Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

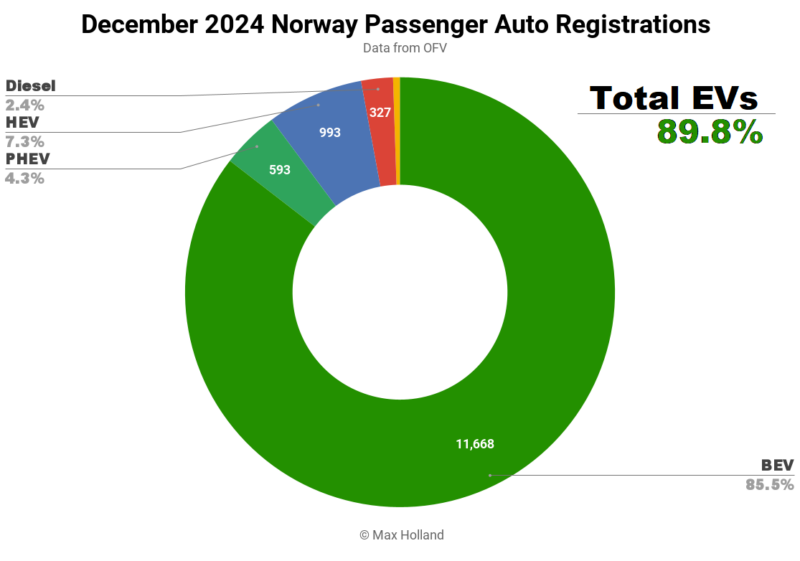

The December auto market saw plugin EVs take 89.8% share in Norway, up from 89.6% year on year. BEVs saw a slight dip in share compared to recent months, due to an end-of-year clearout of other powertrains, and a pull-forward ahead of coming tax changes. Overall auto volume was 13,652 units, an increase of 12.1% YoY. The best selling BEV in December, and in 2024 overall, was the Tesla Model Y.

December’s sales saw combined EVs take 89.8% share in Norway, with 85.5% full battery electrics (BEVs), and 4.3% plugin hybrids (PHEVs). These compare with YoY figures of 89.6% combined, with 73.5% BEV and 16.0% PHEV.

2024 Full Year Trend

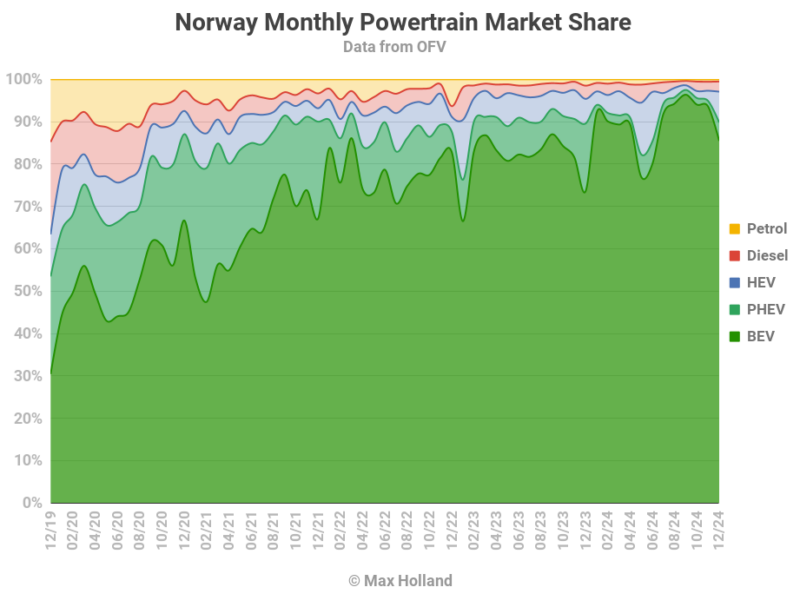

The overall auto market saw 128,691 sales in 2024, slightly up from 126,952 in 2023. The full year powertrain shares for 2024 stood at 88.9% BEV, 2.7% PHEV, 5.3% HEV, 2.3% diesel, and 0.8% petrol. These compare with 2023’s shares of 82.4% BEV, 8.0% PHEV, 6.0% HEV, 2.4% diesel, and 1.2% petrol. It is clear that BEVs have continued to grow at a healthy clip, even as Norway approaches the upper plateau of the technology adoption S-curve.

Unfortunately, the annual figures show that much of BEVs’ continued growth did not come mainly at the expense of non-plugins, but instead mainly came from a decline in PHEV share. Non-plugins combined saw a full year share of 8.4%, only modestly reduced from 9.6% in 2023. Meanwhile, PHEVs lost much more share – down to 2.7%, from 8.0% in 2023.

The full year results show that (plugless) HEVs did much better than PHEVs in 2024 – retaining a significant full year share in 2024 of 5.3%, almost twice that of PHEVs’ 2.7%, and are thus clearly the second most popular powertrain after BEVs. This is largely a result of PHEVs being more heavily taxed in 2024.

This taxation policy appears counterproductive, as modern PHEVs can achieve up to 90% of their annual kilometers on renewable electricity alone, while HEVs are entirely dependent on burning fossil fuels, and are inherently much closer to the pollution levels of ICE-only vehicles. Furthermore, even diesels have barely shrunk YoY, stubbornly clinging on at 2.3% share, from 2.4% share YoY, and are now selling at volumes almost on par with PHEVs.

The relative demise of PHEVs, even whilst HEVs and diesels are almost undiminished by comparison, looks like an unanticipated side-effect of BEV puritanism. Yes, BEVs pollute less than PHEVs, but the latter still have a critical role in certain niches where BEVs may not yet fully meet users’ needs. PHEVs (or EREVs) – when plugged in as designed – pollute a lot less than HEVs, which in turn pollute less than diesels!

It seems to me that, in the simplistic pursuit “BEVs-only, right-now!” – including by placing strong malus taxes on PHEVs – the more polluting HEVs and diesels alternatives have been effectively promoted as the more attractive alternatives to those buyers who feel they can’t yet switch to BEV. Put differently, the baby has been thrown out with the bathwater.

See my discussions of several practical PHEV use-cases in Norway that BEVs cannot fully accommodate just yet (here and here).

More Nuanced Tax Options?

To correct the perverse outcome where PHEVs are now selling far less than HEVs, and almost on par with diesels, I’d like to see Norway adjust their tax policy design. The design must correctly tier the tax burden to ensure that while PHEVs (and EREVs) are not as attractive as BEVs, they are at least more attractive than HEVs and diesels.

Of course there’s the commonly cited argument that some PHEVs users do not plug their vehicles in, and they end up being no more efficient than HEVs (and perhaps even less efficient due to having a heavier battery). This appears to be based on data from corporate fleet buyers (and associated drivers) who were given perverse up-front incentives simply to buy PHEVs, regardless of whether they were plugged in or not.

To put it simply – the main incentive for corporate buyers (as well as for private buyers) should be PHEV’s long-term fuel-cost savings. It should not be some perverse alternative incentive which is generously handed out entirely independently of these vehicles’ fuel-cost savings. The latter approach is instead counterproductive because – by its very existence – it effectively makes plugging in an optional extra saving!

Conversely private PHEV owners, like those of our community here on CleanTechnica who have themselves owned or driven PHEVs, typically plug them in assiduously, and often get 80% + of their annual driving on electricity (you know who you are, please jump in to the comments and confirm this).

Given the potential of wrongly incentivized choices, the question then becomes, how can the Norwegian government more intelligently differentiate between buyers who drive their PHEV mostly on electricity, and those who only buy them to grab the up-front incentives, and almost never plug in. It’s not terribly complicated – don’t give any up-front corporate tax breaks for PHEVs! Make their up-front tax burden closer to HEVs and ICE vehicles. This forces the financial “incentive” to instead be based on behaviour, i.e. actually plugging in and getting cost-savings from using cheaper (and cleaner) energy.

A slightly more nuanced approach could give PHEV’s a level of taxation slightly more attractive than HEV and ICE-only cars, but contingent on a vehicle’s electric-biased design specifications. This might, for example, require PHEVs and EREVs to offer at least 80 km (~50 miles) of WLTP electric range, (and gradually increasing in the years ahead). The mostly-EV design requirement could also require that an ICE engine does not exceed >75 kW in power output (perhaps variable by vehicle weight and use-class), and not contribute more tractive power than the electric motors do. Optionally, a tax might even specify that the ICE can only (or mainly) be run in series-hybrid mode (i.e. as a range-extender generator only), rather than directly power the wheels.

An even more effective tax approach could specify a tax rebate contingent on an annual usage check of the odometer and the data log of total annual kWh charging received (data accessed via the OBD port) – and specify a minimum ratio of these values. For instance, given that an average PHEV should manage ~200 Wh/km when in EV mode, the tax design could require that the recorded annual kilometers driven be matched by an concomitant annual charge-up pattern. For an average PHEV, this might specify at least 100 Wh (0.1 kWh) recharged into the vehicle for each km driven. Effectively demonstrating that the vehicle has typically covered at least half ifs annual km on electricity. The exact ratio could be adjusted by vehicle size or WLTP efficiency.

This check could be implemented relatively simply via what a 10-minute (and perhaps 300 NOK), annual inspection – conducted and certified at existing periodisk kjøretøykontroll (annual safety inspection) garages. It would ensure that only those PHEVs and EREVs confirmed to be covering most of their annual kilometers on electricity, actually receive tax breaks. The tax benefit could be as a rebate (of a tax fee that was already paid at the start of the year), only after being certified to have mostly driven on electricity. The rebate amount could even vary with the percentage of annual driving done on electricity, incentivizing frequent plugging in. A record of on-boarding the equivalent energy (kWh charged) to match 90% of km travelled might qualify for 90% tax rebate. Owners who neglect to plug in at all (or can’t be bothered with the annual test) would have the freedom to do so, but would then effectively pay taxes at HEV or ICE levels. Let us know in the comments whether you think such a tax structure (mostly administrated digitally) would be practical and feasible, or if you have a different tax design in mind.

It might be argued that — despite the issue of HEVs outperforming PHEVs in Norway in 2024 (and diesels not far behind) — Norway is already so close to the almost-all-BEV endgame that nuanced regulations for PHEVs and EREVs are now unnecessary, or even “too late” at this stage. I’d turn that around and say that – precisely because Norway is so far down the path of transition – the country is like the one best positioned to learn (and implement changes) from its vast experience.

Norway has an opportunity to both correct its trajectory, and – more importantly – to help push automakers to greatly improve the real-world use and benefits of these EREV & PHEV technologies, to the ultimate benefit of the other 99.93% of humanity who live outside the country.

I’ll repeat again that virtue-signalling folks living in wealthy bubbles who advocate for “BEVs-only, right-now” also tend to be ignorant of the challenge of DC-charging network build-out in many less wealthy parts of the world. Whatever the state of local EV infrastructure, modern EREVs & PHEVs used correctly can electrify 80% or 90% of annual km driven, already today. Conversely, in most regions of the world, a robust local DC charging network is many years off in the future, perhaps many decades in some places.

Norway can help to design relatively low-friction procedures which incentivize the correct use of PHEVs and EREVs, and ensure these powertrains are viable options going forwards. Not only for Norway’s relatively small market, but for the tens of millions of annual car buyers who are not ready to switch to BEVs, but whom want to do what they can. This would significantly accelerate the increase of km driven on electricity for humanity as a whole.

December Results and Analysis

Turning back to the latest month’s auto market results, similar to the pattern seen in December 2023, December 2024 saw BEVs take a slight dip in share, not from any drop in sales volume, but due to an end-of-year modest jump in the sale volume of other powertrains, especially hybrids (a modest jump for PHEVs, and a significant jump for HEVs). These jumps seem to be part of a seasonal push (mostly by Toyota) to clear stocks of soon to be less saleable models – April 1st will again see an increase in taxes on all non-BEV vehicles, including HEVs and PHEVs.

The 1st April timing might lead us to expect any pull-forward to be most apparent in February and March. December, however, is traditionally a high volume auto sales month in Norway – at around twice the volume of the subsequent January or February. So, it’s likely that Toyota sees December as a good time to “clear the shelves” of these vehicles.

Why do I single out Toyota? The Toyota Corolla (only available as a HEV) saw 436 sales in December – 21% of its total 2024 volume. Likewise The Toyota Yaris/Cross (also HEV only) saw 403 sales in December, and the RAV4 (both HEV and PHEV) saw 228 sales. Toyota supplied over 83% of Norway’s 2024 HEV sales, and over 85% of December’s. Toyota also supplied a large portion (perhaps close to half) of Norway’s 2024 PHEV sales.

The flip side of the December jump in HEV and PHEV sales is that we should see these suffer a corresponding hangover in January and February – let’s watch for that next month. They are also likely to drop anyway after the April 1st tax change.

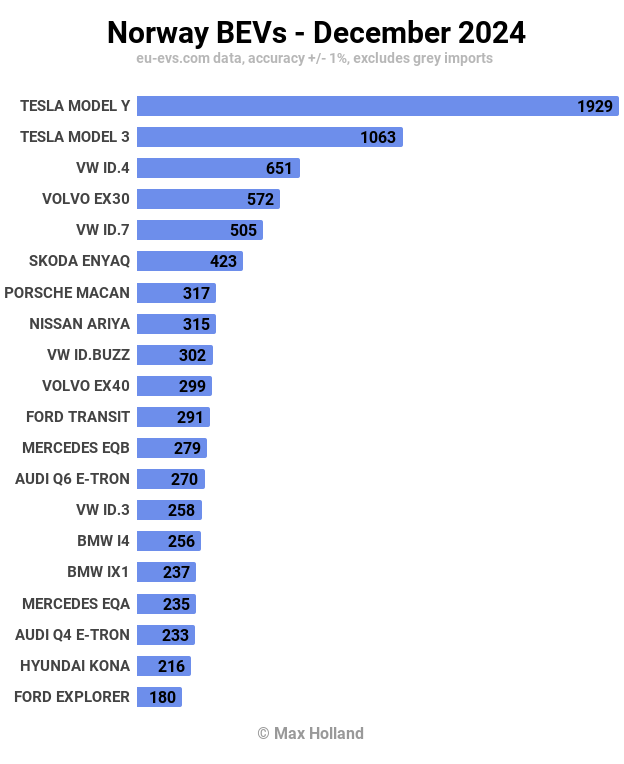

Best Selling BEV Models

Given Tesla’s habitual end-of-year push, it should come as no surprise that the Tesla Model Y was once again the best selling BEV in December. It was also the leader in two thirds of the monthly rankings in Norway across 2024. Its sibling, the Tesla Model 3, was the runner up in December.

In third place in December was the Volkswagen ID.4, with 651 units, roughly inline with its recent monthly averages.

Further back, the Porsche Macan saw its strongest month yet, with 317 sales, and jumped from 15th to 8th place. This underscores the fact that Norway is one of the world’s wealthiest countries, and perhaps that prestige brands can make popular Christmas presents for wealthy people. The Macan’s slightly less prestigious (but equally practical and ~10% less expensive) cousin, the Audi Q6 e-tron, did not get any December rush. Let’s keep an eye on these two.

The new Ford Explorer saw a relatively quiet month, dropping from 12th in November to 20th in December, though this is likely just the temporary allocation roulette that smaller markets suffer from. Let’s see what its average volume settles at in 2025.

Last month’s strongest newcomer, the BYD Sealion, repeated its volume, with 137 units in December, remaining in 22nd spot. The Kia EV3 was equally consistent, keeping its debut rank of 24th.

Unfortunately the same can’t (yet?) be said for the Dongfeng Nammi Box, which declined from its November launch volume of 23 units, to a more modest 6 units in December. Let’s however give it a chance to settle into a shipping pattern, and then see where this super-affordable BEV averages out.

The Citroen-C3, which saw 1 unit in October, and 2 in November, stepped up to 21 units in December but still has a long way to go to become significant in this market. Let’s keep an eye on it.

There was only one debutante in December, the new Opel Grandland, though only with a modest 3 units. Stellantis aren’t really trying for big BEV volumes in Scandinavia, so don’t expect local stardom from this model. The Opel Grandland shares its underlying platform and powertrain specs with cousins the Peugeot e-3008 and e-5008, and sits in between them in size, at 4,650 mm in length. Its MSRP starts from NOK 438,900 (€37,500). I’d expect at most 30-50 monthly units from this model in Norway, perhaps less.

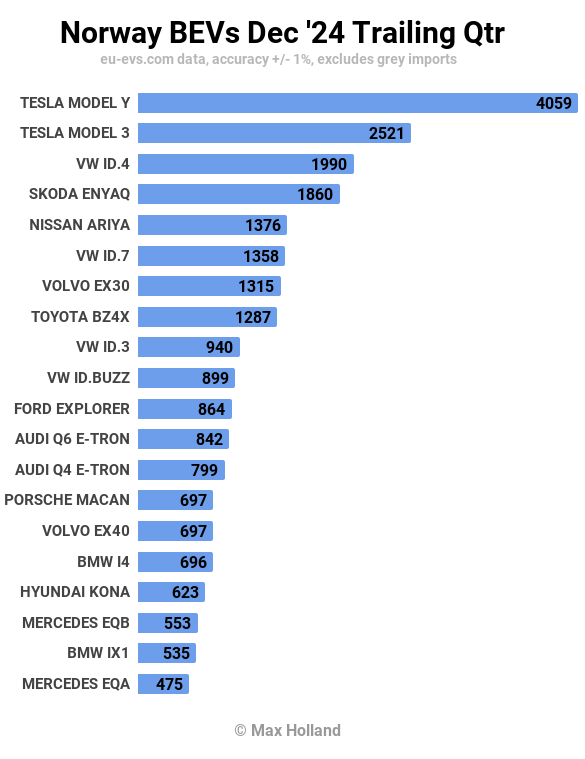

Now let’s look at the 3-month rankings:

The Tesla siblings are at the top of the tree, with the Model Y very far out in front. This is a particularly good performance from the Model 3 which hasn’t often been in the top 5 recently.

Thanks to its recent 3 strong months, the Volkswagen ID.7 has had a remarkable climb from 24th spot in Q3, to 6th spot now.

Due to the strong December result mentioned above, the Porsche Macan has climbed further from last month’s 19th spot, to 14th in December.

In November’s report we made a note to keep an eye on the new BYD Sealion, and the new Kia EV3. Now, in just their second month on sale, these two models have already climbed to 26th and 28th, respectively. Expect one or both to gain a top-20 entry in the next month or two.

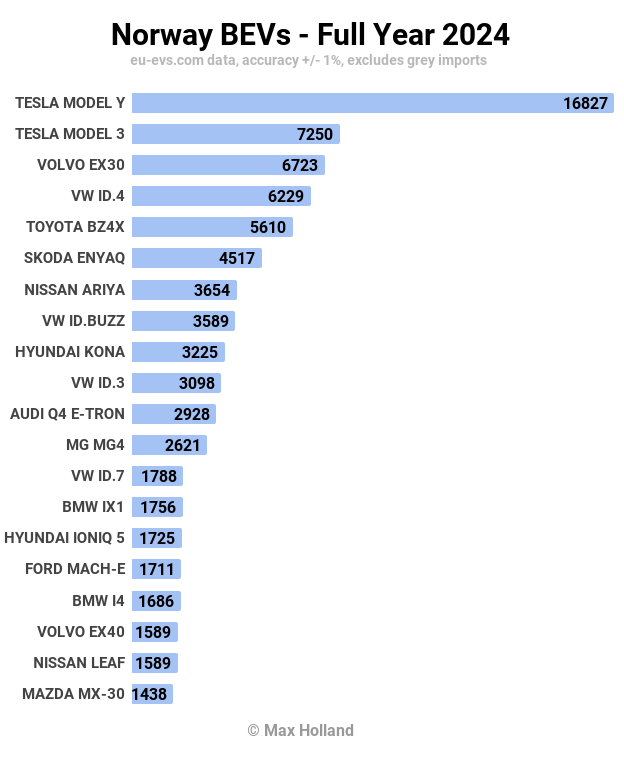

Finally, here’s a brief survey of the full year 2024 model rankings:

Tesla still dominates in Norway. Interestingly though, the Model Y is down in annual volume by 27% from 2023, to 23,058 units, whereas the Model 3 is hugely up, by 3.5x to 7,250 units. Perhaps the Model Y’s refresh expected in the coming months will see it gain volume in 2025.

The Volvo EX30 just about clung on to the third spot in the annual chart, a superb result considering it only debuted in January. Its strongest volumes were in the middle of the year, and Q4 was middling, as can be seen in the 3-month chart earlier. Perhaps a mild refresh with more trim options could rekindle its honeymoon period.

Another decent result was from the Volkswagen ID.7, which only launched in November 2023, and did well to grab 13th spot in 2024. Its recent popularity is largely thanks to the launch of the touring-wagon variant, which arrived in a trickle in August and September, and first hit big volumes in October. Thanks to its practicality, the ID.7 has been voted “people’s favourite” by readers of Dagbladet, DinSide and Elbil24.

Just outside the top 20, in 21st, the new Audi Q6 e-tron has quickly made its mark. Considering that it only arrived in July, this is a great result for the upmarket Audi, and it will get close to the top 10 in 2025.

Those models in decline included the Ford Mustang Mach-e, which fell from 6th in 2023 to 16th in 2024, in large part due to the arrival of its better value and more practical sibling, the Explorer. Another was the Nissan Leaf, which fell from 12th to 18th due to getting long-in-the-tooth, with a platform largely unchanged since its debut in 2010.

Predictably, the Audi Q8 e-tron also tumbled in rank from 16th in 2023, to 41st in 2024. This is largely thanks to the arrival of many alternative large SUVs, not least its own younger sibling, the Audi Q6 e-tron, which debuted in August. Being built on a dedicated BEV platform, the Audi Q6 has similar interior space to the Q8, but is a much more modern and capable vehicle, and has a lower starting price. No wonder the Q8’s volumes dropped off a cliff from September onwards!

What can we expect from 2025? Recent newcomers like the Kia EV3 should do well, as will its sibling the Kia EV5 when it finally arrives in Europe (it’s been on sale in China for almost 18 months already). The BYD Sealion should also do well in 2025, simply because it’s a compelling and great value BEV. If BMW manages to launch the Neue Classe in 2025, it also has a chance to do well in Norway, since this is a market which loves premium marques.

There are a lot of smaller and more affordable models coming, as well as narrow niche models (like working pickups) that will help BEVs grab more of the remaining 10% of market share in 2025. As individual models, none of these will likely make a huge splash in sales volumes in a wealthy market like Norway, this will be more of a team effort to fill in neglected areas of the market. I have in mind models like the VW ID.2, and Hyundai Inster at the smaller-and-affordable end, and the Maxus eTerron, and BYD Shark, in the working pickup niche. Please tell us about other BEV models you are eagerly awaiting in 2025, in the comments below.

In terms of Norway’s passenger vehicle fleet, BEVs now hold 27.7% share, with PHEVs holding an additional 7.2% share. This is up from 24.2% BEV share a year ago (PHEV share is unchanged YoY).

Outlook

At a state level — via the national oil and gas company, Equinor – Norway will likely continue to get strong economic benefit from fossil fuel exports to the rest of Europe in the coming winter months, which may lead to a boost in government spending. However, the energy prices that consumers themselves face, as well as other consumer inflation fundamentals, will likely increase further (as these are in a shared market across Europe). So despite the state-level gains, consumer confidence and spending may face a squeeze in the short term. Latest GDP data has not been updated since Q3 (+3.5% YoY). Interest rates remain static at 4.5% and official inflation is currently at 2.4%. Manufacturing PMI was at 50.3 points in December, from 50.5 in November.

I’ve spelled out what I think should happen in Norway’s auto market in the near future in the discussions above. BEV share will now creep up more slowly, and there will still be some (gradually diminishing) extreme use cases that BEVs still can’t immediately accommodate. The government must design tax policy to make sure that remaining niche cases are fulfilled by PHEVs or EREVs, rather than by HEV or ICE-only vehicles.

What are your thoughts on Norway’s situation? What do you expect to see in 2025? Please join in the conversation below and share your perspective.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy