussion below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.