Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

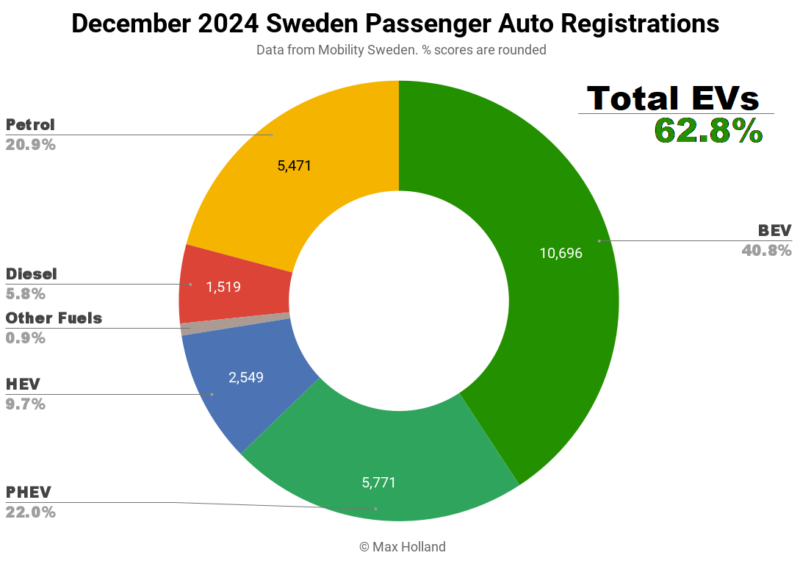

December saw plugin EVs take 62.8% share in Sweden, down slightly from 63.1% year-on-year. BEV share increased YoY, but was outweighed by falling PHEV share. Overall auto volume was 26,237 units, down by 10% YoY. The Tesla Model Y remained the best selling BEV, for the eighth consecutive month.

December’s auto sales saw combined plugin EVs take 62.8% share in Sweden, with full battery-electrics (BEVs) at 40.8%, and plugin hybrids (PHEVs) at 22.0%. These shares compare YoY against 63.1% combined, with 38.9% BEV, and 24.2% PHEV.

2024 Full Year Results

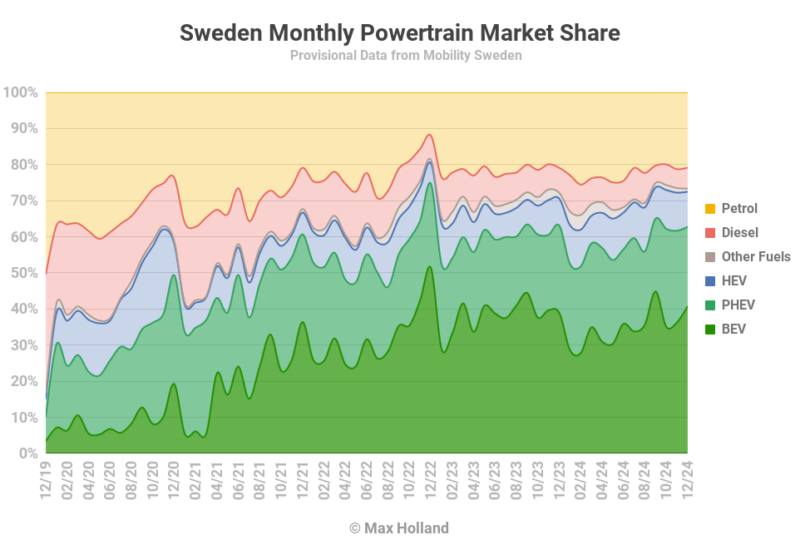

Sweden’s overall auto market saw 269,500 sales in 2024, down by 7% from 289,610 sales in 2023. Full year powertrain shares for 2024 stood at 35.0% BEV, 23.4% PHEV, 10.1% HEV, 22.5% petrol, and 7.0% diesel. These compare with 2023’s equivalent shares of 38.7% BEV, 21.1% PHEV, 8.1% HEV, 21.6% petrol, and 8.2% diesel.

The trend has been notably negative for BEVs – losing a big 3.7% slice of the market pie – and just slightly positive for PHEVs. Combined, plugins actually lost 1.4% market share (from 59.8% to 58.4%). Meanwhile, HEVs gained an extra 2% share, petrol-only gained 1%, and diesel lost over 1%.

The best we can say is that ICE-only vehicles remained roughly flat, but that BEV lost out significantly to both PHEVs and HEVs (roughly equally). This is obviously a poor performance from the perspective of the EV transition.

One could point the finger at the removal of the BEV purchase incentive (for future orders) near the end of 2022. This meant that the first half of 2023 still saw reasonable BEV volumes (deliveries that fulfilled orders placed before the November 2022 cut). However, almost all of those BEV pre-orders had been delivered by Q4 2023, and yet the Q4 2024 BEV volume was still 8% down from that baseline.

This therefore suggests that the incentive cut was likely not the main culprit for BEVs’ weak 2024, and instead the main factors were more likely continued consumer fatigue from a prolonged period of economic belt-tightening over the past two years, combined with BEVs increasing in price over the same period, and still being much more expensive than other powertrains.

December and into 2025

December’s monthly result saw BEVs down about 6% in YoY volume, doing slightly better than the overall auto market downturn (10%), though with PHEVs faring worse than the broader market, down 19% YoY.

One thing to look forward to from now on is the tightening EU-zone vehicle emissions regulations in 2025. These are supposed to see fleet average CO₂ emissions drop by 15% compared to 2021 levels. That year’s headline target was 95 grams / kilometer CO₂, but allowed for substantial fudging. The 2022-2024 period stuck with that 95 g/km target but tightened up on the fudging. 2024 was the final year of this relatively lax regime. It’s likely that there was some pull-forward of ICE-only sales (“clearing the shelves”) into Q4 2024, and a hold-back of some BEV deliveries until 2025, to help get a headstart on meeting the 15% tighter 2025 fleet-level requirements.

That 2025 headline target is (on average) “81 grams/km CO₂”, although there’s again some fudging allowed, to sugar the pill. This fudging will again tighten as we head toward the next headline target scheduled for 2030. The 2030 goal is a 55% drop compared to 2021, with a headline of “43 g/km CO₂” emissions. Again, there’ll likely be some fudging in the initial stage to help the medicine go down.

During this recent 2021-2024 period, legacy automakers have been keeping BEV prices high, and deliberately slow-walking the transition. They have also been deceptively using the outcomes of their own slow-walking strategies to argue that the “market” is not ready. They then in turn take the “market not ready” claim, and lobby European policymakers to loosen requirements going forwards!

This is all a somewhat predictable cynical con by legacy auto. We know that they have kept BEV prices deliberately high and out of reach of many consumers (who have been crying out for years for more affordable BEVs).

Legacy auto’s BEV prices should already be much lower by now. BEVs are already uncutting the price of ICE vehicles in almost all segments in China. In Europe, legacy auto have been keeping BEV prices raised in order to squeeze more economic rents out of their past ICE investments (and paying themselves record profits) whilst they still can, at the expense of European consumers and the EV transition. Their fossil-fuelled gravy train is coming to an end, but we should expect their continued shenanigans all the way through to 2030 (and beyond).

Best Selling BEVs

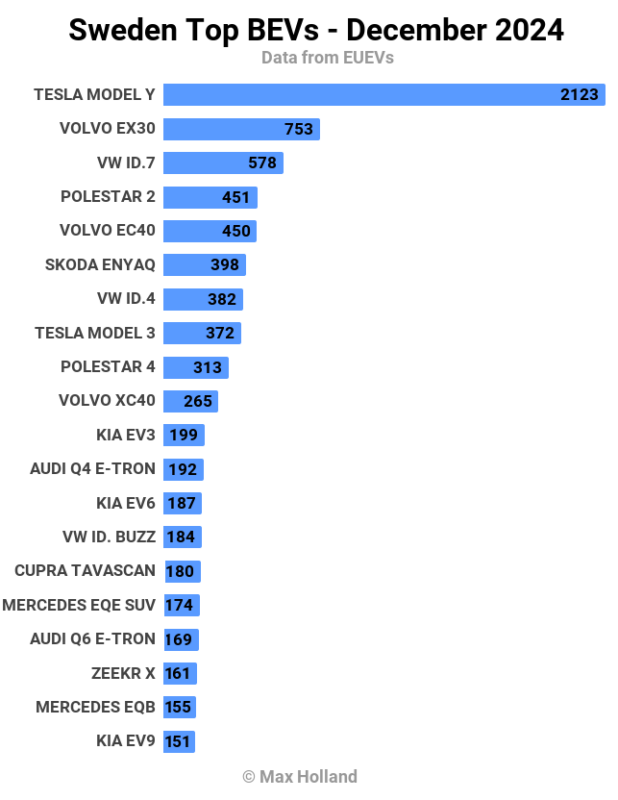

The Tesla Model Y was – predictably – once again the best selling BEV in December, its eighth month in a row in the top spot. Its volume, at 2,123 units, almost matched the next four models combined.

The Volvo EX30 took second place, with 753 units. Third position went to the Volkswagen ID.7.

Just outside the top three, the Polestar 2 outperformed its recent averages and took 4th spot, one unit ahead of the Volvo EC40.

Further back, a strong performance was seen by the new Kia EV3 in just its third month on sale, gaining 11th place (with 199 units), up from 18th in November. The new Cupra Tavascan also did well, climbing to 15th in its fifth month on sale, with 180 units in December. Finally, the Zeekr X had its best ever month, with 161 units, gaining 18th place, from its previous best of 10th in October (113 units).

There was just one debut in December, by the new Ford Capri, with an initial 38 units. The Capri saw its debut in neighbouring Norway back in October, so check that report for a quick overview. Like its sibling, the Ford Explorer, the Capri is based on VW Group’s MEB platform. It hasn’t yet seen strong volumes in Norway, and so don’t expect it to suddenly become a new favourite in Sweden either.

Like all manufacturers, Ford needs to meet the EU’s tighter emission regulations in 2025, as discussed above, and the Capri is a necessary step for them — we can expect its volumes to steadily climb from here.

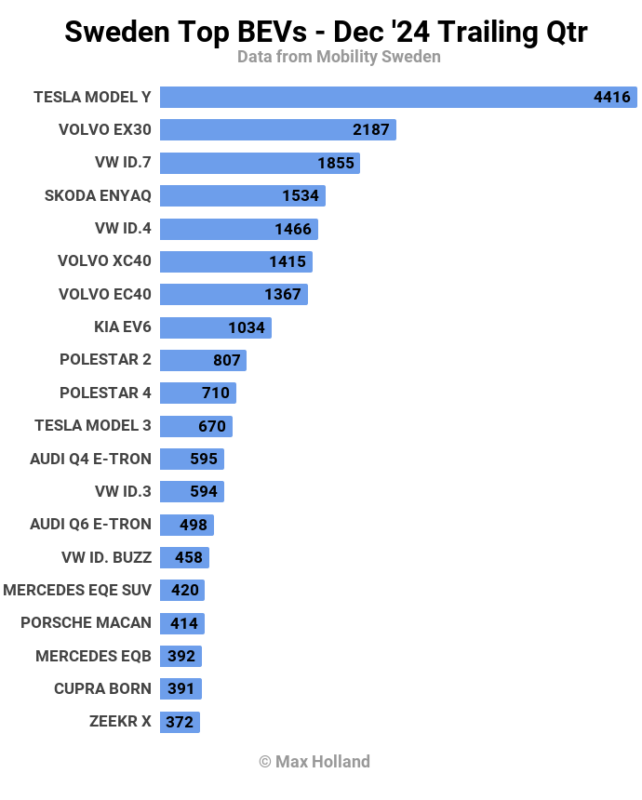

Let’s check in on the 3-month rankings:

Here the top three are the same as in December’s rankings, though with the Tesla Model not quite as overbearing. The Volkswagen ID.7 is up 4 places from the prior period (Q3).

Most of the positions are shuffles of regular faces, with a few exceptions. The Polestar 4 has done well since its July debut, to now reach 10th place. It is a similar story for the Audi Q6 (June debut), now in 14th, and for the Porsche Macan (September debut) now in 17th. The Zeekr X finally sees its first spot in the top 20, thanks to three solid months.

There’s a high chance the Cupra Tavascan (August debut) might make the top 20 in the next month or two, from its current 26th.

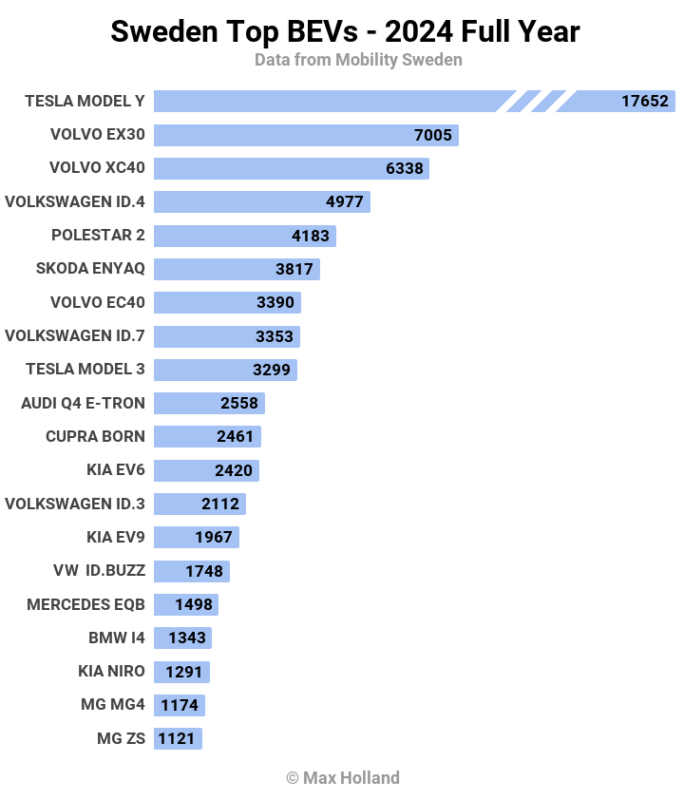

Here’s a brief look at the 2024 full year results:

Obviously the Tesla Model Y keeps the lead, but its weighting has actually grown compared to 2023. The Volvo EX30 has been a great success, grabbing second spot in its first full year on sale.

The Volkswagen ID.7 has also been a strong success, climbing to 8th in its first full year. The Cupra Born has done relatively well (11th), and has now overtaken its Volkswagen ID.3 cousin (13th).

Declines were seen for the BMW i4 (7th in 2023 to 17th in 2024), the Kia Niro (8th to 18th), and the Audi Q8 e-tron (17th to 28th). A big drop was seen for the BYD Atto 3, which was in 11th at the end of 2023, but just 52nd at the end of 2024. This is due to BYD’s strategic caution, rather than any issue with the vehicle (which sold hundreds of thousands of units worldwide in 2024). Sweden’s loss is the Global South’s gain.

As also noted in the recent Norway report, the Nissan Leaf is getting long in the tooth, and is dropping in Sweden also, from 15th in 2023, to 39th in 2024.

What models are you expecting to make a splash in 2025? Let us know in the comments.

Outlook

As mentioned earlier, Sweden’s economy has been fairly weak for the past two years, which is surely draining consumers’ endurance and willingness to spend on expensive items like (deliberately overpriced) BEVs. Latest GDP data is still from Q3, and was 0.7% YoY. Interest rates came down to 2.5% in December, and inflation remained low at 1.6%. Consumer confidence was negative at 96.7 points. Manufacturing PMI moderated to 52.4 points in December, from 53.8 points in November.

All in all, 2024 was certainly a year to forget for Sweden’s EV transition, and we have to look forward to 2025’s tightening of emission regulations to return the trajectory to an upward one.

What are your thoughts on what we might see in 2025? Please join in the conversation in the discussion section below.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy